That’s a tough question – one that is hard to get a candid and impartial answer on. Why? Because the people you are likely to ask for advice might have a vested interest in your decision. A Partner will nearly always want you to stay on. A previous colleague who left practice before you may encourage you to move to industry.

The best place to start is at the end… what are your long-term aspirations? Then, work back from there. We have compiled a number of pointers to help you think this question through carefully. Just remember – everyone’s situation is different, so make sure the decision you are making is in your best interests, not someone else’s….

Broadly speaking, people tend to have three types of answers to the big-picture question:

#1 “I want to become Partner” If you have ambitions to become a Partner, the best route is to stay on in Practice after your training contract. It is very unusual for a Partner to come from industry, even if they have initially trained in Practice. Usually, becoming Partner is achieved by staying with your training firm or transferring to a competitor to get a step up to the next level. What is worth considering now is what area you want to become Partner in – for example, if you want to transfer out of Audit into Advisory or Corporate Finance, you should plan to make this transition as early as possible after you qualify… making a move like that as a Director or a Partner is far less likely.

#2 “I want to become a Financial Controller, and perhaps ultimately, a CFO or CEO” If you have the ambition to become a captain of industry, staying on in Practice after your training contract is less likely to get you where you want to go. It is a misnomer that you will get “paid more” or access “better jobs” in industry if you get a few years under your belt as a Manager in practice. Why?

Let’s look at an example: If a company is looking for a Financial Controller or Finance Manager, they will nearly always look first for a qualified accountant with “x” years of post-qualified experience doing the job they are looking to hire. They will look first for Financial Controllers or Finance Managers that are in industry and look second (and a distant second) to Managers or Directors out of Practice. The people in your intake who left Practice after they qualified will likely have a significant competitive advantage over you for these types of roles as their experience will be more relevant. Fact.

Moving from Practice to industry is not easy. Staying on in Practice simply to receive a bump in salary or an Assistant Manager/Manager job title will likely make your move to industry more difficult than moving once your training contract ends.

#3 “I am not sure where I want my career to take me and want to keep my options open” If you are not 100% sure on your end goal, consider the following questions:

- Enjoy the work you are doing? If yes, staying on for a little while until you feel more comfortable in your decision is not bad – just don’t leave it too long! (see #2 above)

- Not ready to leave but would like to do something new? It might be an idea to look internally and externally for different roles in practice such as consulting, FAAS or similar. This type of move can sometimes give you the best of both worlds and can open up alternative career opportunities down the line beyond Finance teams – don’t underestimate it!

- Torn because you feel a sense of loyalty to your team/Partner? You really need to put that to one side. You have given 3 or 4 years to your team/Partner and now is the time to put yourself and your future first. Even if you sign on for “another 6 months” after your contract ends, remember that the employment relationship changes after your training contract. Your new employment relationship is just like any other – you have a notice period and as long as you honour that, you are playing by the rules. If your “dream” job comes up during your 6-month contract, while it might not be optimal timing for your Partner, you have the right to hand in your notice anytime.

The above only scratches the surface of our original question. The right answer for you might not be the right answer for the person sitting next to you. Keep in mind that a good recruiter should be able to give you objective, personalised, advice on this and other questions.

In summary…

seek out different opinions, align your aspirations for the future with the decisions you make today and make sure you don’t just do what someone else wants you to do; do what’s best for you and your career.

Finishing your training contract in 2026? Do you want to make sure you make the very best first step after qualifying? Do you want a coffee meeting with an experienced talent advisor; someone who is a qualified accountant, just like you (meet our Leinster team here>>> and our Munster team here>>>)?

Do you want a little help to create your very own best professional future? No problem. Just drop us a line today on hello@barden.ie and we will take it from there. Simple.

I have been working on quite a few Identity Access Management roles recently – engineers, governance specialists, architects – and there are a few patterns that keep coming up. Nothing shocking, just trends that give a sense of how the market is shaping up right now.

Role expectations are expanding

Identity Access Management isn’t just “IT’s problem” anymore. It’s firmly tied to security and business risk, especially with regulations such as the NIS2 Directive.

Job descriptions are reflecting that shift. It’s common to see roles touching multiple platforms or specialisms – Microsoft Entra ID, Okta, SailPoint, CyberArk – and sometimes expecting a mix of governance and engineering experience.

IAM professionals naturally have different strengths, so wider specs can slow the process down if expectations aren’t realistic.

Governance vs Engineering

One thing I notice often is that governance and engineering within IAM are still sometimes blended in ways that can confuse people. Governance and engineering within IAM are connected but different.

- Governance: audits, access reviews, policies, stakeholder management

- Engineering: integrations, scripting, automation, platform optimisation

Being clear about the focus helps everyone understand what the role involves and which skills are most relevant.

Infrastructure backgrounds transition well

Engineers with infrastructure experience often move into Identity Access Management. Knowledge of Active Directory and Azure translates well, particularly in cloud-first environments like Microsoft Entra ID.

The technical skills are only part of the picture. Exposure to governance and process makes the transition smoother. IAM isn’t just technical; it’s a mix of tech and process.

What Talent cares about

Strong IAM professionals ask practical questions:

- Who owns the function?

- How mature is the programme?

- Is this about building something new or maintaining existing processes?

- Which tools are already in place?

These aren’t “soft” questions. They shape whether a professional engages with a role and how smoothly the hiring process runs. Clarity here benefits both sides.

Looking at the bigger picture

Identity Access Management is becoming more visible and complex than ever. It touches infrastructure, security, compliance, and audit, which makes planning and hiring a bit more nuanced than in other areas.

Both organisations and talent are figuring out what this means in practice, and the market is gradually aligning with the skills and experience that make IAM functions effective.

Lorraine O’Leary is Business Lead of the Infrastructure & Security division of Barden’s talent advisory and recruitment firm. Connect with Lorraine on LinkedIn or via lorraine.oleary@barden.ie

There’s a lot to be done before you send out your CV. In this article, we help you lay a strong foundation for a successful career search.

There’s a big difference between job-hunting and career planning. The former is essentially a numbers game – send your CV to a sufficient number of would-be employers and you will likely secure an interview.

Career planning, on the other hand, is finding that one potential employer who will help you develop both personally and professionally, and move you closer to your ultimate career goal. Finding this employer, securing an interview and then impressing her or him enough to secure the role takes a lot of advance planning – most of which should be done long before the search begins.

So, whether you’re in your training contract or working happily with your current employer in a post-qualified role, work on the following career projects even if you don’t envisage a career move in the near future.

Set Expectations

We live in a world of increasingly high expectations. Whether it’s parents “encouraging” their kids to achieve a certain academic standard, or friends sharing their “perfect” lives on social media, there’s unprecedented pressure on people nowadays to “achieve” in all aspects of life.

However, success means different things for different people and as you start out in your career, it’s vital that you set your own expectations and work hard to exceed them. If you choose roles that challenge your talents and strength and push you just outside your comfort zone, you will continually grow and improve. The key is to define your own career path and pursue it with passion and enthusiasm.

The best time to build alliances is when you don’t need them. Too often, people seek guidance, or help, without giving any in advance which could lead people to perceive you as being more of a taker than a giver. As a young accounting professional, you should attend industry events, engage with colleagues, and leverage the knowledge and experience of recruitment consultants and mentors. Use these encounters to offer something to the people you meet – make an introduction or share an interesting article, for example – as doing something small now will increase the likelihood of that person doing you an even greater favour in return in the future, even if they didn’t ask for help in the first place. This is the fundamental principle of reciprocity, something all professionals should understand and practise.

Build Your Personal Brand

LinkedIn has become the standard for accounting professionals in pitching their talents, skills and expertise. The CV remains a fundamental part of the job application process, but its digital cousin is often the first port of call for any would be employer. In fact, the internet in general is the hiring manager’s most used tool in researching individual candidates.

With that in mind, set about building your brand now. Lock down your personal social media accounts, such as Facebook and Instagram, and review all content on traditionally more open platforms such as X/Twitter to ensure your brand won’t be tarnished by a tweet from 2017.

Then, share career-related content to demonstrate your passion for your work and conduct an audit of your LinkedIn profile. It should be full of keywords, recommendations and activity that put you at the top of any recruiter’s, or hiring manager’s, list when they advertise a particular role.

Leverage LinkedIn

Use these tips to fine-tune your LinkedIn profile…

- Include all dates of employment and ensure that the content on LinkedIn validates the content on your CV and vice versa. Any anomalies or gaps will cast doubt on your authenticity.

- Include keywords that are relevant to the roles and companies you’re interested in. Doing so will give you the best chance to be discovered.

- Detail some of the key weekly tasks that best represent your current role and could be deemed relevant to the career opportunities you’re interested in.

- Adopt a suitable style and tone when completing your profile. Be professional, but let a little personality shine through as LinkedIn is often your first opportunity to make an impression.

- Connect with former and current colleagues, and join (and contribute to) groups relevant to your role and ambitions. This will help raise your profile within your professional community.

- And lastly, include a professional picture – this is one of the most basic pieces of LinkedIn etiquette and is certainly worth the investment.

Finishing your training contract in 2026? Do you want to make sure you make the very best first step after qualifying? Do you want a coffee meeting with an experienced talent advisor; someone who is a qualified accountant, just like you (meet our Leinster team here>>> and our Munster team here>>>)?

Do you want a little help to create your very own best professional future? No problem. Just drop us a line today on hello@barden.ie and we will take it from there. Simple.

Succession planning is critically important, particularly for Irish business owners.

Firstly, if a business owner decides to sell their business, the first thing prospective buyers ask is “What is your succession plan?” When a founder exits a business, new buyers need reassurance that someone else will continue to drive growth, increase revenue, and lead the team.

Secondly, founders can become exhausted. They often build a business to a certain stage and are delighted to have gotten there, but they usually dreamed of creating it so they could have more freedom. They won’t realise that freedom unless they have somebody else to run the business while they take more of a back seat and enjoy the fruits of their labour.

Finally, having a successor eases daily stress and enables a leader to have someone underneath them to bounce ideas and decisions off. It helps ensure they are running the business as effectively now as when they started.

Barden partners with Boards and executive teams to appoint leaders, build future-ready organisations, and develop succession plans. Our founders and senior leaders work directly with clients, bringing first-hand experience of scaling businesses and driving growth. Reach out to jonathan.olden@Barden.ie to connect.

Your CV is just too important to leave to chance. It’s the most personal document you will ever create. It represents your professional life story and holds the key to your future hopes, dreams and aspirations. It represents you when you are not in the room. It is what makes you stand out from the crowd. Get it right, and it will work tirelessly for you. Get it wrong, and it will close doors before you even get the chance to open them.

We work with newly qualified accountants every day and have advised 1000’s on their CVs. Here’s the best advice you can get to create the perfect newly qualified accountant CV.

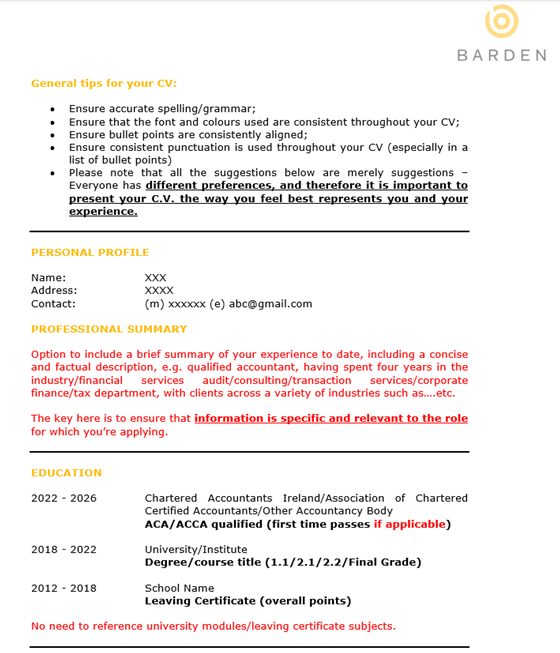

Step 1: Personal details, summary and education. If you do it right here’s how it should look (pay special attention to the advice in red):

Couple of things you might have noticed:

- Address/Contact Information: Keep all to one line if you can. Page 1 is prime real estate so make sure you don’t give up space easily!

- Professional Summary: Tailor this to suit the job you are applying for. Make it specific. Make it a place where you can highlight your suitability for the role. Beware talking about soft skills here; they’re too subjective.

- Education: Reverse chronological order. Only include relevant education (if you did a barista course that’s lovely but it does not deserve to go on the front page…unless you’re applying to a coffee company!). Keep it simple. Bold out the qualification and results.

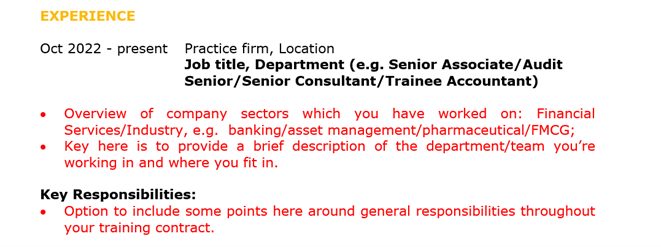

Step 2: Experience: If you do it right here’s how it should look:

It’s a good option to include some points here around general key responsibilities throughout your training contract.

Keep it simple and concise.

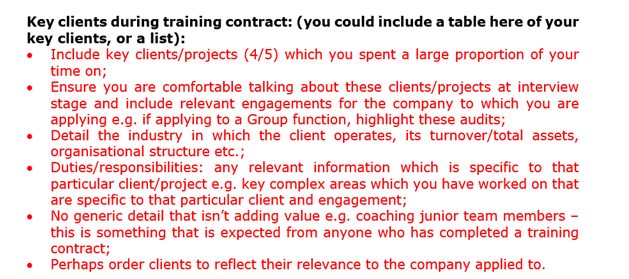

Next it’s a good idea to give a little context on clients and activity; how your experience is different to everyone else:

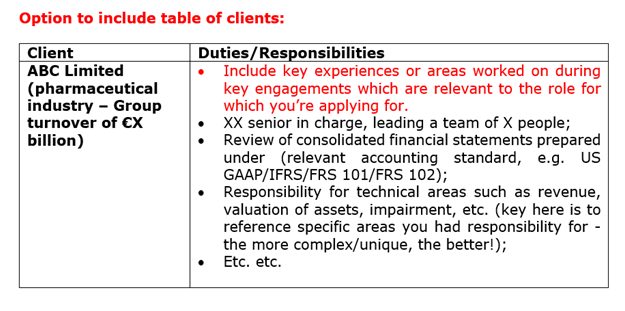

Finally, it’s definitely worth including examples of clients and details on any secondments. Don’t worry about using client names – anything that is in the public record you can feel free to reference. Make sure you give some context too – nature of organisational structure (Group vs BU), scale of business, nature of industry etc..). That stuff really counts.

A great tip is to arrange your clients as relevant to the company you are applying to – applying to an Irish Plc? Put your Irish Plc clients first on the list. Simple.

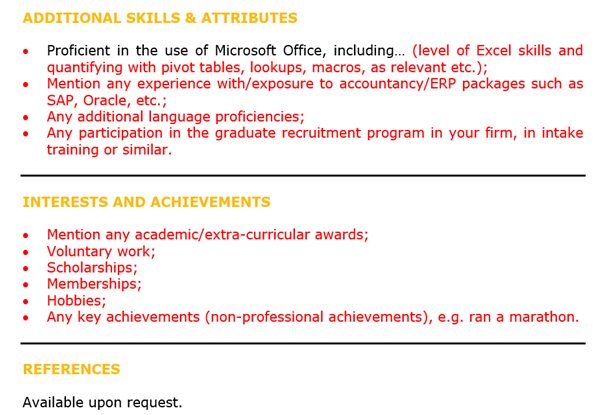

Step 3: The other stuff: The decision to interview you or not will likely already be made by the time the hiring manager gets to this point in your CV. That said it is a great place to talk to you the person rather than just you the professional, can provide great information to break the ice at interviews and you might well be surprised at how much weight some hiring managers can put on non-work activities and achievements. If you do it right it might look like:

CVs are really simple in theory but can be very tricky in practice. We’ve a lot of practice in Barden. If you want an MS Word version of this CV template just drop an email to hello@barden.ie and one of our team will connect with you.

Finishing your training contract in 2026? Do you want to make sure you make the very best first step after qualifying? Do you want a coffee meeting with an experienced talent advisor; someone who is a qualified accountant, just like you (meet our Leinster team here>>> and our Munster team here>>>)?

Do you want a little help to create your very own best professional future? No problem. Just drop us a line today on hello@barden.ie and we will take it from there. Simple.

Barden’s Recently Qualified Accountants Team (most of whom are qualified accountants, just like you) are here to help you make your very best first step as a qualified accountant.

Below you’ll find out more about each of the team. Drop an email to one of our team, and they will take care of you from there…

Siobhán Sexton ACA | Associate Director | Recently Qualified Accountants | Barden Munster

Siobhán Sexton ACA is the Associate Director of the Recently Qualified Accountants practice of Barden’s talent advisory and recruitment firm in Munster.

After completing a Bachelor of Business Studies at UL, Siobhán began her career by training with KPMG’s tax department, achieving her ACA qualification in 2017. Following her time at KPMG, she transitioned into the realm of recruitment, joining Barden’s Recently Qualified Accountants team in Dublin in March 2017.

In July 2018, she embarked on an 18-month sabbatical to live in Canada, where she gained invaluable international recruitment experience and also did some travelling in Southeast Asia and South America. Upon her return to Ireland in April 2020, Siobhán rejoined the Barden team, this time in Munster, where she has since progressed to the position of Associate Director, supporting recently qualified accountants.

Connect with Siobhán at siobhan.sexton@barden.ie or via LinkedIn.

Conor Murphy ACA | Consultant | Recently Qualified Accountants | Barden Munster

Conor Murphy ACA is a Consultant in the Recently Qualified Accountants practice of Barden’s talent advisory and recruitment firm in Munster.

Conor holds a degree in Economics from UCC and an MSc in Corporate Finance. He began his career at KPMG in Cork, working in audit and completing his ACA exams. After qualifying, he spent four years in Australia as a Finance Business Partner for a ski resort while living in Melbourne. Post-COVID, Conor relocated to London and transitioned from finance to recruitment.

Conor joined the Barden team in May 2024 to support Jonathan Olden in developing the emerging practices division and transitioned into the Recently Qualified team in November 2025. His background in Big 4 and industry accounting positions him perfectly to transition into this new role and advise recently qualified accountants on their next career steps.

Connect with Conor at conor.murphy@Barden.ie or via LinkedIn.

Aideen Murphy ACA CTA | Partner | Tax & Practice | Barden Munster

Aideen Murphy is a Partner within the accounting and tax talent advisory and recruitment practice in Munster, leading the Tax and Practice area of the business.

She trained through a Big 4 firm, qualifying as an accountant, and further went on to study tax, in which she qualified in in 2012. Aideen spent a number of years, post qualification, working in both practice and industry before moving to recruitment in 2015.

Aideen is a subject matter expert in tax and accounting careers, is an active member of the Women in Tax in Ireland (WiTii) committee and regularly contributes to publications on the tax profession. Aideen advise leadership teams within Accounting Firms along with CFOs and tax leadership teams in Munster on attracting and retaining world class teams.

Connect with Aideen at aideen.murphy@barden.ie or vis LinkedIn.

Get in Touch With Us

Barden is where recently qualified accountants go before they start looking for a job.

When you meet Barden you will be meeting Ireland’s most experienced talent advisory and recruitment team, many of whom are themselves accounting and tax qualified.

Your future is too important to leave to chance. Take control, get informed and plan your professional future with Barden. Drop us an email at hello@barden.ie and we will get in touch to arrange a time and date that suits you to start planning your professional future.

The C-Suite has been on a journey of transformation, evolving from what used to be a traditional leadership group of the CEO, CFO and COO to a myriad of titles, responsibilities and, indeed, seniority.

C-Suite titles can now include the following, amongst others:

- Chief Digital Officer

- Chief Sustainability Officer

- Chief Diversity Officer

- Chief Data Officer

- Chief Innovation Officer

- Chief Risk Officer

- Chief Wellbeing Officer

- Chief AI Officer

It is important to note that, with the growth of the C-Suite, being a member of the “C-Suite team” does not necessarily mean you belong on the executive team.

The broadening scope and increasing complexity of C-Suite priorities and functions have given rise to a new C-Suite, one where it is critical to:

- Design the strategically needed roles

- Clarify which roles are enterprise critical and hence, belong on the executive team; and

- Adopt titles and reporting lines to define roles, responsibilities, and status.

Designing a Fit-for-Purpose C-Suite

It is a commonly held belief in leadership that, as groups expand beyond five members, coordination costs climb dramatically and decision-making quality declines. As such, when designing a C-Suite or leadership team, it is vital to minimise “adding chiefs,” as this may dilute clarity, slow decision-making, and increase the odds of overlap or conflict – more chiefs may result in more politics, not more performance.

The traditional CEO and CFO roles remain an undisputed requirement for most companies. Designing the remaining C-Suite should be deliberate and align with the entity’s strategy. Strategy clarifies the capabilities your company must excel at to differentiate itself from its competitors.

Common considerations include:

- Data, technology, innovation, and AI need to sit with leaders; do these need to be in the C-Suite?

- Human resources and talent acquisition can be clearly defined as being owned by a potential CPO. Still, consideration should be given to the need for a leader/owner of wellbeing, diversity, and experience.

- Sustainability: for your entity or for your customers? Is this a C-Suite role you may need? Or can it sit below the executive team with clear reporting lines?

- Perhaps a Chief Product Officer is needed if your organisation is product-driven?

- Does the company need a COO? What has often been a staple in companies to date is now being broken down into other titles or bled into functional roles.

Key Takeaways

What is in no doubt is the C-Suite’s critical role in a company.

It leads, sets the tone, and drives the strategy; hence, the roles need to be clearly defined. These roles must be presented to the market and internally in a transparent manner, with minimal functional overlap. Where there is overlap, concentrate on these areas of convergence – the seams – and ensure that ultimate ownership is understood for all decisions. Dual ownership rarely breeds successful outcomes.

In short, design your organisational structure and then acquire the talent. Don’t let leadership morph organically, as it may quickly become unwieldy.

Barden Executive Search

Barden partners with Boards and executive teams to appoint leaders and build future-ready organisations. Our founders and senior leaders work directly with clients, bringing first-hand experience of scaling businesses and driving growth. Reach out to ed.heffernan@Barden.ie to connect. Your Leaders, found by Ours.

Barden’s Recently Qualified Accountants Team (most of whom are qualified accountants, just like you) are here to help you make your very best first step as a qualified accountant.

Below you’ll find out more about each of the team. Drop an email to one of our team, and they will take care of you from there…

Brian O’Connor ACA | Team Lead | Accounting & Finance | Recently Qualified Appointments | Barden Leinster

Brian O’Connor ACA is the Team Lead of the Recently Qualified Accountants division of Barden’s talent advisory and recruitment firm in Leinster.

After completing his BComm and MAcc at UCD, Brian completed his training contract with Deloitte’s FS Audit team. There, he worked on fund and reinsurance audits and achieved his ACA qualification. Post-contract, Brian moved to Melbourne, where he diversified his experience through various industry roles, including financial reporting, project accounting, and fixed assets.

After returning from Australia in January 2020, Brian decided to leverage his ACA qualification in an advisory capacity by joining Barden. He was promoted to Partner in January 2026 and assumes a leadership role, guiding the Recently Qualified Accountants practice with a blend of expertise, insight, and a commitment to delivering excellence. These values extend to serving clients, newly qualified accountants and our partners in CASSI and Chartered Accountants Ireland as well as fostering a culture of growth and collaboration within the Barden team.

Niall O’Keeffe ACA | Business Lead | Recently Qualified Accountants & Aircraft Leasing Advisor | Barden Leinster

Niall O’Keeffe ACA is a Business Lead in the Recently Qualified Accountants team, and Aircraft Leasing Advisor, at Barden’s talent advisory and recruitment firm in Leinster.

Niall successfully qualified as a Chartered Accountant in 2021, having completed his training contract with the Audit team in Deloitte Ireland. Before this, Niall completed an accounting degree and an accounting master’s at University College Cork.

Niall works directly with the recently qualified team in Dublin to support recently qualified accounting professionals in Leinster. He also specialises in careers in the aircraft leasing sector.

Jack O’Regan ACA | Associate | Recently Qualified Accountants | Barden Leinster

Jack O’Regan ACA is an Associate in the Recently Qualified Accountants division of Barden’s talent advisory and recruitment firm in Leinster.

After studying Commerce at UCC, Jack began his trainee contract with the Deloitte Dublin audit department. During his time there, he worked with large PLCs, giving him great exposure to complex financial environments and helped him build a strong technical foundation.

Once he had finished his contract and achieved his ACA qualification, Jack moved to Australia, where he worked in two different contract roles in property accounting. On his return to Ireland, Jack became increasingly curious about exploring new ways to apply his qualification beyond traditional accounting roles. Barden’s people-first approach strongly resonated with Jack, reaffirming that Barden was exactly the kind of organisation he wanted to be part of.

Jack works with the recently qualified team in Dublin to support recently qualified accounting professionals in Leinster.

Aoibhín Byrne | Associate Director | Tax, Treasury & Practice | Barden Leinster

Aoibhín Byrne is Associate Director of the Tax, Treasury & Practice division within Barden’s talent advisory and recruitment firm in Leinster. In this capacity, she supports professionals through career transitions while complementing business recruitment strategies across tax, treasury, audit and consulting.

After graduating from UCC with a BComm in French, Aoibhín started her professional journey with KPMG’s tax department. During her time there, she supported multinational businesses across a variety of industries in the provision of corporate tax compliance and advisory services.

Aoibhín joined Barden Leinster in October 2019 as an Associate, progressing into the role of Associate Director in January 2025. She is passionate about helping Barden’s clients build the best teams, actively engaging with them to discern their requirements, preferences, and aspirations while sharing key market insights.

Get in Touch With Us

Barden is where recently qualified accountants go before they start looking for a job.

When you meet Barden you will be meeting Ireland’s most experienced talent advisory and recruitment team, many of whom are themselves accounting and tax qualified.

Your future is too important to leave to chance. Take control, get informed and plan your future with Barden. Drop us an email at hello@barden.ie and we will get in touch to arrange a time and date that suits you to start planning your professional future.

Let me start with a question: after a hybrid team meeting ends and the screen goes blank, what happens in the room if you’re in the office with your colleagues?

You chat. You walk out of the meeting room, brainstorming on how to tweak the proposal you just went through in the meeting, talking about your weekend plans, or chatting about the soccer game that happened last night.

Those few minutes before and after meetings are highly valuable for building relationships and for influencing decision-making. These simple social interactions create chemistry, strengthen relationships and deepen trust. Relationships can be maintained online, but they cannot be built to the same level in a virtual environment.

Opportunities for Learning

We learn by osmosis. Being present and engaged in office life enables us to pick up small nuggets of information all the time, and this wisdom compounds over time. One small new learning this week doesn’t feel like much. Still, new learning every week for five or ten years amounts to in-depth insights into an organisation, ways of working, technical knowledge, and interpersonal skills.

Learning doesn’t always come from the top down. Often, emerging technologies are better understood by grads and younger people, allowing senior leaders to collect their weekly nuggets of information from their junior colleagues.

Purposeful Presence

Presenteeism is not the goal. Employees should not be in the office if their core team isn’t there or if there is no real value in doing so. Mandating presence for the sake of it is counterproductive. There must be a purpose and value to being in the office, and a critical mass of people should be present to enable meaningful, dynamic interaction. If one person goes into the office on a Friday and nobody else is there, the value is lost. Similarly, if an employee is sitting alone in a meeting room for eight hours to write a report, they may as well be working from home. Being in the office should provide opportunities for interaction, learning, and collaboration.

Takeaway

In-person presence matters when it creates connection, learning, and collaboration. Time in the office should be purposeful, not just procedural.

Padraig Ryan (LinkedIn>>>) is the Managing Director of Navitise Consulting. Navitise is a boutique consulting firm that combines big-firm expertise with a personalised approach, delivering strategy, operational excellence and transformation solutions.

Barden and CASSC are delighted to bring you the not-to-be-missed FAE Careers Evening taking place on Thursday, 26th February 2026.

What is the event all about?

The Barden & CASSC FAE Careers Evening 2026 is designed specifically for FAE students to answer any questions they might have about their professional futures. The evening has been structured to ensure CASSC members get access to the right information at the right time so that when they qualify, they can make informed decisions about their professional future.

Those who attend will also have the opportunity to ask any questions they might have about their professional future and visit a variety of Barden information stands to speak directly to Barden’s expert newly qualified careers team.

Who is it for?

This event is for those who have passed FAEs and are approaching the end of their training contract. It is also open to recently qualified accountants. The event is free of charge, but registration is required. Get your tickets here>>>>

On the night, you’ll gain insights from:

- Michael Sheehan | Chief Financial Officer | The Irish Times

- Martin O’Reilly | Manager | Xeinadin

- Avril O Callaghan | RTR Accountant | FMC

- David Collins | CASSC Chair 2024/25 | Audit Senior | EY Ireland

- Maighread Meehan | Financial Accountant | Musgrave

- Conor Murphy ACA | Consultant | Recently Qualified Accountants | Barden Munster

- Siobhán Sexton ACA | Associate Director | Recently Qualified Accountants | Barden Munster

Michael Sheehan | Chief Financial Officer | The Irish Times

Mikie is from Glanworth in North Cork. He went to secondary school in St. Colman’s College, Fermoy and studied Accounting in UCC. From there, he began his career at Deloitte, where he qualified as a chartered accountant and worked in the areas of audit, corporate finance and corporate recovery, while also completing various international secondments in Australia, the Channel Islands and the UK. He moved to the Examiner Group in 2013 following an industry secondment from Deloitte.

Following the acquisition of the Group by The Irish Times in 2018, he held various roles within the finance department before becoming Chief Financial Officer (CFO) in October 2020. In the intervening period, he has also held interim roles as Managing Director of The Examiner Group for 18 months, Group Chief Information Officer for 12 months, and, more recently, Group Managing Director for 4 months. He is also a member of The Irish Times DAC’s board of directors.

Martin O’Reilly | Manager | Xeinadin

Martin O’Reilly is a Manager at Xeinadin, based in the Blackpool office, where he is responsible for managing a diverse portfolio of clients across a wide range of industries and geographic locations. He provides a comprehensive suite of professional services, including accounts preparation, audit, and advisory support, alongside ongoing compliance and company secretarial services.

Prior to joining Xeinadin, Martin gained valuable experience at PwC in Cork, where he trained within the audit department. During his time at PwC, he worked with a variety of clients, developing strong technical expertise, commercial awareness, and a client-focused approach to delivering high-quality professional services.

Avril O Callaghan | RTR Accountant | FMC

Avril is a qualified chartered accountant from Cork. She studied Accounting at UCC and began her career with Deloitte (Audit) in the graduate programme, qualifying in 2023. Following her graduate contract, she moved to Australia for six months, where she worked as a finance lead for a start-up construction company.

She returned to Cork in December 2023, where she navigated the job market with Barden’s support and became a Financial Accountant at MSL, a mechanical engineering company. She spent 1.5 years there, gaining in-depth experience across a multitude of business areas.

After working in SMEs since leaving Deloitte, Avril was keen to grow her business knowledge, particularly in a multinational environment. As a result, she began looking for a new role, again with Barden’s help. She has been working at FMC as an RTR accountant for the past 7 months.

David Collins | CASSC Chair 2024/25 | Audit Senior | EY Ireland

David Collins is the 2025/26 chair of the CASSC and an Audit Associate at EY, specialising in Wealth and Asset Management. He graduated from UCC in 2021 with a first-class honours in the BSc Government and Political Science programme. David’s achievements include receiving the Breifne O’Callaghan award for youth leadership and being named the Department of Government and Politics 2021 graduate of the year.

Maighread Meehan | Financial Accountant | Musgrave

Originally from Waterford, Maighread completed an undergraduate degree in Accounting at the University of Limerick. After graduating, she joined EY, where she completed her training contract in Audit. After qualifying in 2023, she travelled and settled in both Australia and New Zealand, using the opportunity to work across different industries in short-term roles to broaden her experience and perspective, while also enjoying the chance to explore new countries. Maighread returned to Ireland in Q4 2025 and is now working with Musgrave as a Financial Accountant in their Group Finance team.

Conor Murphy ACA | Consultant | Recently Qualified Accountants | Barden Munster

Conor Murphy ACA is a Consultant in the Recently Qualified Accountants practice of Barden’s talent advisory and recruitment firm in Munster.

Conor holds a degree in Economics from UCC and an MSc in Corporate Finance. He began his career at KPMG in Cork, working in audit and completing his ACA exams. After qualifying, he spent four years in Australia as an accountant for a ski resort while living in Melbourne. Post-COVID, Conor relocated to London and transitioned from finance to recruitment.

Conor joined the Barden team in May 2024 to support Jonathan Olden in developing the emerging practices division and transitioned into the Recently Qualified team in November 2025. His background in Big 4 and industry accounting positions him perfectly to transition into this new role and advise recently qualified accountants on their next career steps. Connect with Conor on LinkedIn>>>>

Siobhán Sexton ACA | Associate Director | Recently Qualified Accountants | Barden Munster

Siobhán Sexton ACA is the Associate Director of the Recently Qualified Accountants practice of Barden’s talent advisory and recruitment firm in Munster.

Siobhán began her career by training with KPMG’s tax department, achieving her ACA qualification in 2017. Following her time at KPMG, she transitioned into the realm of recruitment, joining Barden’s Recently Qualified Accountants team in Dublin in March 2017.

In July 2018, her career took an adventurous turn when she embarked on an 18-month sabbatical to work and live in Canada. There, she gained invaluable international recruitment experience and also travelled to Southeast Asia and South America. Upon her return to Ireland in April 2020, Siobhán rejoined the Barden team, this time in Munster, where she has since progressed to the position of Associate Director, supporting recently qualified accountants. Connect with Siobhán on LinkedIn>>>