Audit as a profession is often in the spotlight.

For quite some time, the supply of external audit talent in Ireland has been significantly below demand. This has been evident from the reliance we’ve had on other talent markets, including the Philippines, India and Pakistan.

The audit talent supply has faced many challenges over the last number of years. From the outflow of talent to international markets and other verticals, to the slight “audit aversion” – there is a lot to digest.

Here are some things that may be worth thinking about as an audit professional or audit hiring manager…

#1 Perception of Audit Careers in Practice

Before we dive into real-time data, it’s vital we take a step back and assess the perception of external audit as a profession.

For the purposes of this Talent Monitor, we are not focusing on client bases below the audit threshold.

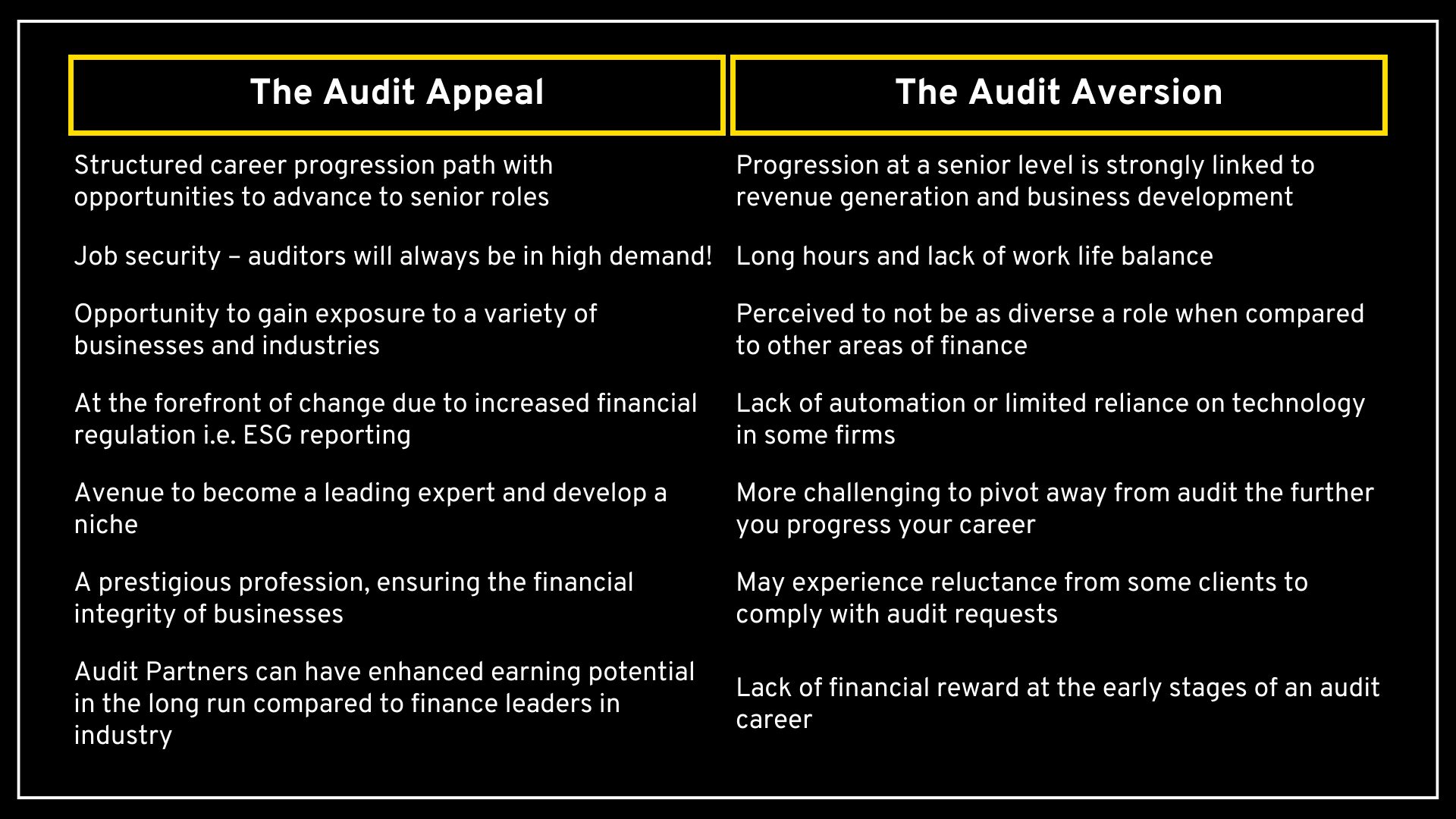

We’ve spent a lot of time getting to know the audit community, and here are some shared views of a long-term career in audit…

There are thousands of people happily employed in the external audit world worldwide; however by the nature of the general audit training route in Ireland, many leave the audit profession on completion of their training. It’s important to note that this is to do with the structure of a typical audit training path and not the audit profession itself – many professionals are burnt out and feel a career change (or career break) is necessary.

Although this profession evokes mixed feelings, the role of the external auditor is crucial in maintaining the financial health and integrity of businesses.

#2 The Audit Landscape

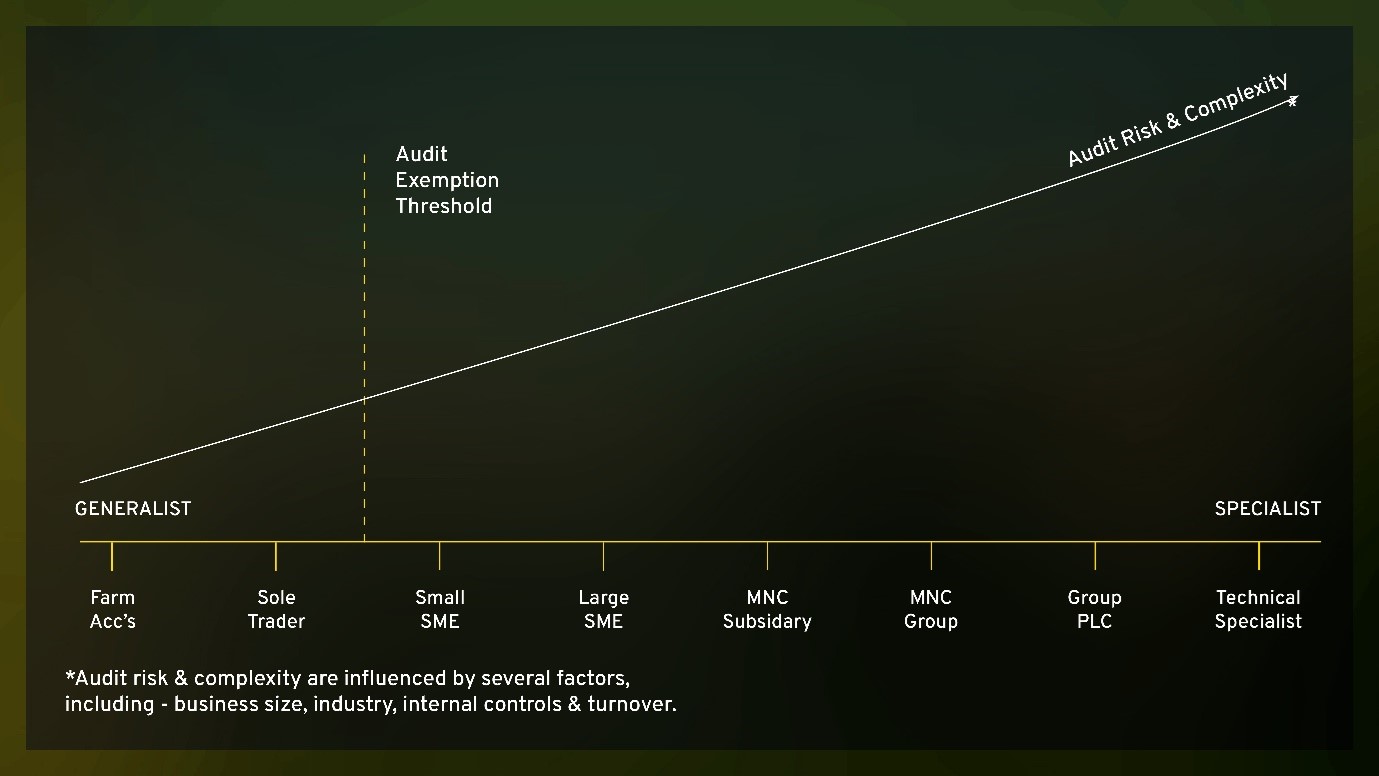

When assessing your audit experience and how this may be perceived on the external audit market, it’s important to consider…

- Your client base

- Which tends to be dictated by the size of the firm you are working in

- And in turn will shape your scope of experience

For the purposes of transparency, let’s categorise the audit landscape into two categories based on client base – Generalist and Specialist.

As a Generalist…

Client Base – usually serves local businesses and SME’s. More diverse in terms of industry. More likely to have direct and frequent interactions with clients, providing personalised services while building strong relationships.

Scope of Work – a broad range of audit responsibilities and tends to be involved at all stages of the audit – planning, execution and reporting. Need to adapt to a variety of client needs and industries, offering a broader skillset. The audit team can also wear multiple hats and support other areas of the firm, i.e. payroll, accounts preparation, tax compliance.

Team Structure – Smaller teams, often with more responsibility and autonomy. Less hierarchical in terms of structure.

As a Specialist…

Client Base – support larger businesses, including multinational corporations, public companies and government entities. Relationships tend to be managed by senior members of the team, so less direct client interaction at a junior level. Larger audit firms can have dedicated industry teams, allowing you to develop a niche, so you may only gain exposure to certain industries, i.e. financial services, pharmaceuticals, technology.

Scope of Work – the audits tend to be larger and more complex, with enhanced reporting requirements leading to a higher degree of risk. They can also involve multiple accounting standards, various jurisdictions and extensive documentation. Roles will be more specialised, and you may only focus on a specific area of the audit. More likely to use advanced audit software and data analytics tools.

Team Structure – Larger teams, often with less responsibility and autonomy. More hierarchical in terms of structure, with defined roles. More likely you will collaborate with other specialists, i.e. tax, advisory.

#3 Base

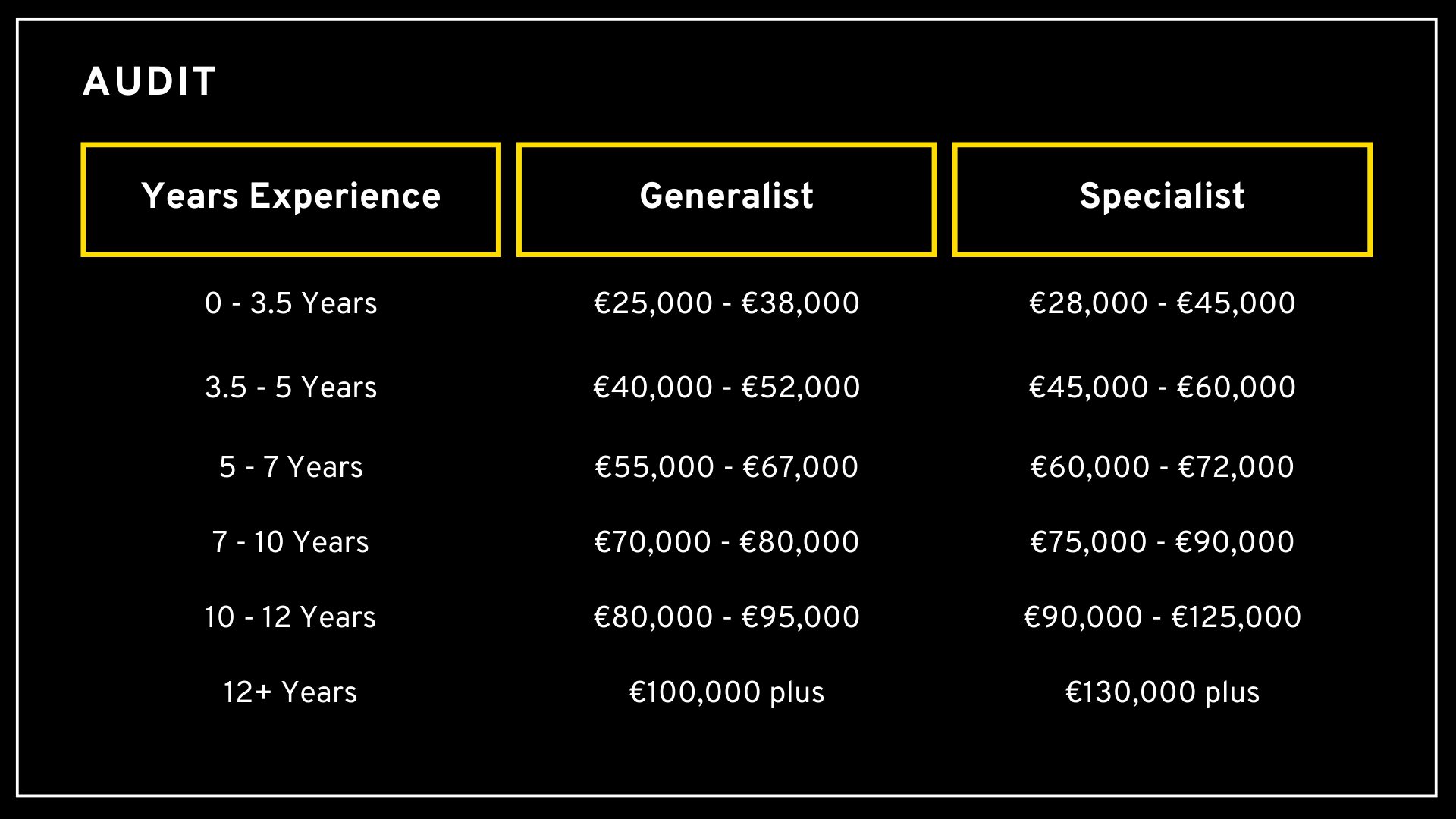

As we have explored above, the role of an auditor can differ depending on the client portfolio, which tends to be influenced by the size of the firm you’re working in.

For the purposes of transparency, we’re going to focus on years of experience and audit category (Specialist or Generalist).

This is also a very broad guideline, and it’s important to understand the specifics of each individual role, i.e., people management, scope of responsibilities, business development initiatives and technical knowledge.

As you will notice, deemed specialists are paid a premium for their technical knowledge as their clients are under more scrutiny in terms of financial regulation.

#3 Demand v Supply

The demand for audit professionals in practice continues to outweigh the supply of experienced audit professionals, which can largely be explained by:

- Near-full employment

- Increased global financial regulation, resulting in further demand for audit services (and talent)

- Significant outflows of talent to other verticals (mainly industry accounting and financial services).

The audit professional is in “very high demand”. Here are some data points about the audit talent pool in Ireland this quarter. It’s important to note that while a portion of the talent pool is demonstrating job-seeking behaviours, the majority are likely to be seeking a move away from the external audit profession.

#4 What are employers doing to attract Audit talent?

- Flexibility – while client demands and statutory deadlines will dictate working arrangements, flexible working hours and an opportunity to work from home are essential. Part-time arrangements may be worth considering in certain circumstances.

- Monetary – competitive base salaries that are talent-led rather than budget-led, and definitive salary review periods. Strengthening additional benefits, i.e. sign-on bonus and bonus multipliers, to recognise professionals exceeding expectations.

- Career Progression – defining clear paths for progression in the current role and offering promotions based on performance rather than tenure.

- Learning & Development – rotations through different departments, exposure to various types of audits, and opportunities to work on diverse projects. Offering a sense of purpose is essential for auditors and has recently been connected to sustainability assurance and reporting.

- Boomerangs – Employers are placing greater emphasis on “boomerang” employees—those who leave and later return. By fostering positive relationships with former staff and creating a welcoming environment, companies can benefit from their experience while signalling a commitment to long-term career growth

- Embrace technology to remain relevant – those considering a career in the profession wish to embrace advanced technologies. While certain firms can fulfil that wish, others are lagging. Bridging the technology gap is a strategic imperative for the profession.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please contact Aoibhín Byrne, our Audit Talent Advisor here in Barden (aoibhin.byrne@barden.ie); we’re where leaders go before they start hiring Audit talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Aoibhín Byrne at aoibhin.byrne@barden.ie.

Business Support professionals – the people who keep organisations moving.

There’s a lot more to business support professionals than meets the eye. Behind the calendar invites, scheduling and office administration, these people are the glue that holds organisations together and are essential to the smooth operation of an organisation

It is important to understand the value a business support professional can add to your organisation. This can range from junior administrators who hold entry-level roles or more senior, highly experienced professionals who have made a career of providing immeasurable support to organisations. These professionals find opportunities to add value to the operations of a company while continuing to develop in their own careers and making it easier for others to do their roles.

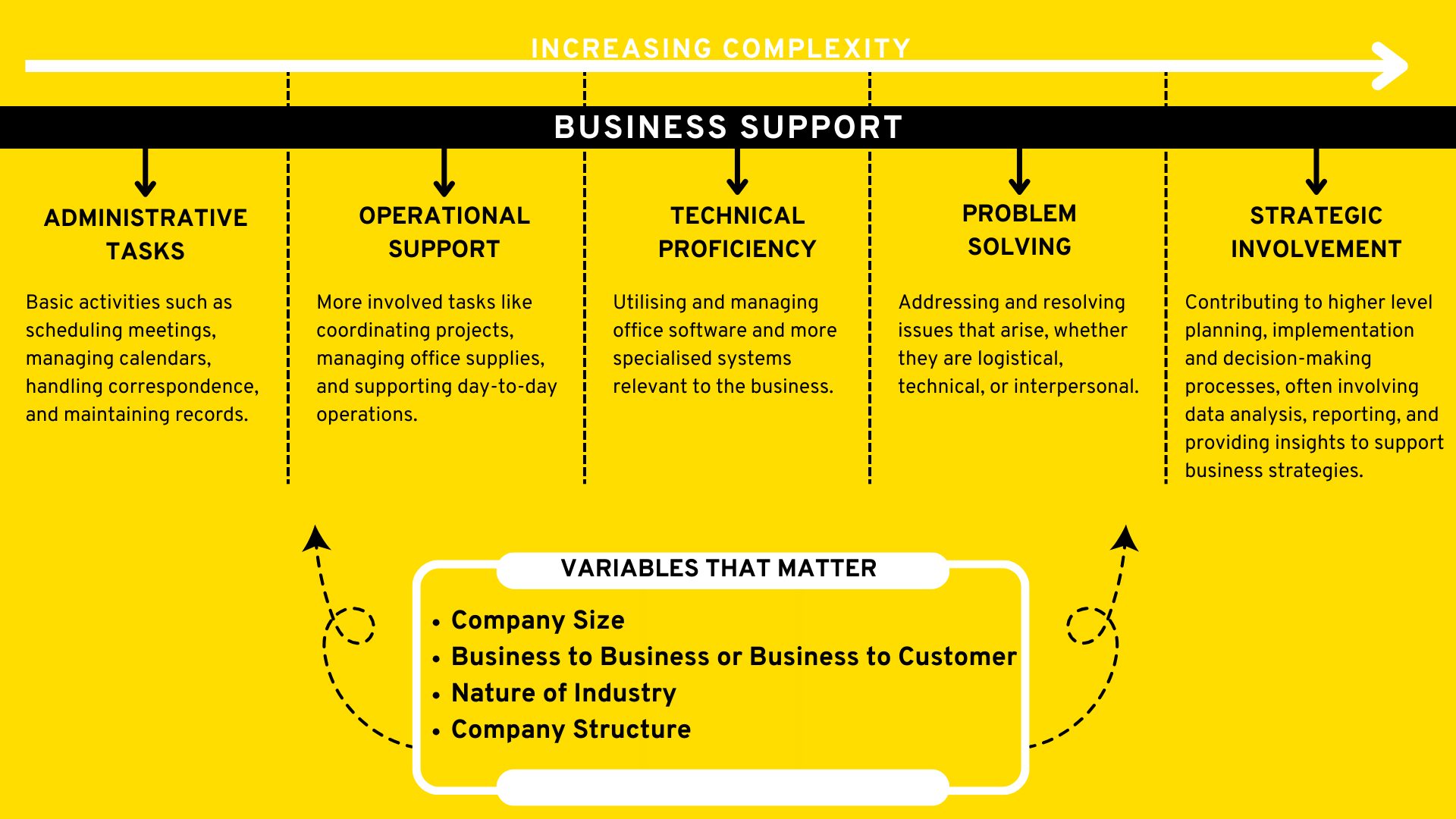

#1 The Continuum Of Activity

In the business support industry, job titles alone don’t capture the full scope of a role. It’s the specific responsibilities and demands placed on individuals that truly define their positions. Whether it’s a receptionist managing the first impressions of a company or an Executive Assistant coordinating high-level operations, understanding the context behind each title is essential to appreciate the true value these professionals bring to their organisations.

The continuum of activity for a business support professional can be understood as a range of tasks and responsibilities that vary in complexity.

Variables Influencing Business Support Roles:

The role of business support professionals can vary widely depending on factors like company size, the complexity of the day-to-day operations, and the level of specialisation needed. Hiring managers need to understand these factors to match their talent effectively.

- Company Size: Larger companies often have more specialised roles, while smaller ones may require employees to handle a broader range of tasks.

- Business to Business or Business to Customer: In B2B settings, roles involve complex tasks, strategic relationship management, and multiple stakeholders. B2C roles focus on high-volume customer interactions, emphasising satisfaction and brand loyalty.

- Nature of Industry: Different industries have unique requirements. For example, tech roles might need specific software knowledge, while healthcare roles might focus on medical terminology.

- Company Structure: Larger organisations may have clearly defined roles, whereas flatter organisations might require more collaboration and flexibility.

#2 Salary Insights:

Salaries and compensation for business support professionals in Ireland are influenced by several factors, including the level of experience, specific job role, industry, and location. Overall, the salary range for business support roles can vary widely, reflecting the diverse opportunities and career paths available within the field.

Examples of Recently Delivered Assignments:

This is a very broad guideline and it’s important to take into account the specifics of each individual role. For bespoke advice please contact susan.greene@barden.ie

This is a very broad guideline and it’s important to take into account the specifics of each individual role. For bespoke advice please contact susan.greene@barden.ie

#3 Challenges for Attracting & Retaining Talent for the future:

- Business support roles can sometimes be seen as stepping stones, leading to higher turnover if employees don’t feel recognised by the business or see clear career advancement opportunities. Ensuring that employees feel valued and engaged in their roles is essential to prevent burnout and turnover.

- Offering competitive salaries that match or exceed market rates is necessary to attract top talent. Beyond salary, offering attractive benefits and perks is important to attract and retain employees.

- AI presents several challenges to the business support industry. It can lead to job displacement as routine tasks become automated, requiring roles to be redefined. There’s a significant need for upskilling, as professionals must adapt to new technologies and continuously learn. Integrating AI systems can be complex and costly, with concerns about data privacy and security. Additionally, ensuring AI systems are free from bias and operate transparently is crucial.

- Despite these challenges, it’s crucial to keep business support professionals involved. Their human insight, judgment, and ability to build customer relationships are irreplaceable. They provide essential oversight, adaptability, and problem-solving skills, ensuring AI systems function ethically and effectively. By combining AI with human expertise, organisations can create a more efficient and human approach to business support.

Hiring business support talent comes with its own set of challenges. Recognising the intricacies of challenges allows companies to develop more efficient recruitment and retention strategies. Offering competitive salaries, flexible working conditions, and providing continuous learning are crucial to attracting and nurturing adaptable, innovative talent.

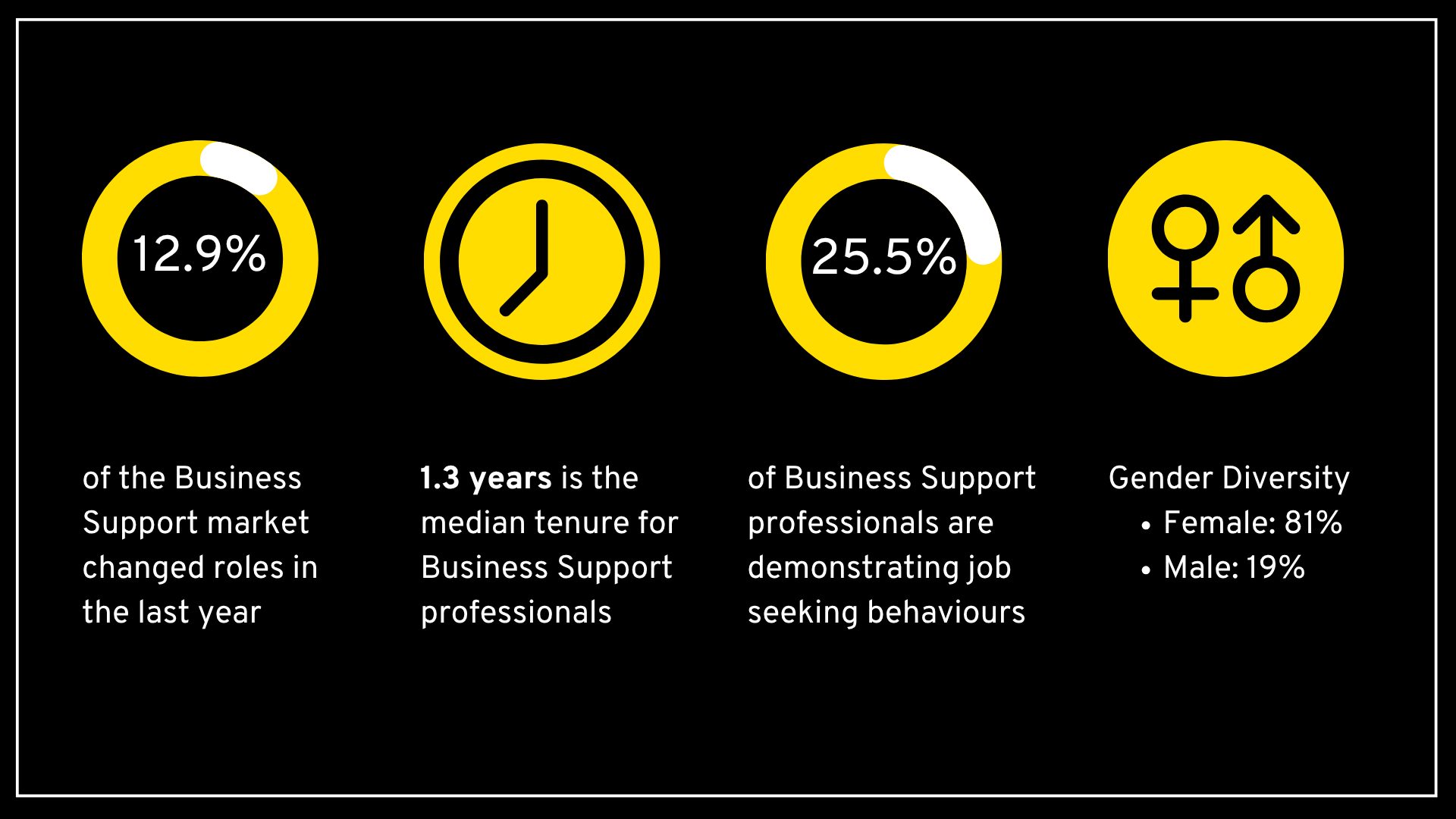

#4 Demand vs Supply

Here’s what we’ve noticed this quarter in the administration and business support talent pool in Ireland:

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches that would suit you, please feel free to contact Susan Greene | Business Support Talent Advisor here in Barden (susan.greene@barden.ie); we’re where leaders go before they start looking for Business Support talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Susan Greene at susan.greene@barden.ie.

Ireland’s engineering profession is a dynamic and vital sector, encompassing a wide range of disciplines such as civil, mechanical, electrical, and chemical engineering. The profession is known for its strong export performance, with engineering products and services accounting for a substantial portion of national exports.

The profession is known for its best-in-class talent originating from world-renowned engineering courses in Irish universities.

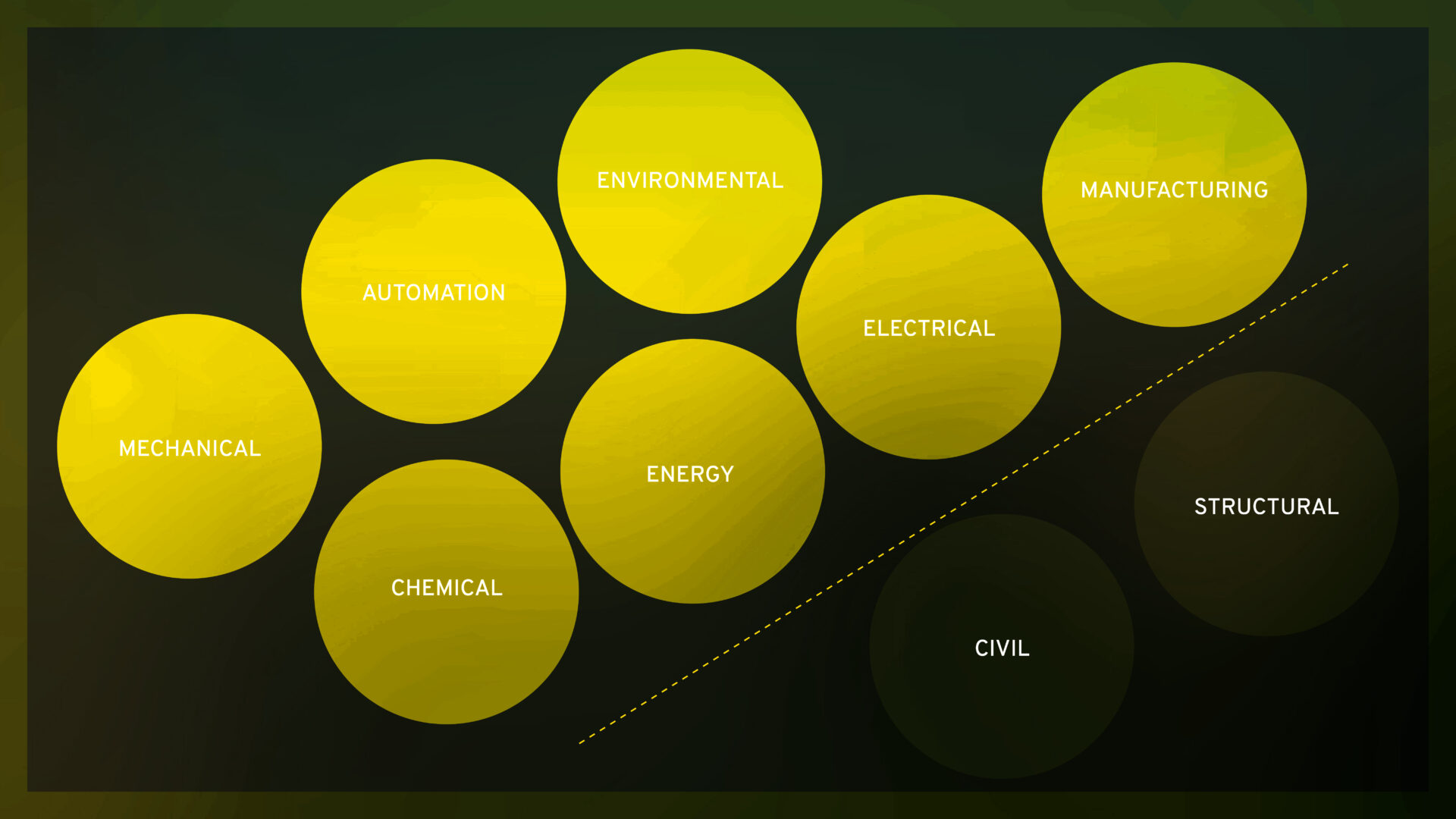

#1 Engineering Verticals

Engineering qualifications cover diverse fields such as those identified below. For this report, we have decided not to include an analysis of the civil or structural engineering professions.

Each field has distinct roles: mechanical engineers design machinery, electrical engineers develop power systems, chemical engineers manage chemical processes and so on.

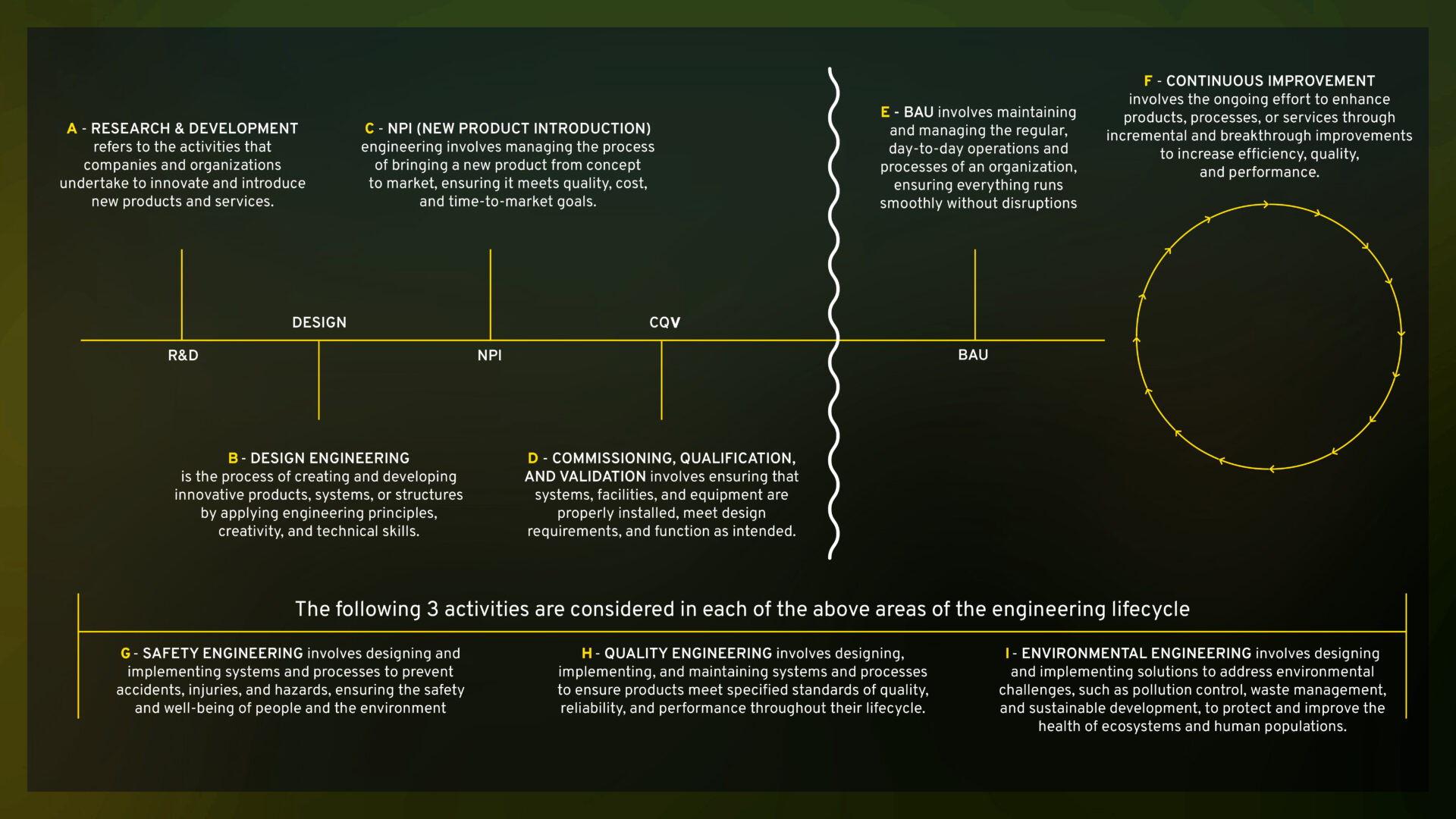

Illustrated below is where each of the above qualifications can sit within the engineering lifecycle.

#2 Engineering Variables

Job title alone often does not capture the full scope of an Engineering role. Here are the key variables that help define what a position truly entails:

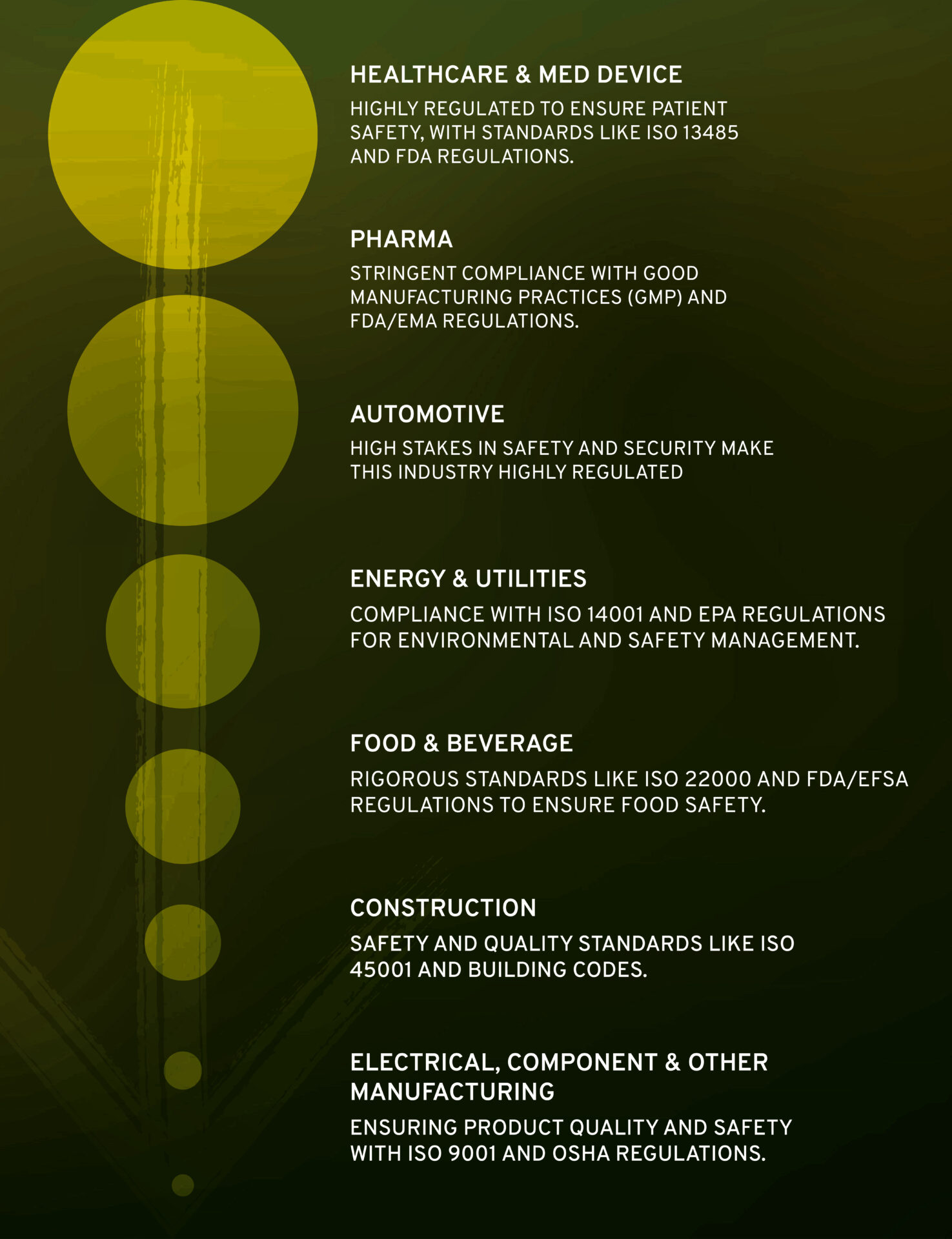

- Industry & Compliance – Compliance differences across industries significantly influence engineers’ career decisions, as they must navigate varying regulatory landscapes, which impact innovation, risk management, and the complexity of their work. Below is a snapshot of the intensity of regulations across industries.

- Size of business – Whether you are in an SME or a Multinational company, this can have a significant impact on several factors. If you are in an SME type business, your role is more likely to have a broader scope, perhaps including several different areas, i.e. an Engineering Manager covering manufacturing, operations, CAPEX, etc. However, for a larger multinational organisation, it may often be the case where your role is part of a wider function, e.g. NPI, R&D, CAPEX, Automation, etc. The larger the team, the more specialised each role is in most circumstances.

- Global/ regional/ local role – This again probably depends on the size of the business or the organisational structure. You may be working on a global scale, covering several sites, or you may be managing operations for one manufacturing site, or you may be managing operations for a whole region/or multiple regions.

- Sole contributor/ people manager – both SME and multinational companies have positions which often oversee or lead a team. It is also the case that both of these types of businesses will have sole contributor roles, e.g. Principal NPI Engineer, Principal R&D Engineer, Stand Alone Safety Engineering Manager.

- Jurisdiction – There will be different rules and regulations in every jurisdiction, be it customs, imports or regulations around manufacturing, packaging, etc. For example, a drink may be allowed to have a certain amount of an ingredient in one country but not in the next. This can influence manufacturing processes, etc, which in turn can influence a person’s decision when exploring roles in different regions.

#3 Engineering Levels

Engineering levels typically reflect an engineer’s experience, skills, and responsibilities. Here is a general overview of how these levels might be described.

These levels can vary between organizations, but they generally reflect an engineer’s progression from learning and applying basic principles (L1, L2, etc) to leading and innovating at the highest levels (L8, L9, L10+, etc).

#4 Salary Data

Below is a high-level salary guide for engineers based on their years of experience and the size of the team they are responsible for, if they oversee a team. It is a caveat that the chart below is a guide, however, Barden’s engineering practice can help talent and hiring teams benchmark at a more precise level based on the scope of the role, nature of business, etc. This data was extracted from the Engineers Ireland salary survey 2025.

#5 Demand Versus Supply

Here is what we have observed from Q3 2024 – Q3 2025 in the Engineering talent pool in Ireland:

#6 What are companies doing to attract talent?

- Internship/ co-op/ grad programmes – Offering internships and co-op opportunities allows students and recent graduates to gain practical experience. Many companies use these programs as a pipeline for full-time hires.

- Promotion opportunities – Encouraging internal promotions helps create a sense of opportunity and career progression within the organisation. This strategy not only builds loyalty but also maintains a consistent corporate culture, saving costs associated with external hiring and training. Having regular communications around progression, performance, and future development can show talent that employers are invested in their future and can help to develop a sense of loyalty from employees.

- Investment in facilities & technologies – Companies are investing in new technologies such as new automation systems, robotics, etc, to streamline processes and improve efficiency. Providing employees with the latest tools and technologies makes the work environment more dynamic and appealing.

- Innovation & new products – Leading companies are attracting engineers by working on cutting-edge projects like AI integration, sustainable & next-generation technologies. They are also investing in advanced tools and health tech innovations, creating exciting opportunities for top engineering talent. Additionally, companies are focusing on projects that have a significant impact, such as developing AI-powered design tools.

- Strategic roles versus BAU – Strategic roles attract engineers by offering high-impact, innovative projects (e.g. Capital Programmes), while BAU roles focus on maintaining and improving existing systems. Engineers in strategic roles work on transformative initiatives, whereas BAU roles handle routine tasks. Companies need to balance both to ensure operational efficiency and strategic growth.

#7 Projected challenges for the next 12 months

For employers:

- Geopolitical uncertainty: This poses a significant risk to Irish employers due to potential tariffs and protectionist policies that could disrupt trade and lead to job losses.

- Skill Shortages: There is a significant shortage of skilled engineering professionals, particularly in specialised fields like project management and sustainability.

- Competitive Salaries: Companies must offer competitive salaries and benefits to attract top talent, which can be challenging given budget constraints.

- Retention: Keeping skilled engineers engaged and preventing turnover requires ongoing professional development and career growth opportunities

For Talent:

- Geopolitical uncertainty: This poses risks to Irish employees due to potential job losses from US multinationals relocating back to the US, driven by changes in tax policies and protectionist measures.

- Experience Requirements: Engineers may struggle to meet the specific experience requirements for many positions, especially when transitioning to new industries.

- Technical Interviews: Rigorous technical interviews that test problem-solving and practical skills can be daunting and challenging.

- Competitive Job Market: The high number of applicants for engineering roles means that standing out requires exceptional qualifications and networking.

In Barden, we understand that each team, role, and requirement is unique. If you’re interested in exploring which approaches would be best suited for you & your organisation, please feel free to contact Conor Murphy, our Engineering Talent Advisory & Recruitment expert here in Barden (conor.murphy@barden.ie); we’re where leaders go before they start looking for Engineering talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Conor Murphy at conor.murphy@barden.ie

Tax professionals remain in demand. Our latest talent monitor highlights specific trends and data around the movement, availability and salary trends for tax professionals in Ireland:

#1 Reasons for high demand:

The demand for tax professionals has arisen due to the rapid change in the tax landscape, particularly in the international tax environment. Tax professionals with international tax expertise are in high demand. Pillar II/BEPS and the focus on transformation/automation skills to support enhanced reporting requirements have heightened this demand. Recent years have also brought a focus on controversy, tax, audits and disputes as Revenue and tax authorities around the world ramp up investigations.

At the same time, tax professionals who are deemed generalists are back in demand to manage a broad scope of tax areas for their clients or company stakeholders. Domestic issues such as wealth & succession planning remain a focal point for private client tax advisors.

The recent Trump administration, with a focus on tax and tariffs, will be another factor contributing to the demand for tax professionals. Paradoxically, this focus on tariffs leading to potential trade wars could be a massive disruption in the global economy, which will slow down investment opportunities including recruitment plans. It’s too early to say whether this will impact the cohort of tax professionals looking for a new opportunity this quarter or next quarter.

#2 Salary trends of tax professionals

Salaries have remained steady over recent quarters and are in line with average salaries monitored throughout 2024. Below are some guidelines for salaries within the industry and practice.

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice, our team can provide further details, for contact aoibhin.byrne@barden.ie (Leinster) or aideen.murphy@barden.ie (Munster).

Some important points to note:

- Figures relate to base salary only.

- Context is key. There can be variances in these figures(and significant ones) dependent on the industry sector, scope of responsibility, geographical reach, reporting line and years of experience.

- Job titles themselves can vary between one company to another, so it’s important to figure out what they mean, particularly the title of Tax Manager/International Tax Manager.

- Bonuses and other benefits impact the total comp value of a tax professional’s salary and need to be considered.

- Finally to note the importance of benchmarking each role using real-time market info from a trusted source, as our salary guideline (as many others on the markets) is a broad guide…

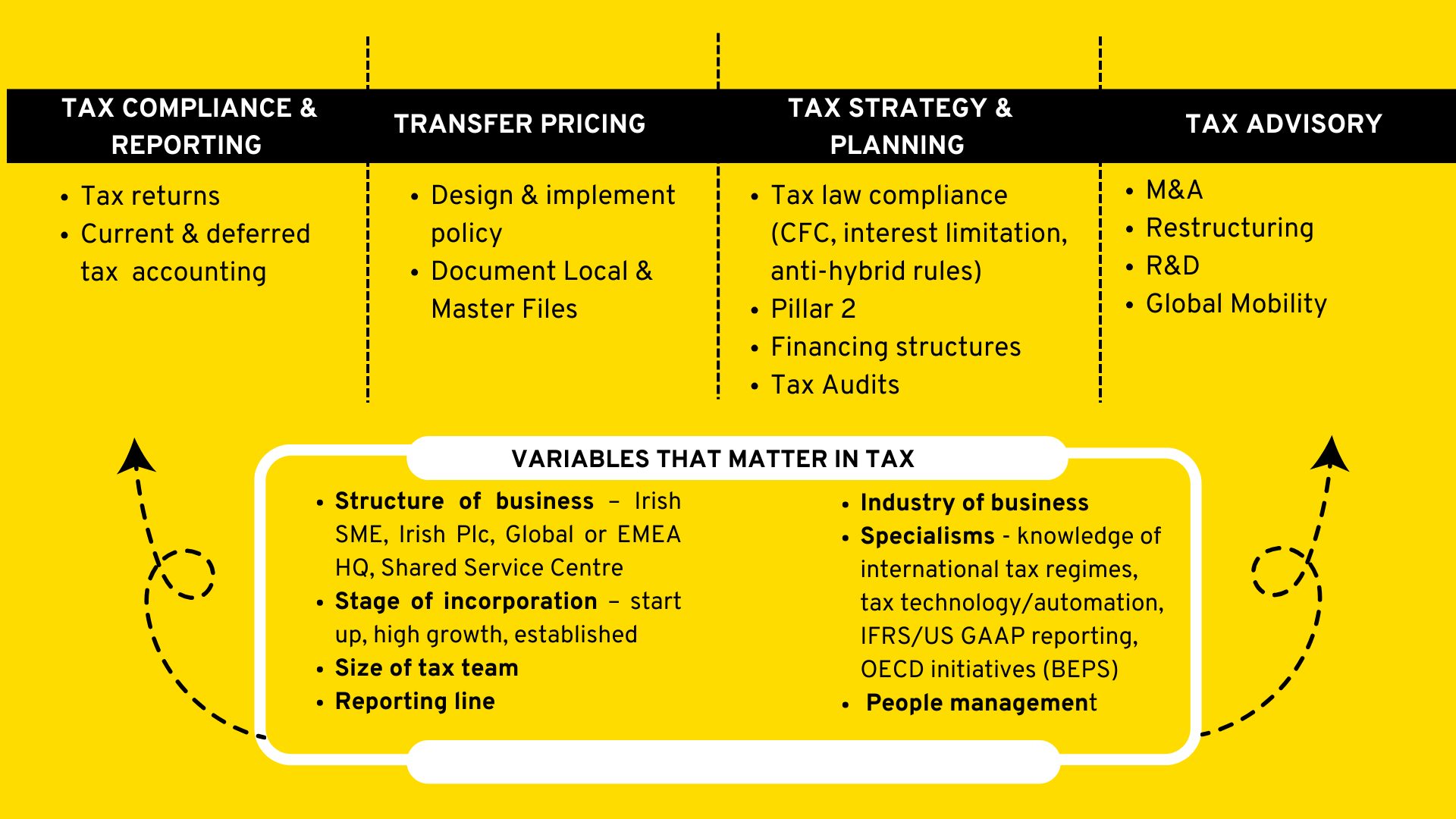

#3 Continuum of Activity | Tax Industry

A job title in the Tax Industry doesn’t define your role in the external market. A rule of thumb, the smaller the tax team, the broader your scope of duties is likely to be. The role of the Tax Professional in industry is largely defined by the variables listed below. The variables that are relevant to the role you are hiring for matter a lot.

#4 Movement trends of tax professionals this quarter

The demand for tax professionals across Tax and Industry continues to outweigh the supply of experienced tax professionals. Companies recruiting in this quarter are predominantly international tax groups with their EMEA headquarters in Ireland and Irish professional service firms across the Big 4 and top 10 sector.

We are noticing a significant outflow of talent to international tax markets for tax professionals with 3 – 5 years’ experience– Australia, Canada, and London remain the most popular destinations.

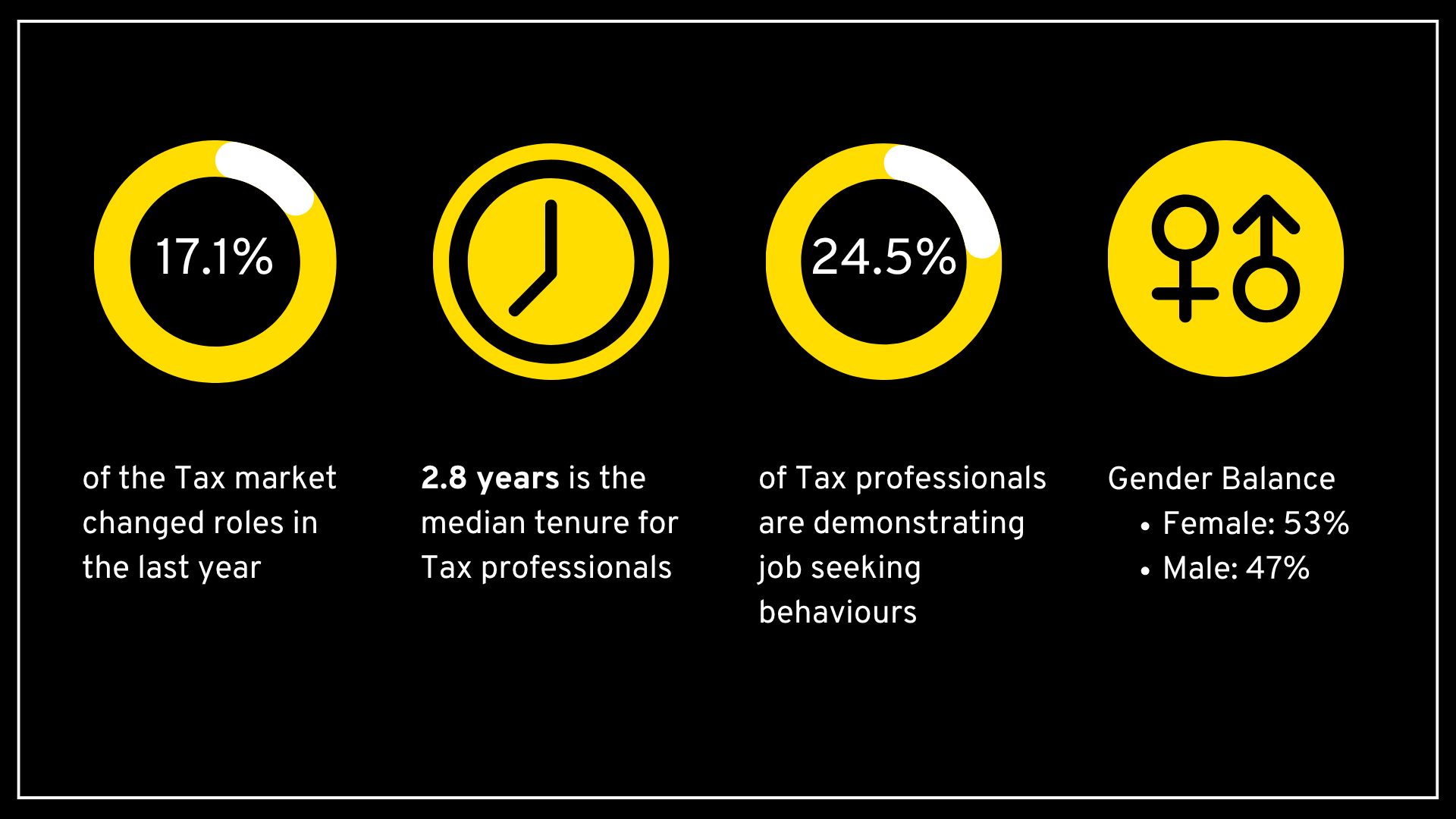

The tax professional is in “very high demand”. Here are some data points about the tax talent pool in Ireland this quarter:

- There is a marked cautious sentiment due to the Trump administration, where some tax professionals, particularly at the senior end, are deciding to hang tight and wait out this period of uncertainty.

- Qtr 1 of any year is usually a time for promotions and bonuses paid, so it can result in lower movement and hence a lower supply of talent.

#5 What can companies do to attract and retain talent?

- Align salary expectations to current market trends. Unfortunately, current team members may be below the salary averages, so when looking to recruit an additional person onto the team, it can be challenging for many hiring managers to meet an increased base salary.

- If base salaries can’t be moved, strengthen additional benefits – sign-on bonus, bonus multipliers, stronger employer % pension contribution, wellness subsidies, enhanced annual leave offering.

- Emphasise the culture of the firm or company.

- Provide a clear pathway for career development, and if possible, promotional opportunities.

- Communicate the hybrid working policy or any flexible work practices.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, contact Kate Flanagan, Aoibhín Byrne, Aideen Murphy our Tax Talent Advisory & Recruitment team here in Barden (kate.flanagan@barden.ie; aoibhin.byrne@barden.ie; aideen.murphy@barden.ie); we’re where leaders go before they start looking for Tax talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Kate Flanagan at kate.flanagan@barden.ie, Aoibhín Byrne at aoibhin.byrne@barden.ie or Aideen Murphy at aideen.murphy@barden.ie.

Barden’s National Talent Monitor is a quarterly snapshot of Ireland’s private enterprise professional workforce, covering all major professions including accounting, engineering, analytics, administration, legal, engineering and beyond. Collated through multiple data sources (LinkedIn data mining, CSO data, Barden data, third-party proprietary source), using our unique research methodologies, we are able to identify patterns and insights that help business leaders make more informed decisions about their talent attraction and retention strategies.

#1 Key Talent Market Trends

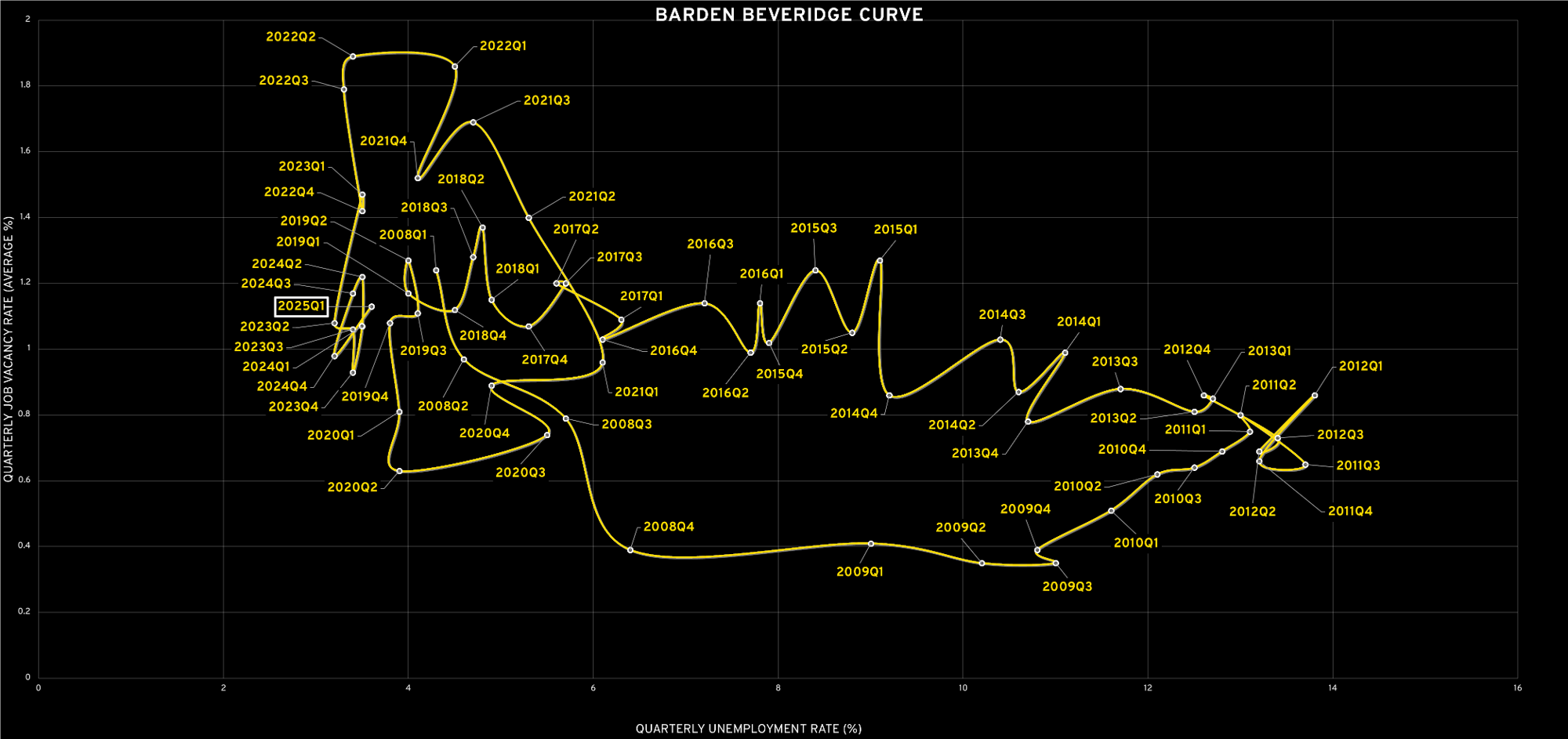

1.1 Barden Beveridge Curve

The Barden Beveridge Curve is an indicator of employment activity and talent demand in the market. It plots job vacancy rates against unemployment levels, with movements to the top left indicating higher demand for talent and movements to the bottom right indicating lower demand.

Specifically curated by Barden to represent private enterprise professionals, the curve helps track trends using CSO data, which lags quarter-on-quarter. Recent data for Q1 2025 shows a slight increase in both unemployment and job vacancy rates. An increase in job vacancy rates is highly indicative, reflecting a market that remains robust despite facing unusual macroeconomic risks.

While unemployment levels have been slowly increasing, Ireland is still experiencing record-high employment rates and record-low unemployment rates. This positioning suggests that the job market remains competitive and there may be slightly more opportunities for talent over the coming quarters.

1.2 Job-Seeking Behaviour:

Year on year, the percentage of professionals in Ireland demonstrating job-seeking behaviour has remained flat. 26.1% of professionals in Ireland are demonstrating job-seeking behaviour. Companies with less than 26.1% of their workforce showing this behaviour are performing well, while those above this benchmark may need to address potential challenges.

Of those exhibiting job-seeking activity, less than 10% (9%) actually changed roles last year. For a company with 100 employees, a normalised turnover rate suggests a loss of 7–10 people annually.* As above, this number can be used to benchmark a company’s current turnover rate against the norm.

1.3 Tenure and Role Changes:

The median tenure for professionals is 1.6 years, meaning that while people are not necessarily changing companies every 1.6 years, they are likely changing roles within that timeframe (promotion, moving teams, etc.).

Leaders should consider this when planning promotions, development, and succession strategies.*

1.4 Gender Balance:

The workforce participation in this cohort is 43% female and 57% male, although disparities exist across professions and seniority levels.*

1.5 Talent Movement Trends:

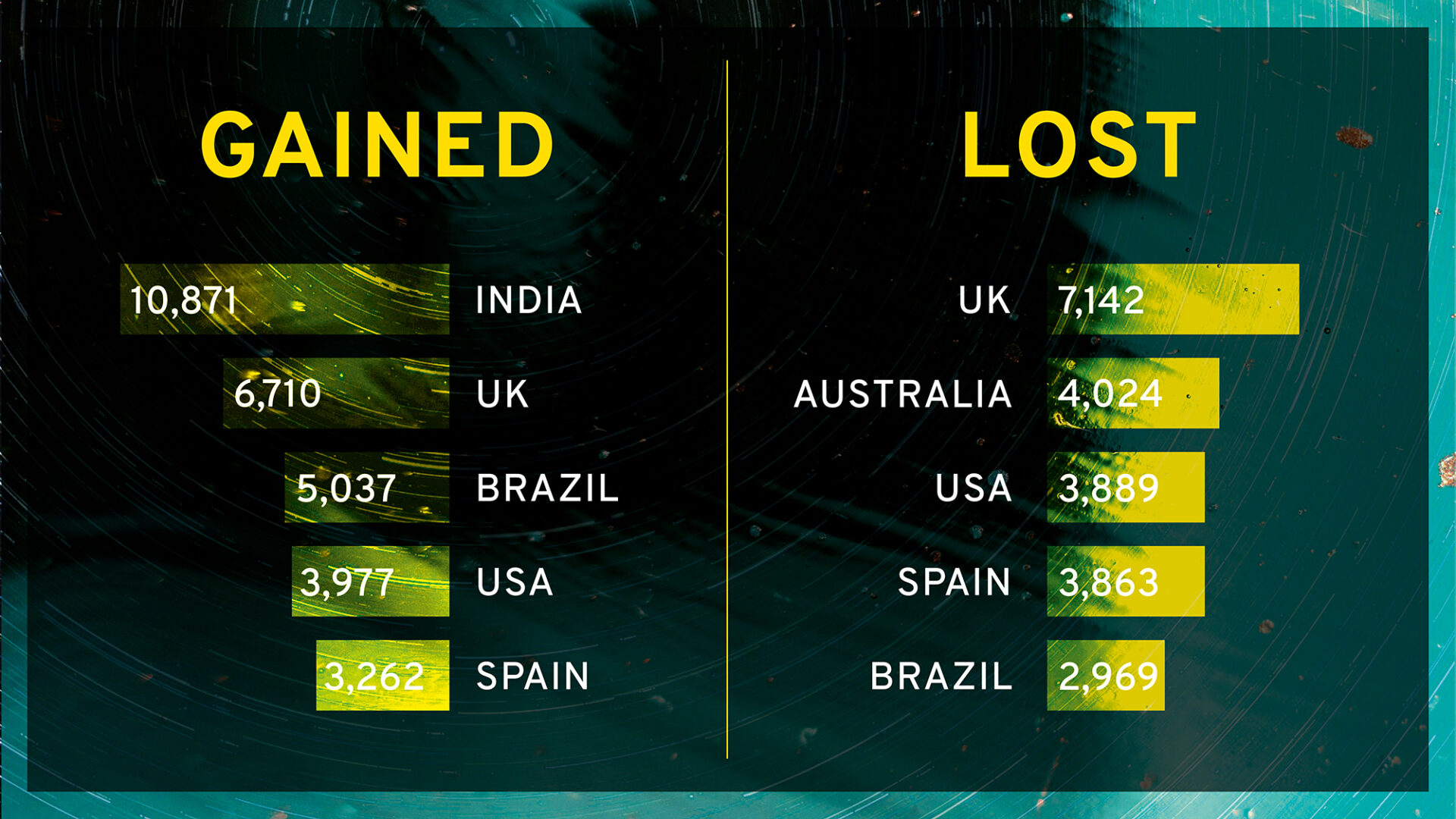

Ireland’s professional workforce grew by over 13,200 in the last twelve-month period, an increase from the previous analysis period. This suggests that companies are becoming more open and agile in their sourcing of talent, and also likely reflects improvements in visa and work permit processes.

However, Ireland continues to face a net loss of talent to some jurisdictions, specifically English-speaking markets and, in particular, Australia, where two Irish professionals leave for every one returning.

On the other hand, Ireland is seeing a net gain of talent from countries like India and Brazil, contributing to workforce diversification and signalling a continuing trend toward more international hiring strategies.

#2 Trends in Work Arrangements and Benefits

2.1 Hybrid Work as the Norm

71.6% of roles now follow a 2–3 day hybrid model, making it the clear standard for most organisations. Notably, full-time office work has increased from 7.6% to 13.3%, which is undeniably reflective of the move by some US multinationals and others to a five-day working week in the office in H1 of this year.

Fully remote roles continue to decrease, now accounting for just 4.4% of jobs. This highlights that expectations of 100% remote work no longer align with market realities.

2.2 Reward Packages

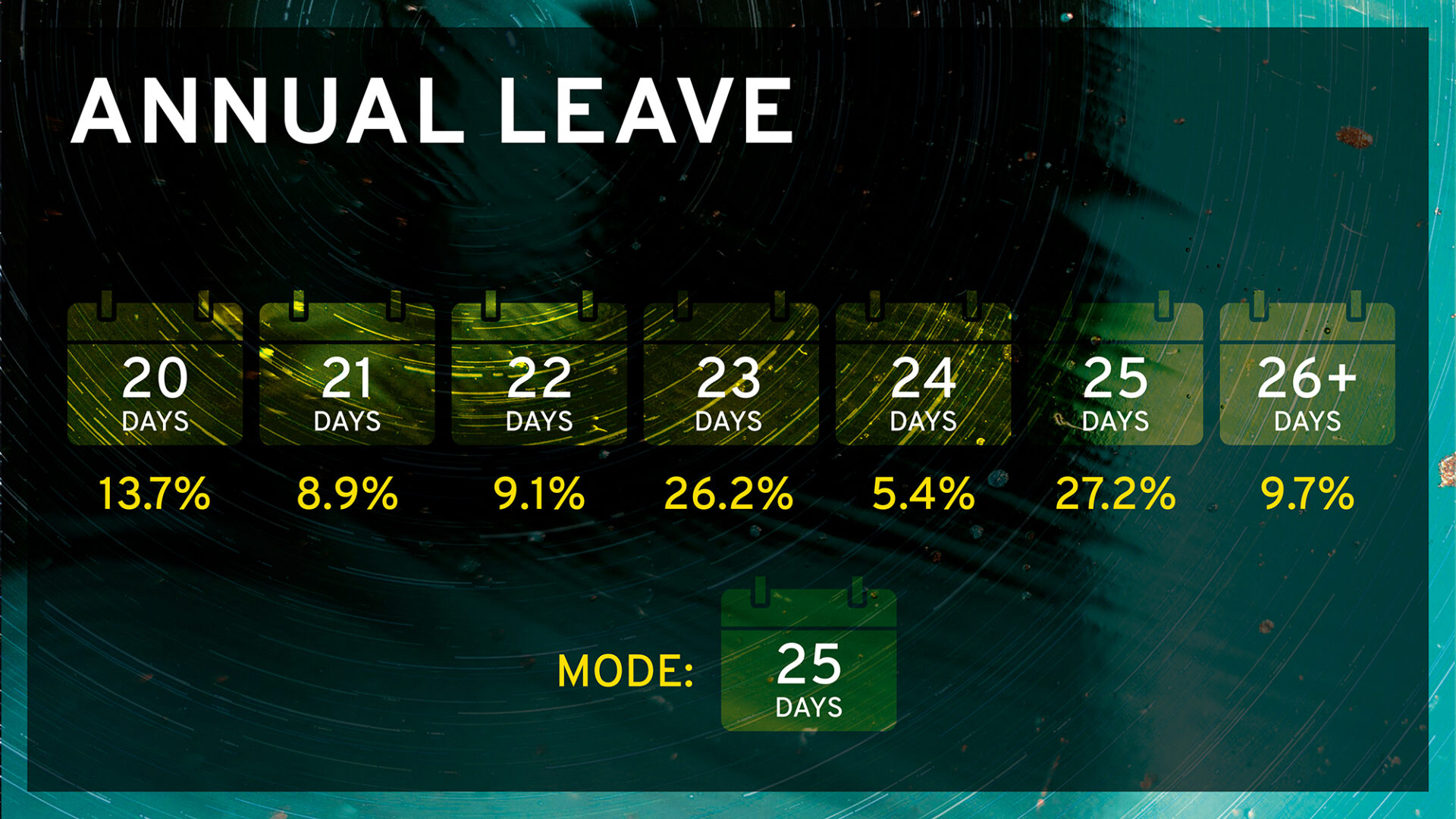

Offering 23–25 days of annual leave or more is critical. Anything less puts companies at a notable disadvantage in attracting and retaining talent.

The mode represents the number that occurs the most in a given list.

The most frequent (mode) employer pension contribution offered remains unchanged at 5% and for bonuses, it is 10%. However, it is important to highlight that standard benefits vary significantly between SMEs and multinational companies.*

#3 Are you shaping your Talent Strategy?

The above data provides valuable national-level insights, but competition for talent is typically local rather than national. While understanding the macro perspective is essential, it should be complemented with real-time, localised, peer-to-peer comparisons to assess your organisation’s true competitiveness for talent and inform strategic decision-making. For example, a large multinational group function will typically not be competing for the same talent as a local SME in a given location.

This is where Barden can help you. We offer over 20 profession-specific talent monitors, such as for early-career accountants or data analysts, that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

*For more detailed insights, peer comparisons, company-specific turnover data, performance benchmarks, or gender diversity trends by profession and level, contact Ed Heffernan at ed.heffernan@barden.ie for bespoke insights to help shape your talent strategy.

Ireland is a global leader in Aircraft Leasing. It all started in 1975, when Guinness Peat Aviation(GPA) was established in Shannon and went on to become the world’s largest commercial aircraft lessor in the 1980s.

Fast forward to 2025, and 14 of the Top 15 aircraft lessors are headquartered in Ireland, with Irish lessors owning and managing $150 billion of assets. And yes, these Lessors need newly qualified accountants.

Below, I outline current trends in the Aircraft Leasing market in Dublin and Ireland, as well as Top Tips for Newly Qualified Accountants eager to work in this industry.

Current Trends:

It was noteworthy that the Taoiseach, Micheál Martin, mentioned AerCap’s high volume of purchases of Boeing airplanes when he met US President, Donald Trump, on St. Patrick’s weekend.

This, following the continued success of the Airline Economics Growth Frontiers Conference in Dublin in January, where thousands of aviation delegates took over Stephen’s Green for four days, has firmly put the industry into the global spotlight.

Furthermore, I attended the ICBE Commercial Aviation Outlook 2025 webinar in March, with the consensus being that current market trends are very positive for Lessors in Ireland.

The key takeaways were twofold –

- The market is deemed to be back to “pre-COVID rental levels” – approximately 16,000 aircraft are spread amongst circa 180 leasing companies worldwide, and the demand for aircraft is strong, and the pricing of aircraft is relatively strong.

- “Anything that can fly, is flying,” as there is a “shortage of new aircraft supply, with a long lead time.” Due to this limited supply, 90% of leases on aircraft are now being extended instead of being transitioned. As airlines are finding it difficult to source new aircraft and waiting longer for them to be ready and operational, there is an increasing trend of holding onto older aircraft, which they would have otherwise retired, which is very good for Lessors.

Top Tips – Newly Qualified Accountants:

Typically, you’re going to spend over 90,000 hours of your life in work. By the time you finish your training contract, you’ll have about 7,500 of those hours banked. The decisions you make over the next two years will fundamentally impact the next 82,500 hours… that’s a lot of hours! And if you have an interest in the Aircraft Leasing sector, you need to consider the following Top Tips:

Have you audited Aircraft Leasing clients? If so, mention these in your CV using a client table. If worried about confidentiality, the often-used workaround is to write, for example, ‘Large Aircraft Leasing client, with net assets of circa €x million’. Also, make sure to mention any technical areas you worked on, such as IFRS 16 or Consolidation Reporting on Group Audits.

Barden has a sample Newly Qualified Accountant CV template, illustrating the above – feel free to reach out for a softcopy.

It may be the case that you have not audited Aircraft Leasing clients but really wish to work for a Lessor. What can you do to boost your chances?

Although Lessors generally tend to favour newly qualified accountants who have audited Lessors, there are steps you can take if you have come from a non-Aircraft Leasing audit client base to help bridge that knowledge gap.

For example, lots of newly qualified accountants take a month or two off after their training contracts to unwind, travel, etc. You can use this time to upskill on Aircraft Leasing knowledge – 2 short term courses which I recommend are:

- John McMahon (Former Chair and CEO of Genesis Lease Limited) carries out a 1-day Aviation Leasing Online Course a couple of times a year – his most recent one was on the 8th of April.

- City Colleges offer a fully Online Diploma in Aviation Leasing and Finance, over a 12-week period.

Firstly, you need to figure out what type of aircraft leasing company you would like to work in.

For example, would you like to be working in the large companies, such as AerCap and Avolon, or the mid-sized Lessors such as Sky Leasing or smaller Lessors such as White Oak Aviation. To note, a financial accountant/analyst role in a large Lessor will be very different in scope of responsibilities to a similar role in a small Lessor.

Furthermore, you may need to broaden the net and consider Corporate Service Providers, that provide an outsourced accounting function for Lessors. For example, Walkers and Maples. Financial Accountant roles in these companies can be a good stepping stone to ultimately securing a role in a Lessor in 18-24 months’ time, especially if you are coming from a non-Aircraft Leasing audit background.

Also, make sure to listen to podcasts and attend webinars related to Aircraft Leasing in Ireland – the more up-to-date you are on current trends, the more you will impress at interview stage.

There’s no getting away from it. If you haven’t already, it’s time to embrace, build and promote your online presence. As a newly qualified accountant, your LinkedIn profile is your online personal brand.

Make sure to use your summary title (the title under your name) and your profile summary to communicate your skill-set fully. For example, instead of placing ‘Audit Senior’ in your title, what about saying “Audit Senior, Aviation Advisory | Exam-Qualified ACA Accountant – 1st Time Passes” – the more keywords the better. You have 120 characters so use them!

Be accurate and be conscious that your profile is public – ensure all dates of employment are correct and that your dates mirror those on your CV. The last thing you want is a discrepancy between your CV and LI profile.

Remember that it is a networking tool and could be a main method of building a professional network that will be hugely valuable to you in the future. Make sure to leverage your current network and send connects to those who you have crossed paths with in the past – for example, someone who was your Audit Senior on an Aircraft Leasing job early on in your training contract – and is now 2 years into a Financial Accountant role in a Lessor.

Finally, don’t forget to include a (professional) picture! Not a selfie…definitely, not a selfie.

The above is only the tip of the iceberg in relation to advice to newly qualified accountants looking to make that move to the Aircraft Leasing industry – if curious to find out more, as well as having your draft CV reviewed, getting advice tailored to your own personal situation, having a comprehensive interview preparation session, seeing what roles are available, etc – then, feel free to reach out.

Connect with Niall on LinkedIn or email niall.okeeffe@barden.ie

Sustainability has moved from a “nice-to-have” to a strategic priority for life sciences organisations. It’s about compliance, yes, but also cost savings, brand image, and talent attraction. Energy, water, and waste are now key focus areas. Companies are investing in solar, wind, and water reduction.

This isn’t feel-good PR; saving 20–30% on energy makes a real impact. With carbon levies and EU targets tightening, sustainability is smart business.

We are seeing a clear two-pronged approach:

- Avoid penalties and

- Position as green employers to attract values-driven talent.

Let’s take a look at some of the companies implementing significant sustainability initiatives.

J&J

- Renewable Energy: The Ringaskiddy site is powered by wind turbines constructed in collaboration with the Cork Lower Harbour Energy Group, contributing to Johnson & Johnson Ireland’s achievement of sourcing 100% of its electricity from renewable sources by 2025 .

- Zero Waste to Landfill: Since 2016, the Ringaskiddy plant has achieved zero waste to landfill, ensuring all waste is recycled, reused, or disposed of sustainably.

- Water Efficiency: The site operates closed-loop water systems and has implemented rainwater harvesting, with collected water used for cooling towers and non-potable purposes.

- Biodiversity Initiatives: Efforts include establishing an apiary to support local bee populations, building bug hotels, and planting 741 indigenous trees to enhance local biodiversity.

- Global Targets: Johnson & Johnson aims to achieve carbon neutrality across all operations by 2030 and has signed the Business in the Community Low Carbon Pledge, committing to carbon reduction targets in line with the Paris Agreement

Recordati Ireland

- Renewable Energy: In 2022, photovoltaic solar panels were installed at the Ringaskiddy site, aiming to provide 15–20% of the site’s annual electricity needs.

- As of 2023, 100% of the electricity purchased for Recordati’s production sites and annexed offices in countries where renewable energy is available comes from renewable sources. The company aims to install additional renewable energy systems across its facilities, targeting a total installed capacity of 11,000 kWp by 2026.

- Electric Vehicle Infrastructure: To promote sustainable transportation, electric vehicle charging stations have been introduced at the Ringaskiddy facility, encouraging employees to adopt low-emission vehicles

- Biodiversity and Pollinator Support: The site has joined Ireland’s National Pollinator Plan, established pollinator-friendly habitats, and participated in Pollinator Week activities. These efforts aim to enhance local biodiversity and support pollinator populations

- Tree Planting Initiatives: Between 2021 and 2023, Recordati planted over 14,000 trees as part of its commitment to environmental conservation, with a goal to reach 24,000 trees by 2024, equating to approximately five trees per employee

Gilead Sciences Ireland

- Zero Waste Certification: The Carrigtwohill facility achieved TRUE Gold Certification with a diversion rate of 92.3%, reflecting a robust zero-waste strategy.

- Waste Reduction Initiatives: Implemented measures include eliminating single-use plastics, introducing reusable alternatives in food service areas, and advanced in-house waste segregation and recycling techniques.

- Employee Engagement: Comprehensive training programs, regular waste audits, and the use of data management platforms have empowered staff to actively participate in waste reduction efforts.

Eli Lilly

- Solar Energy: The Kinsale site operates a solar farm comprising 12,600 panels, producing up to 5.6MW of power, reducing the site’s annual carbon footprint by 2,350 tonnes .

- 2030 Environmental Goals:

- Climate: Achieve carbon neutrality in operations and use 100% renewable electricity.

- Waste: Achieve zero waste to landfill and repurpose 100% of plastic waste for beneficial use.

- Water: Ensure no impact on water-stressed areas and prevent pharmaceutical contamination in the environment.

- Sustainable Transportation: Introduced bus services from Cork city to the Kinsale campus to reduce individual car usage

MSD Ireland – Brinny

- Greenhouse Gas Reduction: Aims for a 40% reduction in greenhouse gas emissions by 2025 compared to 2015 levels.

- Renewable Energy Goals: Targets 50% of purchased electricity from renewable sources by 2025 and 100% by 2040.

- Carbon Neutrality: Committed to achieving carbon neutrality in operations (Scope 1 & 2) by 2025.

AbbVie – Carrigtwohill

- Emission Reduction Targets: Commits to reducing absolute Scope 1 and 2 greenhouse gas emissions by 42% by 2030 from a 2021 base year.

- Renewable Electricity: Plans to increase sourcing of renewable electricity from 29.5% in 2021 to 100% by 2030.

- Supplier Engagement: Aims for at least 79.1% of its suppliers by emissions to have science-based targets by 2027.

- Environmental Management: All five Irish manufacturing sites are certified in ISO 14001, 45001, and 50001, reflecting robust environmental and energy management systems.

Final Thoughts

From renewable energy adoption to biodiversity efforts and zero waste strategies, these companies are proving that sustainable practices drive both compliance and commercial value. As regulations tighten and expectations rise, those who lead on sustainability will be best positioned to thrive – attracting top talent, avoiding penalties, and building brands that endure.

For more Life Sciences insights or to discuss career opportunities in this field…

Connect with Aidan on LinkedIn or at aidan.crowley@barden.ie

Over the past decade, the role of finance professionals has expanded beyond just number crunching to encompass compliance, regulation, risk management, and sustainability. It’s an exciting time to be part of the finance function, but it also means that the skills and expectations required from finance professionals are rapidly evolving.

How Regulation Made ESG Everyone’s Business

Perhaps the most significant shift in recent years has been the growing importance of Environmental, Social, and Governance (ESG) reporting. Ten years ago, no one was talking about ESG in the way we are now.

The CSRD (Corporate Sustainability Reporting Directive) is one of the key regulations that will reshape ESG reporting, requiring companies to disclose more detailed information on their sustainability activities.

At first, companies responded to CSRD requirements with a compliance mindset, often assigning the responsibility to finance due to the metrics involved. However, as the regulatory pressure eased, many started to see it as a commercial opportunity. Teams are asking how sustainability reporting can enhance their brand, attract customers, or improve talent acquisition. From a talent perspective, this evolution means finance professionals must not only understand compliance but also contribute to broader conversations about risk, strategy, and market positioning.

IFRS

Another significant regulatory shift impacting finance teams has been the implementation of IFRS. You can’t talk about finance and regulation without mentioning it. When IFRS was first introduced, there was a noticeable response in the talent market, especially in industries like property and aircraft leasing, with companies creating specialist IFRS roles. In particular, IFRS 9 and 7 considerably impacted financial services, not just changing how teams report but also requiring new capabilities: interpreting data, exercising judgment, and understanding nuance. These regulatory changes sparked a shift away from the black-and-white rules of traditional accounting and more toward qualitative assessment.

Gender Pay Gap and Strategic Reporting

Another area where regulation has had a broader impact is gender pay gap reporting. This responsibility often landed with the finance team in collaboration with HR, who have to monitor, analyse, and interpret the data. However, the value of this reporting has extended beyond compliance; it has helped organisations shape broader strategies around diversity, workforce planning, and equity.

Data Governance in the Age of AI

The General Data Protection Regulation (GDPR), which came into effect in 2018, transformed how finance teams handle personal data, especially concerning payroll, supplier, and customer data. As technology and AI have evolved, finance professionals must now be well-versed in how these regulations intersect with financial data management. This means understanding how to protect sensitive financial data when using emerging technologies like AI and ensuring that companies meet the growing compliance requirements in this space.

First, address the risk, set guidelines, and define how and where they can be used, particularly in terms of data governance. Once that’s in place, opportunities can be unlocked in a safe and compliant manner.

Moving Beyond the Numbers

Changes in regulation and technology have made finance roles more complex. Even traditional roles like Financial Controllers and Finance Managers now require expertise in data analytics tools like Power BI, Tableau, and advanced Excel. The finance function has evolved from a reactive, reporting-focused department to a proactive, data-driven function that contributes to strategic decision-making. This shift is not just a technological one; it reflects a broader change in how companies view finance, not just as a support function, but as a key player in shaping the future of the business.

Accounting vs. Audit Careers

Interestingly, this broadening of finance skills contrasts with what is happening in audit. Recent changes to auditing standards and the shifting hands of regulators across the globe have made the environment more focused, streamlined, and prescriptive.

Early-career professionals, especially those trained purely in auditing, may need assistance in transitioning into broader finance roles, as they are accustomed to a look-back mindset rather than a look-forward mindset. For hiring managers, it is essential to recognise this divergence and be clear about the specific skills an accounting professional is bringing to the table.

The Future of the Finance Professional

Business partnering is a key area that will shape the future of finance. As finance continues to evolve, finance professionals must work closely with other departments, particularly in risk management and strategic planning. Climate change, cybersecurity, and other external risks will have a growing impact on financial performance, and finance teams will need to assess and communicate these risks to the broader organisation.

They must be proactive, not reactive, and think about the broader financial implications of the challenges we face today and in the future. Thus, business partnering will become a critical skill as finance professionals play a larger role in shaping the company’s overall strategy.

This shift from number-cruncher to strategic business partner will accelerate with the rise of AI. As automation takes over repetitive numerical tasks, the emphasis for finance professionals is moving towards strategic thinking, data interpretation, and business partnering. Accountants now need to help identify which tasks can be automated, contribute to designing those processes, and then use the time gained to drive value in the business

The focus is no longer solely on technical expertise; breadth is becoming more important than depth. It’s about foresight, judgment, and contributing to the broader financial picture. As Chartered Accountants Ireland says, “It’s not all about the numbers anymore.”

Connect with the Barden team for more insights…

This article was written by Sarah Murphy | Director | sarah.murphy@barden.ie in collaboration with Sinead Donovan | Strategic Board Advisor

The integration of advanced technologies into supply chain management continues to play a vital role in transforming how businesses operate. In Ireland, the adoption of innovative solutions across various supply chain touchpoints has been pivotal in boosting efficiency, resilience, and global competitiveness throughout 2024 and into 2025. With industries under constant pressure to adapt to changing market conditions, technological innovation is essential.

Recent reports indicate that a significant portion of Irish companies are experiencing supply chain disruptions. A study by Reichelt Elektronik found that 79% of Irish companies reported major or moderate disruptions due to supply chain bottlenecks, with one-third having to halt production for at least 20 days over the course of the year due to missing components, resulting in substantial production and financial losses. This underscores the critical need for technological advancements to address these challenges and enhance supply chain resilience.

1. Automation

Automation remains at the forefront of supply chain modernisation. Irish manufacturers are increasingly deploying robotics, machine vision systems, and intelligent automation tools to streamline repetitive tasks, minimise human error, and lower operational costs.

Example: Kerry Group uses robotic process automation (RPA) in its procurement and logistics departments to handle repetitive administrative tasks, allowing staff to focus on higher-value work. Automated assembly lines, for instance, have significantly reduced production time, while robotic arms and conveyors have enhanced precision in tasks such as welding, packaging, and materials handling. The use of automated guided vehicles (AGVs) in warehouses is also on the rise, helping businesses meet tight delivery schedules with improved accuracy and speed.

2. Data Analytics

In today’s data-driven world, supply chains are becoming smarter thanks to advanced analytics. Irish companies are harnessing vast volumes of data from across their operations, spanning procurement, inventory management, logistics, and customer behaviour, to derive actionable insights. Predictive analytics helps forecast demand trends, avoid stockouts, and plan capacity more effectively. Real-time analytics dashboards allow decision-makers to monitor key performance indicators (KPIs), enabling agile responses to disruptions or inefficiencies. By turning data into strategic value, Irish supply chains are becoming more responsive and cost-effective.

Example: Musgrave Group, which operates SuperValu and Centra, uses predictive analytics to forecast customer demand based on past sales trends, weather patterns, and regional events. This enables smarter stock replenishment and reduces waste, particularly in perishable goods.

3. Internet of Things (IoT)

The Internet of Things (IoT) is bridging the gap between the physical and digital worlds within supply chains. In Ireland, IoT-enabled sensors and connected devices are now commonly used to monitor everything from machine health and energy usage to inventory levels and environmental factors such as humidity and temperature.

Example: smart sensors installed on machinery can alert maintenance teams to potential faults before breakdowns occur, reducing downtime. In warehousing, RFID tags and IoT systems enable real-time tracking of goods, enhancing inventory accuracy and overall supply chain visibility. In logistics, An Post has implemented IoT-enabled tracking devices in its delivery fleet to optimise routes and monitor parcel status in real time, enhancing delivery accuracy and customer satisfaction.

4. Blockchain Technology

Blockchain is steadily gaining traction as a tool for enhancing trust, security, and transparency in supply chain transactions. While not unique to Ireland, its implementation across various Irish industries is proving valuable, particularly in high-stakes areas like food safety and cold chain logistics. By using blockchain to log each step of a product’s journey, stakeholders can verify the origin, handling, and integrity of goods in real time.

Example: In the cold chain sector, for instance, blockchain works in tandem with IoT sensors to provide immutable records of temperature data, ensuring compliance with safety standards and reducing the risk of spoilage.

5. Generative AI

Generative AI is emerging as a transformative force in supply chain management. Its capacity to analyse vast sets of complex data across multiple platforms at speeds no human could possibly match enables rapid decision-making and process optimisation. According to a recent KPMG study, AI can help ensure procurement and regulatory compliance, streamline and enhance the efficiency of manufacturing production workflows, and enable virtual logistics communication by using virtual assistants to handle routine enquiries and provide quick responses. However, experts caution that organisations need to be aware of the limitations and risks associated with the use of generative AI in supply chains. The quality and availability of data from supply chain partners are of critical importance, and organisations must take all possible steps to ensure it meets the required standard.

6. Cybersecurity

As supply chains become more digital, cybersecurity is becoming an increasingly important concern. With so much sensitive data being shared and stored online, businesses need to ensure that their systems are secure from hackers and other threats. A single breach can have catastrophic consequences, leading to data loss, financial penalties, and damage to a company’s reputation. To protect their supply chains, businesses are investing in advanced cybersecurity measures, including encryption, firewalls, and intrusion detection systems. They’re also training their employees to recognise and avoid common cyber threats, such as phishing attacks and malware. By taking a proactive approach to cybersecurity, businesses can safeguard their supply chains and build trust with their partners and customers.

Example: Irish Distillers has implemented advanced cybersecurity frameworks including multi-factor authentication and endpoint monitoring to protect its digital supply chain systems, especially after increasing ransomware threats globally. IDA Ireland is working with multinationals to promote stronger cyber defences in the manufacturing sector. Regular penetration testing, staff training, and encryption tools are now standard practice to ensure supplier and customer data remains protected.

Final Thoughts

As global markets continue to evolve, the Irish supply chain landscape is keeping pace through strategic technology adoption. These advancements are enabling businesses to build more agile, transparent, and resilient supply networks. Whether through automation that boosts production efficiency, data analytics that drives smarter decision-making, IoT that enhances real-time monitoring, blockchain that fosters trust, or generative AI that accelerates innovation, technology is laying the foundation for a new era of supply chain excellence in Ireland.

More about Cliodhna…

Cliodhna O’Brien is the Business Lead of Barden’s Supply Chain & Procurement in Munster. Connect with Cliodhna on LinkedIn or at cliodhna.obrien@Barden.ie

Life sciences is different from fields like tax or finance, mainly because everything is so tightly regulated. Whether it be MSD making Keytruda, Gilead making Biktarvy or Haleon making Panadol, they must all meet the standards set by the Health Products Regulatory Authority (HPRA). And that’s just one agency; there is also the FDA in the US, the EMA across Europe, and the MHRA in the UK. Every region has its own version; if you want to sell a product there, you must play by their rules.

Regulation covers the full product lifecycle: from raw materials to packaging to distribution. Companies regularly get audited, sometimes with very short notice, and those audits can run for one or two weeks, depending on the complexity. Auditors want to see everything: transportation logs, warehouse conditions, test results, and batch manufacturing records. This puts a lot of pressure on teams to be constantly audit-ready.

The Constant Evolution of Regulatory Updates

Regulatory updates happen all the time. The HPRA, EMA, and FDA regularly publish changes to how things are handled, such as cold chain logistics for biologics or updates to pharmacopoeias. Each region operates independently, requiring global companies to manage multiple compliance requirements. While complex, these regulations keep the standards high in this industry.

These include changes to good manufacturing practices (GMP), clinical trial requirements, pharmacovigilance standards, and labelling rules. The frequency tends to increase during public health crises, such as the COVID-19 pandemic, where expedited pathways and emergency use authorisations become prevalent.

For context, in 2024, the FDA released over 30 guidance documents, while the HPRA published approximately 15 new or revised guidance documents related to drugs, covering topics from clinical trial protocols to labelling requirements.

How Tech Is Transforming Compliance

One of the most significant shifts in the life sciences industry in recent years has been the transition from paper-based systems to digital compliance platforms. Auditors today routinely examine records spanning four to five years, requiring a complete and traceable audit trail.

Digital Quality Management Systems (QMS), such as TrackWise and similar platforms, are now widely used across the life sciences sector. These systems provide comprehensive oversight by capturing critical data points, including material receipt, storage durations, testing activities, and approval workflows. Each step in the process can be accessed to reconstruct a complete and verifiable record of events.

This level of traceability is essential, particularly in the case of deviations. In such instances, Corrective and Preventive Actions (CAPAS) are initiated: issues are logged, investigated, and resolved to prevent recurrence. Auditors expect to see complete documentation: when the issue was identified, what actions were taken, and who authorised the resolution.

The role of the Qualified Person (QP) serves as the final checkpoint before a product is released from the manufacturing site. This position carries significant responsibility and provides assurance that all products dispatched meet safety, compliance, and documentation standards.

What’s Actually Changing in the Industry

While the regulatory framework is not undergoing radical transformation, parts of life sciences are evolving fast, particularly biologics. Biologics are drugs made with active substances that are, in a sense, “alive.” These include complex injectables such as Ozempic rather than conventional solid-dose formulations like Panadol. The use of biologics is expanding rapidly, especially in oncology and the treatment of chronic conditions.

Although no major regulatory overhaul is currently anticipated, the pace of innovation, particularly in biologics, precision medicine, and advanced manufacturing and distribution models, is reshaping industry priorities.

Sustainability Is No Longer Optional

Sustainability has transitioned from a “nice-to-have” to a real strategic focus. While compliance remains a driving factor, sustainability initiatives are now equally as important when it comes to cost, brand image, and talent attraction. Resource efficiency is at the forefront of operational planning, particularly in energy, water, and waste. Significant investments are being made in renewable energy and conservation measures, with on-site wind turbines in operation in Ringaskiddy and solar energy systems deployed by manufacturers such as Reckitt in Athy.

Organisations have adopted a clear two-pronged approach:

- Avoid regulatory penalties and compliance issues.

- Position themselves as green, responsible employers to attract and retain talent.

That kind of messaging is effective, especially with younger professionals who want to feel like they are working for a company that shares their values.

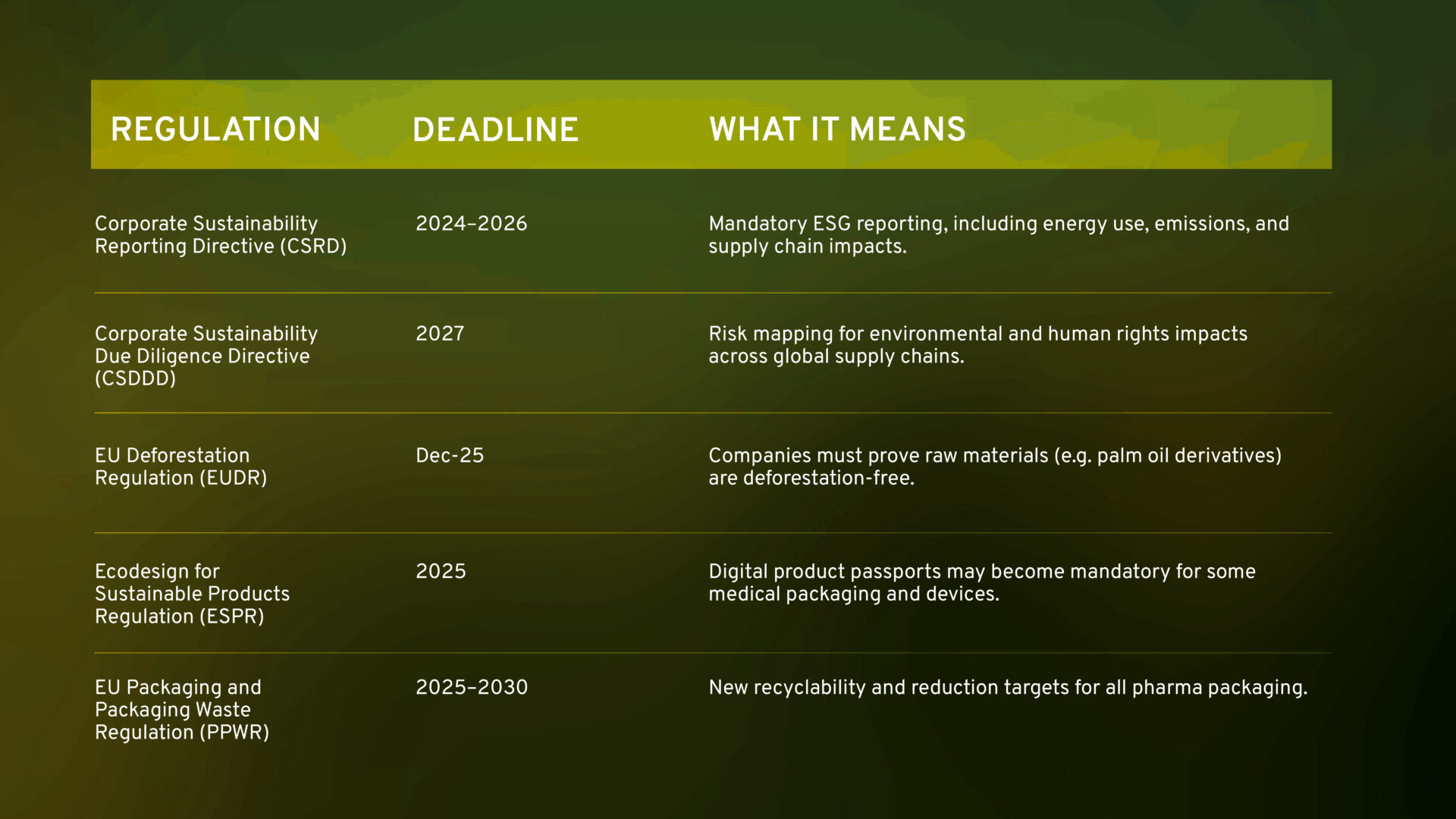

Regulations Impacting the Life Sciences Industry

How Talent Is Evolving and Upskilling

Despite all the changes in tech and sustainability, the core talent pipeline has not fundamentally shifted. Ireland’s pharmaceutical science programmes are world-class. Graduates finish university with a solid foundation, and once they begin their careers, there are plenty of opportunities to move up the ladder or specialise.

That said, we are seeing upskilling across the board. People with 20+ years in the industry are returning to do diplomas or new degrees to stay competitive. Additionally, with sustainability taking centre stage, there is a growing demand for environmental engineers, facilities engineers, and energy specialists.

Even though equipment and systems have become more advanced, such as modern HPLCs and automated labs, the core processes remain familiar. What’s improved is reliability and speed. There is less downtime, fewer breakdowns, and ultimately, fewer deviations.

The Global Opportunity and Local Stability

One major advantage of working in life sciences is the global transferability of skills. Ireland is the launchpad; skills acquired here are highly transferable, opening opportunities across major international markets such as the United States, Australia, and other regions with established life sciences ecosystems. Ireland offers unmatched career stability, with a mature infrastructure, an experienced talent pool, and strong government support. Ireland is not a low-cost destination, but we are a high-skill one, and that’s why companies keep investing here.

Looking Ahead

So, what’s next? We will not witness a life sciences revolution, but we will see steady, smart evolution. Compliance will get more digital, not more complex, sustainability will keep climbing the priority list, and biologics will continue to reshape where investment and innovation happen.

I anticipate that there will also be more targeted regulation around energy efficiency and ESG, especially from the EU. That will push companies to keep hiring for green roles and stay ahead of potential fines. But again, these changes won’t rewrite the industry; they will make it more robust.

The fundamentals are strong. The education system is delivering. The career paths are clear. Life sciences is evolving, but it’s doing so with purpose. And that makes it an incredibly exciting space to be part of.

For more Life Sciences insights or to discuss career opportunities in this field…

Connect with Aidan on LinkedIn or at aidan.crowley@barden.ie