This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Jane Olden at jane.olden@barden.ie, Christine McCarthy at christine.mccarthy@barden.ie or Catherine Drysdale at catherine.drysdale@barden.ie.

Firstly, it’s important to clarify what we mean by the mid-senior segment of the accounting & finance market. At Barden, this typically refers to professionals with 5+ years of post-qualified experience, encompassing roles such as Finance Director, Head of Finance, Financial Controller, and Finance Manager level roles, across Controllership, FP&A, Finance Business Partnering, Compliance, and Corporate Finance.

*Tax & Treasury insights are covered in a separate publication.

#1 Framing the mid-senior market

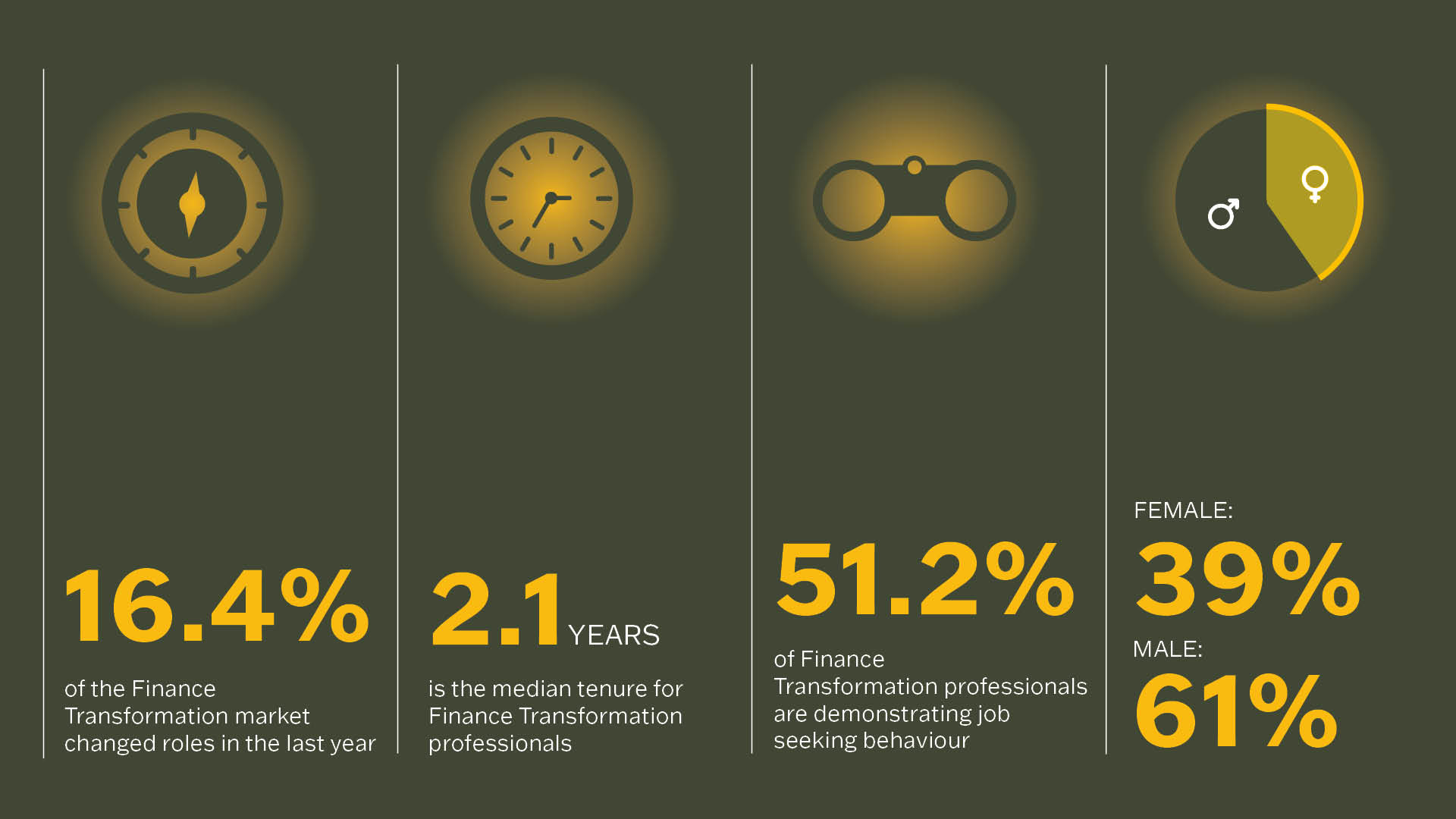

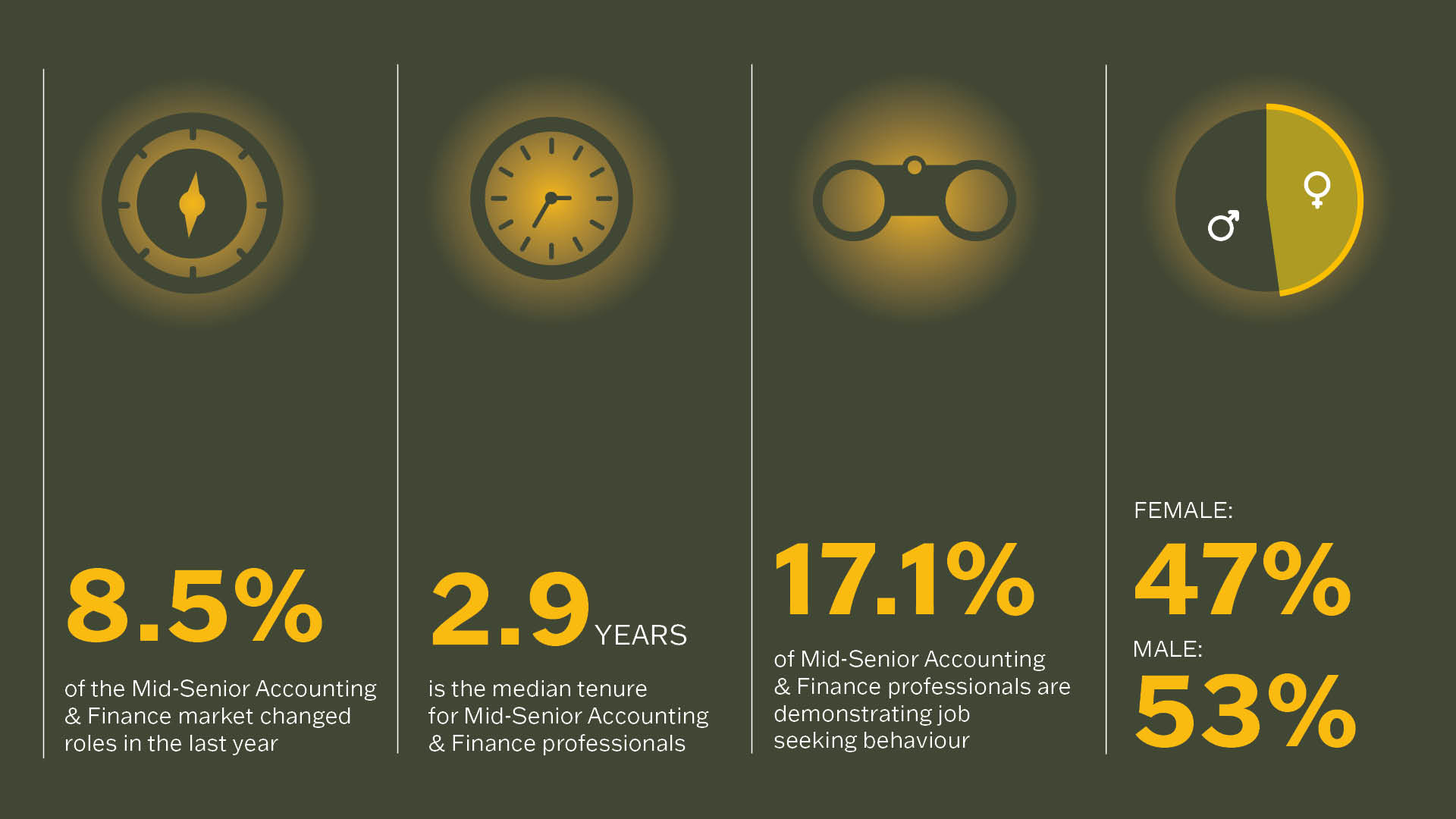

17.1% of professionals in this segment of the market are demonstrating job-seeking behaviour, an increase of 1.1% from this time last year. Of those exhibiting job-seeking activity, 8.5% actually changed roles last year. For a company with 100 employees, a normalised turnover rate suggests a loss of 9–10 people annually.

Talent behaviour remains measured in this segment. The median tenure has edged up to approximately 2.9 years, reflecting a continued trend towards longer tenure and greater role commitment, influenced in part by ongoing macroeconomic uncertainty.

Workforce participation in this cohort is 47% female and 53% male, though disparities exist across professions and seniority levels.

Quality over volume is the dominant theme. Employers seek finance leaders who can operate effectively in ambiguity, control costs, influence decision making, and communicate confidently with senior stakeholders – particularly in roles close to the executive leadership. Many senior finance positions now also encompass responsibility for finance transformation, systems upgrades & implementation, process improvement, or automation initiatives.

#2 Outlook for 2026

Global economic uncertainty has driven a more cautious approach to hiring, with many organisations moderating recruitment activity throughout 2025, and this is likely to continue into 2026. Career focused professionals are likely to stay largely passive, engaging selectively for roles that offer clear scope, career progression, and organisational credibility & culture.

We believe demand will continue to centre on finance professionals who combine strong financial control, governance, transformation capability, and commercial partnering. Salary growth is expected to remain contained, with successful hiring outcomes driven more by role clarity, leadership quality, and culture than by remuneration alone.

Talent movement is expected to rise modestly as more professionals reach the 2.5-3 year tenure mark, particularly where progression has stalled or responsibilities have expanded without commensurate recognition. Organisations that offer clear career pathways, flexible working, and ongoing investment in finance systems will be best positioned to attract and retain top mid-senior accounting & finance talent.

We spend the majority of our time getting to know mid-senior accounting & finance talent in Ireland, and here’s what we’ve learned along the way:

#3 Base Salary

Salaries in Ireland at the mid-senior accounting & finance end have remained strong, with clear premiums for roles that carry leadership responsibility, strategic impact, or manage the full finance function. Overall, salaries have been broadly rising in line with inflation, reflecting both market competition for talent and the increasing complexity of finance roles, with compensation now driven as much by scope and impact as by title.

For the purposes of transparency, for the mid-senior accounting & finance talent in Leinster, we’re going to focus on job titles (as opposed to PQE given this disconnects from salary and job title as early as 3 years after completing your training) and business structure for the accounting & finance industry.

This is also a very broad guideline, and it’s important to understand the specifics of each individual role, i.e., reporting manager, size of the team, and scope of responsibilities. What one company calls a ‘finance manager’, another might call a ‘FP&A manager’, and another might call a ‘financial controller’.

*We are deliberately not covering the salaries of CFOs in this Talent Monitor but will address this in a separate publication.

You can expect a 10-15% reduction on the above numbers when considering appointments outside of Leinster.

Titles mean nothing without context, and every organisation is different and there are lots of factors and variables that impact this.

Examples of recent appointments in Leinster and how context can impact salary include:

- Head of Finance Irish MNC – €170k – managing small team responsible for all finance & compliance related activities.

- M&A Manager Irish HQ – €130k – leading all mergers & acquisition activities for the group.

- Interim FD MNC – €145k – commercially focused across FP&A and Controllership, managing small high performing team.

- Head of Commercial Finance Irish HQ – €105k – managing commercial finance activities for a specific business unit. Managing small team.

- Senior Manager FP&A – Irish HQ PLC – €145k – managing FP&A and business partnering for a large division.

- FP&A Manager – Irish international – €80k – managing FP&A and business partnering for a business unit. No direct reports.

- Finance Manager – Irish SME – €85k – managing small team responsible for a broad range of finance activities.

- Financial Controller – Irish international – €115k – managing small team responsible for month end, external reporting & compliance.

For illustrative purposes above, we have only focused on base salary. Of course, it’s important to highlight here all components of total compensation (Base + Package) should be considered, including pension contribution, bonus, LTIP, healthcare, and annual leave entitlement. Again, this can vary from company to company, role to role.

#4 Other benefits

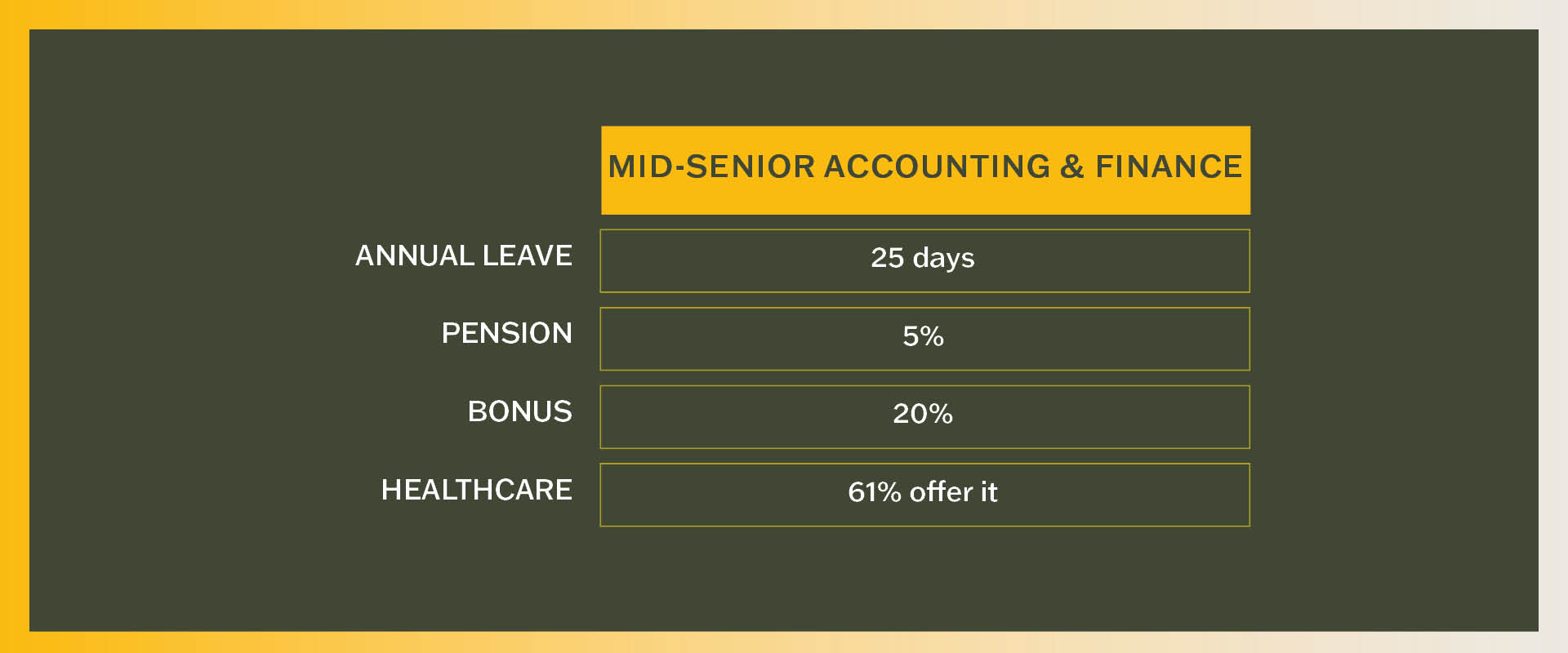

The graph below outlines the mode for benefits offered based on a sample of roles the mid-senior accounting & finance team in Barden supported in 2025.

#5 Key Market Trends

Here’s what we’ve observed this quarter in the mid-senior accounting & finance talent pool in Ireland:

Hybrid working trends:

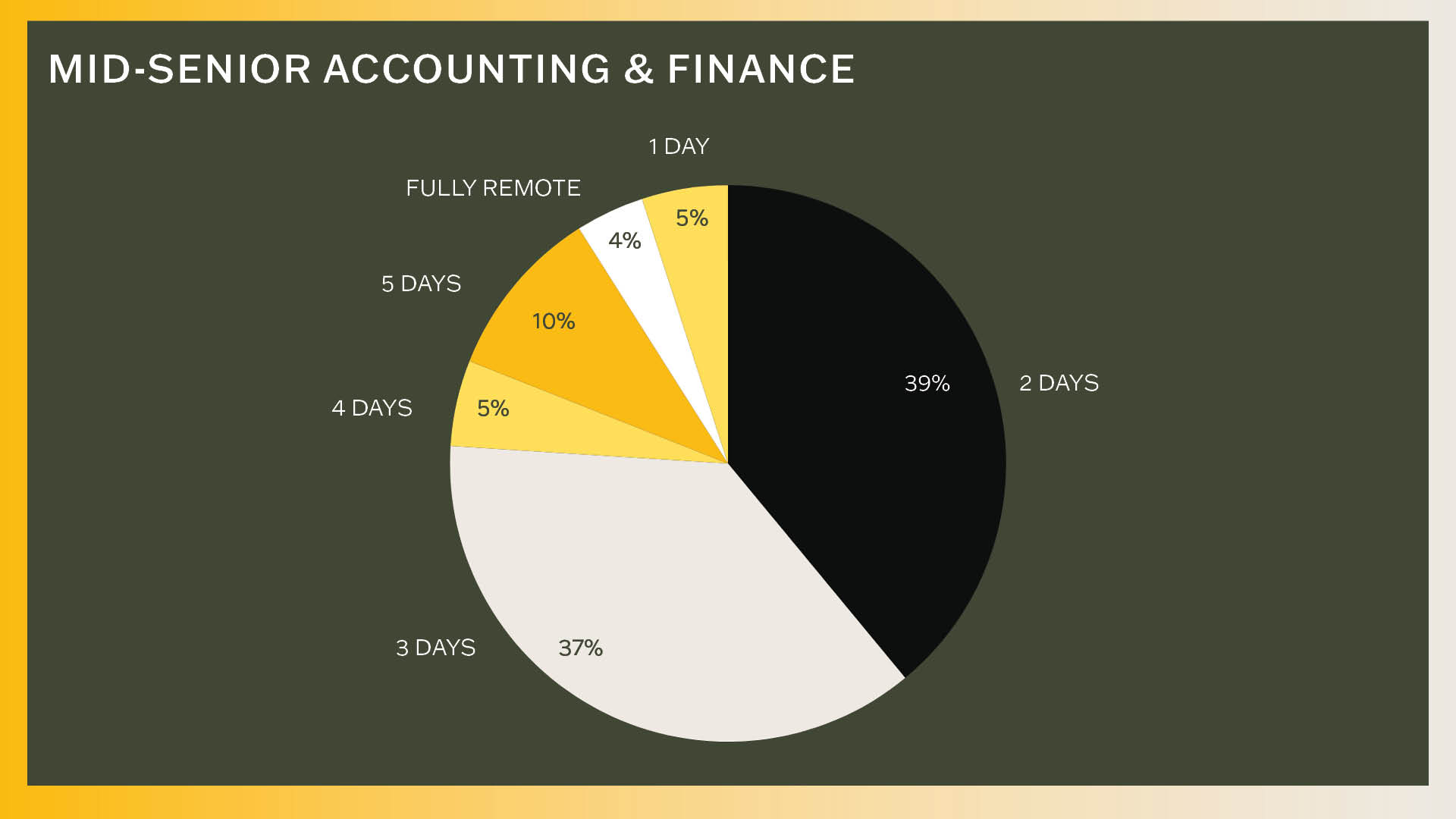

Hybrid working has firmly established itself as the default expectation at the mid-senior accounting & finance level in Leinster. While hybrid models remain prevalent, many Irish organisations are beginning to reduce flexibility and encourage a greater on-site presence as we move into 2026. Especially at the more senior end of the market, we see some companies pushing for nearly a fully onsite presence. Although fully remote leadership roles remain rare, employers mandating a full-time office presence are finding it more difficult to attract top-tier talent unless the role offers exceptional scope or remuneration. This dynamic has become a subtle but increasingly important differentiator in hiring outcomes.

The graph below is based on a sample of roles the mid-senior accounting & finance team in Barden supported in 2025 and as you can see, the most common hybrid arrangements vary depending on the organisation.

It is important to note that the working arrangements change depending on seniority, the sector and the specialism in finance. Certain specialisms like Corporate Finance, Corporate Development, Finance Business Partnering and senior management positions are more likely to be office based regardless of wider company policies as they can require more face-to-face engagement. Sectors like Construction, Commercial Property, Family Offices also tend to be more office based.

Where there has been a notable shift to more officed based working over the last 18 months and although this is expected to continue, there is no expectation for fundamental changes to what we see in the graphs above.

We hear on a daily basis, that most professionals would be happy to turn down a role that does not offer hybrid working arrangements – where hybrid working arrangements are as important for some people as salary, location and the role itself. Where possible, offering a flexible hybrid policy gives access to a much larger pool when looking to attract new talent.

#6 What are companies doing to attract mid-senior accounting & finance talent these days?

In our experience and what we see, hiring managers with the most success, tend to follow some of these key aspects below:

Talent-driven job market – Individuals are now firmly in the driving seat due to a shortage of talent to meet the demand for suitably qualified accountants, particularly at the junior and mid-career levels. Be market-led, or risk not attracting top talent!

- Culture and values – Culture is a key differentiator for professionals considering their next move. Individuals increasingly want to align with a company’s values, feel passionate about their work, and believe in the wider mission, with a clear shift towards roles where they feel valued and can make a positive impact.

- Employer Brand – To attract top talent, hiring managers must therefore have a stellar brand in the marketplace. As we all know, the finance community in Ireland, specifically in Dublin, is very close-knit, and your brand in the market therefore matters.

- Clear articulation of the people, role, and purpose – High-calibre professionals expect clarity on leadership, role scope, and organisational direction from the outset. To compete for the best, organisations must communicate opportunities with conviction and purpose.

- WLB and flexibility – The demand for flexible working arrangements continues to be of growing importance and a continued focus on work-life balance (“WLB”). Day in day out, we hear from talent that they are willing to take less money for a role that will offer more WLB. Striking the right balance is key.

- Hybrid working – What hybrid working arrangements are being offered to individuals? The ongoing discussion. To stay competitive, a hybrid work model that offers both flexibility and the benefits of workplace collaboration. No flexibility to work from home is a significant detractor and will greatly limit your access to talent.

- Reward and benefits – Competitive base salaries that are talent/market-led rather than budget-led, and definitive salary review. Strengthening additional benefits i.e., sign-on bonus, bonus multipliers to recognise professionals exceeding expectations, stronger employer % pension contribution, wellness subsidies, enhanced annual leave offering and other enhanced statutory leave entitlements.

- This talent-driven market will also lead to salary inflation in the months and years ahead, while intrinsic reward – how people feel about the work they do – will become an increasingly important differentiator.

- Career progression – Defining clear paths for progression in the current role and secondment opportunities to other business functions.

- Learning & development – Offering exposure to commercial projects/decisions and supporting educational opportunities to upskill in line with career progression.

- Technology and automation – Focusing on automation and technology enhancements where possible and outsourcing administrative duties.

Finally, and most importantly, how you make someone feel in a process is vital. Don’t leave ‘em hanging. Hiring managers must be willing to act quickly when the right individual comes along. If engaging in a recruitment process, expectation management and a fast-hiring process are absolutely key. As the hiring manager, it is your responsibility to set expectations with both internal and external stakeholders. If expectations are managed correctly, you’ll dramatically increase the likelihood of a positive outcome for both you and your prospective hire. Remember, silence and time kill all deals.

This is where Barden can help you. We offer over 20 profession-specific talent monitors, such as for early-career accountants or data analysts, that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact contact Tony Kerslake (Leinster) at tony.kerslake@barden.ie, or Denis Galvin (Munster) at denis.galvin@barden.ie; we’re where leaders go before they start looking for Mid-Senior Accounting & Finance talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Tony Kerslake (Leinster) at tony.kerslake@barden.ie, or Denis Galvin (Munster) at denis.galvin@barden.ie.

If you’re hiring an AR professional this quarter, here are some things you need to know…

AR by any other name is still accounts receivable. The exact role of an Accounts Receivable professional is shaped by the specific processes and procedures a company uses to manage customer invoicing and collections. This typically includes generating and sending invoices, tracking payments, following up on overdue accounts, reconciling discrepancies, maintaining accurate financial records, and ensuring timely collection of outstanding balances, but the name varies depending on the company. You might know it as:

- AR

- OTC (Order to Cash)

- O2C (Order to Cash)

- Credit Control

- Billing & Collections

- Accounts Receivable

Accounts Receivable and Credit Control are often treated as different functions, but the distinction is mostly about emphasis. AR is transactional—raising accurate invoices, maintaining balances, and recording payments. Credit Control is preventative—managing customer risk, setting credit terms, and chasing overdue debt.

The nuance is that AR manages what’s already happened, while Credit Control shapes what should happen. Ultimately, though, they serve the same goal: converting sales into cash and protecting cash flow. For simplicity, we will refer to these roles collectively as AR professionals.

We meet hundreds of professionals every year across a wide variety of companies, structures, and jurisdictions and here is some of what we’ve learned from them over the years.

#1 Job Seeking Behaviour of AR Professionals

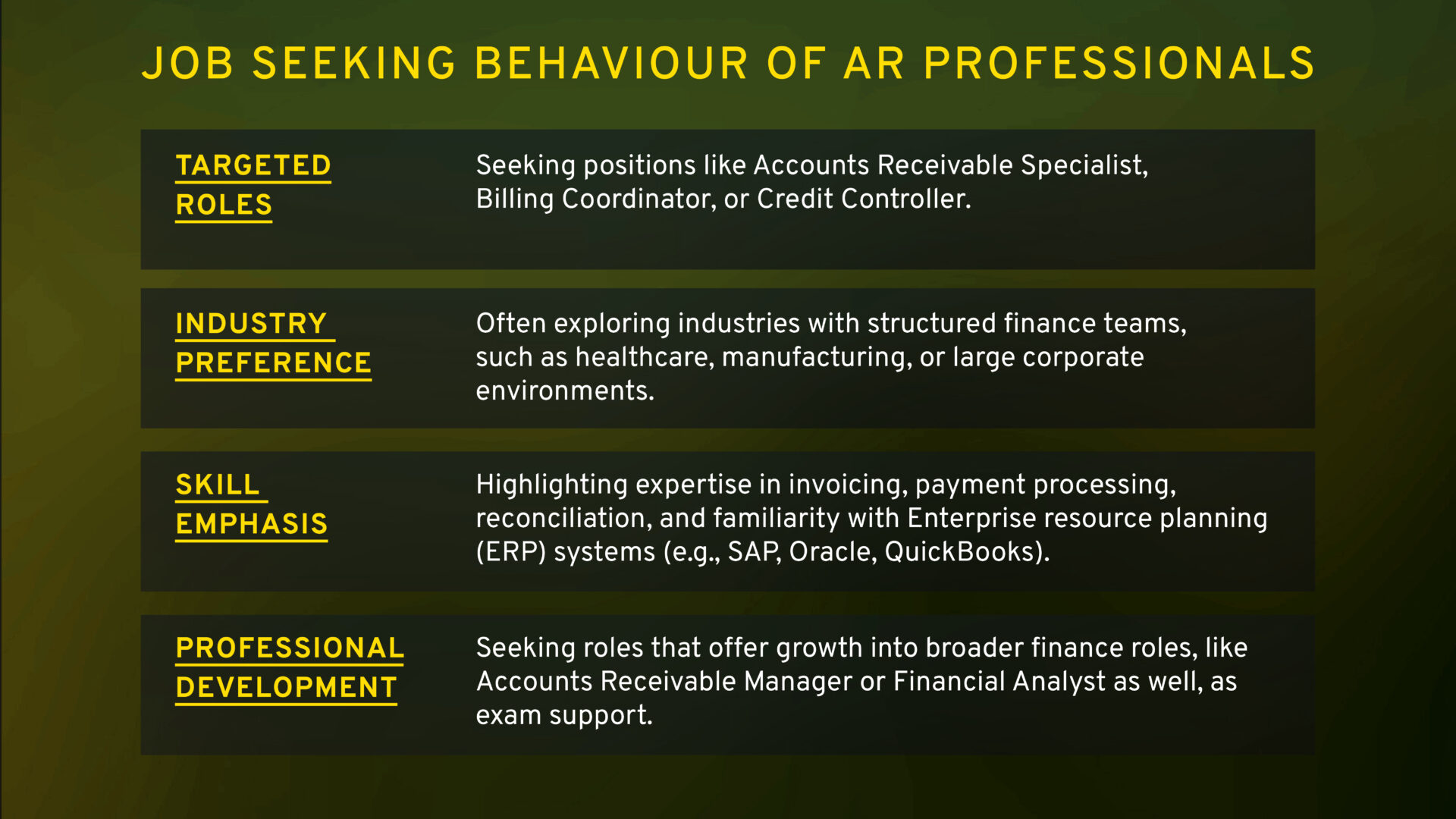

Accounts Receivable professionals tend to show two clear job-seeking behaviours. Some are highly driven and focused on career progression, looking for roles that offer a step toward management or a move into broader accounting functions. Others are more influenced by practical factors such as salary, industry, and whether the business operates in a B2B or B2C environment, valuing stability and fit over rapid advancement.

An Accounts Receivable professional’s job-seeking behaviour typically focuses on roles where they can apply their skills in managing incoming payments, maintaining financial records, and ensuring timely collection of outstanding invoices. Key aspects of their job search include:

#2 Salary

For AR talent, it can be all about the base. Here is what you would expect to pay today:

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice please contact our team; phonsie.irwin@barden.ie (Leinster) or tara.higgins@barden.ie (Munster).

It’s important to note some caveats to the salary ranges above. Leading a team—typically 1–5 people (€60,000 – €65,000) or 5+ people (€70,000+)—can increase compensation. Similarly, roles focused on specific projects, such as transformation, automation, or AI, may command higher pay. The extent of any increase generally depends on the proportion of time spent on day-to-day responsibilities versus project-based work.

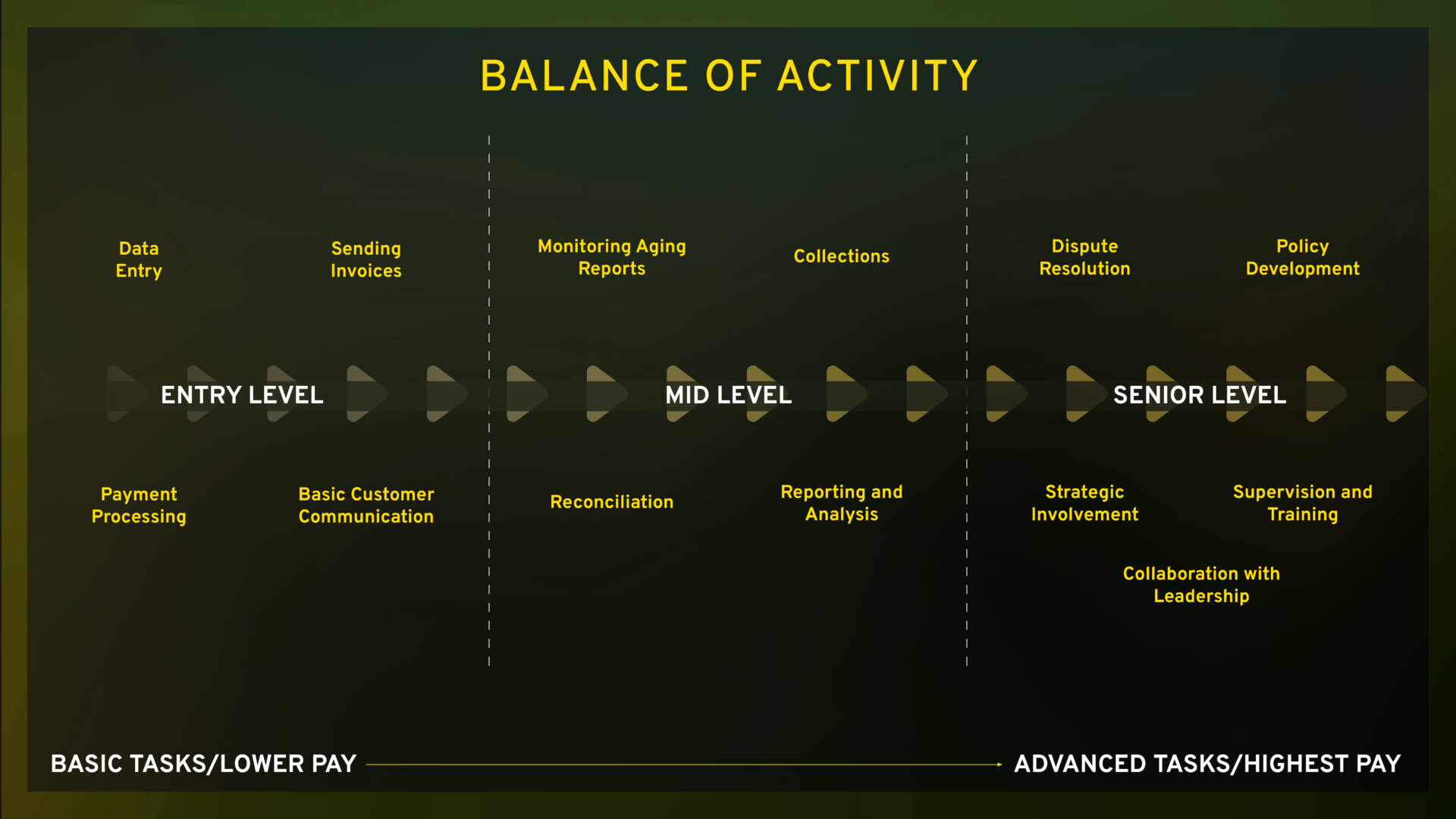

#3 Continuum of Activity

In AR, scale plays a crucial role in shaping responsibilities. Generally, the larger the AR team, the more specialised each role becomes, focusing on a smaller segment of the workflow. On the other hand, smaller teams require broader involvement across the entire process. Simple. Below is a breakdown of the tasks an AR Specialist typically handles. Their day-to-day focus — or “balance of activity” — meaning the tasks they spend most of their time on, is a strong indicator of their seniority and, ultimately, their salary.

At the entry level, the job is mostly about processing and recording payments. As you move up, it becomes more about problem-solving, analysis, negotiation, and financial strategy. Senior AR Specialists may even have a say in shaping the company’s financial policies.

#4 Demand vs Supply

The continued shift in the market has given further rise to supply of AR professionals seeking employment opportunities across Ireland. The demand or open roles across this space is slightly down on last year.

The surplus of talent has allowed managers to be selective in their hiring processes, as the supply of accounts receivable talent exceeds the available job opportunities. However, this surplus relates specifically to junior and mid-level AR professionals, with the demand for senior and specialised talent still being identified in the ‘very high demand’ category.

Here’s what we’ve observed this quarter in the AR talent pool in Ireland:

What are companies doing to attract talent?

The AR Leaders and Financial Controllers that we work with use some of the following tactics to make sure they get the best results:

- Competitive base salaries that are talent-led rather than budget-led.

- Additional benefits (bonus, healthcare, working abroad for short periods of time).

- Considered Hybrid working patterns that reflect the nature of the role.

- Pathways for development internally.

- Investing in company culture dynamics.

- Outsourcing or automation.

- Identifying junior talent and investing in upskilling.

#5 Challenges for Attracting & Retaining AR Specialists in Dublin

Career Growth & Recognition AR roles can be seen as stepping stones, leading to turnover if employees don’t feel recognised or see clear advancement opportunities. Organisations must acknowledge the value AR Specialists bring, offering career development plans, regular feedback, and skill diversification to keep employees engaged.

Competitive Compensation & Benefits Attracting AR talent in Dublin requires more than filling roles; it demands competitive salaries and attractive benefits like flexible work, wellness programs, and performance incentives. A supportive environment where contributions are valued is key to job satisfaction and retention.

Adapting to AI & Technological Changes AI and automation are reshaping AR roles, shifting responsibilities and requiring continuous upskilling. Companies must invest in training to empower teams to embrace these changes while ensuring human expertise continues to drive data interpretation, relationship management, and problem-solving.

By recognising these challenges and implementing thoughtful strategies, businesses can build a resilient, engaged AR workforce ready for the future.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Phonsie Irwin (Leinster), Tara Higgins (Munster) our AR Talent Advisory & Recruitment team here in Barden (phonsie.irwin@barden.ie; tara.higgins@barden.ie); we’re where leaders go before they start looking for AR talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Phonsie Irwin (Leinster) at phonsie.irwin@barden.ie or Tara Higgins (Munster) at tara.higgins@barden.ie.

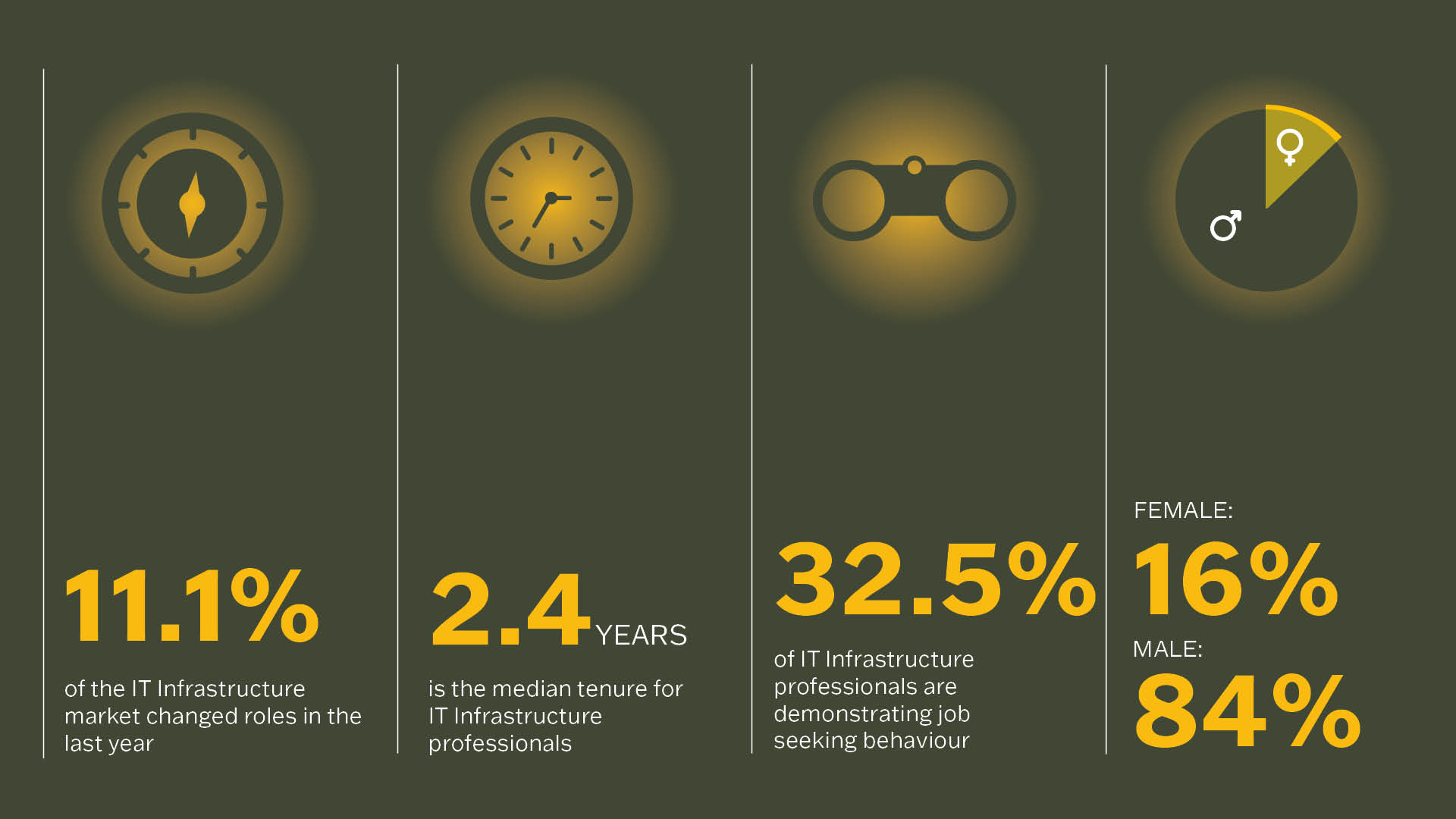

The IT infrastructure talent market in Ireland is experiencing significant pressure, with demand for skilled professionals far outstripping supply. As businesses accelerate their digital transformation efforts and adopt cloud technologies, the need for experts capable of designing, managing, and securing IT systems has never been more critical.

IT infrastructure professionals are no longer confined to supporting roles – they are now pivotal to driving business innovation and ensuring operational resilience. However, the rapid pace of technological change and evolving business needs make navigating this landscape both challenging and rewarding.

Through our direct work with IT infrastructure professionals and employers across Ireland, here’s what we’ve observed:

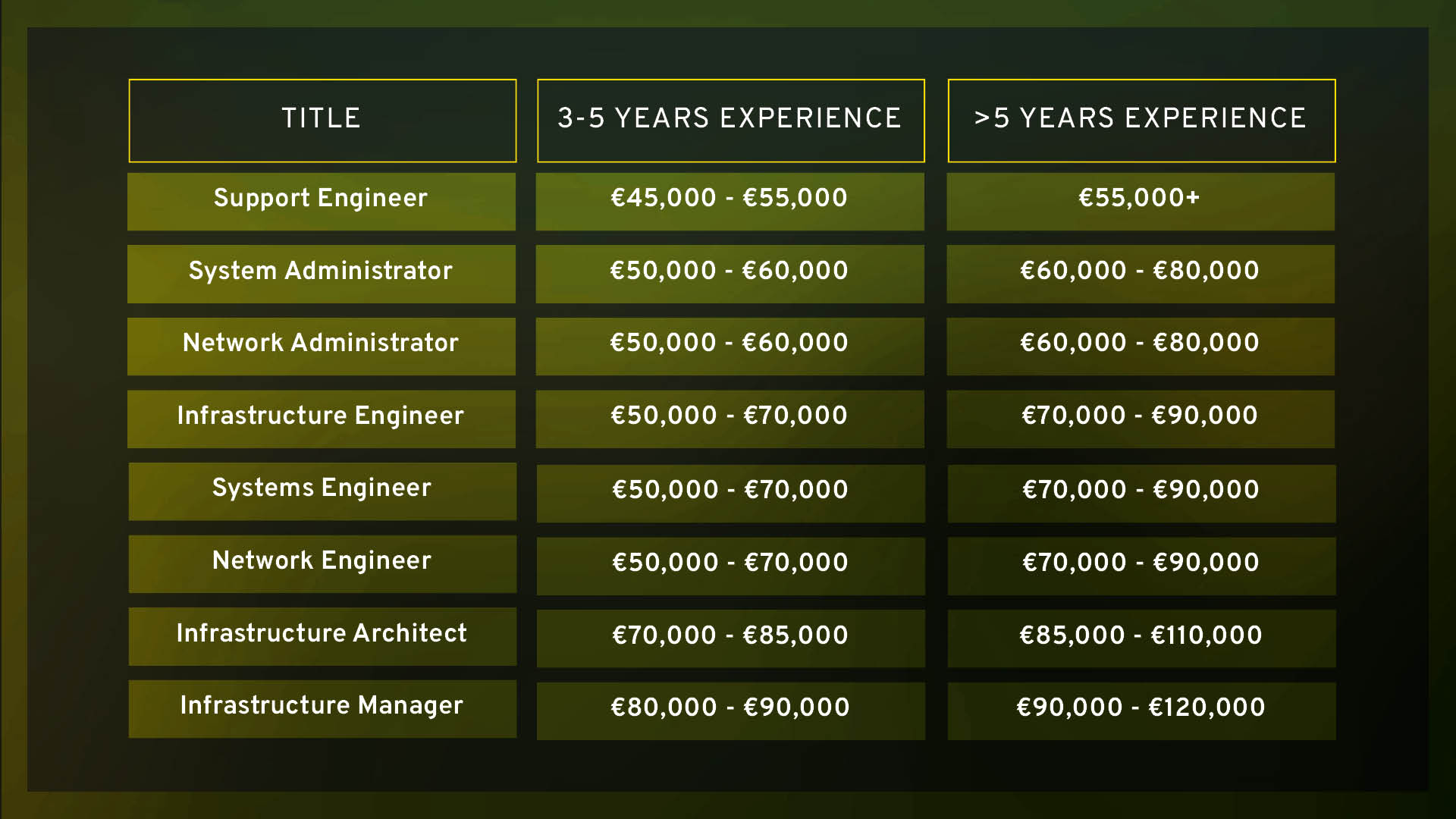

#1 Base Salary

Salaries for IT infrastructure roles in Ireland vary widely, and for good reason. Here are the key factors that influence base salary:

- Certifications: Industry-recognised certifications such as AWS, Azure, or ITIL can substantially enhance earning potential.

- Organisation Size: Larger organisations, tend to offer more competitive salaries due to the complexity and scale of their IT infrastructure requirements.

- Supply & Demand: Skills in high demand but short supply, such as cloud computing, cybersecurity, and automation can directly influence salary.

- Location: Dublin typically leads in salary offerings, reflecting the concentration of tech hubs and multinational companies in the capital.

This is a very broad guideline and it’s important to take into account the specifics of each individual role. For bespoke advice please contact lorraine.oleary@barden.ie

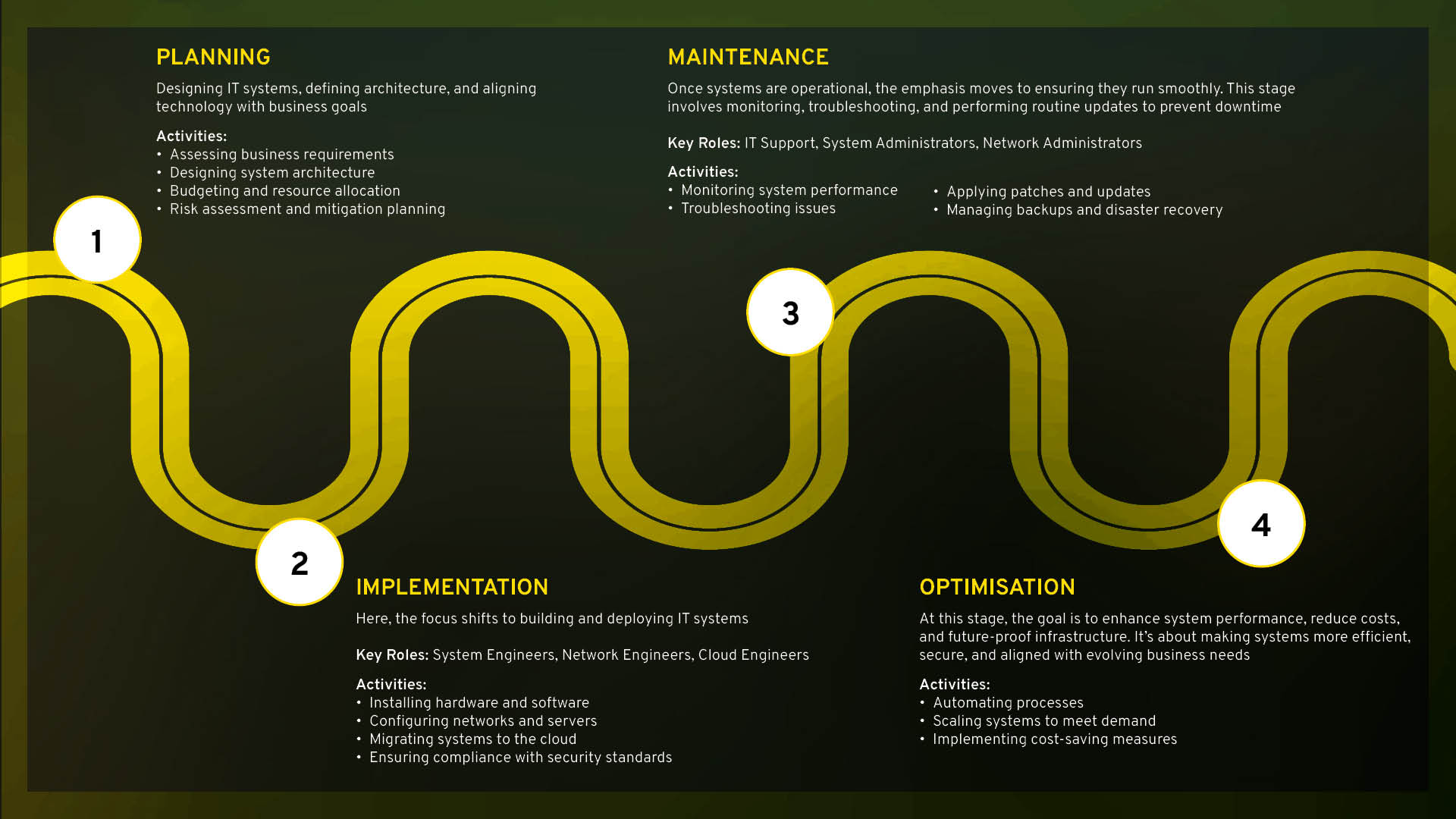

#2 IT Infrastructure Lifecycle

IT infrastructure roles typically follow a continuum of activities, spanning planning, implementation, maintenance, and optimisation. Understanding this lifecycle is essential, as it underscores the complexity of the field and highlights the importance of context when evaluating roles and responsibilities.

While some roles encompass the entire lifecycle, others are more specialised, focusing on specific stages. Here’s a structured view of the continuum and the roles that align with each stage:

#3 Variables that matter

Job title alone often doesn’t capture the full scope of an IT infrastructure role. Here are the key variables that help define what a position truly entails:

Role Focus: Is the role operational and hands-on, or more strategic, focusing on planning and architecture?

Technical Focus: Does the role emphasise hardware, software, networking, or a combination of these?

Project-Based vs. Ongoing Support: Is the position centred on implementing new systems (project-based) or maintaining and optimising existing ones (ongoing support)?

Industry Requirements: Different sectors, such as finance, healthcare, and technology, come with unique challenges and regulatory demands that shape the role.

By considering these variables, employers and talent can gain a clearer understanding of what a specific IT infrastructure role entails, beyond the job title alone. This helps in matching the right skills and experience with the appropriate job functions.

#4 IT Infrastructure Talent Availability

Here’s what we’ve observed this quarter in the IT infrastructure talent pool in Ireland:

#5 Projected challenges for the next 12 months

For Employers:

- Cloud Migration: The transition to cloud-based systems presents both technical and organisational challenges, requiring the expertise to navigate this effectively.

- Cybersecurity: As cyber threats evolve, ensuring IT infrastructure remains secure will be a top priority.

- Sustainability: Organisations will face increasing demands to adopt greener IT practices, such as energy-efficient data centres and sustainable hardware solutions.

For Talent:

- Continuous Learning: Staying relevant in the field will require ongoing learning to keep pace with emerging technologies like AI, edge computing, and automation.

- Competition: High demand for specialised skills will lead to more competition for roles, making it essential for talent to differentiate themselves.

- Specialisation: Professionals may face the challenge of choosing between specialising in a niche area (e.g., cloud architecture) or developing a broader skill set to remain versatile.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Lorraine O’Leary our IT Infrastructure Talent Advisor & Recruiter here in Barden (lorraine.oleary@barden.ie); we’re where leaders go before they start looking for IT Infrastructure talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Lorraine O’Leary at lorraine.oleary@barden.ie

If you’re hiring a part-qualified accountant this quarter, here are some things you need to know…

Before you go to market to hire a part-qualified accountant, it’s crucial to understand current market trends, identify what level and type of part-qualified accountant you need, and figure out how to position yourself as an employer of choice. That’s where Barden steps in.

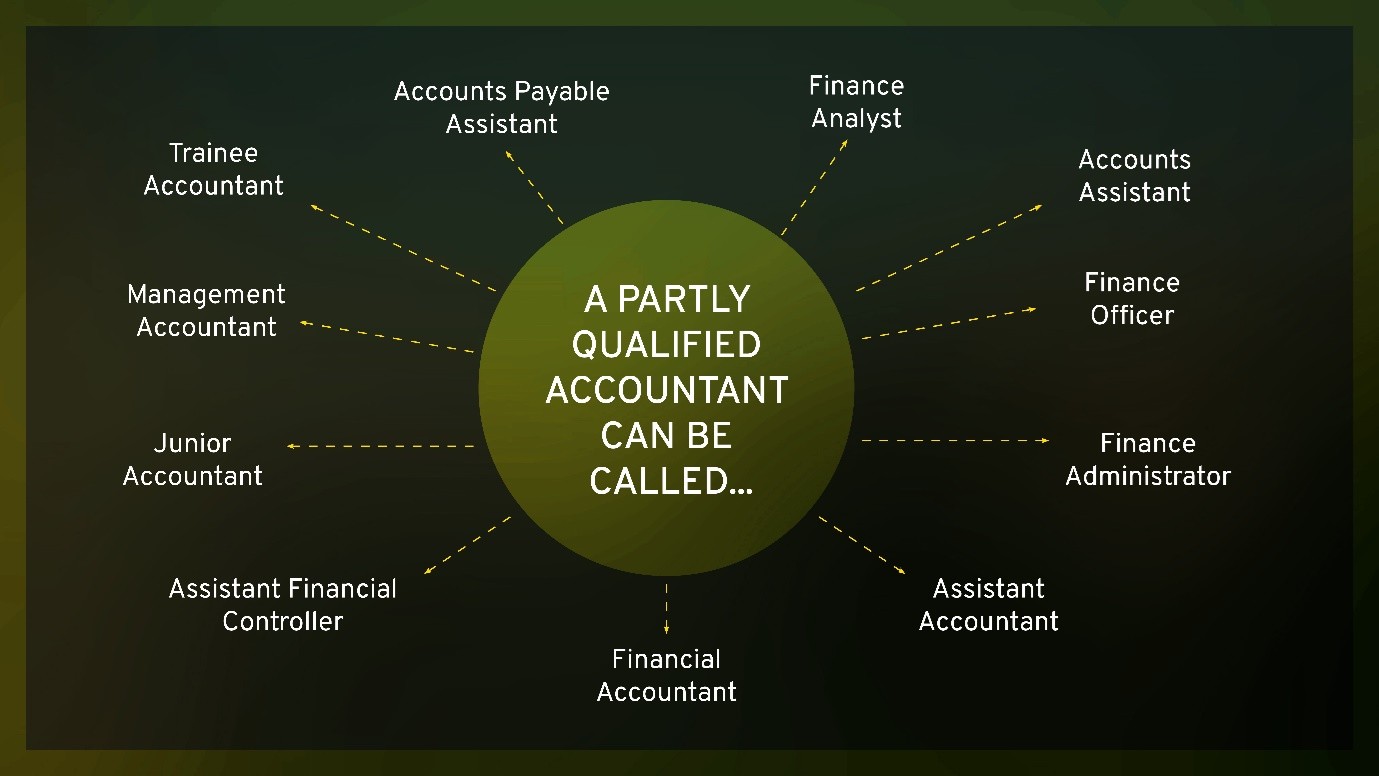

#1 Job Title

When hiring a part-qualified accountant, it’s important to remember that job titles can vary widely. We’ve often seen two individuals performing very similar roles, yet one may be titled Accounts Assistant while the other is called Assistant Financial Controller. Job titles alone don’t fully reflect the breadth of a role; it’s the specific responsibilities and expectations that truly define a person’s position.

So, before you decide on a job title for a part-qualified accountant, it is important to consider some of the points outlined below. After all, job titles mean nothing without context.

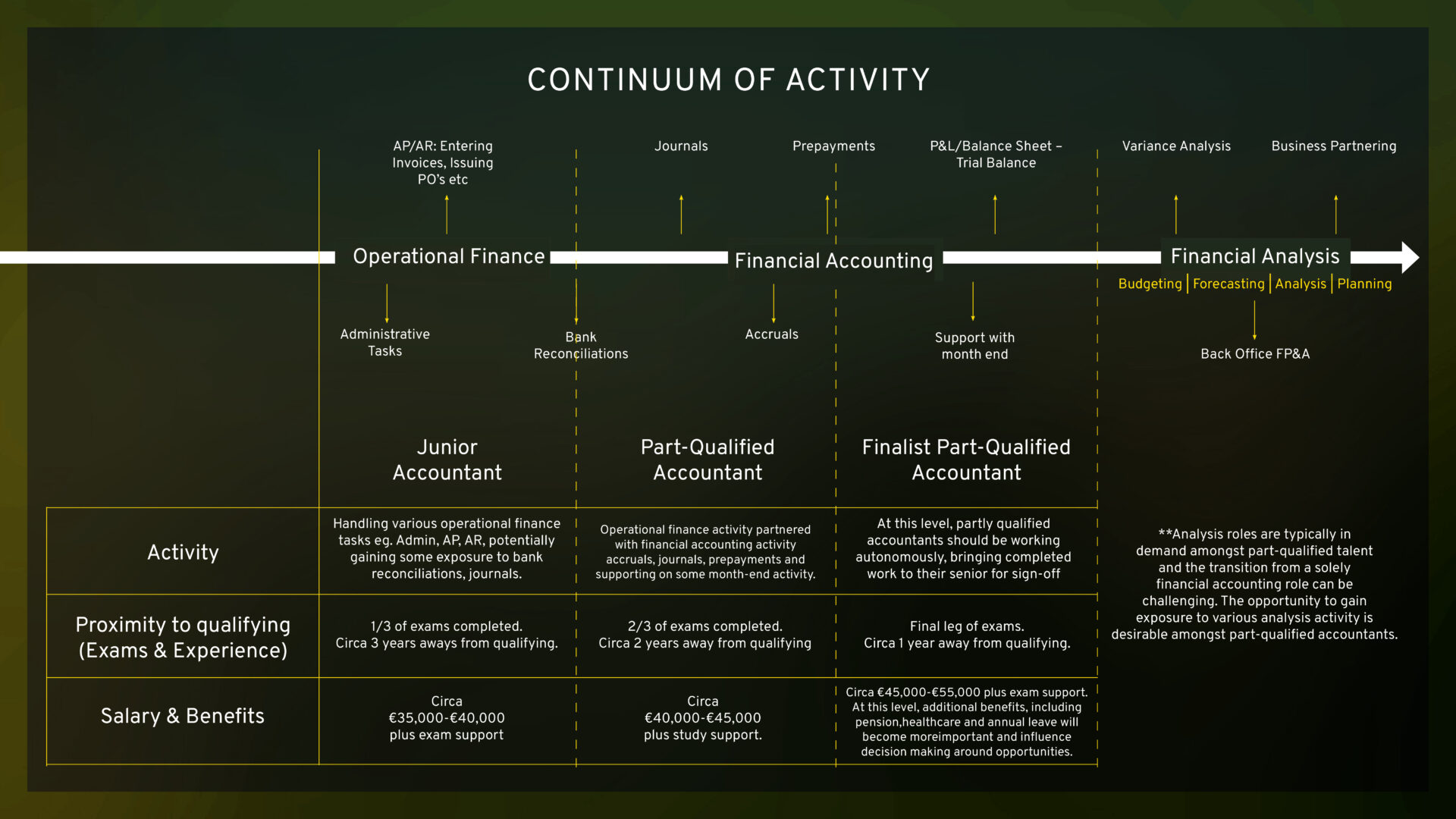

#2 Balance of Activity

To effectively navigate the challenges of identifying the right person for your role, it’s essential to focus on the balance of activity and how an individual allocates their time and divides it between various tasks. This is important but it can be a little tricky.

Below is a simple continuum of the activity you would expect to see in any finance team/role from a part-qualified perspective. This continuum is deliberately focused on financial accounting activity as most part qualified accountants train and spend their time here. We have also mapped various activities in the continuum and how titles relate to salary and proximity to exam completion, all of which will paint a picture of the natural order and flow of a part-qualified accountants’ career. This continuum ignores things like finance transformation, statutory reporting, tax etc.…let’s keep it simple for now.

#3 Exceptions to the rule

Of course, there are always exceptions to the rule, especially when it comes to part-qualified accountants… Here are some exceptions and variables which matter.

- Qualified By Experience (QBE):

These individuals have a significant amount of hands-on practical experience. This cohort typically decide not to progress with the exams but have worked within the accountancy space for a number of years and have a high-level of knowledge and experience. As the title above suggests, they have qualified through experience but not through exams.

- Career Changers:

This cohort have had a previous career with experience in the likes of supply chain, business support, technology and made the move into accounting recently. These individuals have the potential to add significant value to an organisation, particularly if their prior experience is of relevance to the business. It is important to attribute some value to prior careers should it have relevance to the organisation as they will have advanced knowledge of the business.

- Coming from Practice:

These are individuals making the transition from Practice into Industry. There will be a small percentage of this cohort who will be looking to leave an Audit or related training contract in a large practice and looking to transition into Industry. This group might not have debits and credits exposure but will be professional and capable of learning quickly. They will likely require some additional time to find their feet but ultimately, can be a great asset to a business.

#4 Demand VS Supply

This is tricky to quantify, given the transient nature of the part-qualified community and that many qualify in time. What we do know is that these individuals are finite in number and are often bound to an employer given the investment in education, be this formally or informally. As a result, the supply of talent at all levels above is typically quite low.

For junior accountants, often employers will look at AP, AR or similar transactional level exposure, who have a capability of pursuing exams rather than someone who is working as a junior accountant.

If you are hiring a part-qualified accountant, it is important you realise that someday they will likely become qualified. Succession planning will increase the likelihood of retaining talent beyond qualification. Understanding the qualified accountant market, knowing the market rate and budgeting for the inevitable increases when qualified, are all important factors to consider for the medium term.

In summary, the more you invest and support a part-qualified accountant on the journey, the more likely you are to retain them beyond the qualification.

#5 What are companies doing to attract talent?

The Finance Managers and Financial Controllers that we work with use some of the following tactics to make sure they get the best results:

- Identifying junior talent and investing in upskilling – earning and learning.

- Pathways for development internally. As outline above, this is key. Clear and defined pathways for qualification will not only attract the right talent but retain them.

- Competitive base salaries that are talent-led rather than budget-led. We have seen an increase in salaries over the last 12-18months in this space and renumeration has become increasingly competitive.

- Additional benefits (bonus, healthcare, working abroad for short periods of time) this is not necessarily the norm in this space, but including a more robust benefits package is more attractive to talent and can somewhat offset the increase we are seeing in salaries.

- Considered Hybrid working patterns that reflect the nature of the role.

- Investing in company culture dynamics.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Jodie Meehan our Part-Qualified Accountant Talent Advisor & Recruiter here in Barden (jodie.meehan@barden.ie); we’re where leaders go before they start looking for Part-Qualified Accountant talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Jodie Meehan at jodie.meehan@barden.ie.

Finance transformation isn’t just about new systems or processes; it’s about delivering meaningful & lasting change. The best transformations don’t just improve finance functions; they enable smarter decision-making, drive efficiency, and future-proof businesses, enabling the finance function to scale. When done right, finance transformation feels seamless, but behind the scenes, skilled professionals are making it all happen.

At Barden, we understand the Finance Transformation space and the talent that drives it. Our latest talent monitor highlights specific trends and data around the movement, availability and salary trends for Finance transformation professionals in Ireland. If you’re thinking about strengthening your team in the coming months, here are a few key things to consider.

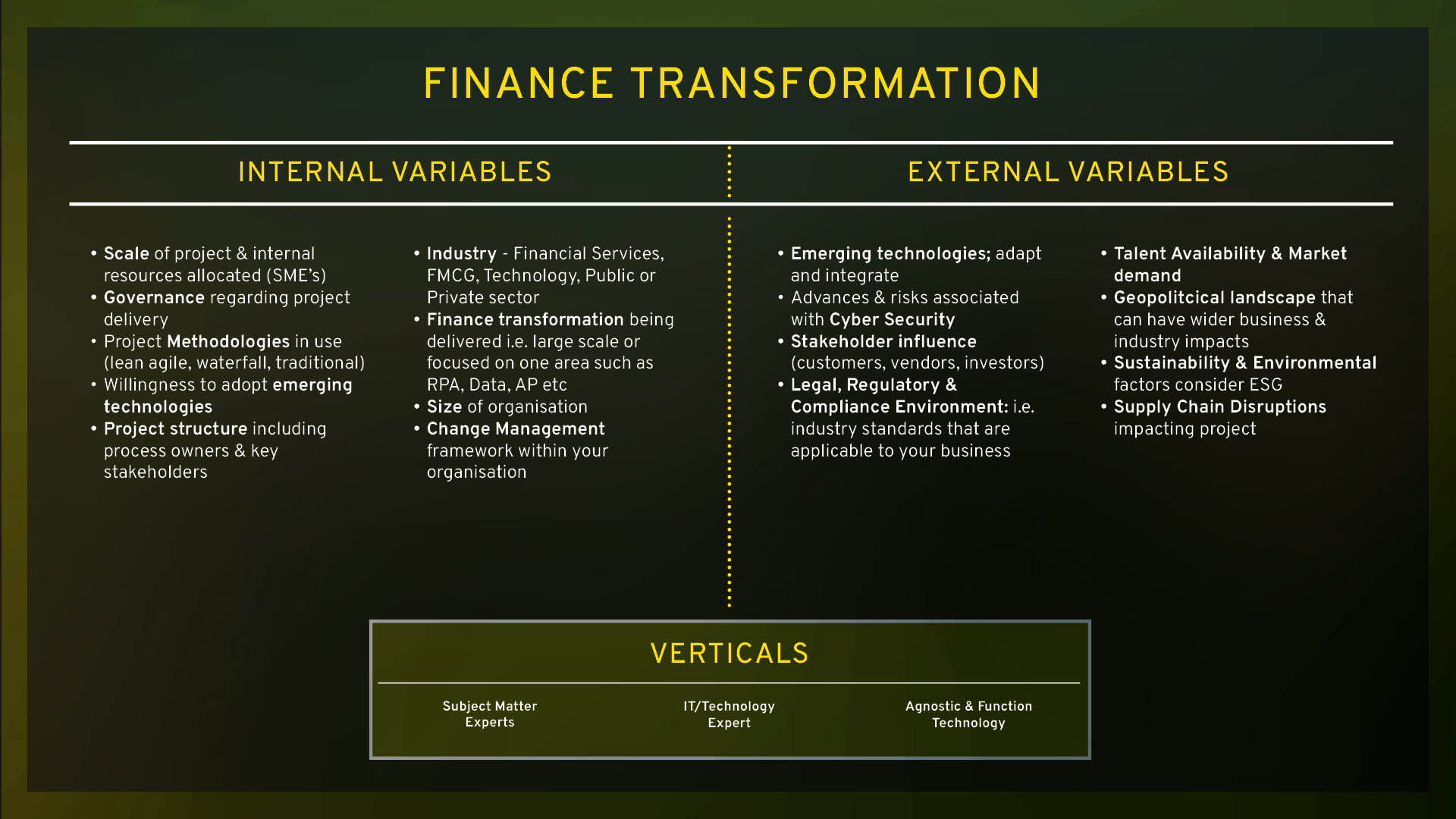

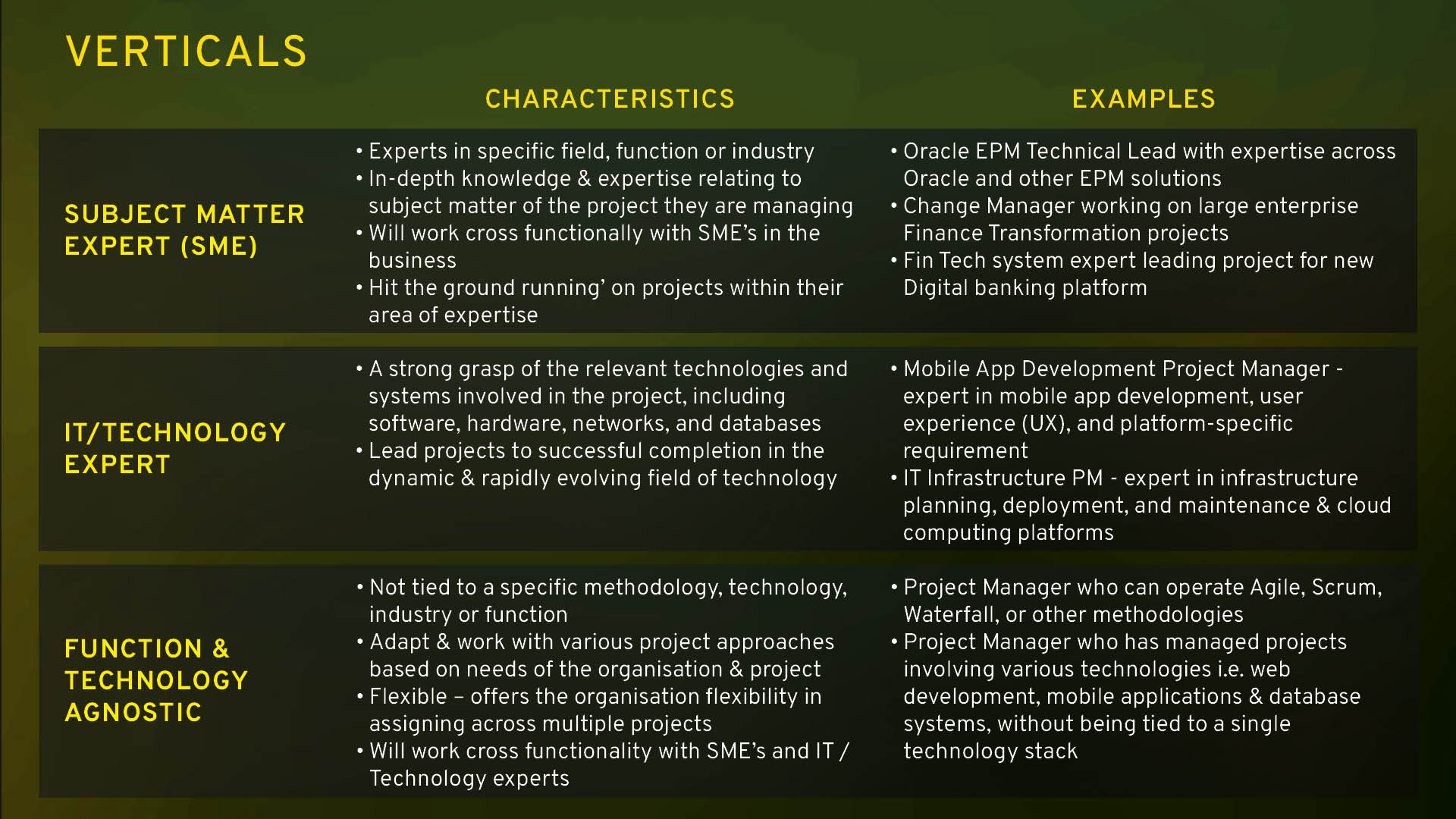

#1 Finance Transformation Professionals – Verticals

Finance transformation specialists are the architects of change, translating vision into action. Their work may not always be front and centre, but the impact of what they deliver is significant. Finding the right talent to shape and execute transformation initiatives is critical to ensuring meaningful, sustainable results.

In Barden, we categorise Finance Transformation professionals across 3 core verticals as follows:

- Subject Matter Expert

- IT / Technology Expert

- Agnostic – SME & Technology

Let’s explore the verticals in more detail including typical characteristics and examples, delving into the SME category in more granular detail.

When defining your talent needs for a finance transformation program you should focus on the key verticals and essential attributes required for successful delivery. It will of course be dependent on the Finance project or programme of work you are looking to deliver. It is worth noting that most projects will have a number of these verticals involved; for example, when delivering an ERP project, a technology professional with expertise in delivering ERP projects will work alongside SME’s in areas such as Record to Report, Order to Cash, Finance & Controlling.

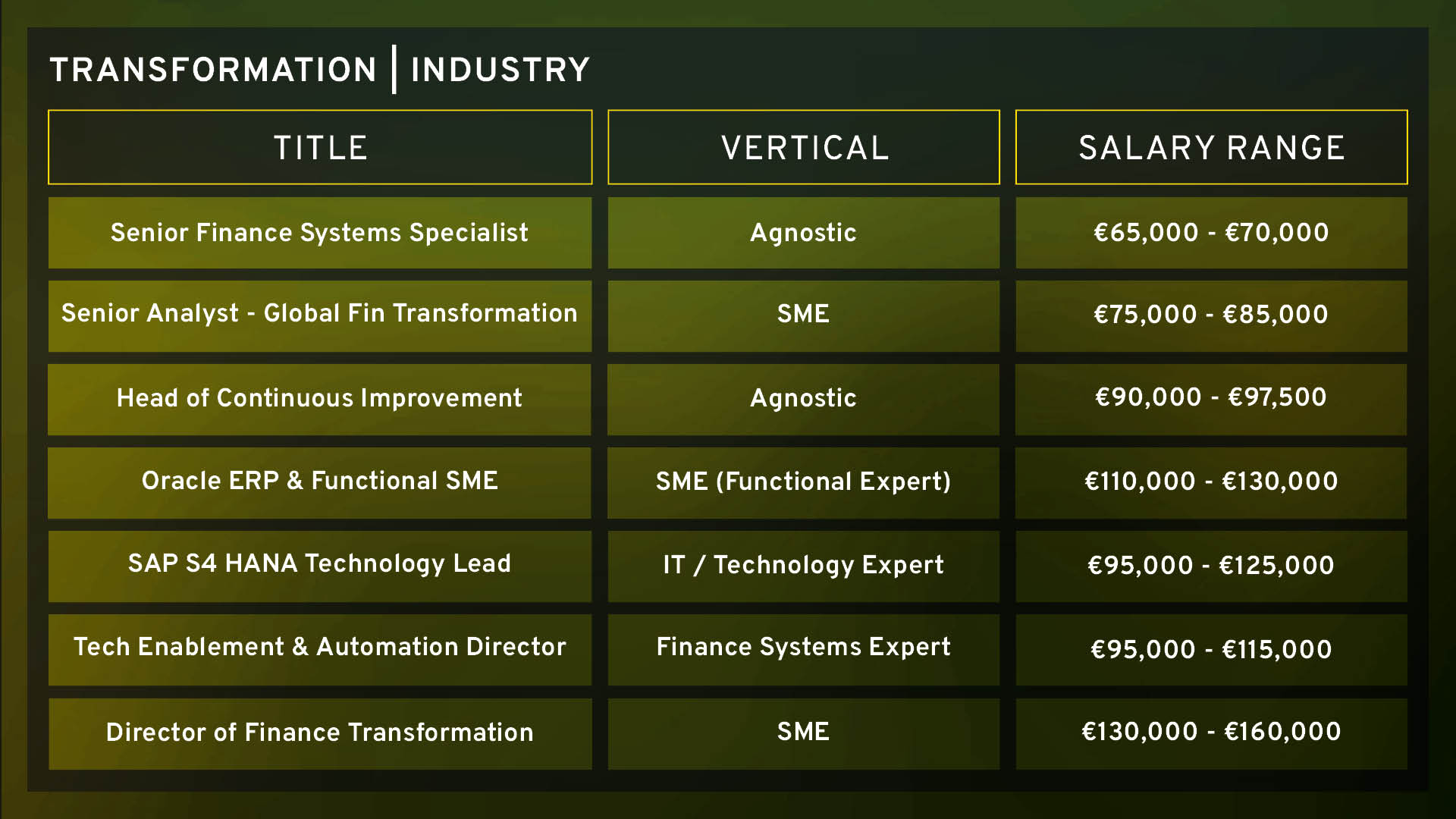

#2 Base/Salary Considerations

Salaries have remained steady over recent quarters and are in line with average salaries monitored throughout 2025. Below are some guidelines for salaries, for Finance Transformation roles both within industry and practice.

Some important points to note:

- Figures above relate to base salary only.

- Context is key – this includes both context on breath and scope of the role and sector in which the role resides. There can be considerable variances in these figures dependent on those variables including industry, scope of responsibility, geographical reach, reporting line and years of experience.

- Important consideration is being attributed to benefits outside of base salary. These include bonus, health (individual & family), pension, LTIP’s (level dependent), hybrid working arrangements etc. These are as important to people as the base salary alone and often form key aspect of attracting talent to an organisation.

- Offering 23–25 days of annual leave or more is critical. Anything less puts companies at a notable disadvantage in attracting and retaining talent.

Bespoke salary advice based on your unique set of requirements is always the best approach to benchmark salaries for the talent required in the project and transformation space.

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice please contact our team; catherine.drysdale@barden.ie (Leinster) or christine.mccarthy@barden.ie (Munster).

#3 Continuum of Activity | Finance Transformation

The variables that are relevant to the role you are hiring for matter a lot in Finance Transformation and will play an important factor in defining the base salary and overall remuneration package. We have provided below some general guides along with an overview of both the internal & external variables, some include:

- Technology or SME expertise – a project requiring specialised skills in areas such as ERP, emerging technologies, Change and programme management and IT or specific industry expertise can contribute to higher salaries.

- Project Complexity – The complexity and scale of the finance project or programme often comes with higher compensation & specialised niche talent requirements.

- Industry and Sector – Project and transformation talent working in specific sectors such as Technology or financial services may receive higher compensation due to the specialised knowledge and complexities associated with programmes of work being delivered.

- Responsibilities and Scope – Transformation experts overseeing a portfolio of projects or managing cross-functional teams are likely to receive higher salaries compared to those handling smaller, less complex projects.

- Market Demand & talent availability – The demand for finance transformation professionals in a particular region or industry can influence salaries and may lead to increased compensation. For example, talent specialising in ERP implementations such as Oracle Fusion & SAP S4 HANA are seeing increased demand for their expertise as organisations move from on-prem to Cloud solutions across those ERP platforms.

#3 Talent Availability & Working Arrangements

Demand remains “very high” for finance transformation professionals across both industry and practice. Here are some key data points about the Finance Transformation talent pool in Ireland this quarter:

- The first quarter of the year is traditionally when bonuses are paid and promotions are granted, which tends to reduce employee movement and leads to a tighter talent market across the board.

- There has been a surge in demand for talent across projects, transformation and change functions, particularly in roles at the intersection of compliance, risk, operations, finance and technology. At Barden, we see this play out across sectors, including financial services, pharma, technology, fintech, and beyond, as companies respond to increased scrutiny, new standards, and heightened expectations from regulators, investors, and the public alike.

- Given the current geopolitical landscape and uncertainty surrounding the Trump administration, there’s a sense of caution among transformation professionals especially those at senior level, many of whom are choosing to stay put and wait for more stability.

- A marked shift in hybrid models has been experienced since the start of 2025 with 71.6% of roles now aligning to a 2–3-day hybrid model, making it the clear standard for most organisations. Notably, full-time office work has increased from 7.6% to 13.3%, which is undeniably reflective of the move by some US multinationals and others to a five-day working week in the office in H1 of this year.

- Fully remote roles continue to decrease, now accounting for just 4.4% of jobs. This highlights that expectations of 100% remote work no longer align with market realities.

#4 Key Considerations for the Next 12 Months

The Finance Transformation Office within any organisation continues to play a vital role, especially in the context of the continued heightened focus on finance transformation. Staying agile and forward-thinking will be critical for professionals in this space.

Some key considerations for the year ahead:

- Compliance at the Core of Transformation & Change: Project and change professionals are no longer operating on the periphery of compliance; they are being pulled into the centre of it. Whether it’s leading SOX readiness programmes, DORA implementation, ESG reporting readiness, or integrating cybersecurity and privacy solutions, transformation teams are increasingly at the forefront of regulatory and compliance initiatives. This shift requires new capabilities, including understanding the language of controls, compliance, and regulation and designing change initiatives that meet both business and regulatory objectives. For employers, this means the talent profile is evolving.

- Project Governance: As transformation agendas grow in scope and complexity, strong project governance remains a key consideration. Placing continued emphasis on clear prioritisation, structured oversight, and tangible value tracking across finance transformation programmes is a key aspect to ensure successful delivery. This drives demand for talent with deep programme governance expertise, not just delivery capability.

- AI Governance & Ethics: With AI adoption, Finance leaders must manage risks such as bias and transparency while ensuring compliance and accountability to maintain trust and drive responsible AI use across their finance functions.

- Cybersecurity considerations: As organisations accelerate digital transformation, cybersecurity risk continues to remain a top priority. Finance transformation initiatives must embed security from the outset, requiring leaders to be well-versed in risk management & data privacy regulations. Close collaboration with key business stakeholders is essential to proactively identify and mitigate vulnerabilities, ensuring transformation outcomes are secure and compliant. This is especially important in highly regulated environments such as financial services.

- Value creation through data: Companies with large, fragmented data systems will need Transformation talent who can integrate these systems, unlocking the value of data across the organisation for smarter decision-making and competitive advantage.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Catherine Drysdale (Leinster) or Christine McCarthy (Munster) our Finance Transformation Talent Advisory & Recruitment team here in Barden (catherine.drysdale@barden.ie; christine.mccarthy@barden.ie); we’re where leaders go before they start looking for Finance Transformation talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Catherine Drysdale at catherine.drysdale@barden.ie or Christine McCarthy at christine.mccarthy@barden.ie.

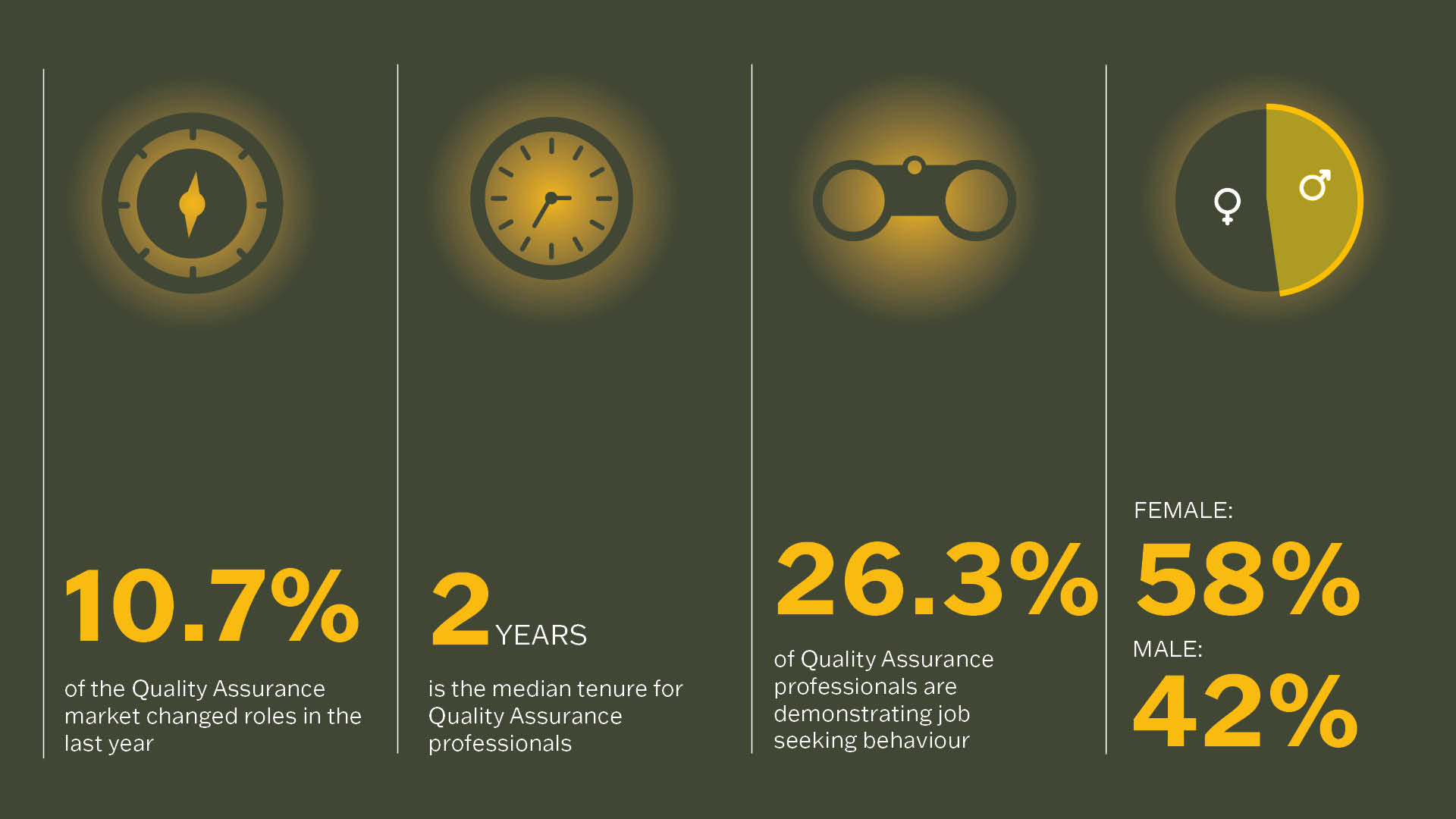

The “Quality Assurance Talent Monitor” provides an in-depth analysis of the Quality Assurance (QA) profession within Ireland’s pharmaceutical industry. As a key function ensuring compliance, product integrity, and regulatory adherence, Quality Assurance plays a vital role in maintaining Ireland’s reputation as a leading pharmaceutical exporter.

#1 Continuum of Activity

The below imagery, from left to right, depicts the continuum of activity within the Quality Assurance profession, beginning with Raw Material sourcing and control to QP Batch release.

In Quality Assurance (QA), all activities generally fall within the above 3 key areas, which ensure compliance, effectiveness, and continuous improvement. Here are the 3 main areas:

1.1 Quality Management Systems (QMS)

- Manages document control systems, change control, deviations, and CAPAs (Corrective and Preventive Actions).

- Ensures records are maintained per regulatory expectations.

- Implementation of Good Manufacturing Practice (GMP) requirements per EU GMP guidelines (EudraLex Volume 4).

- Compliance with HPRA (Health Products Regulatory Authority) and EMA requirements.

1.2 Regulatory & Compliance

- Adherence to industry regulations (FDA, EMA, MHRA, GMP, GLP, GCP, etc.).

- Adherence to EU and Irish pharmaceutical laws (e.g., EudraLex, ICH guidelines, HPRA regulations).

- Regulatory submissions and approvals via HPRA, EMA, and FDA (if exporting to the U.S.).

- Handling regulatory inspections and audits from the HPRA, EMA, and FDA.

- Ensuring GMP, GDP compliance in manufacturing and distribution.

1.3 Product & Process Control

- Analytical testing and Review.

- Investigation and resolution of out-of-specification (OOS) and non-conformance issues.

- Implementation of Corrective and Preventive Actions (CAPA) as a result of OOS investigations.

- Batch record review and lot release (Qualified Person (QP) certification in Ireland).

- Pharmacovigilance and complaint handling to ensure patient safety.

- Ongoing GMP training and personnel qualification to ensure compliance and competency.

These 3 pillars ensure a structured and effective QA system that meets regulatory requirements while driving high product and process quality.

QA professionals operate across various domains, with responsibilities influenced by multiple factors, including:

- Function and scale of Team:

- Key areas include Compliance and regulatory, Batch Release & QP, Supplier Quality and Vendor Management, Internal & External Auditing, QMS and Document Control, Deviation and CAPA Management.

- Smaller teams, one individual could cover the full continuum, whereas in larger teams, specialisation occurs, and hierarchy emerges.

- Product Type:

- Sterile (Injectables, Ophthalmic, Biologics) v Non-Sterile (Tablets, Capsules, Syrups).

- Biologics (Vaccines, Monoclonal Antibodies, Gene Therapy) v API (Generics, OTC products).

- High Risk (Oncology Drugs, Hormones, Blood Products) v Low Risk products (Vitamins, Cosmetics, OTC Medicines).

- Regulatory Scope:

- Ensuring compliance with guidelines from regulatory bodies such as the EMA, FDA, HPRA, and WHO.

- Company Type:

- Differences exist between Pharma, Biopharma, Contract Development and Manufacturing Organisations (CDMO), Contract Manufacturing Organisations (CMO), and Generic Pharma companies.

These elements shape the scope of QA roles and impact salary structures across the sector.

#2 Base Salary

*Salaries for both Quality Auditors and QPs vary significantly.

*Salaries for both Quality Auditors and QPs vary significantly.

There are a number of factors that play a critical role in influencing these variations.

For Quality Auditors, Product type and complexity of the product, frequency of travel coupled with base locations of suppliers will significantly impact salary.

For a QP, salaries differentiate depending on whether an individual is purely QP Qualified with no licence experience versus a QP who has experience working under a license as a QP. Having licence experience is becoming a key requirement for hiring companies. These companies may have QP qualified talent within their Quality Team, but who are lacking the necessary licence experience.

In recent years there has been a large uptake in QA Professionals undertaking QP courses.

Salary levels in QA are determined by a number of factors. Below I have categorised them specifically in relation to internal and external factors:

Some of which are already mentioned above.

- Internal Factors:

- Function of Team:

- QA teams that focus on specialised functions (e.g. QP, Aseptic QA, Sterility assurance, QA Auditing) often require highly skilled professionals, leading to higher salaries. More general QA roles may not command the same premium.

- Regulatory Complexity:

- Teams directly responsible for ensuring compliance with strict regulations (e.g. Qualified Person (QP) teams or audit teams dealing with global regulatory bodies like the FDA or MHRA typically earn more due to the critical nature of their work.

- Size of Team:

- In smaller teams, individuals may take on broader responsibilities, which can justify higher pay. In larger teams, roles may be more segmented, affecting salary depending on whether a role is strategic or operational.

- Function of Team:

- External Factors:

- Demand vs. Supply:

- The availability of skilled QA professionals impacts salary competitiveness within the industry.

- Industry Trends:

- The increasing focus on digitalisation, automation, and data integrity in QA influences the demand for specialised skill sets.

- Demand vs. Supply:

#3 Demand vs. Supply / Talent Availability

As the pharmaceutical sector continues to maintain a strong performance, the demand for qualified QA professionals remains consistently high.

Quality Auditors and QP talent remain in high demand.

#4 Conclusion

Barden’s “Quality Assurance Talent Monitor” highlights the evolving landscape of QA roles within the pharmaceutical industry in Ireland. Understanding the interplay of internal job functions, external market trends, and salary benchmarks is crucial for both employers and professionals navigating this competitive field.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Aidan Crowley our Quality Assurance Talent Advisor & Recruiter here in Barden (aidan.crowley@barden.ie); we’re where leaders go before they start looking for Quality Assurance talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Aidan Crowley at aidan.crowley@barden.ie.

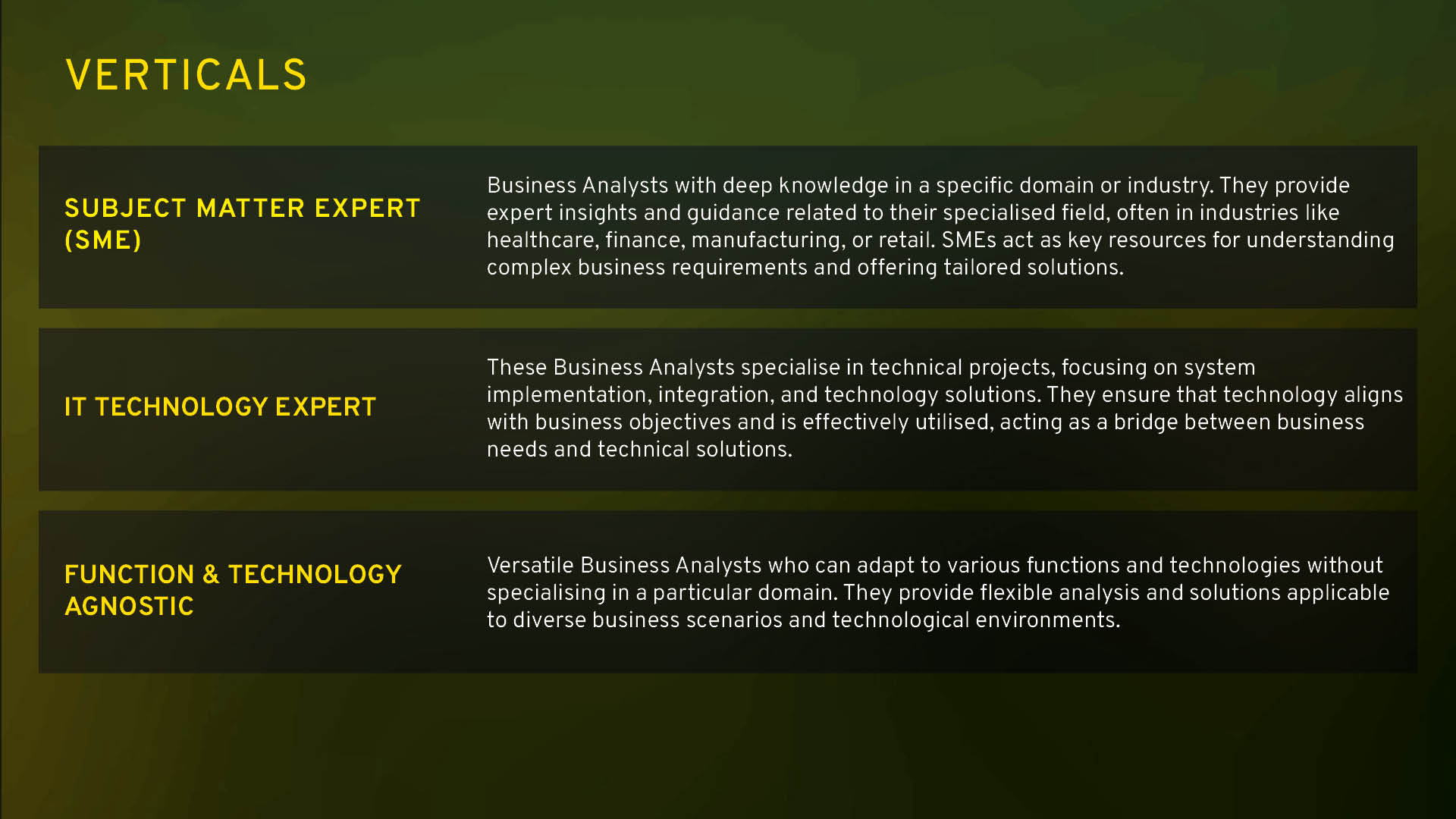

The demand for skilled Business Analysts in Ireland continues to rise as businesses prioritize process improvement, efficiency, and strategic initiatives. Business Analysts play a crucial role in bridging the gap between technical solutions and business objectives, enabling organisations to navigate an evolving landscape and leverage emerging technologies for competitive advantage.

#1 Business Analysts – Defining Your Vertical

For Business Analyst professionals, verticals can be defined based on specialisation, industry focus, and the types of projects they work on. Defining these verticals allows Business Analysts to align their job search with roles that match their expertise and career aspirations. It also provides a clear framework for career development, particularly for those interested in diversifying across verticals. At Barden, we define the following key verticals:

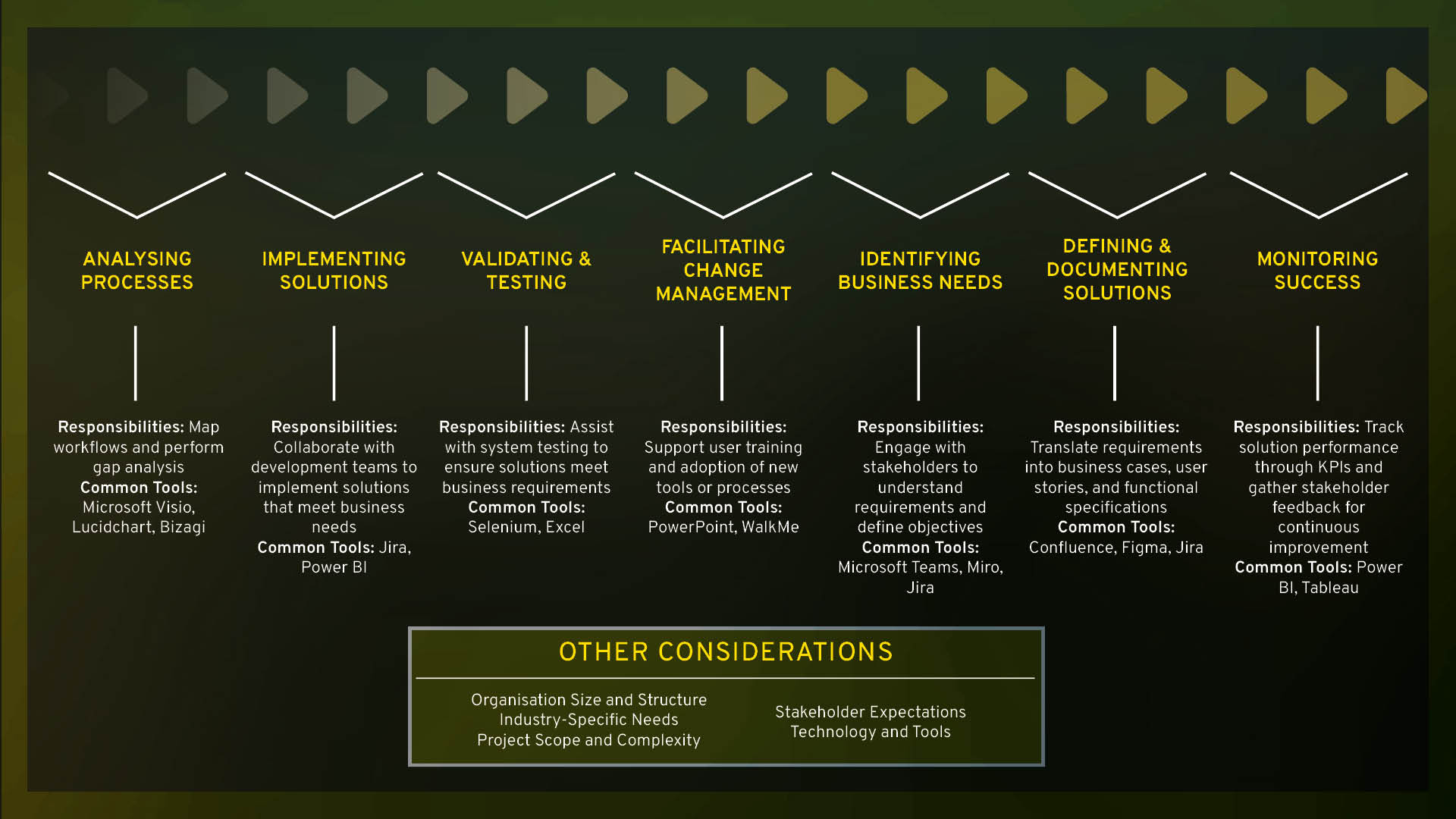

#2 Key Responsibilities & Tools

Business Analysts handle a broad range of activities across various stages. Below is an overview of their key responsibilities and the common tools used at each stage:

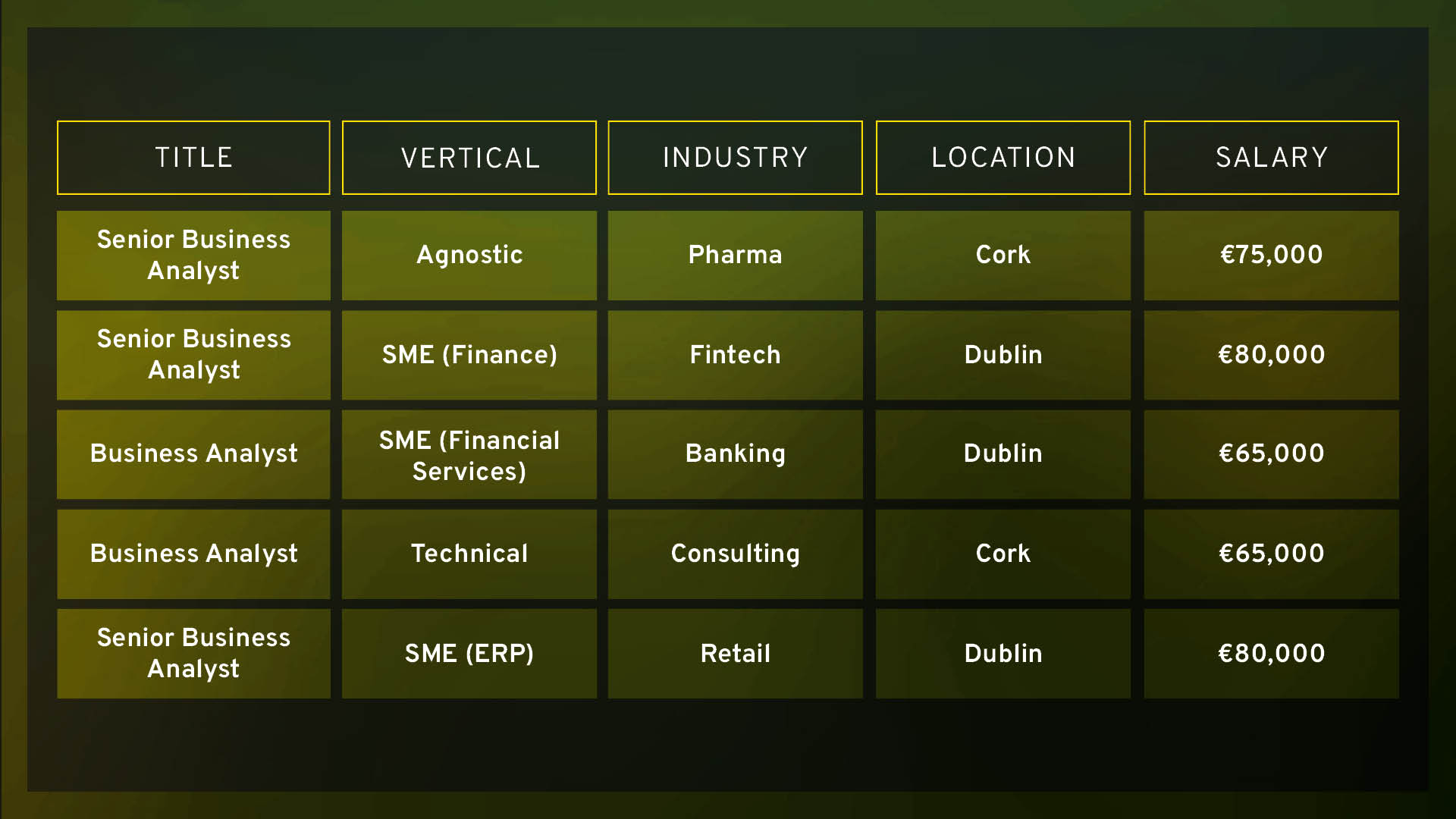

#3 Base Salary Expectations

For transparency, below is a broad guideline of salaries based on recent engagements with our clients across various verticals and industries:

Salaries outside Dublin are generally 10–15% lower, reflecting regional cost-of-living differences. Despite rising compensation expectations, regional variance persists. For bespoke advice please contact jane.olden@barden.ie.

#4 Key Considerations Impacting the Business Analyst Role

Several factors are shaping the evolving landscape for Business Analysts, which will affect the attraction and retention of talent including:

- Rising expectations beyond salary: To attract top talent, businesses must offer as well as competitive salaries – role impact and development opportunities.

- Skills Evolution: There is now a growing demand for analysts with more hybrid skillsets spanning across business and technology. Employers should look to balance hiring for potential with targeted learning and development initiatives.

- High Demand and Supply Constraints: Demand for skilled Business Analysts, especially in digital transformation and process optimisation, is outpacing supply. Analysts with 3-5 years of experience are exploring international opportunities, while in Ireland, the limited talent pool is driving competition, longer recruitment timelines, and salary inflation, particularly outside Dublin.

#5 Current Snapshot of the Business Analyst Talent Pool

Here are some data points about the Business Analyst talent pool in Ireland this quarter:

While turnover is not exceptionally high, the active interest in new opportunities demonstrates the importance of career progression, competitive compensation, and flexibility to attract and retain talent.

#6 Key considerations for the next 12 months

- Certification Opportunities: Encourage certifications such as CBAP, CSM/PSM, PRINCE2, or Lean Six Sigma (Green Belt).

- Skill Development: Provide opportunities to learn new tech stacks or specialise in areas like ERP systems, finance, or AI projects.

- Clear Progression Plans: Outline long-term career growth opportunities to retain top performers.

- Hybrid Work Models: Offer flexible arrangements where feasible to appeal to a wider pool of talent.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Jane Olden, Christine McCarthy or Catherine Drysdale our Business Analyst Talent Advisory & Recruitment team here in Barden (jane.olden@barden.ie; christine.mccarthy@barden.ie; catherine.drysdale@barden.ie); we’re where leaders go before they start looking for Business Analyst talent.

If you’re hiring a data analytics professional this quarter, here are some things you need to know…

Despite recent changes to the geopolitical landscape and the uncertainty they bring, we find that the demand for Analytics professionals in Ireland remains positive and is on an upward trajectory. Companies, ranging from startups to multinational corporations, rely on data-driven insights for strategic planning and understanding customer behaviour. As companies evolve, so do their needs, and this extends to the requirements of their customers. With the emergence of advanced technologies, organisations are leveraging AI, machine learning, and big data analytics to gain deeper insights from their data. We are seeing this move across entire organisations and functions where technical analytics expertise are residing not only in technical departments but within Finance, Sales, Supply Chain, Procurement, manufacturing etc. The demand for analytics talent is not going anywhere and attracting/retaining analytics talent will continue to be a challenge, both now and into the future.

#1 The Analytics profession – a definition

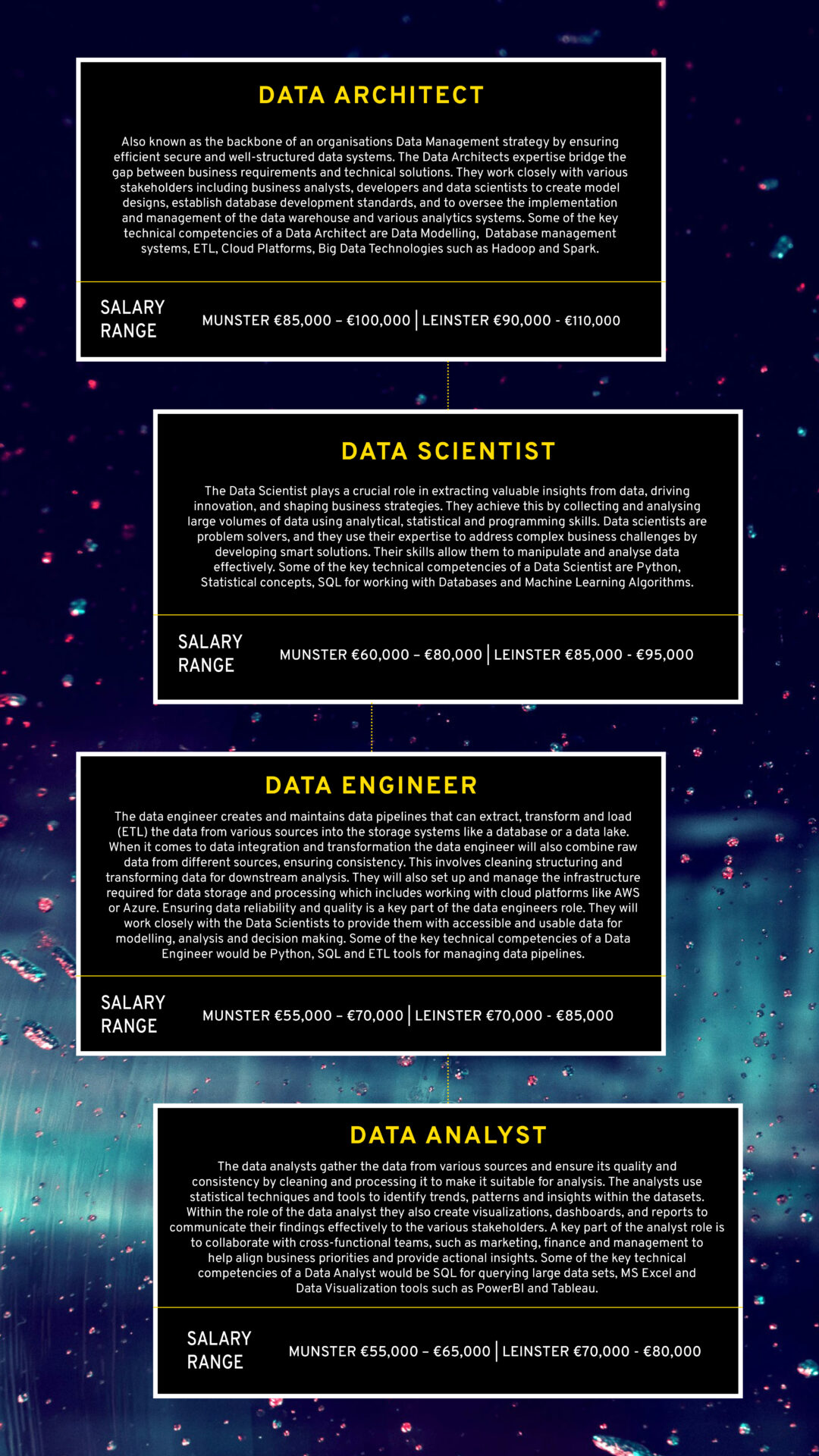

Different companies call different roles by different titles. That can make things confusing as job specs meet talent in the market. This is only exasperated as oftentimes companies themselves do not know exactly what skill sets, they need as they go to market. A common terminology can be very helpful in clarifying what talent can actually do, what companies actually want done, and where they overlap. So we’ve gone to the trouble of creating a common definition of the key roles that exist in the analytics profession; just for you:

Oh – we also included the common salary ranges by title for you – thought that might be interesting to know.

#2 Data Analytics Talent Availability

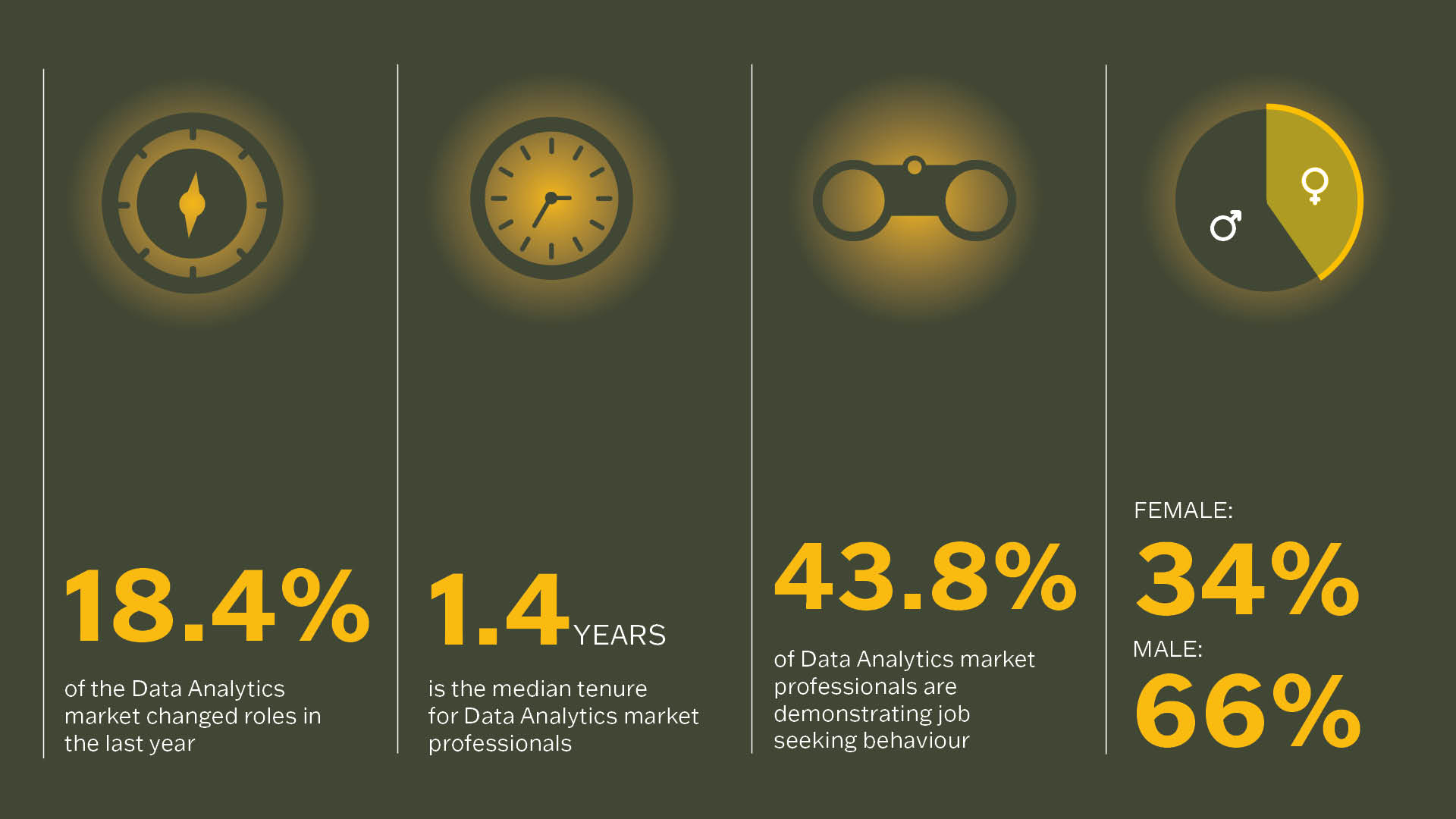

Here’s what we’ve noticed this quarter in the Data Analytics talent pool in Ireland:

#3 What smart companies are doing to try and attract top analytics talent

- Tech stack matters: analytics professionals want to know they will be getting exposure to the latest tools. If you’re not investing in your tech stack then you’ll find it hard to engage and retain good people.

- Flexibility is a given: hybrid is here to stay and analytics professionals have gotten used to flexibility. The nature of the work itself lends towards working in isolation at times. If you’re not flexible your external talent pool will reduce dramatically.

- The hiring process matters: analytics talent have options out there – the more accessible, engaging and fluid your recruitment process the more likely you are to be able to win top talent. Good communication through the recruitment process can be the difference between an offer accepted and an offer declined.

- Emergent tech: if you are not aware of and planning for emerging tools you’re going to be behind the others.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Dan Hoctor our Data Analytics Talent Advisor & Recruiter here in Barden (dan.hoctor@barden.ie); we’re where leaders go before they start looking for Data Analytics talent.

Ireland remains a hub for multinational tech companies while also supporting a growing number of local start-ups. In this expanding market, software testing plays a critical role in ensuring products function reliably and meet user expectations.

Drawing on conversations with Software QA Engineers across the industry, we examine key trends, insights, and the factors shaping Ireland’s QA landscape.

#1 Software QA Landscape

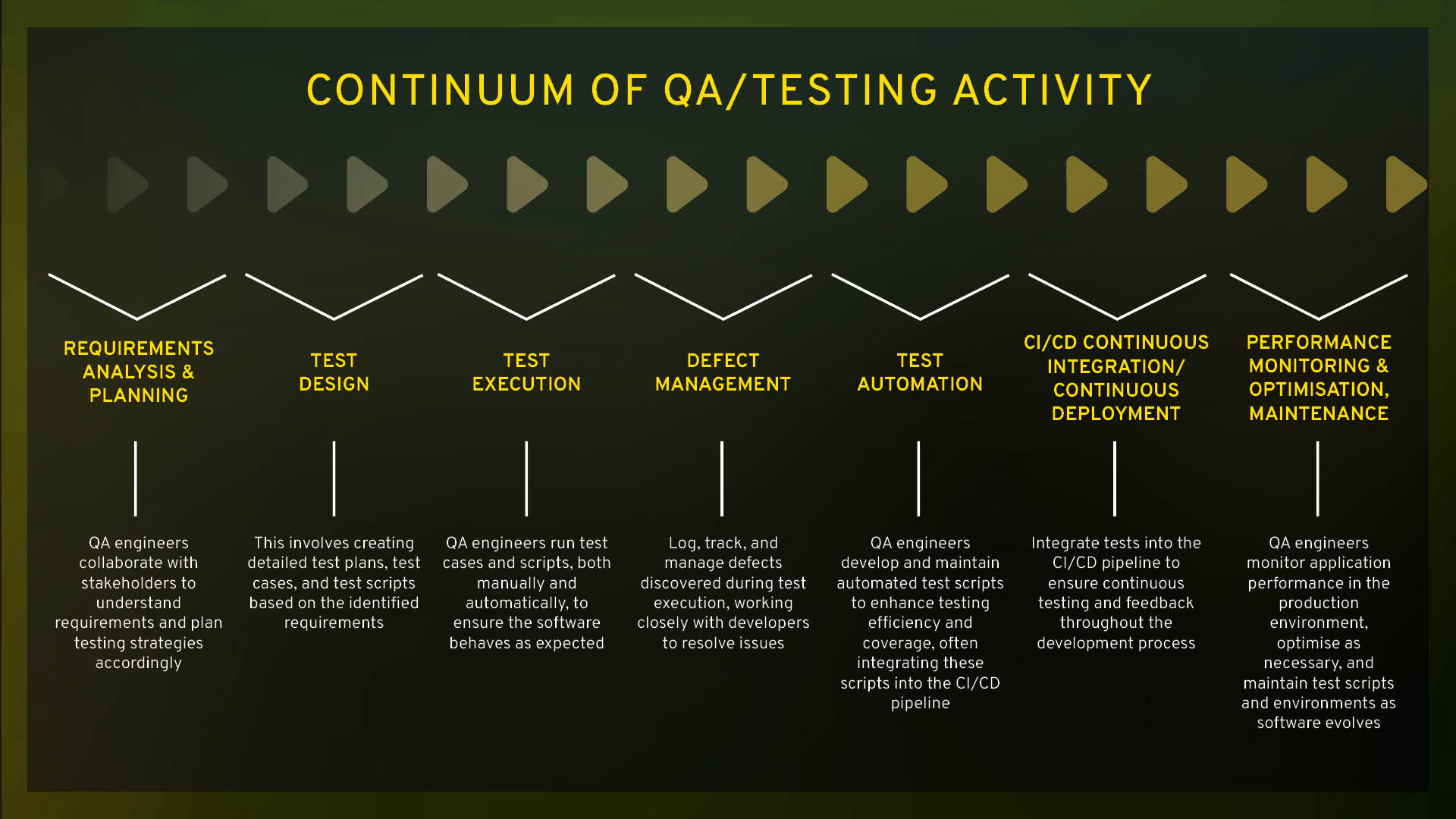

A Software QA Engineer’s role involves a continuum of activities, from planning and designing tests to executing them, as well as performance monitoring and maintenance. The balance of these activities can vary depending on the project, team, or organisation, as shown in the image below.

Key points along this continuum include:

#2 Factors Influencing QA Roles

Job titles in Software QA and Test Automation can be misleading without context – they don’t fully capture one’s role or market value. This is influenced by several factors, reflecting the role’s scope and diversity of experience. Here are some that tend to matter most:

1. Team and Company Size:

In smaller teams, testers often take on broader responsibilities across multiple testing domains. For example, in a multinational firm, a Software QA Engineer might focus on performance testing for a specific product line. In a start-up, the same role could encompass performance, security, and usability testing across all products.

In larger organisations, effective communication and teamwork become increasingly critical for Software QA teams, as they collaborate with more developers, product managers, and other stakeholders to navigate complex cross-functional dynamics

2. Scope of Responsibilities:

Experience and seniority further shape the role. Junior and mid-level QA Engineers typically focus on hands-on testing, while senior engineers gradually take on more strategic and leadership responsibilities – a progression that depends on both company size and team growth. For example, a Senior QA Engineer transitioning into a Test Lead role gains market value not only through technical expertise but also by guiding testing efforts across complex projects. In larger teams, Test Leads often mentor multiple engineers, manage workflows, and provide oversight for critical projects, expanding both the depth and breadth of their responsibilities.

3. Project Complexity and Automation:

As projects grow in complexity, so do the testing strategies required. Larger initiatives often rely on robust automation frameworks, making proficiency in tools like Selenium, Appium, Jenkins, and TestNG highly valuable. Most automation testers specialise in a limited set of tools, given their depth and complexity. In contrast, those with only manual testing experience may find fewer opportunities as automation becomes more widespread. As of Q3 2025, low-code/no-code testing tools are gaining traction

4. Cloud Technologies and Testing:

Cloud platforms offer scalable and flexible testing environments that are integral to modern QA practices. Experience with leading providers like AWS, Azure, and Google Cloud – especially when it comes to testing distributed systems and serverless architectures – is highly valuable. Those who are also skilled in cloud-specific testing, such as API and microservices testing, bring added versatility and impact to their teams.

5. Web and Mobile Apps:

Software QA Engineers in Ireland who are skilled in both web and mobile testing provide substantial value to organisations offering multi-platform products. For companies with mobile apps, they can ensure seamless user experiences across platforms, quickly identify cross-device issues, and support faster release cycles. Mobile app testing isn’t just “nice to have” – it’s often a critical part of compliance, quality, and user retention.

In summary, a Software QA Engineer’s value is shaped by how effectively they navigate variables like those discussed above. Proficiency in automation, cloud technologies, and diverse testing environments not only broadens their scope but also strengthens their position in the market.

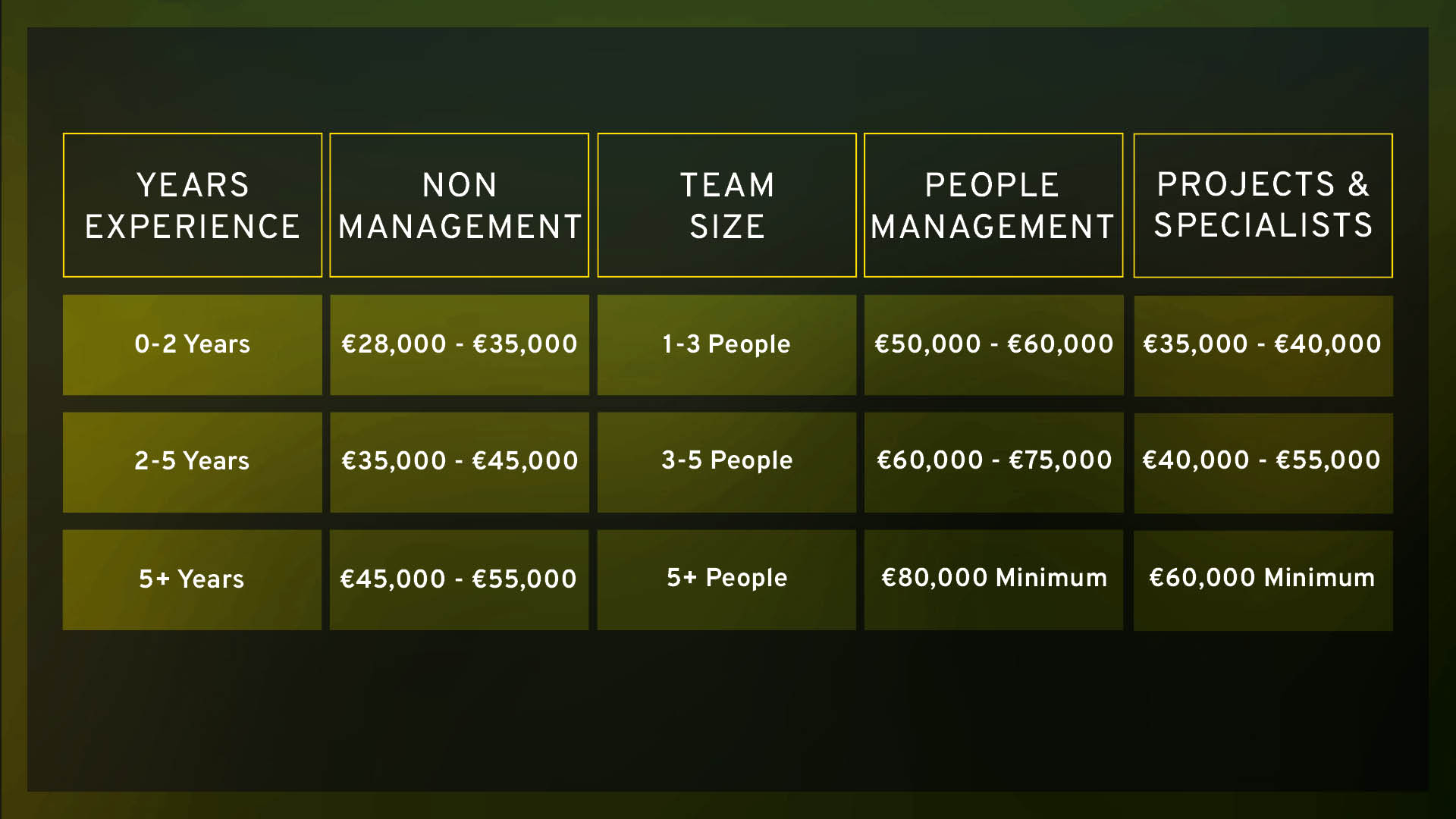

#3 Base Salary

Due to the wide range of variables discussed in Section 2, it can be misleading to use fixed salary ranges. Understanding the specific context of each role is essential, as factors such as company size, industry, location, and market demand (e.g., niche skill sets) all play a part.

Engineers with advanced skills in areas such as automation or cloud testing are particularly sought after.

Here are some examples of recently completed assignments:

- Dublin – Software Test Lead (Mobile Apps & Cloud): €115,000

- Munster – QA Manager: €95,000

- Dublin – Senior Test Automation Engineer: €90,000

- Munster – Mid-level QA Engineer: €50,000

If you’d like to discuss a salary range tailored to your role and location, please contact Rachel at rachel.mcguckian@barden.ie for a confidential discussion.

#4 Current Snapshot of the Software QA Talent Pool

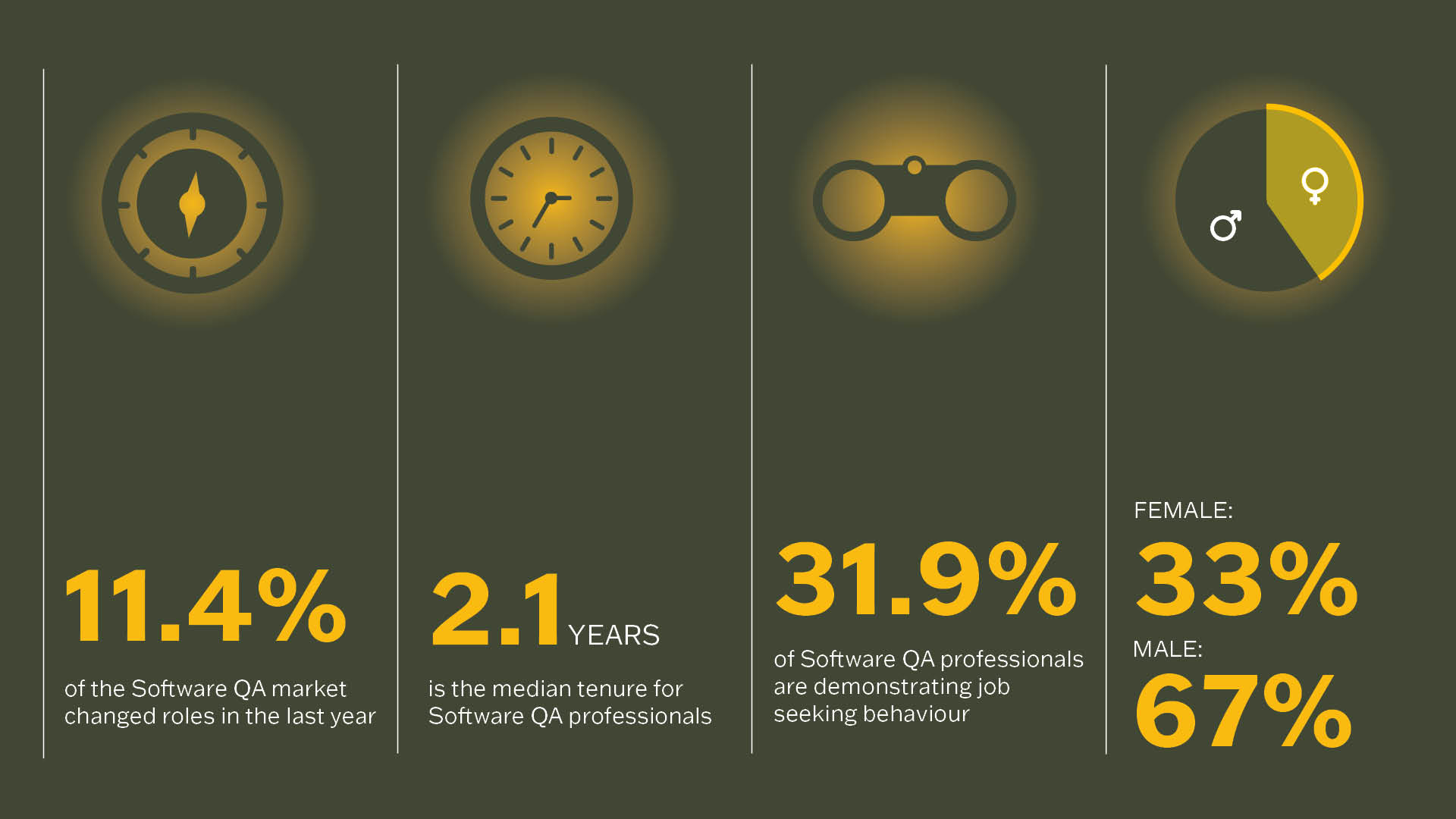

Here’s what we’ve noticed this quarter in the Software QA talent pool in Ireland:

#5 Projected Challenges for the Next 6 Months

For Employers:

- AI Integration: As AI becomes embedded in more products, employers face the challenge of ensuring their QA teams can validate AI-driven systems while also adopting AI-assisted testing tools effectively.

- Full-Lifecycle Testing: Shift-left testing remains a core best practice for catching issues early in development, but testing in production (shift-right) is becoming more important. QA teams must balance both approaches to ensure quality throughout the entire SDLC. How these practices are applied depends on factors like industry needs, release speed, and risk tolerance.

- Security and Performance: Regulatory demands and user expectations mean performance and security testing can no longer be optional. Building QA teams with baseline expertise in these areas is critical.

- Cloud-Native Testing: The rise of cloud technologies means QA teams must adapt to testing in dynamic, distributed environments like microservices and serverless architectures. Employers face challenges ensuring test automation and monitoring tools effectively cover these complex systems.

For Talent:

- AI and Automation Upskilling: QA engineers will need to actively learn and apply emerging tools and techniques – particularly in AI-assisted testing, prompt engineering, and continuous test automation.

- Broader Responsibilities: As QA roles expand across pre- and post-release phases, testers are expected to work more cross-functionally with development, DevOps, and data science teams – requiring both technical versatility and soft skills.

- Cloud Skills and Testing: QA engineers should actively seek opportunities – whether through work projects, training, or self-learning – to build expertise in cloud platforms and cloud-native testing methods such as containerised testing, API testing for microservices, and automated monitoring. Building these skills is crucial to keep pace with the rising demand for cloud-based testing, even if a current role does not fully leverage them.

#6 What Should Companies Focus on When Hiring QA Talent in 2025/2026

- Hybrid Work: QA engineers continue to prefer flexible working arrangements, with 1-3 days in the office per week being the norm. Mandating more on-site days risks losing top talent, especially for geographically dispersed teams.

- Contractors & Niche Skills: For specialised QA roles – cloud, AI-assisted testing – companies may need to look beyond Ireland. Contractors from other EU countries are increasingly filling these gaps, often remotely.

- Upskilling & Continuous Learning: QA professionals who invest in ongoing learning – automation, cloud platforms, AI tools, performance/security testing – bring the most value. Companies should support training to retain talent and stay ahead of the curve.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Rachel McGuckian, our Software QA Talent Advisor & Recruiter here in Barden (rachel.mcguckian@barden.ie); we’re where leaders go before they start looking for Software QA talent.

If you’re hiring an AP professional this quarter, here are some things you need to know…

AP by any other name is still accounts payable. The exact role is defined by the processes and procedures used by a given company to manage invoice processing/payment, but the name varies depending on the company. You might know it as:

- AP

- PTP

- P2P

- S2P

- Or simply Accounts Payable

We meet hundreds of AP professionals every year across a wide variety of companies, structures, and jurisdictions and here is some of what we’ve learned from them over the years.

#1 Base

For AP talent it can be all about the base, so let’s talk reward first. Here is what you would expect to pay today:

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice please contact our team; cole.carroll@barden.ie (Leinster), or tara.higgins@barden.ie (Munster).

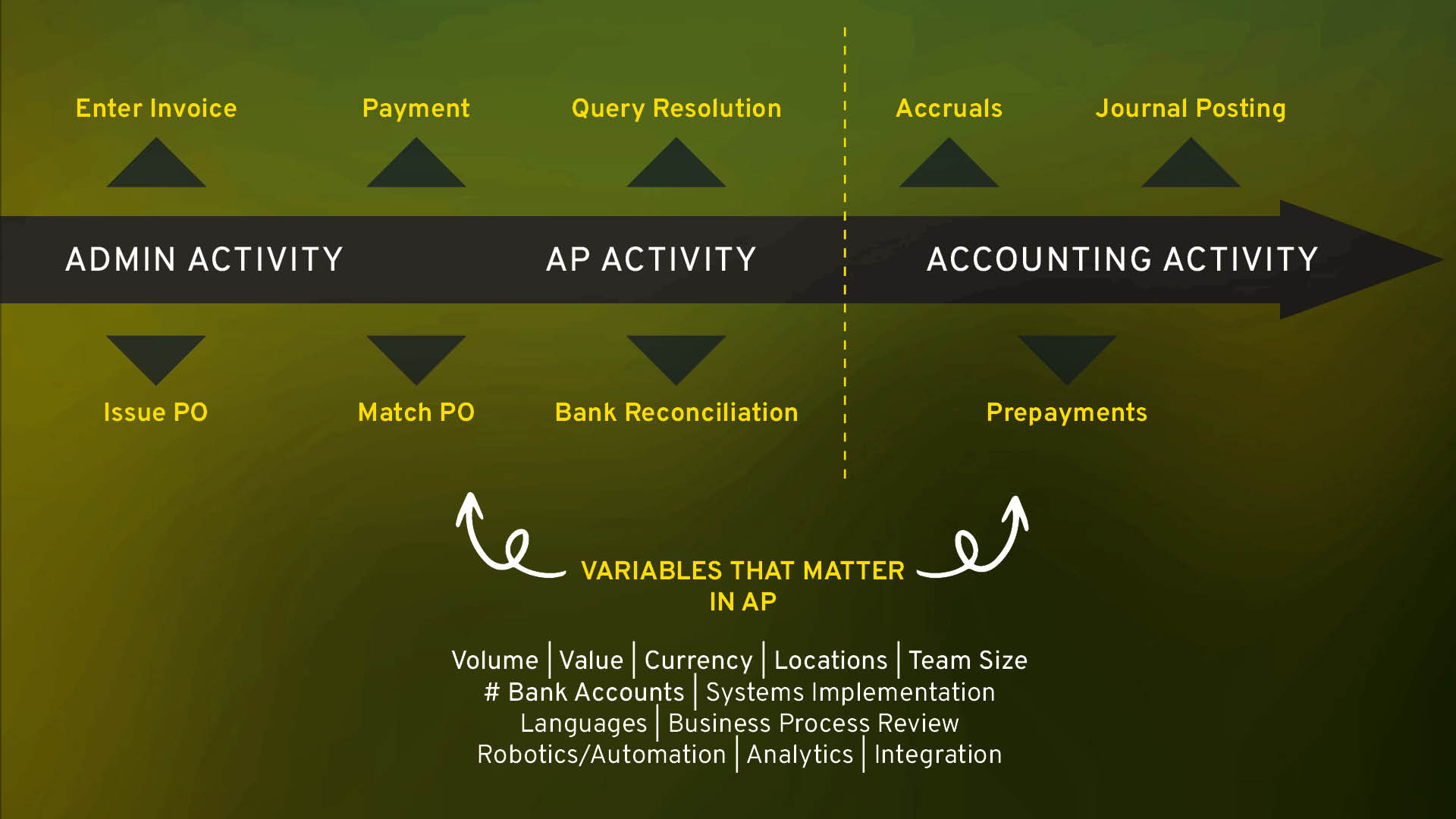

#2 Continuum of Activity in AP

Scale is the primary driver for differentiating AP roles. Generally, the larger the AP team, the less of the continuum a specific role will cover, and the smaller the team the more of the continuum is covered. Simple.

Other variables that matter are listed above. There are many and they are what differentiate one role from another. What variables are relevant to the role you are looking to hire matter a lot. Fact.

#3 Demand vs Supply

The continued shift in the market has given further rise to supply of AP professionals seeking employment opportunities across Ireland. The “demand” or “open roles” across this space is slightly down on earlier this year.

The surplus of talent has allowed managers to be selective in their hiring processes, as the supply of accounts payable talent exceeds the available job opportunities. However, this surplus relates specifically to junior and mid-level AP professionals, with the demand for senior and specialised talent still being identified in the ‘very high demand’ category.

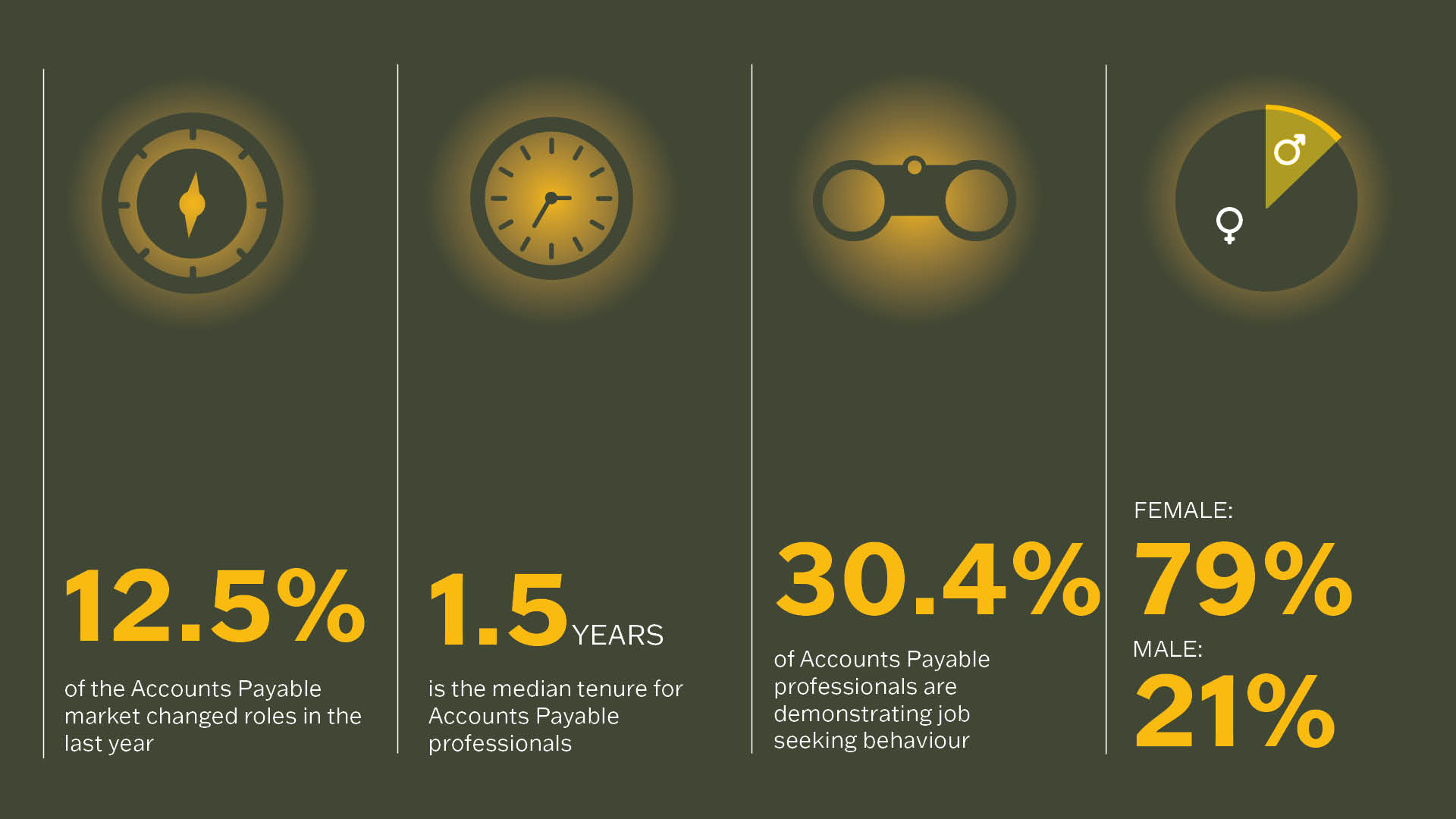

Here’s what we’ve observed this quarter in the AP talent pool in Ireland:

What are companies doing to attract talent?

The AP Leaders and Financial Controllers that we work with use some of the following tactics to make sure they get the best results:

- Competitive base salaries that are talent-led rather than budget-led.

- Additional benefits (bonus, healthcare, working abroad for short periods of time).

- Considered Hybrid working patterns that reflect the nature of the role.

- Pathways for development internally.

- Investing in company culture dynamics.

- Outsourcing or automation.

- Identifying junior talent and investing in upskilling.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Cole Carroll (Leinster), Tara Higgins (Munster) our AP Talent Advisory & Recruitment team here in Barden (cole.carroll@barden.ie; tara.higgins@barden.ie); we’re where leaders go before they start looking for AP talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Cole Carroll (Leinster) at cole.carroll@barden.ie or Tara Higgins (Munster) at tara.higgins@barden.ie.