If you’re hiring a part-qualified accountant this quarter, here are some things you need to know…

Before you go to market to hire a part-qualified accountant, it’s crucial to understand current market trends, identify what level and type of part-qualified accountant you need, and figure out how to position yourself as an employer of choice. That’s where Barden steps in.

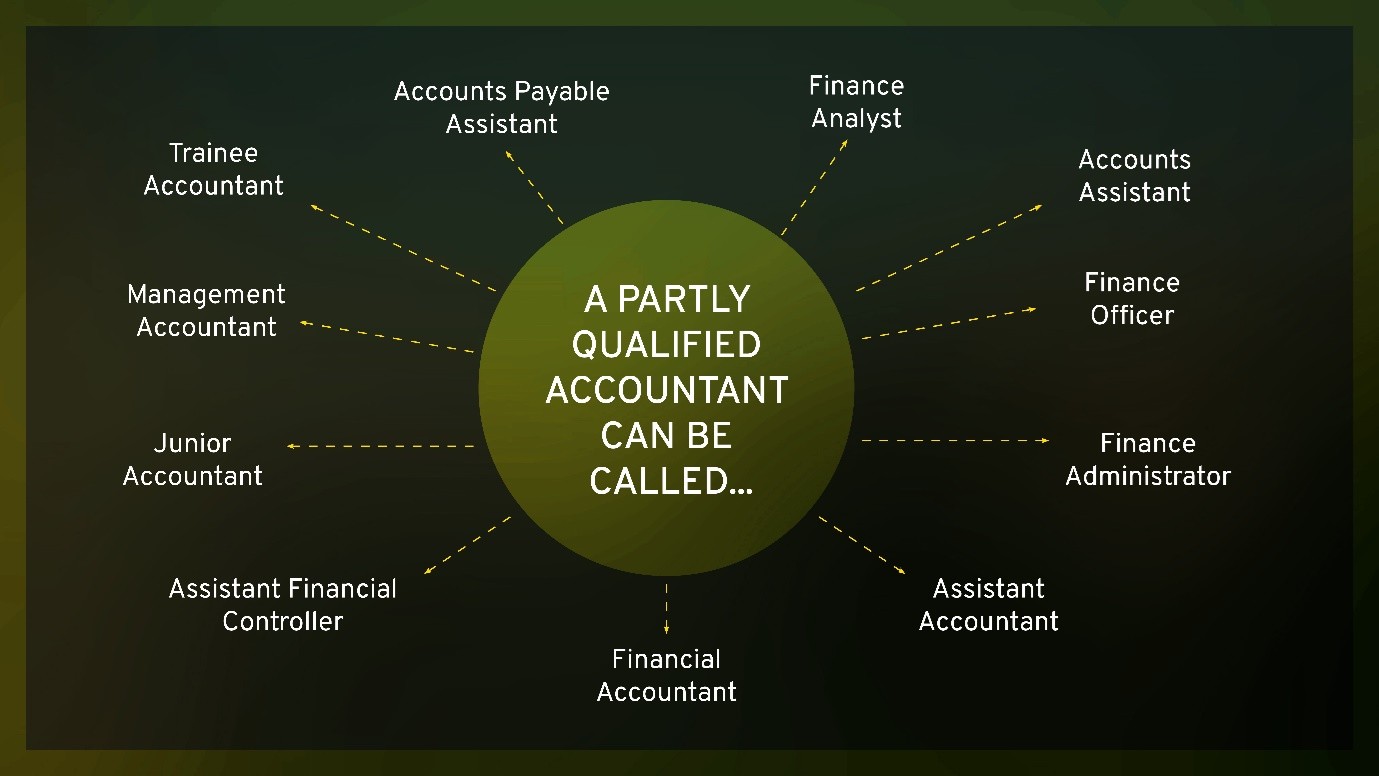

#1 Job Title

When hiring a part-qualified accountant, it’s important to remember that job titles can vary widely. We’ve often seen two individuals performing very similar roles, yet one may be titled Accounts Assistant while the other is called Assistant Financial Controller. Job titles alone don’t fully reflect the breadth of a role; it’s the specific responsibilities and expectations that truly define a person’s position.

So, before you decide on a job title for a part-qualified accountant, it is important to consider some of the points outlined below. After all, job titles mean nothing without context.

#2 Balance of Activity

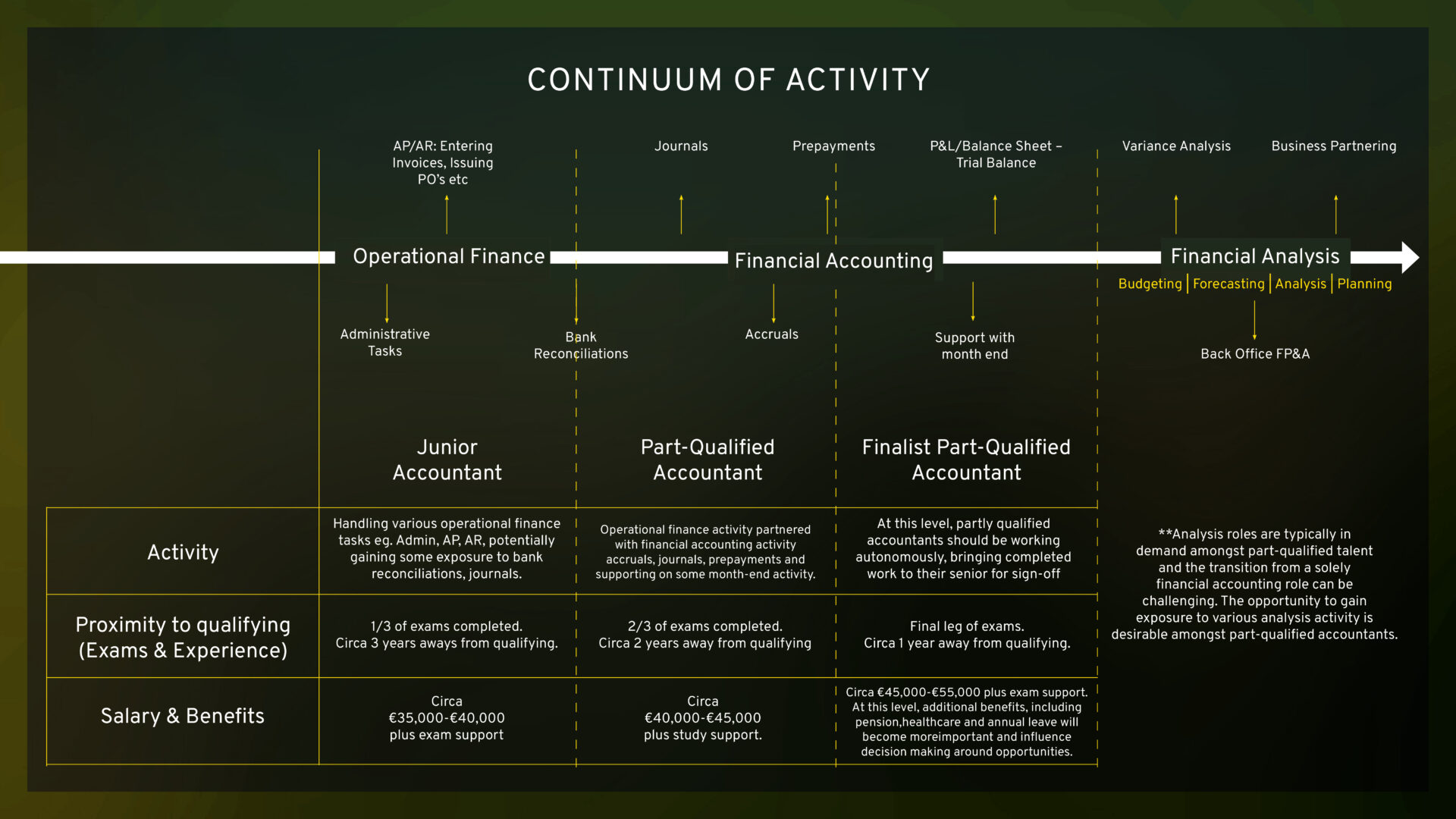

To effectively navigate the challenges of identifying the right person for your role, it’s essential to focus on the balance of activity and how an individual allocates their time and divides it between various tasks. This is important but it can be a little tricky.

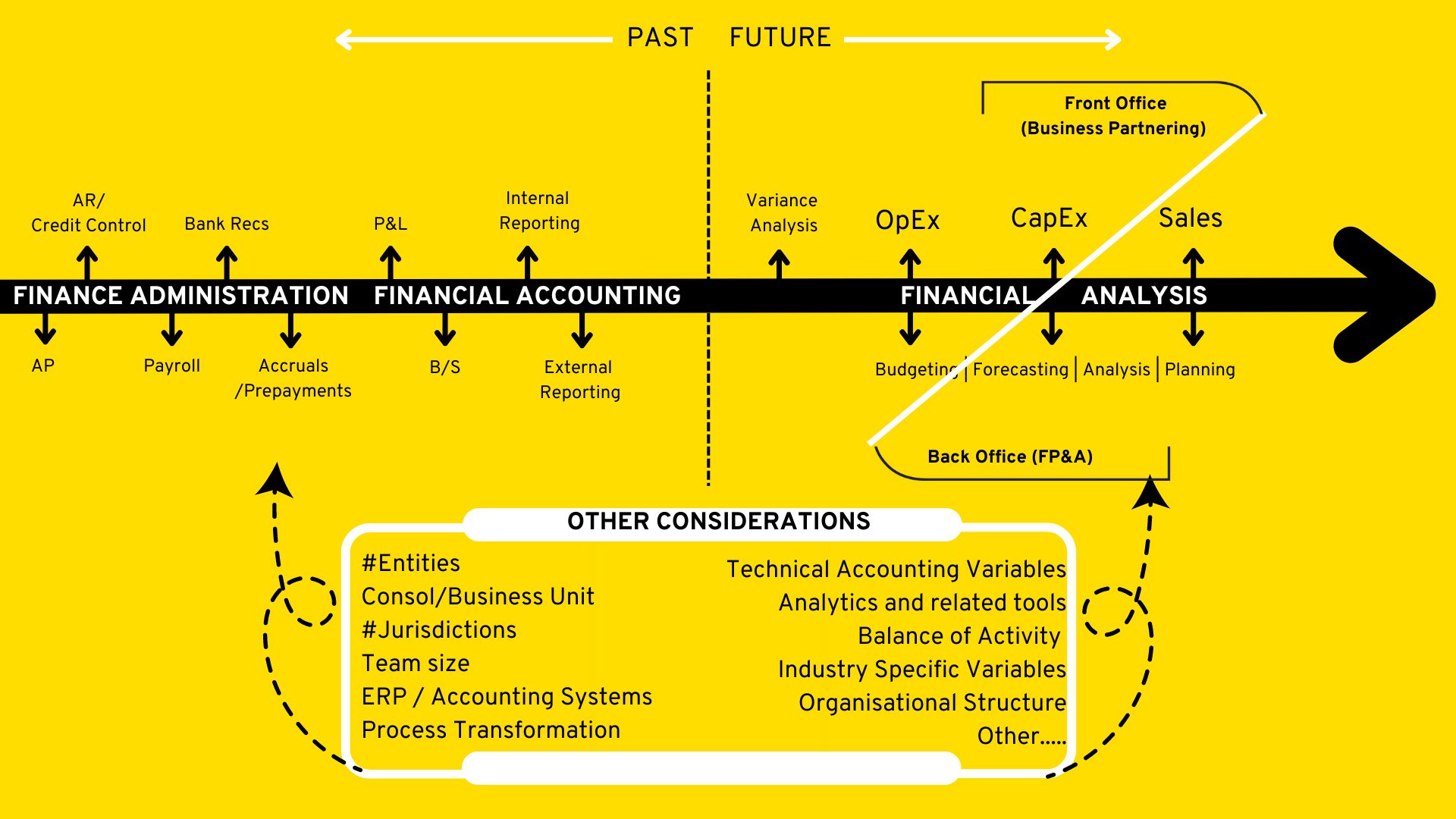

Below is a simple continuum of the activity you would expect to see in any finance team/role from a part-qualified perspective. This continuum is deliberately focused on financial accounting activity as most part qualified accountants train and spend their time here. We have also mapped various activities in the continuum and how titles relate to salary and proximity to exam completion, all of which will paint a picture of the natural order and flow of a part-qualified accountants’ career. This continuum ignores things like finance transformation, statutory reporting, tax etc.…let’s keep it simple for now.

#3 Exceptions to the rule

Of course, there are always exceptions to the rule, especially when it comes to part-qualified accountants… Here are some exceptions and variables which matter.

- Qualified By Experience (QBE):

These individuals have a significant amount of hands-on practical experience. This cohort typically decide not to progress with the exams but have worked within the accountancy space for a number of years and have a high-level of knowledge and experience. As the title above suggests, they have qualified through experience but not through exams.

- Career Changers:

This cohort have had a previous career with experience in the likes of supply chain, business support, technology and made the move into accounting recently. These individuals have the potential to add significant value to an organisation, particularly if their prior experience is of relevance to the business. It is important to attribute some value to prior careers should it have relevance to the organisation as they will have advanced knowledge of the business.

- Coming from Practice:

These are individuals making the transition from Practice into Industry. There will be a small percentage of this cohort who will be looking to leave an Audit or related training contract in a large practice and looking to transition into Industry. This group might not have debits and credits exposure but will be professional and capable of learning quickly. They will likely require some additional time to find their feet but ultimately, can be a great asset to a business.

#4 Demand VS Supply

This is tricky to quantify, given the transient nature of the part-qualified community and that many qualify in time. What we do know is that these individuals are finite in number and are often bound to an employer given the investment in education, be this formally or informally. As a result, the supply of talent at all levels above is typically quite low.

For junior accountants, often employers will look at AP, AR or similar transactional level exposure, who have a capability of pursuing exams rather than someone who is working as a junior accountant.

If you are hiring a part-qualified accountant, it is important you realise that someday they will likely become qualified. Succession planning will increase the likelihood of retaining talent beyond qualification. Understanding the qualified accountant market, knowing the market rate and budgeting for the inevitable increases when qualified, are all important factors to consider for the medium term.

In summary, the more you invest and support a part-qualified accountant on the journey, the more likely you are to retain them beyond the qualification.

#5 What are companies doing to attract talent?

The Finance Managers and Financial Controllers that we work with use some of the following tactics to make sure they get the best results:

- Identifying junior talent and investing in upskilling – earning and learning.

- Pathways for development internally. As outline above, this is key. Clear and defined pathways for qualification will not only attract the right talent but retain them.

- Competitive base salaries that are talent-led rather than budget-led. We have seen an increase in salaries over the last 12-18months in this space and renumeration has become increasingly competitive.

- Additional benefits (bonus, healthcare, working abroad for short periods of time) this is not necessarily the norm in this space, but including a more robust benefits package is more attractive to talent and can somewhat offset the increase we are seeing in salaries.

- Considered Hybrid working patterns that reflect the nature of the role.

- Investing in company culture dynamics.

In Barden, we understand that each team, role, and requirement is unique. If you’re interested in exploring which approaches would be best suited for you & your organisation, please feel free to contact Jodie Meehan our Part-Qualified Accountant Talent Advisory & Recruitment expert here in Barden (jodie.meehan@barden.ie); We’re where leaders go before they start looking for Part-Qualified Accountant talent.

This information is accurate as of July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Jodie Meehan at jodie.meehan@barden.ie.

If you’re hiring a newly qualified accountant this quarter, here are some things you need to know…

While 100s of newly qualified accountants enter the job market every year (typically around May and October each year) demand for top accounting talent is always high, with Ireland’s top finance teams competing intensely for the best of the best. Before you think about trying to attract newly qualified accounting talent to your team, it’s important to get a real-time snapshot of the driving forces in the market and how you could position yourself as an employer of choice. That’s where Barden comes in.

#1 Base

Base salary is only a part of Total Compensation (Base + Package) – want to know about total comp for newly qualified accountants? We asked one of our experts in Barden Munster, Siobhán Sexton, and she shared the following:

Interesting, right? There are a couple of things that really stand out to us in the above, namely:

The average Salary for H1 2025 was €60,778 (The average Salary for H2 2024 was €60,444).

- The average Bonus for H1 2025 was 9% (The average Bonus for H2 2024 was 7%).

- The average Pension for H1 2025 was 5% (The average Pension for H2 2024 was 5%).

- The average Annual Leave days for H1 2025 was 23 days (Average Annual Leave days for H2 2024 was 24 days – all exclude Company Days).

*These are Cork-only numbers. For bespoke advice on salaries in Leinster, contact Niall O’Keeffe.

#2 Continuum of Activity

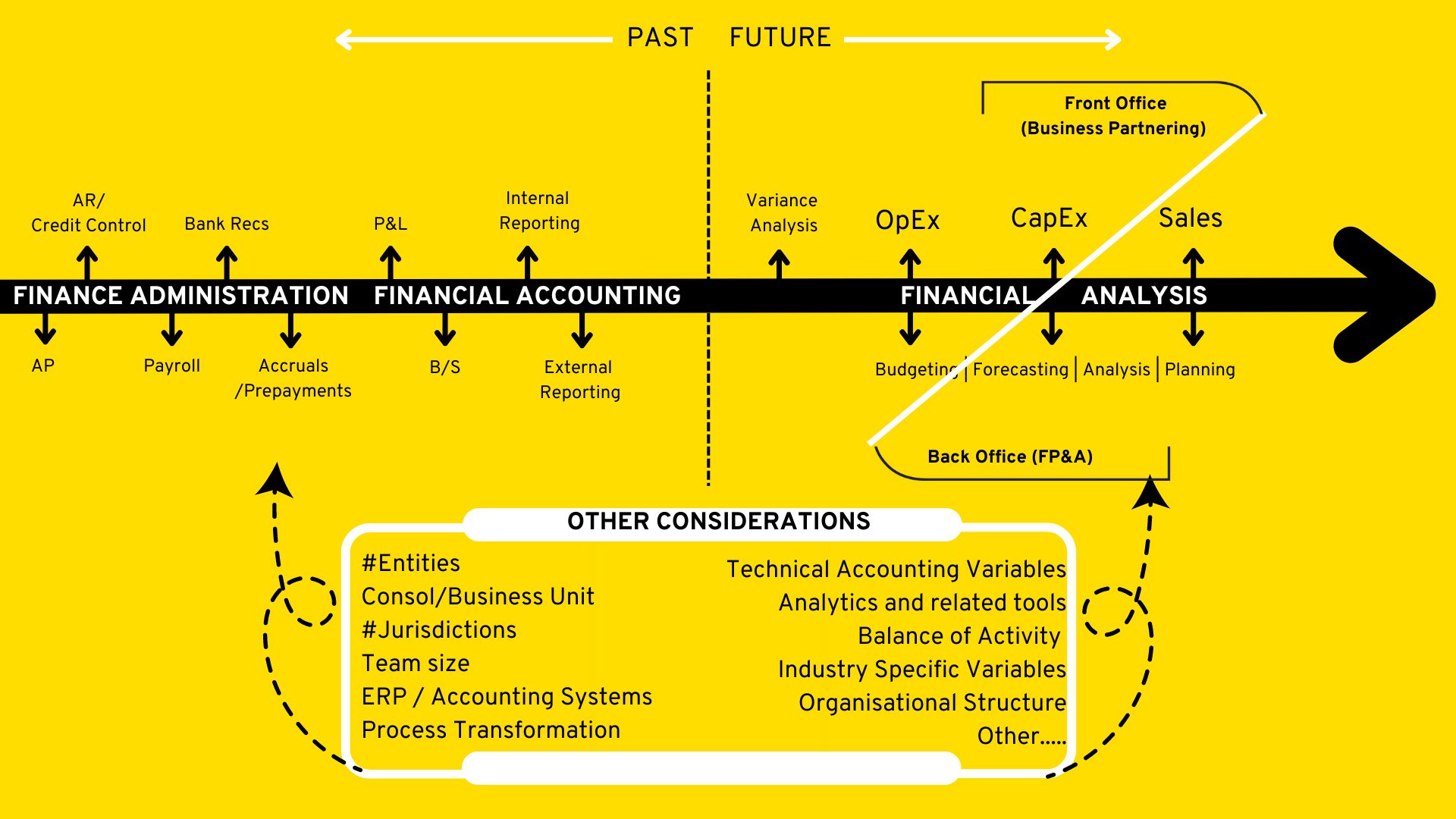

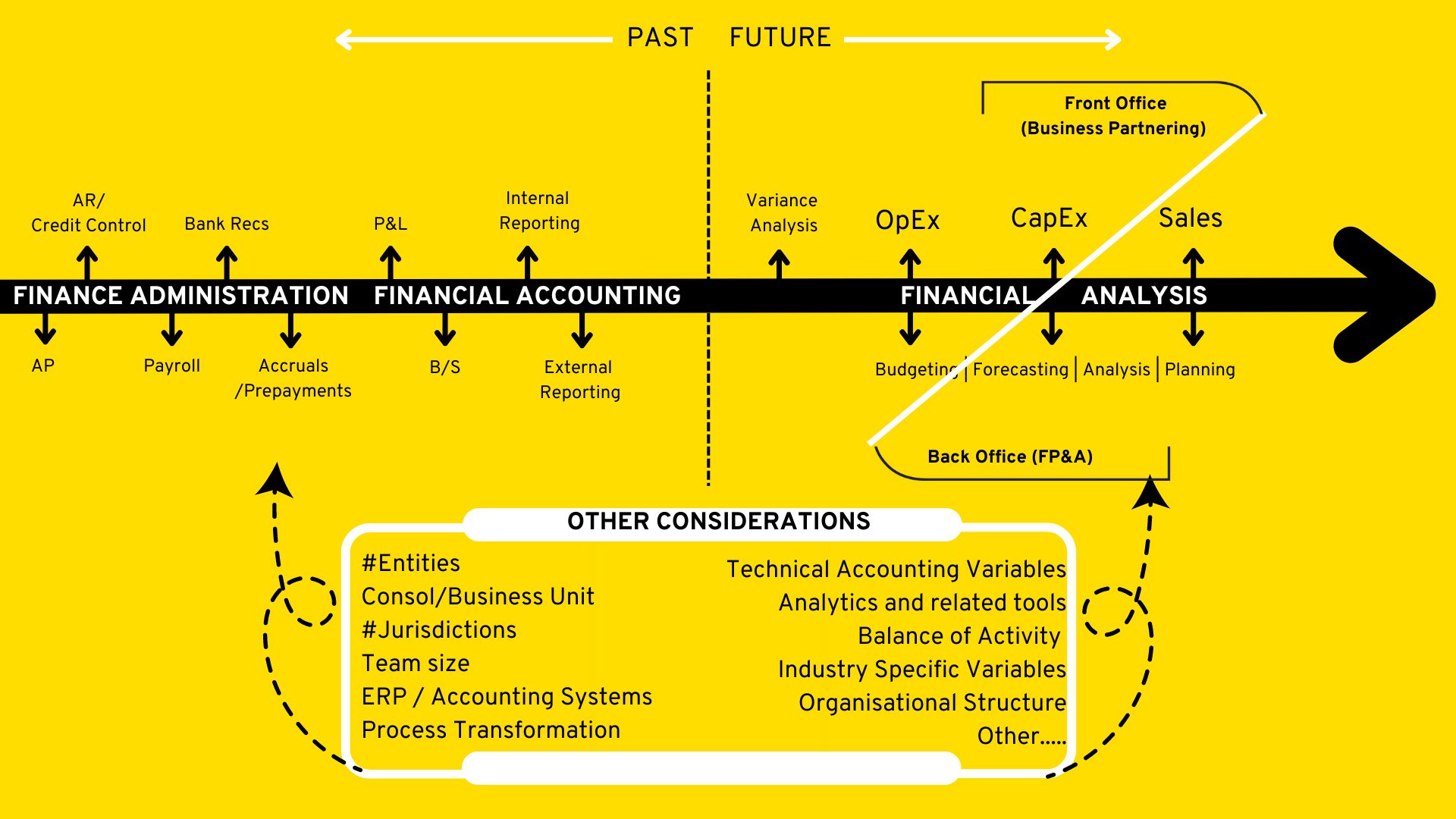

This is important. But a little tricky. Below is a simple continuum of the activity you will expect to see in any finance team/role. It ignores things like finance transformation, stat reporting, and tax…let’s keep it simple for now.

Two companies can be looking to hire a financial accountant, but the nature of their roles can be very, very different. What % of the person’s time is spent on what activity will matter to talent. Broadly speaking, newly qualified accountants end up in:

- Financial Accounting roles 75% of the time (the balance of activity in these roles will matter. Larger companies often come with more specialised roles. There are lots of rules of thumb like this. We can talk about them when we meet).

- Financial Analysis roles 10% of the time (very hard to get straight out of contract).

- Internal Audit roles 5% of the time (an excellent route often overlooked).

- Other roles 10% of the time (the ones we’re not talking about here).

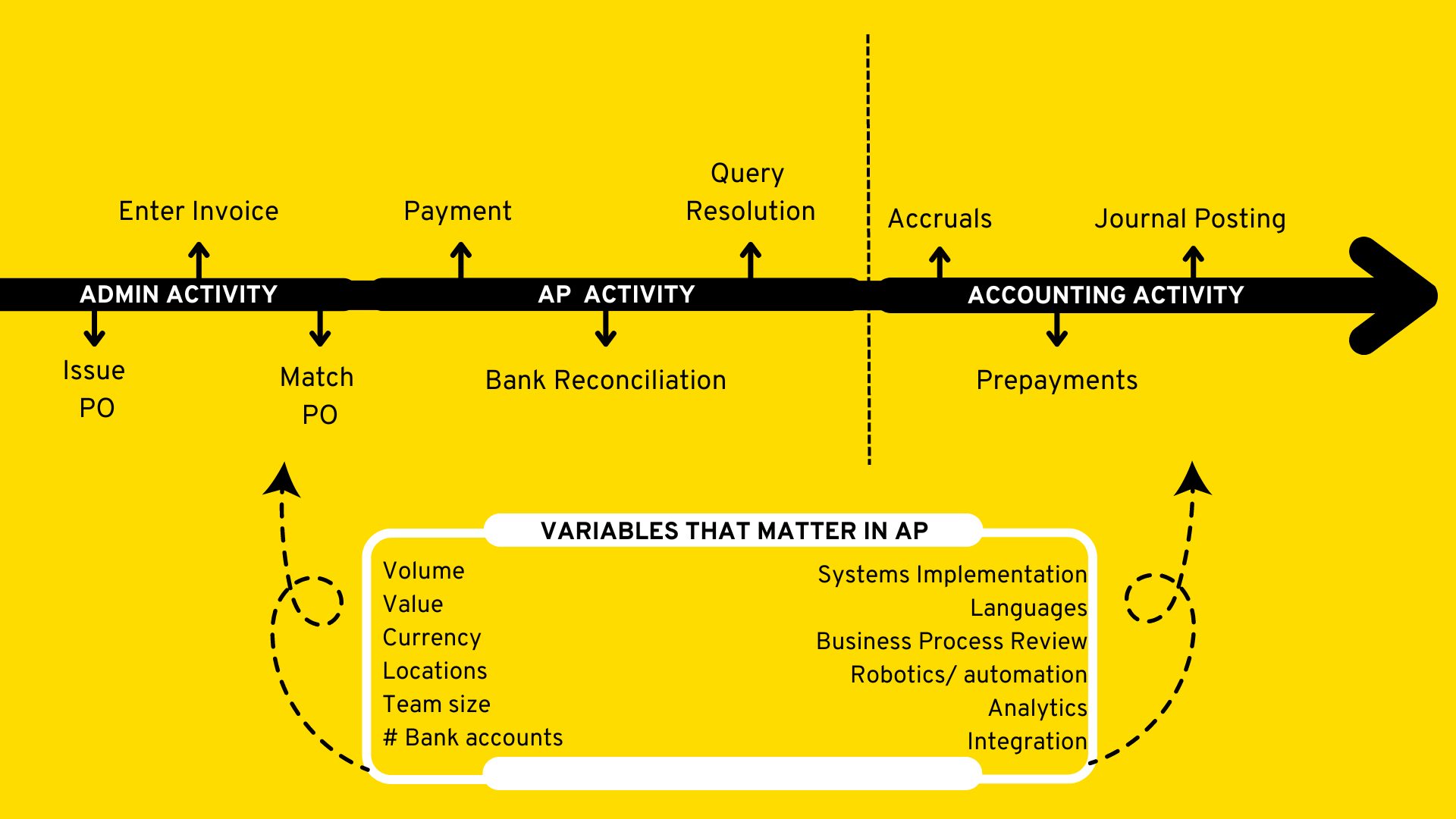

Below is a visual representation of the activity in a basic finance team, along with some of the variables that come with the context of the role. The % of time your hire will spend on either side of the line below, along with the variables in their client/company experience compared to your company/needs, are critical considerations for you and your HR team.

What to learn more about applying these concepts to make sure your role is fit for the market and you attract the right talent for the right role at the right time? Simple. Drop our Talent Advisors a line and they will help you bespoke these concepts to your unique needs.

#3 Demand vs Supply

This is a tricky thing to quantify, given 1) the transient nature of this talent pool (only newly qualified once) and 2) the fact that supply peaks at particular times of the year as people exit training contracts. Exact data points on the number of people available are not possible to gather in any meaningful way over a particular quarter and can be highly time-sensitive. As opposed to referencing data we cannot stand over, we thought it better to flag a few things:

- If you want to have the best access to talent, timing is everything – sync your search in line with training contracts ending, then you’ll have options; do the opposite, and you’ll experience the opposite.

- If you are searching for talent in sync with the market, then you can be more specific in terms of the exact client/industry experience you would like. Search for talent out of sync, then you may need to be more open-minded in terms of training experience to get good people into your process (FS trained being an option for an Industry role, for example).

- With competition high and the talent market aware, many newly qualified accountants will look to secure a job offer months ahead of their contract completion date. Keep this in mind when it comes to considering timing.

- Make sure you are clear in articulating the context of your role and the purpose behind your organisation. Talent these days looks to people, role and purpose in that order, so make sure you are very clear on those points when you craft a job description and articulate your opportunity externally.

#4 What are companies doing to attract Newly Qualified talent these days?

The CFOs that we work with use some of the following tactics to make sure they get the best results:

- Clear articulation of the people, role and purpose (as above) – if you want to compete for the best, you need to compete like the best.

- Competitive base salaries – money is often a hygiene factor – its presence does not necessarily motivate, but its absence most certainly demotivates. Price your role right to the quality of talent you are looking to attract.

- Additional benefits – it is not all about the base, and making sure you have sense-checked the averages out there for bonus, pension, and similar before you go to market is key.

- Considered Hybrid working patterns that reflect the nature of the role – hybrid working has, over the years has also become a hygiene factor – no flexibility to work from home is a significant detractor and will greatly limit your access to talent.

- Pathways for development internally are key – ambitious people have ambition, so make explicit the opportunity to grow in the role and how the team/company will support professional development.

There are lots of other tactics companies use to engage and attract newly qualified accounting talent; Curious? Get in touch.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, contact our Newly Qualified Team in Barden, Munster – Siobhán Sexton (siobhan.sexton@barden.ie) and Leinster – Niall O’Keeffe (niall.okeeffe@barden.ie); we’re where leaders go before they start hiring Newly Qualified talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics, and other proprietary 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Siobhán Sexton (Munster) at siobhan.sexton@barden.ie or Niall O’Keeffe at niall.okeeffe@barden.ie.

If you’re hiring a newly qualified accountant this quarter, here are some things you need to know…

While 100s of newly qualified accountants enter the job market every year (typically around May and October each year), demand for top accounting talent is always high, with Ireland’s top finance teams competing intensely for the best of the best. Before you think about trying to attract newly qualified accounting talent to your team, it’s important to get a real-time snapshot of the driving forces in the market and how you could position yourself as an employer of choice. That’s where Barden comes in.

#1 Base

Base salary is only a part of Total Compensation (Base + Package) – want to know about total comp for newly qualified accountants? We asked one of our experts in Barden Leinster, Niall O’Keeffe, and he shared the following:

Interesting, right? There are a couple of things that really stand out for us in the above; namely:

The average Salary for H1 2025 was €65,357 (The average Salary for H2 2024 was €65,083, H1 2024 was €63,889).

- The average Bonus for H1 2025 was 8% (The average Bonus for H2 2024 was 7%, H1 2024 was 8%).

- The average Pension for H1 2025 was 5% (The average Pension for H2 2024 was 5%, H1 2024 was 6%).

- The average Annual Leave Days for H1 2025 was 23 Days (Average Annual Leave Days for H2 2024 was 25 Days, H1 2024 was 23 days – all exclude Company Days).

*These are Dublin-only numbers. For outside Dublin, you would typically apply a 10% reduction on base +/- 2.5 % depending on location. For bespoke advice on salaries in Munster, contact Siobhán Sexton.

#2 Continuum of Activity

This is important. But a little tricky. Below is a simple continuum of the activity you will expect to see in any finance team/role. It ignores things like finance transformation, stat reporting, and tax…let’s keep it simple for now.

Two companies can be looking to hire a financial accountant, but the nature of their roles can be very, very different. What % of the person’s time is spent on what activity will matter to talent. Broadly speaking, newly qualified accountants end up in:

- Financial Accounting roles 75% of the time (the balance of activity in these roles will matter. Larger companies often come with more specialised roles. There are lots of rules of thumb like this. We can talk about them when we meet).

- Financial Analysis roles 10% of the time (very hard to get straight out of contract).

- Internal Audit roles 5% of the time (an excellent route often overlooked).

- Other roles 10% of the time (the ones we’re not talking about here).

Below is a visual representation of the activity in a basic finance team, along with some of the variables that come with the context of the role. The % of time your hire will spend on either side of the line below, along with the variables in their client/company experience compared to your company/needs, are critical considerations for you and your HR team.

Want to learn more about applying these concepts to make sure your role is fit for the market and you attract the right talent for the right role at the right time? Simple. Drop our Talent Advisors a line and they will help you bespoke these concepts to your unique needs.

#3 Demand vs Supply

This is a tricky thing to quantify, given 1) the transient nature of this talent pool (only newly qualified once) and 2) the fact that supply peaks at particular times of the year as people exit training contracts. Exact data points on the number of people available are not possible to gather in any meaningful way over a particular quarter and can be highly time-sensitive. As opposed to referencing data we cannot stand over, we thought it better to flag a few things:

- If you want to have the best access to talent, timing is everything – sync your search in line with training contracts ending, then you’ll have options; do the opposite, and you’ll experience the opposite.

- If you are searching for talent in sync with the market, then you can be more specific in terms of the exact client/industry experience you would like. Search for talent out of sync, then you may need to be more open-minded in terms of training experience to get good people into your process (FS trained being an option for an Industry role, for example).

- With competition high and the talent market aware, many newly qualified accountants will look to secure a job offer months ahead of their contract completion date. Keep this in mind when it comes to considering timing.

- Make sure you are clear in articulating the context of your role and the purpose behind your organisation. Talent these days looks to people, role and purpose in that order, so make sure you are very clear on those points when you craft a job description and articulate your opportunity externally.

#4 What are companies doing to attract Newly Qualified talent these days?

The CFOs that we work with use some of the following tactics to make sure they get the best results:

- Clear articulation of the people, role and purpose (as above) – if you want to compete for the best, you need to compete like the best.

- Competitive base salaries – money is often a hygiene factor – its presence does not necessarily motivate, but its absence most certainly demotivates. Price your role right to the quality of talent you are looking to attract.

- Additional benefits – it is not all about the base, and making sure you have sense-checked the averages out there for bonus, pension, and similar before you go to market is key.

- Considered Hybrid working patterns that reflect the nature of the role – hybrid working has, over the years has also become a hygiene factor – no flexibility to work from home is a significant detractor and will greatly limit your access to talent.

- Pathways for development internally are key – ambitious people have ambition, so make explicit the opportunity to grow in the role and how the team/company will support professional development.

There are lots of other tactics companies use to engage and attract newly qualified accounting talent; Curious? Get in touch.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, contact our Newly Qualified Team in Barden, Leinster – Niall O’Keeffe (niall.okeeffe@barden.ie) or Munster – Siobhán Sexton (siobhan.sexton@barden.ie); we’re where leaders go before they start hiring Newly Qualified talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics, and other proprietary 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Niall O’Keeffe at niall.okeeffe@barden.ie or Siobhán Sexton (Munster) at siobhan.sexton@barden.ie.

In the ever-evolving software development landscape, Quality Assurance (QA) is a vital component embedded in every phase of the Software Development Life Cycle (SDLC). Ensuring the reliability, functionality, and excellence of software products, QA is fundamental to successful software engineering.

Ireland has emerged as a prominent tech hub, attracting multinational corporations due to its supportive innovation ecosystem. This influx has also sparked the development of indigenous startups. Amidst this growth, the software QA role has become increasingly important, ensuring that both multinational and homegrown companies deliver reliable, high-quality software products.

After engaging with a diverse group of software testers, let’s explore some key insights, emerging trends, and important factors in the industry.

#1 Software QA Landscape

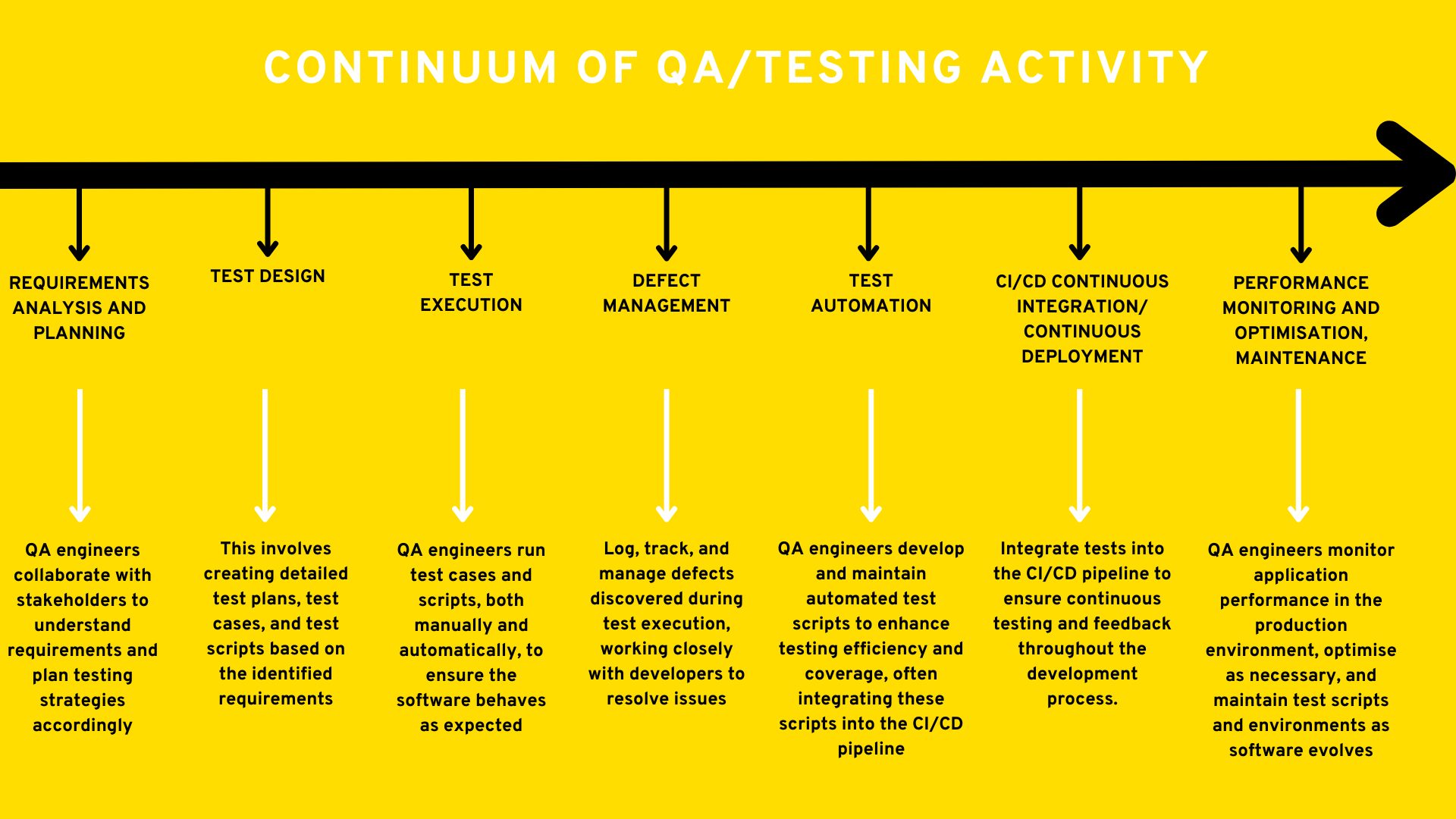

The continuum of work for a QA engineer reflects the balance of activities they engage in throughout the SDLC. This balance can vary significantly from one company to another. For instance, in some organisations, QA engineers may take on broader responsibilities including leadership and managerial duties, whereas in larger multinational companies, their roles may be more specialised.

Here are the key points that outline this continuum:

Understanding this continuum of testing activity is essential, as it illustrates the varied and complex nature of the QA engineer’s role. It emphasises the importance of context when discussing roles and corresponding salaries.

#2 Variables

Job titles in software QA and test automation can be misleading without context. They don’t fully define your role or market value. Several key factors influence a QA tester’s value, highlighting the role’s scope and the diversity of experience. Here are the ones that tend to matter the most:

- Team and Company Size:

In smaller teams within local companies, individuals often have wider responsibilities across various testing domains. For instance, in a multinational corporation, a QA Engineer might specialise in performance testing for a specific product line. Conversely, in a startup environment, the same role could involve overseeing performance, security, and usability testing across all company products.

Similarly, the responsibilities of test leads expand in larger teams. As they manage and mentor more engineers, their leadership and oversight duties increase significantly.

Another point to consider here is that QA teams collaborate closely with developers, product managers, and other stakeholders. Effective communication and teamwork lead to better outcomes and provide valuable exposure to cross-functional dynamics.

- Scope of Responsibilities:

Roles evolve with experience and seniority. Junior and senior QA engineers typically focus on hands-on testing tasks, while those at lead levels are expected to bring leadership and strategic oversight to testing initiatives. Companies value QA engineers who can navigate both technical intricacies and project management challenges.

Consider a senior QA engineer transitioning to a lead role. Their market value increases not just because of technical proficiency but also due to their ability to steer testing efforts across complex projects.

- Project Complexity and Automation:

The complexity of projects dictates the testing strategies needed. Larger and more intricate projects require sophisticated approaches, including robust automation frameworks. Automated testing tool suites used in QA are complex, so automated testers are often skilled in a limited set of them. Proficiency in tools like Selenium, Appium, Jenkins, and TestNG is highly valued, as these tools streamline testing processes and ensure scalability.

For example, a QA engineer adept in automation frameworks might lead the implementation of a comprehensive test suite for a new feature rollout in a major software release. In contrast, individuals primarily experienced in manual testing may face more restricted job opportunities, given the growing prominence of automation in the industry.

- Cloud Technologies and Testing:

Cloud platforms offer scalable and flexible testing environments that are integral to modern QA practices. Familiarity with popular cloud providers such as AWS, Azure, and Google Cloud, along with expertise in cloud-specific testing such as API and microservices testing, enhances a QA engineer’s versatility and value.

Imagine a QA engineer specialising in cloud testing for a SaaS company. Their proficiency in API testing on AWS Lambda or Azure Functions ensures seamless integration and functionality across distributed systems.

- Web and Mobile Application Testing:

Versatility across different platforms—web and mobile—significantly enhances a QA engineer’s adaptability. Companies seek professionals who can navigate the nuances of testing on various devices and operating systems.

For instance, a QA engineer experienced in cross-platform testing might oversee the launch of a new mobile app, ensuring it performs flawlessly across iOS and Android devices.

In summary, a QA professional’s worth in the market is shaped by their ability to navigate these variables effectively. Proficiency in automation, cloud technologies, and diverse testing environments not only broadens their scope but also positions them as invaluable assets capable of driving quality and innovation within their organisations.

#3 Base Salary

In this article, we have not used specific base salary ranges due to the multitude of variables discussed in #2. Understanding the context and specific variables is important, as using salary ranges without this information would be misleading. Salaries vary significantly based on expertise and what the company in question needs.

Those with advanced skills in automation, mobile, or cloud testing are typically highly sought-after by companies. In summary, without a clear understanding of these factors and where a role falls on the continuum, any given salary range associated with job titles wouldn’t be accurate.

Here’s an example of some recently delivered assignments:

- MNC – Cork – QA Manager: €100,000 – €110,000

- MNC – Dublin – Software Test Lead: €95,000 – €110,000

- MNC – Dublin – Senior QA Automation Engineer: €90,000 – €95,000

- Tech Startup – Dublin – Senior QA Automation Engineer: €80,000 – €90,000

- MNC – Dublin – QA Engineer (manual & automation): €65,000 – €75,000

- MNC – Munster – Manual Tester (Mobile Apps): €55,000 – €60,000

- Small Fintech Company – Cork – Junior Software Tester: €36,000 – €40,000

If you would like to discuss a salary range bespoke to your role and location, simply contact Rachel at rachel.mcguckian@barden.ie to chat in more detail.

#4 Current Snapshot of the Software QA Talent Pool

Here’s what we’ve noticed this quarter in the Software QA talent pool in Ireland:

#5 What are the key considerations for companies in 2025?

- What are QA Leaders doing? In 2025, QA leaders are navigating the shift back to hybrid working by embracing a blend of flexibility and structure. While some mandatory in-office days are becoming the norm, hiring managers are offering other flexible arrangements, such as adaptable working hours or fewer office days each week. This approach allows companies to attract talent from across Ireland and even internationally, broadening their talent pool.

- Automation Impact and Continuous Learning: QA engineers must continuously upskill in emerging technologies related to automation to stay relevant. Staying updated with industry trends, tools, and methodologies is crucial for maintaining effectiveness in their roles. Automation frameworks and tools are becoming increasingly essential for streamlining testing processes, enhancing efficiency, and improving test coverage.

- Navigating the AI Frontier: The landscape for QA engineers is rapidly evolving with the emergence of AI. As software increasingly incorporates AI components, QA testers face unique challenges. There will be a strong focus on upskilling in AI and machine learning, understanding common algorithms, and collaborating with data science teams. By embracing these changes, QA testers can ensure robust testing of AI components.

- Skill Development and Knowledge Sharing: The demand for QA engineers in Ireland remains strong, and leading companies should consider hiring engineers who can be upskilled in automation tools and other areas. Facilitating knowledge transfer from experienced team members to new hires ensures the company doesn’t miss out on top talent simply due to a lack of specific tool experience. A strong engineer demonstrates a proven ability to adapt to evolving technologies throughout their career, seamlessly transitioning between different companies and toolsets. There’s every reason to believe they can do the same in this new role.

- Data-Driven Recruitment Strategies for Software Testers: The use of data analytics and AI in recruitment is becoming increasingly popular. Companies are leveraging predictive analytics to find software testers who best fit their organisational culture and specific testing requirements. This data-driven approach streamlines hiring decisions and enhances recruitment outcomes. QA engineers seeking new opportunities should optimise their LinkedIn profiles, highlighting their experience with specific tools to appear in relevant keyword searches.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches that would suit you, please feel free to contact Rachel McGuckian our Software QA Talent Advisory & Recruitment expert here in Barden (rachel.mcguckian@barden.ie); we’re where leaders go before they start looking for Software QA talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Rachel McGuckian at rachel.mcguckian@barden.ie

If you’re hiring an AP professional this quarter, here are some things you need to know…

AP by any other name is still accounts payable. The exact role is defined by the processes and procedures used by a given company to manage invoice processing/payment, but the name varies depending on the company. You might know it as:

- AP

- PTP

- P2P

- S2P

- Or simply Accounts Payable

We meet hundreds of AP professionals every year across a wide variety of companies, structures, and jurisdictions and here is some of what we’ve learned from them over the years.

#1 Base

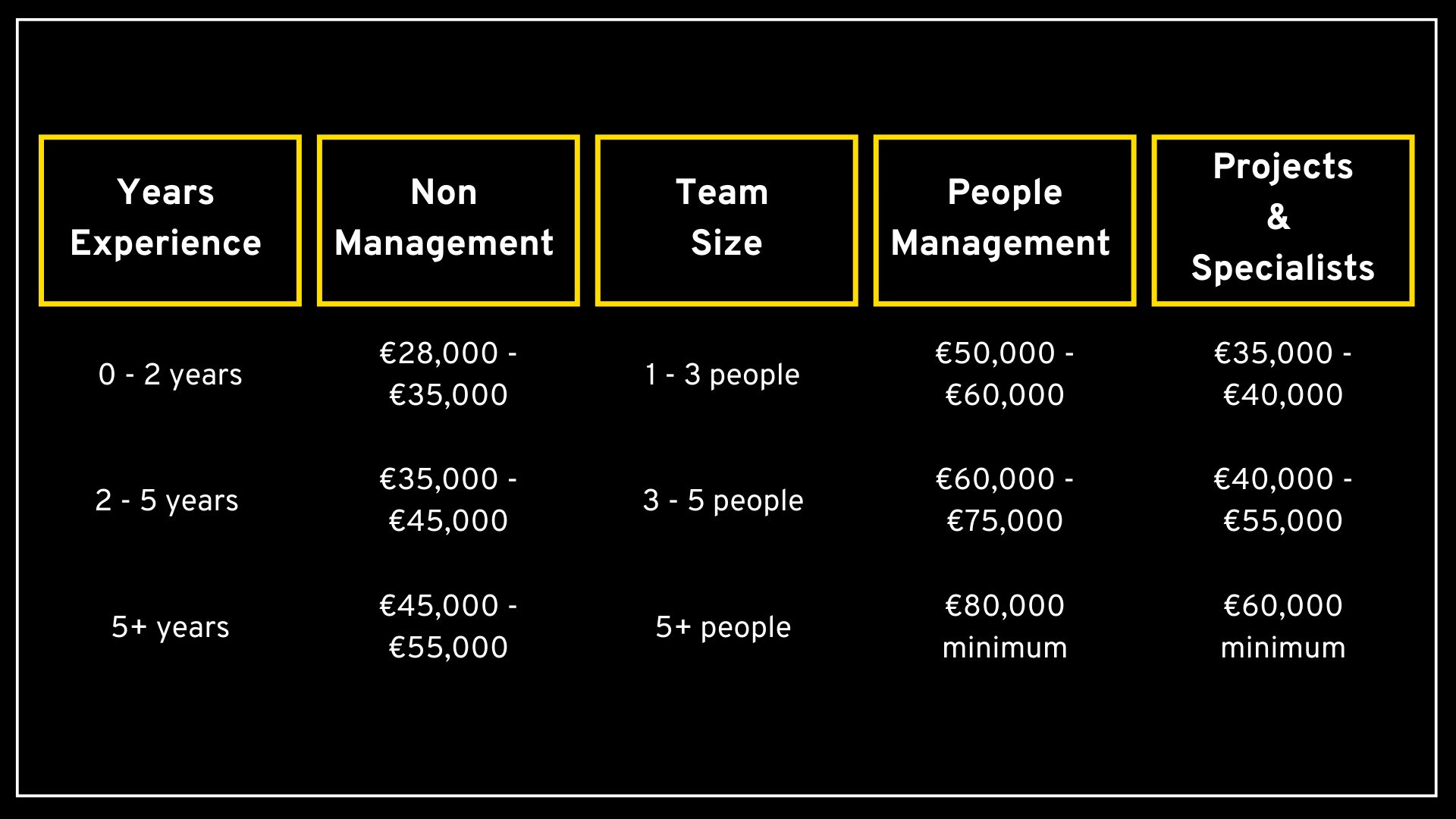

For AP talent it can be all about the base, so let’s talk reward first. Here is what you would expect to pay today:

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice, our team can provide further details, for contact cole.carroll@barden.ie (Leinster) or tara.higgins@barden.ie (Munster).

#2 Continuum of Activity in AP

Scale is the primary driver for differentiating AP roles. Generally, the larger the AP team, the less of the continuum a specific role will cover, and the smaller the team the more of the continuum is covered. Simple.

Other variables that matter are listed above. There are many and they are what differentiate one role from another. What variables are relevant to the role you are looking to hire matter a lot. Fact.

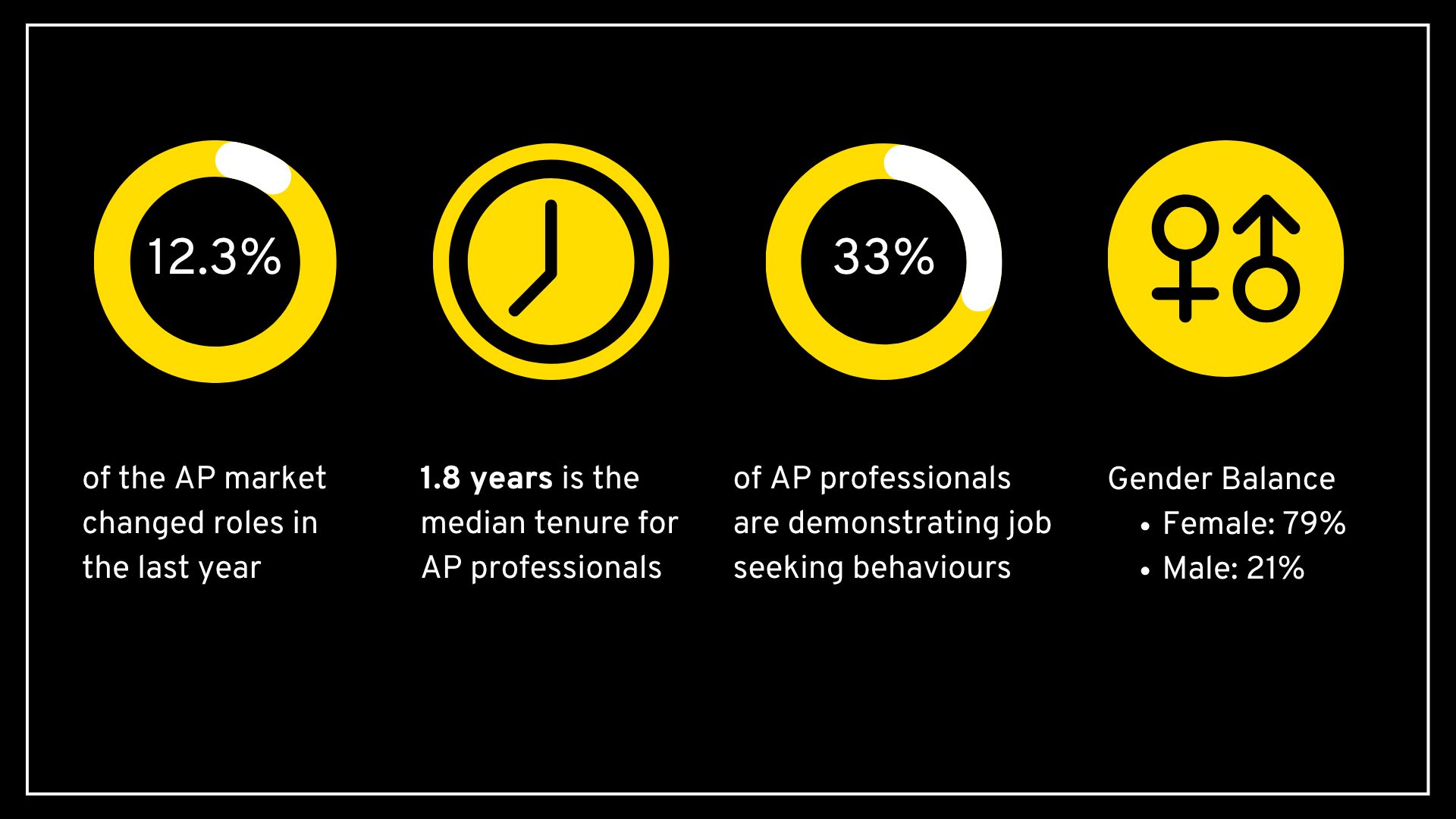

#3 Demand vs Supply

The continued shift in the market has given further rise to supply of AP professionals seeking employment opportunities across Ireland. The “demand” or “open roles” across this space is slightly down on earlier this year.

The surplus of talent has allowed managers to be selective in their hiring processes, as the supply of accounts payable talent exceeds the available job opportunities. However, this surplus relates specifically to junior and mid-level AP professionals, with the demand for senior and specialised talent still being identified in the ‘very high demand’ category.

Below are some data points about the AP market in Ireland this quarter:

What are companies doing to attract talent?

The AP Leaders and Financial Controllers that we work with use some of the following tactics to make sure they get the best results:

- Competitive base salaries that are talent-led rather than budget-led.

- Additional benefits (bonus, healthcare, working abroad for short periods of time).

- Considered Hybrid working patterns that reflect the nature of the role.

- Pathways for development internally.

- Investing in company culture dynamics.

- Outsourcing or automation.

- Identifying junior talent and investing in upskilling.

In Barden we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, contact our team here in Barden, Leinster – Cole Carroll (cole.carroll@barden.ie), Munster – Tara Higgins (tara.higgins@barden.ie); we’re where leaders go before they start looking for AP talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Cole Carroll (Leinster) at cole.carroll@barden.ie or Tara Higgins (Munster) at tara.higgins@barden.ie

Supply Chain Management is an ever-changing landscape and is steadily becoming more and more crucial to the overall success of a business. An efficient supply chain results in a company having competitive advantage. Let us help you understand the key verticals within this chain and the part they play in everyday life.

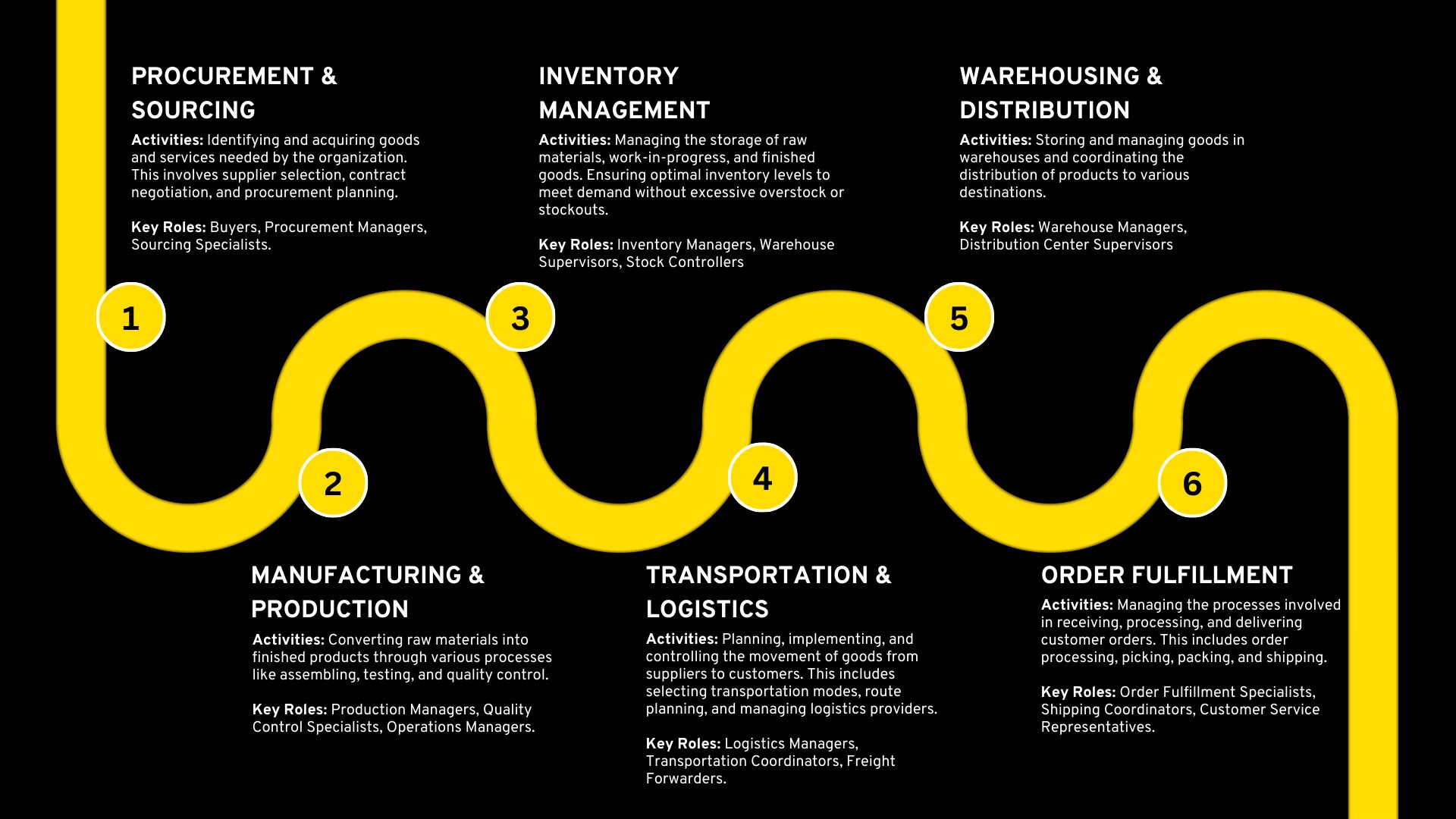

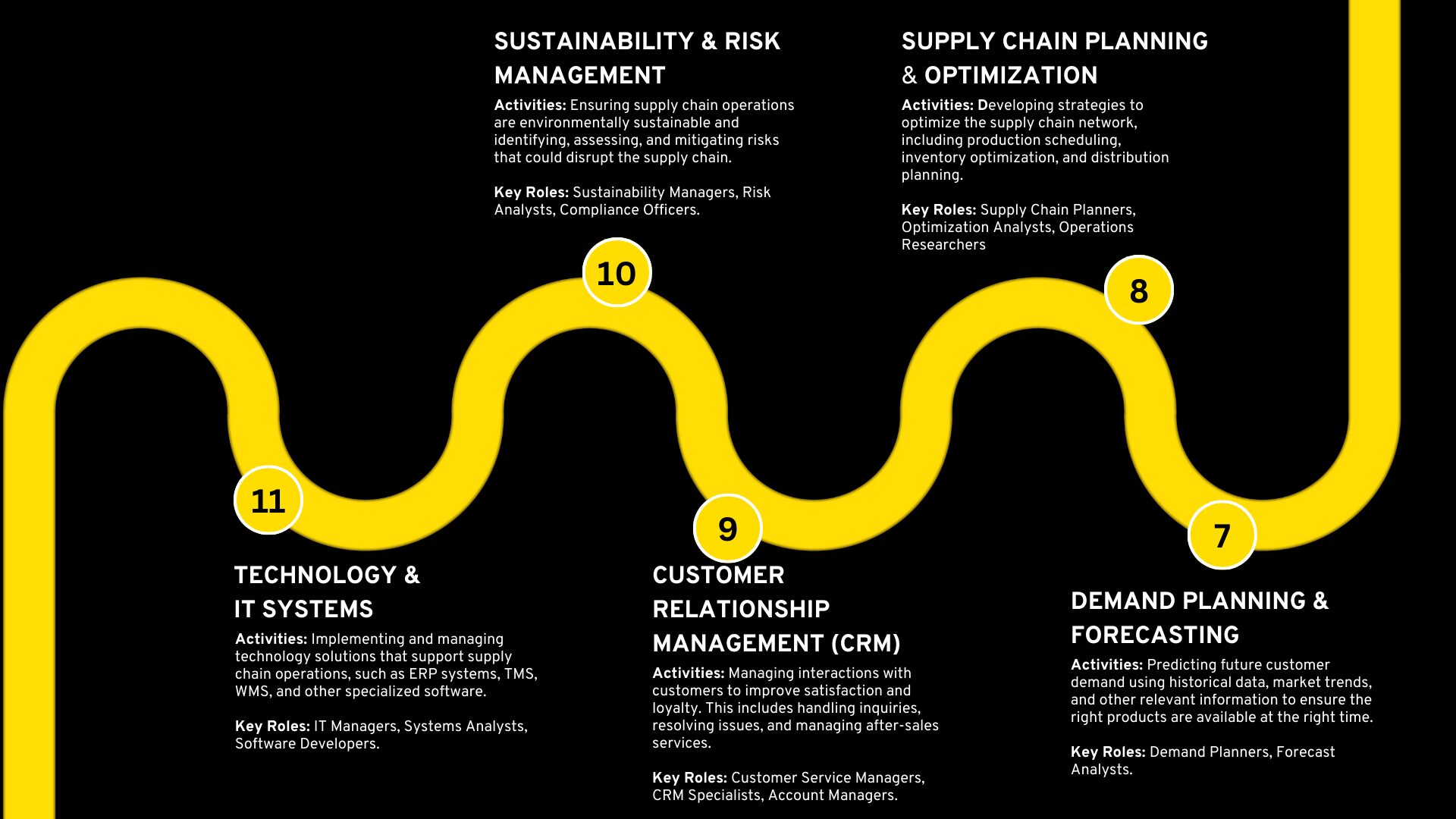

#1 Supply Chain Verticals

The variety of roles in the supply chain management space continues to grow and there are a significant number of distinct sectors or categories within the broader supply chain ecosystem nowadays. Each vertical encompasses specific functions, processes, and roles critical to the efficient operation and management of the supply chain. These include:

Each vertical plays a crucial role in the overall efficiency and effectiveness of the supply chain, contributing to the seamless flow of goods, information, and finances from suppliers to end customers.

#2 Variables

Various different variables will impact the nature of your role within the supply chain space. I have some of the key examples below that we see on a daily basis:

- Size of the business – Whether you are in an SME or Multinational company, this can have a significant impact on several factors. If you are in an SME type business your role is more likely to have a broader scope perhaps including several different areas, ie. Buyer/Planner, you if you are a Supply Chain Specialist you could be covering even more ground, ie logistics, purchasing, order management. The larger the team the more specialised the role is most circumstances.

- Global vs Regional roles – This again probably depends on the size of the business or the organizational structure. You may be working on a global scale covering a number of entities or you may be managing say production planning for one manufacturing site or you may be demand planning for a whole region/or multiple regions.

- Manufacturing site vs Shared Service Centre/HQ roles, in relation to the last point you may be in a centralised role, or you may be onsite where it all happens.

- The nature of the product will dictate both the scope of your role and the size of the team. Naturally manufacturing businesses require a large supply chain and procurement function, as they will have significant direct and indirect sourcing requirements, whereas a smaller business which offers a service as their product may require less manpower and the focus will be on indirect procurement for example as opposed to sourcing raw materials and packaging. The nature of your role will change again depending on whether its active ingredients, or finished products you are buying to sell on. All businesses require IT, marketing and professional services so indirect is almost guaranteed regardless of the type of business. Both are specialised areas and it can be tricky to move between the two.

- Value – the value of the product you are buying will vary from sector or sector, business to business.

- Volume – The volume of product your are sourcing will vary from business to business and category to category, ie. You may be negotiating an annual agreement for a marketing contract or you may be ordering raw materials in bulk on a monthly basis.

- Jurisdiction – There will be different rules and regulations in every jurisdiction, be is customs, or imports or regulations around packaging and production etc. For example a drink may be allowed to have a certain amount of an ingredient in one country but not in the next.

#3 Demand vs Supply

Here’s what we’ve noticed this quarter in the supply chain talent pool in Ireland:

#4 What are companies doing to attract talent?

Attracting talent in the supply chain vertical is crucial. Here are some strategies that we are seeing being used to attract talent in this area:

- Skills Development Programs: Companies invest in training and development programs to upskill existing employees and attract new talent. These programs cover areas like logistics, procurement, and inventory management. Continuous training programs ensure that employees are up-to-date with the latest industry trends and technologies. This demonstrates the company’s commitment to their professional growth.

- Internship and Co-op Programs: Offering internships and co-op opportunities allows students and recent graduates to gain practical experience. Many companies use these programs as a pipeline for full-time hires.

- Flexible Work Arrangements: Companies are adopting flexible work options, including remote work and flexible hours. This appeals to a diverse workforce, including parents and those seeking work-life balance.

- Competitive Compensation: Offering competitive salary is essential. Additionally, offering strong benefits such as pensions, health insurance, bonuses, and flexible working hours are crucial for attracting talent. Ensuring salary packages meet or exceed market expectations helps in retaining top talent.

- Emphasizing Purpose: Companies highlight their impact on global supply chains and sustainability efforts. Talented individuals are drawn to organisations with a clear purpose and positive impact.

- Embracing Diversity and Inclusion: Organizations are actively promoting diversity and inclusion (D&I) to expand their talent pools. By creating an open and inclusive work environment, companies can attract a wider range of candidates and foster innovation and creativity within their teams (Ibec)

- Promoting Internal Talent: Encouraging internal promotions helps create a sense of opportunity and career progression within the organization. This strategy not only builds loyalty but also maintains a consistent corporate culture, saving costs associated with external hiring and training (Deskera).

- Utilizing New Technologies: Companies are investing in new technologies such as artificial intelligence and machine learning to streamline processes and improve efficiency. Providing employees with the latest tools and technologies makes the work environment more dynamic and appealing (Deskera).

- Engaging in Strategic Partnerships and Events: Companies are also engaging with industry bodies and participating in events to address skills shortages. Initiatives like Logistics and Supply Chain Skills Week highlight career opportunities and promote the sector to a younger, more diverse audience (Ibec).

Creating an attractive workplace involves a combination of financial incentives, professional growth opportunities, innovation, a positive and supportive company culture as well as the companies vision and purpose being clear.

#5 Salary examples

- Inventory Analyst (SME) €50,000

- Procurement Analyst MNC (temp contract) €70,000

- Junior Purchasing Assistant (Entry level) €33,000

- Sourcing Manager (Large Irish Business) €75,000

- Senior Buyer (MNC) €88,000

- Head of Warehousing & Logistics (SME) €95,000

- Senior Planner €67,000

- Senior Manager Operations €90,000

- Category Lead €80,000

- Planning Team Lead €72,000

- New Product Introduction Specialist €65,000

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice, our team can provide further details, for contact cliodhna.obrien@barden.ie (Leinster and Munster).

#6 Challenges over the next 12 months

Over the next 12 months, Irish supply chains face several challenges:

- Global Market Uncertainty: Ongoing market volatility and economic uncertainty pose significant challenges for businesses.

- Supply Chain Disruptions: Renewed disruptions due to factors like the resurgence of COVID-19 in China and the Ukraine war are impacting supply chains.

- Inflation and Energy Costs: Rising fuel costs and inflation are putting pressure on supply chain operations.

- Skills and Talent Shortages: Finding and retaining skilled workers remains a concern for businesses.

- Sustainability: Companies are increasingly focusing on sustainability and green credentials to compete in international markets.

Despite these challenges, there’s optimism among Irish exporters, with 84% planning to enter new international markets in the coming year.

Companies in Ireland are adapting to supply chain challenges in several ways:

- Diversification: Businesses are diversifying their supplier base to reduce reliance on a single source. This helps mitigate risks associated with supply chain disruptions.

- Technology Adoption: Companies are investing in digital technologies like IoT, blockchain, and AI to enhance supply chain visibility, efficiency, and resilience.

- Collaboration: Collaborative efforts among supply chain partners are increasing. Companies are sharing information, coordinating logistics, and jointly addressing challenges.

- Resilience Planning: Organizations are developing contingency plans to respond swiftly to disruptions. This includes stockpiling critical components and identifying alternative routes.

- Sustainability Initiatives: Many companies are prioritizing sustainability by optimizing transportation routes, reducing waste, and adopting eco-friendly practices.

Overall, agility, adaptability, and forward-thinking strategies are key to navigating the evolving supply chain landscape in Ireland.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches that would suit you, contact our Supply Chain & Procurement Talent Advisory & Recruitment team here in Barden (cliodhna.obrien@barden.ie); we’re where leaders go before they start looking for Supply Chain & Procurement talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Cliodhna O’Brien at cliodhna.obrien@barden.ie.

Firstly, it’s important to establish who does the “Recently Qualified” segment of the accounting market refer to? Here in Barden, we define this as anyone with 1 to 5 years post-qualified experience. Accountants tend to change roles an average of 2 or 3 times within their first 5 years post-qualified, so this segment of the accounting talent pool is very buoyant but can also be a difficult space for employers to recruit for, particularly as peoples’ experience becomes increasingly specified.

#1 Base

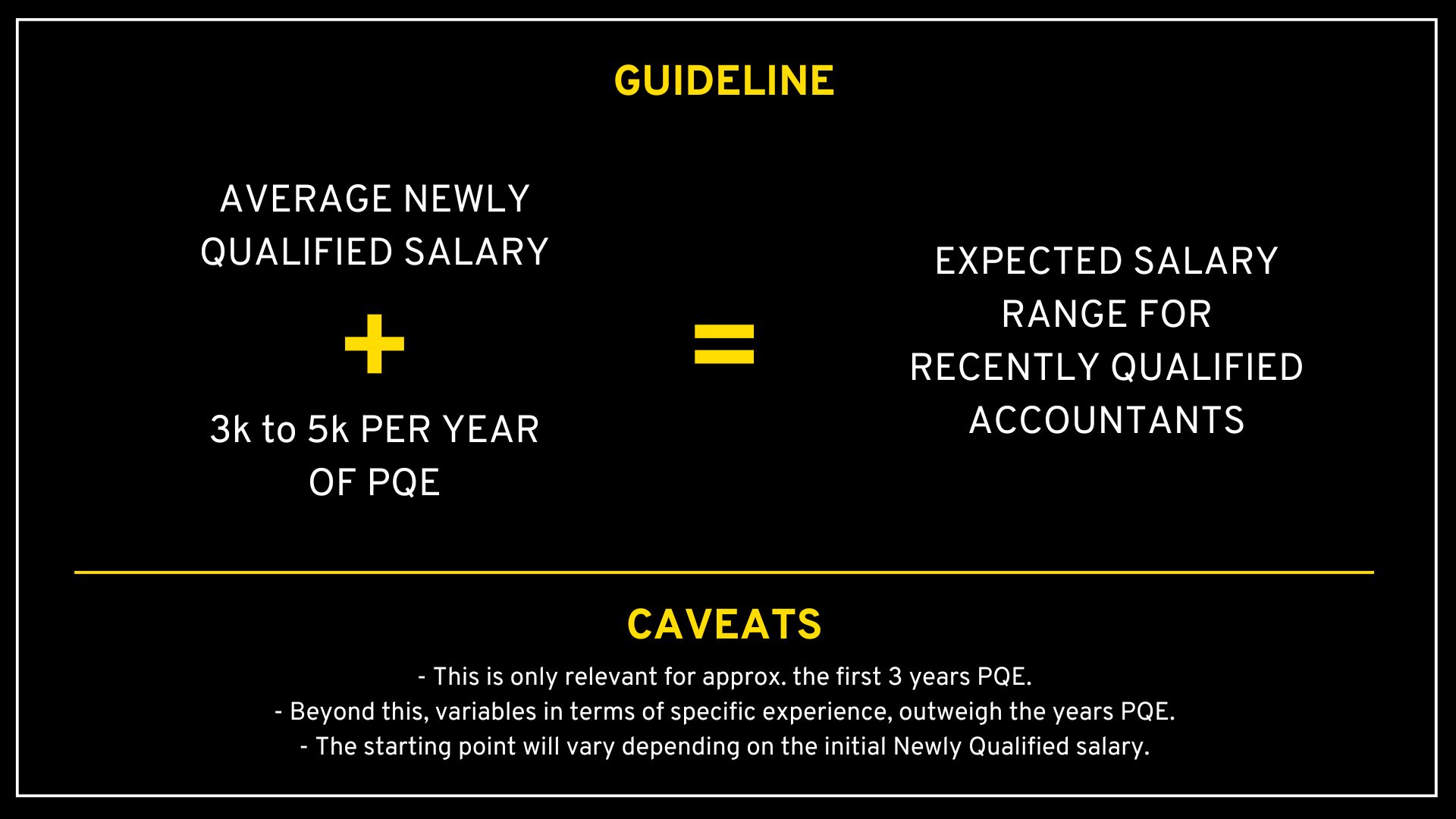

For this part of the market, we’re going to focus on years of experience and business structure for Industry roles (non-practice) rather than focusing on job titles (titles can massively differ from business to business due to internal structures).

A useful tool to estimate base salaries is to take the Newly Qualified salary average (currently €60k to €65k) and add €3k to €5k per year of post-qualified experience. However, context is very important when considering salary guides and this tool should only be used as a guideline and is also only relevant for the first 1 to 3 years post-qualification.

Beyond that, the salary depends on several variables such as; how specialised the experience is, people management experience, size of team, scale of the business, scope of responsibilities, etc. From 3 years post-qualified onwards, these variables become more important and the number of years’ “PQE” becomes less relevant.

It is also important to note that newly qualified salaries have inflated over the last couple of years, therefore the starting point for some recently qualified accountants might be lower than the €60k to €65k mentioned above, i.e. when starting from a lower initial base salary, it might take longer to catch up with external market averages.

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice, our team can provide further details, for contact brian.oconnor@barden.ie (Leinster) or siobhan.sexton@barden.ie (Munster).

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice, our team can provide further details, for contact brian.oconnor@barden.ie (Leinster) or siobhan.sexton@barden.ie (Munster).

#2 Continuum of activity

Similarly to the Newly Qualified Talent Monitor, the continuum of the activity outlined below is what you will expect to see in any finance team/role. It ignores things like finance transformation, stat reporting, and tax… let’s keep it simple for now.

Two companies can be looking to hire a financial accountant, but the nature of their roles can be very, very different. The % of the person’s time spent on certain activities will be very important to the individual’s decision making.

Below is a visual representation of the activity in a basic finance team along with some of the variables that come with the context of the role. The % of time your hire will spend either side of the line below, along with the variables in their client/company experience compared to your company/needs, are critical considerations for you and your HR team.

#3 Demand vs Supply

- Demand:

- There is usually always demand for accountants at this level and things are no different this quarter. Employers are always looking for talent with hands-on experience, that can hit the ground running, and require little handholding.

- As a result of this consistent demand, competition for talent at this level is high and therefore it is usually a difficult level to attract talent.

- Supply:

- As mentioned above, Accountants tend to change roles/employers an average of 2 or 3 times within their first 5 years post qualified, therefore, similarly to the newly qualified talent pool, the recently qualified pool is also relatively transient.

- Historically, there is also usually a steady stream of recently qualified talent returning from Aus/Canada/London with good PQE and can be immediately available to start. This pool has been significantly smaller over recent years, however, with COVID delaying many people’s travel plans, it should start returning to normal levels as we move further into the post-COVID market.

#4 What are companies doing to attract Recently Qualified Accounting talent these days?

An important factor to consider when attracting Recently Qualified Accounting talent, is that there needs to be an incentive for someone to change roles.

A lot of recently qualified accountants who are actively looking for a new role are doing so because they are looking for a new challenge, an opportunity to gain experience in a new area or a change in their working environment.

This can give rise to challenges when looking to recruit talent that can hit the ground running, as people don’t want to move “like for like.” i.e. Experienced Group Accountants commonly look to gain commercial experience and look for FP&A or Finance Business Partnering roles, rather than looking for another role in a Group Accounting team.

When trying to attract talent, keep an open mind to the type of experience you’ll consider and what incentive this opportunity gives to the relevant talent pool. If you need someone who can hit the ground running and there is less time to invest time in training someone who is coming in with a different skill set, you might have to consider incentivising through other means, like salary or flexible working arrangements. Vice versa, if you are willing to consider a different background and you can invest the time in training them, you may not have to incentivise through other means.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, contact our Recently Qualified Team in Barden, Leinster – Brian O’Connor (brian.oconnor@barden.ie), Munster – Marissa Maher (marissa.maher@barden.ie), Siobhán Sexton (siobhan.sexton@barden.ie); we’re where leaders go before they start hiring Recently Qualified talent.

This information is accurate as of July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics, and other proprietary 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Brian O’Connor at brian.oconnor@barden.ie or Marissa Maher (Munster) at marissa.maher@barden.ie, Siobhán Sexton (Munster) at siobhan.sexton@barden.ie.

If you’re hiring a Payroll professional this quarter, here are some things you need to know…

The payroll profession in Ireland is a vital component of the country’s workforce and without payroll teams businesses just do not function. The market for Payroll talent is competitive, with a consistent demand for skilled experienced professionals.

When hiring in payroll it is always a good idea to understand the key variables that exist within the profession, the variables that exist in your own specific opportunity and, where you can be flexible and where you cannot be flexible. Engaging talent with very specific skill sets in Payroll can be very challenging, so thinking outside the box, to a degree, can have a significant impact on lead time to hire and the salaries involved.

In 2025, the top 4 challenges likely to face leaders in the payroll profession will continue to include regulatory changes, technological advancements, talent retention, and cybersecurity. More on that later.

In Barden we know payroll and we know talent. Here are a few things that might be helpful if you are thinking of bringing new payroll talent into your team:

#1 Base

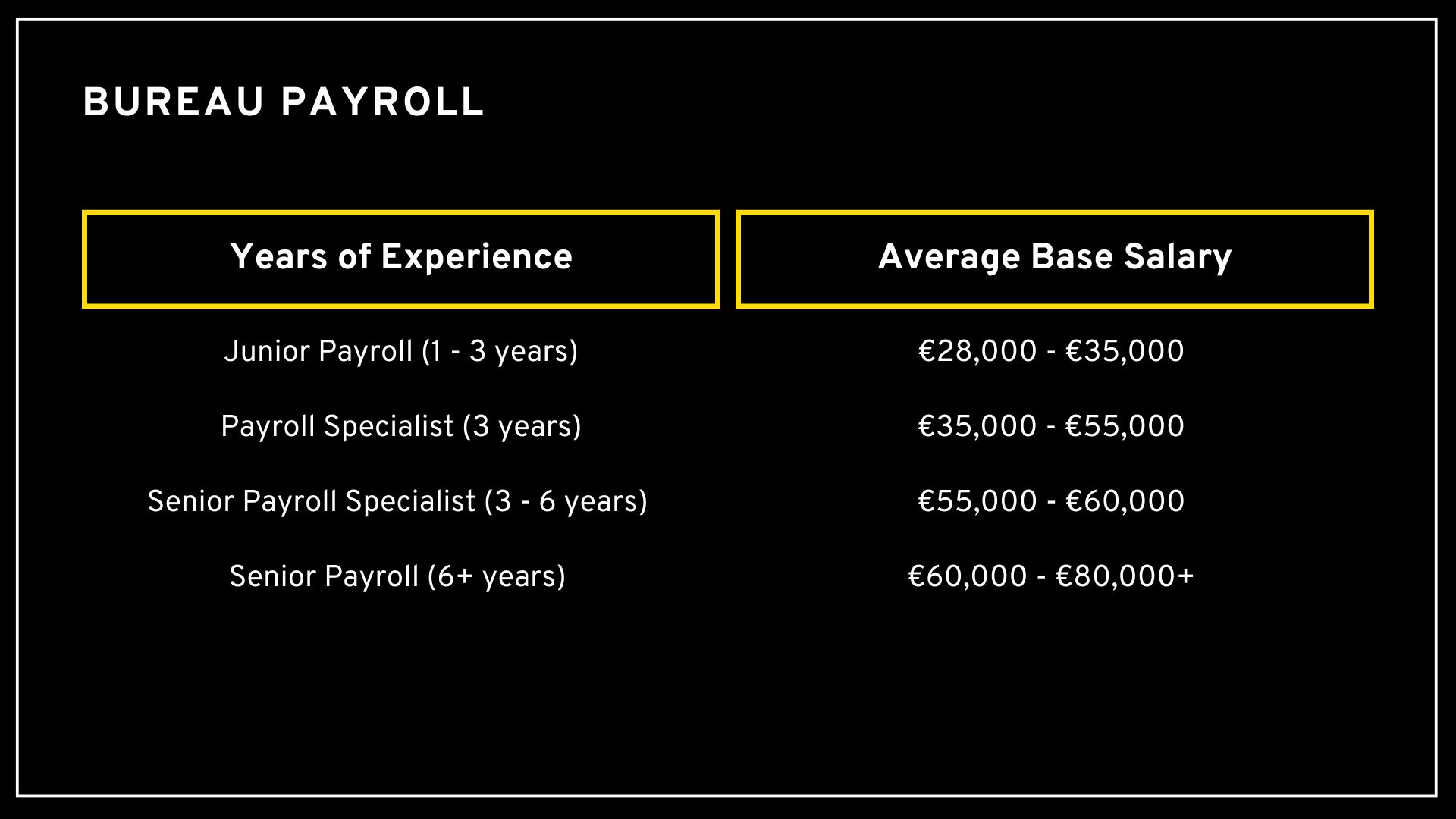

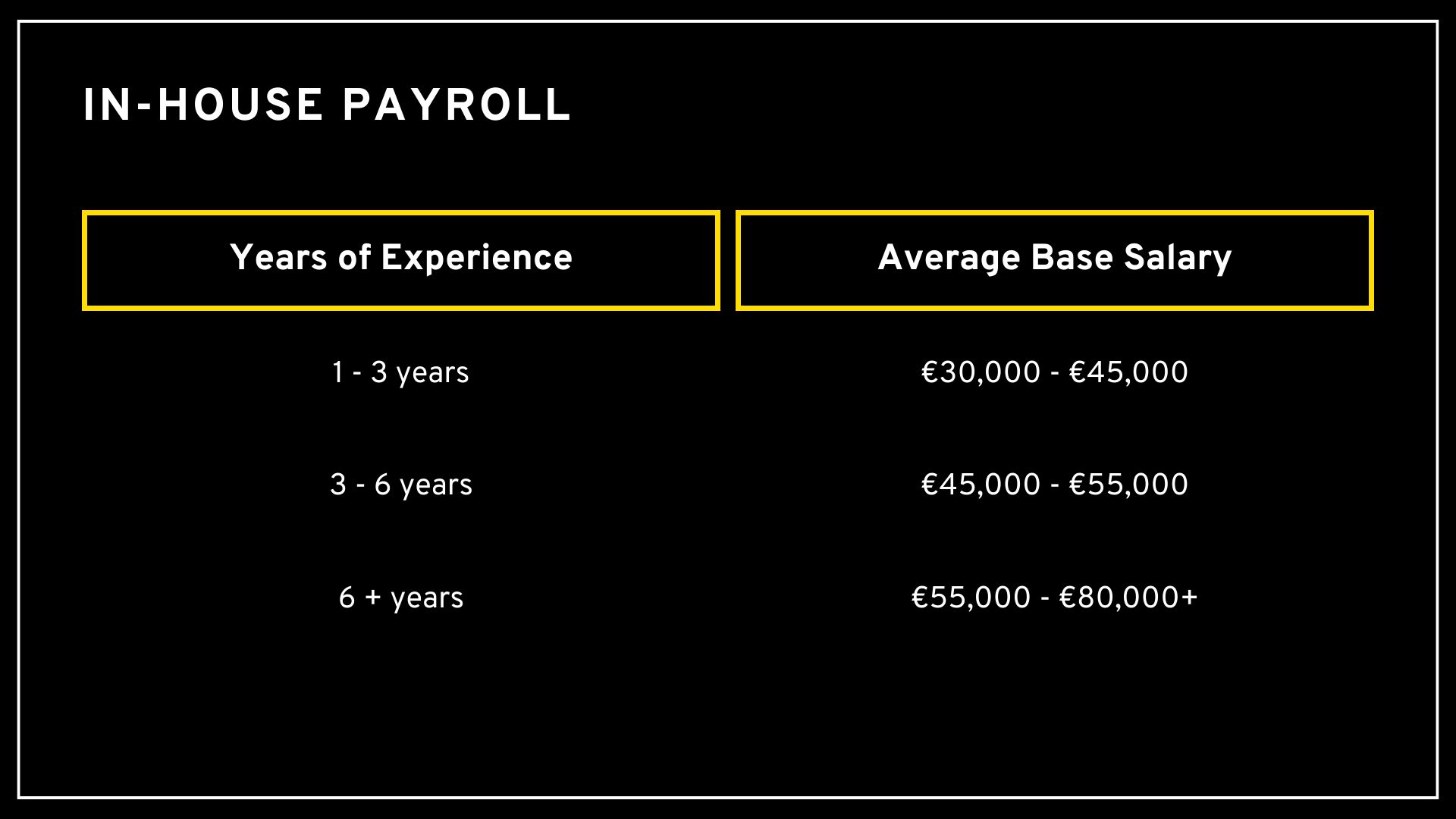

Let’s talk reward first and what you would expect to pay today.

We’re going to focus on both bureau payroll and in-house payroll. This is also a very broad guideline and it’s important to understand the specifics of each individual role i.e., specialities, size of team, scope of responsibilities (context is very important when considering salary guides as we further delve into below!).

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of the greater Dublin area. For bespoke advice, our team can provide further details, please contact cole.carroll@barden.ie (Leinster) or tara.higgins@barden.ie (Munster).

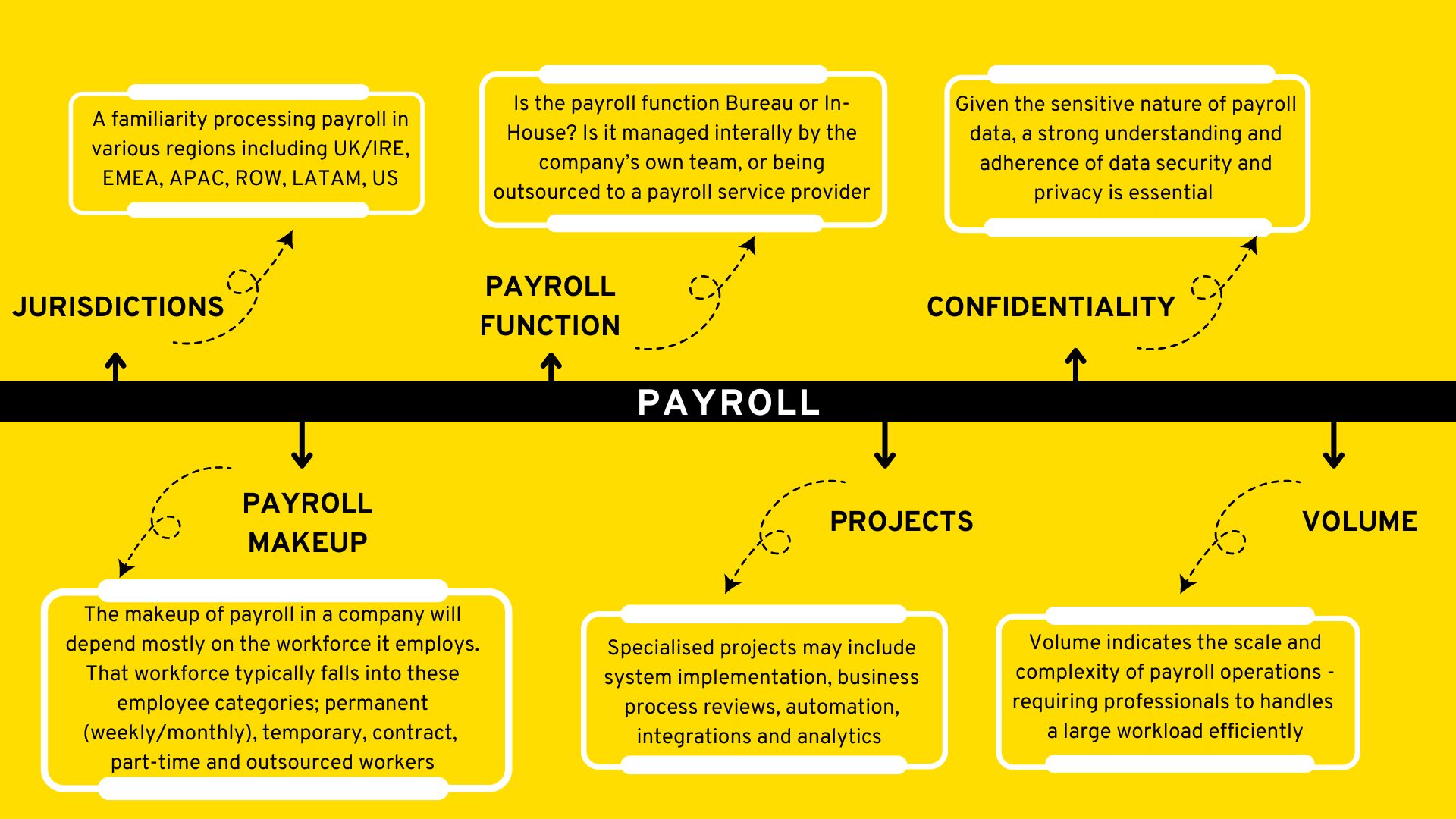

#2 Niche skills and variables that matter…

Identifying talent with niche payroll skills is tricky. Fact. Specialisations may include knowledge of international payroll, complex tax regulations, expertise in specific software systems and more.

Employers often rely on professional certifications like IPASS (The Irish Payroll Association) to identify talent with the required skill set, however our best advice is to be led by experience and expertise first, qualifications second.

What jurisdictions/regions a payroll professional covers is one of the most important variables to consider. Does the payroll cover just ROI or IOI; or is it UK&I; or what about if it is across EMEA or even Global. The footprint of the headcount, the employment relationships that exist (temporary v permanent) and the division of labour between internal and third party in country providers, all combine in a way that can make one payroll professional very different to the next.

And that’s just for starters – some other variables include:

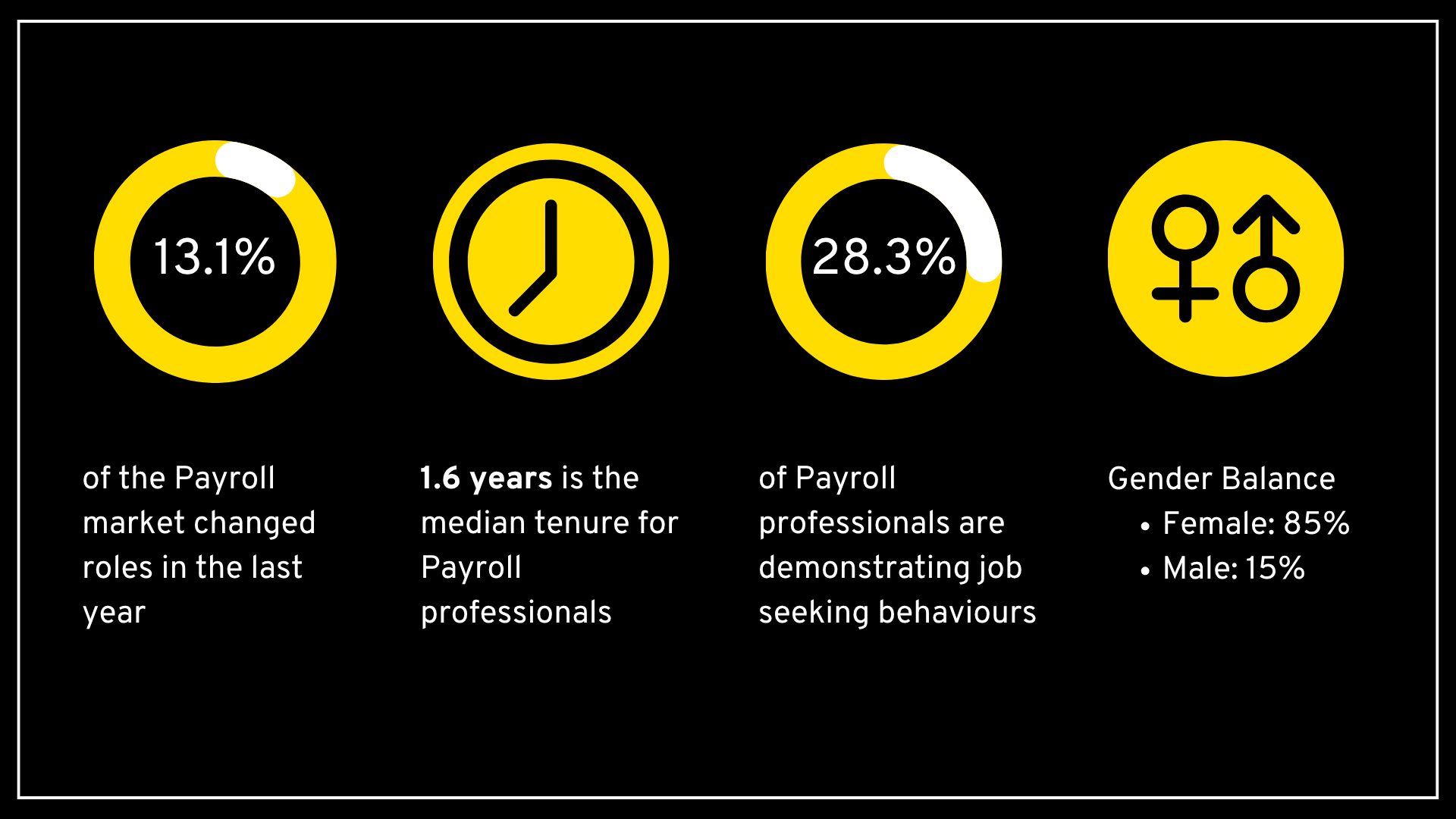

#3 Talent Availability

The demand for payroll professionals in Ireland has been consistent over the last decade and while advances in tech have improved efficiencies in the process, human oversight, approval and management of such a business sensitive activity remains firmly in the hands of Payroll talent.

Over the last decade payroll has increasingly become not just a function of finance/HR but a destination for finance talent. This steady supply of people choosing Payroll as their career is promising and bodes well for the future for both employers and professionals looking to build and grow payroll teams.

At a macro level there is a good supply of junior payroll professionals in the market -getting the right culture fit and retaining the more junior talent over time, are the biggest challenges for hiring managers at this level.

Conversely, there continues to be a challenge in identifying and attracting senior payroll professionals with large volume payroll or multijurisdictional payroll experience; with competition high the experienced end of the payroll profession continues to be in the driving seat.

Below are some data points about the Payroll market in Ireland this quarter:

#4 Projected Challenges for 2025

The payroll profession in Ireland is likely to face some challenges in 2025, including:

- Regulatory Changes – Continual updates to payroll laws and tax regulations necessitate staying up-to-date and adapting to changes.

- Evolving Technology – The integration of AI and automation in payroll processes may require professionals to upskill to remain relevant.

- Talent Retention – As the demand for skilled payroll professionals continues to rise, retaining top talent will likely be a challenge for employers.

- Cybersecurity – With an increased reliance on digital systems, payroll departments need to focus on cybersecurity to protect sensitive financial data.

In Barden we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, contact our team here in Barden, Leinster – Cole Carroll (cole.carroll@barden.ie), Munster – Tara Higgins (tara.higgins@barden.ie); we’re where leaders go before they start looking for Payroll talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Cole Carroll (Leinster) at cole.carroll@barden.ie or Tara Higgins (Munster) at tara.higgins@barden.ie.

Ireland’s life sciences sector has a global reputation for operational and innovational excellence. With over 90 Pharmaceutical companies based here, Ireland is the world’s third largest exporter of pharmaceuticals, with €116+ Billion annual exports. The sector continues to evolve, expanding its capabilities to include innovation, digitalisation and next-generation technologies.

At the cornerstone of the industry sits the Quality Control profession. Quality Control testing in the pharmaceutical industry ensures the safety, efficacy, and consistency of products through rigorous analysis at every stage, from raw materials to finished products. The comprehensive QC process builds trust and reliability in pharmaceutical products by maintaining the highest of standards of quality throughout production.

#1 Continuum of Activity

While the above captures in a simplistic way the nature of activities in QC, it’s important to note that roles will differ from one another depending on additional variables, which affect roles and salaries, and are further detailed in the Salary section below.

A synopsis of the key additional variables affecting the continuum of activity include:

- Function of team – Chemistry, Potency, Microbiology, Bioassay

- Product: Oral Solid Dose, Biopharmaceuticals, Vaccines, Injectables, Topical Products, Inhalation Products

- Equipment – HPLC, GC, UV-Vis, Karl Fisher, Dissolution systems, Mass Spectrometry, Autoclaves, incubators, centrifuge

- Company Type: Big Pharma, CDMO, CMO, Generic Pharma

#2 Base Salary

Salaries mean nothing without context. A salary figure on its own doesn’t provide a complete picture of compensation. The true value of a salary is influenced by multiple factors *see index 1 further down.

This Barden salary monitor provides a comprehensive overview of real time salary ranges for this quarter within the pharmaceutical industry. However, it is important to consider that numerous additional factors can influence these figures, in particular if a role sits on the higher or lower end of the above scales.

Without this context, it is difficult to accurately assess the real worth of a compensation package. Understanding these elements is crucial for evaluating the full value of a salary.

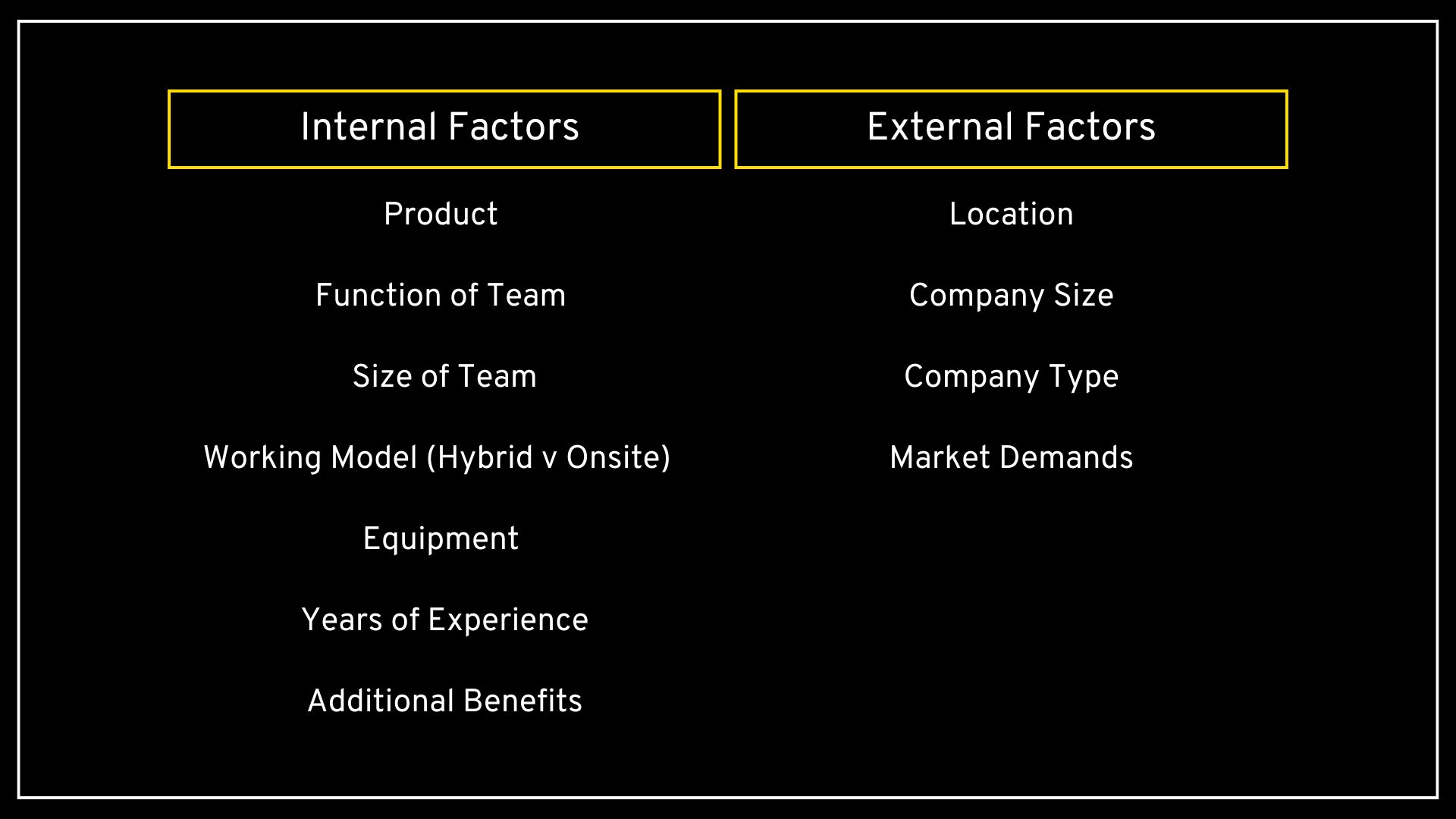

As mentioned above, salaries are influenced by multiple factors. We have divided these factors into 2 subsections – Internal and external factors

- Internal factors are elements within an organisation or related to the individual that influence salary levels

- External factors are elements outside the organisation that influence salary levels

By taking these factors into account, we can gain a more nuanced understanding of the compensation landscape in the Quality Control profession (some of which are cited already above).

*Index 1

Internal factors that affect salary include:

- Function of team – The function within a QC team (Chemistry, Microbiology, Potency & Bioassay) in the pharmaceutical industry can significantly impact salary due to the varying levels of responsibility, expertise, and impact on product quality. Entry level positions conducting routine analysis compared with Senior Analysts conducting more complex analysis that may include method development will have varying salaries (revert back to salary guide)

- Product: Product Type and complexity will affect the salaries on offer – the more complex a product, the more skilled talent is required – examples of key products include: Oral Solid Dose, Biopharmaceuticals, Vaccines, Injectables, Topical Products, Inhalation Products

- Size of team – Small specific testing lab teams can offer higher salaries v larger teams focused on standard testing

- Working models – Fully onsite v Hybrid options – Hybrid offers flexibility, cost savings (commuting, childcare) and access to a wider talent pool allowing for less salaries. Fully onsite with additional overhead costs (commuting, additional childcare costs), geographic limitations for talent will increase the potential for higher salaries to attract talent

- Equipment – The equipment a QC professional works with in a pharmaceutical / Biopharmaceutical site can significantly impact their salary due to the specialised skills and knowledge required to operate and maintain these advanced instruments – HPLC, GC, UV-Vis, Karl Fisher, Dissolution systems, Mass Spectrometry, Autoclaves, incubators & centrifuges

- Years of experience – Years of previous experience impacts salary significantly because it often correlates with a deeper understanding of the role, industry-specific knowledge, and a proven track record of success

- Benefits and Perks: In addition to base salary, companies offer various benefits such as annual bonuses, Private health insurance, pension and life assurance as standard. The level of health coverage and bonus and pension percentages can vary with each company along with pension type (Defined Contribution or Defined Benefit). For more Senior positions, companies offer additional benefits in RSU (Restricted Stock Units), Car allowance, Sign on bonuses

External Factors:

- Location: Salaries can vary depending on the specific location within Ireland. Dublin would offer a higher salary rate compared to the rest of Ireland. This is primarily due to much higher cost of living

- Company Size: Larger pharmaceutical companies typically have more resources and a bigger budget, allowing them to offer higher salaries to attract and retain top talent

- Company Type: Each type of pharmaceutical company has its own set of factors that influence salary

- Big Pharma: Dominant market players with a global reach. The competitive market for top talent leads to higher salaries to attract and retain skilled professionals

- CDMOs and CMOs: Dependent on contracts from other companies. Market demand for their specialised services can drive salary levels up or down

- Generic Pharmaceutical Companies: Operate in a highly competitive market focused on cost efficiency. Salary structures may reflect the need to maintain low production costs

- Market Demand: The demand for QC professionals can fluctuate based on industry trends, regulatory changes, and the overall economic climate, this in turn will directly affect salaries

#3 Demand vs Supply / Talent Availability

In the pharmaceutical industry, the balance between demand and supply is crucial, especially when it comes to talent within Quality Control profession (QC). As the industry grows and evolves, the demand for skilled QC professionals increases.

Here’s what we’ve noticed this quarter in the Quality Control talent pool in Ireland:

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss any of the above in more detail or you would like our expert advice, please contact Aidan Crowley, our Life Sciences Practice Lead here in Barden (aidan.crowley@barden.ie); we’re where leaders go before they start hiring Quality Control talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Aidan Crowley at aidan.crowley@barden.ie

The IT infrastructure talent market in Ireland is experiencing significant pressure, with demand for skilled professionals far outstripping supply. As businesses accelerate their digital transformation efforts and adopt cloud technologies, the need for experts capable of designing, managing, and securing IT systems has never been more critical.

IT infrastructure professionals are no longer confined to supporting roles – they are now pivotal to driving business innovation and ensuring operational resilience. However, the rapid pace of technological change and evolving business needs make navigating this landscape both challenging and rewarding.

Through our direct work with IT infrastructure professionals and employers across Ireland, here’s what we’ve observed:

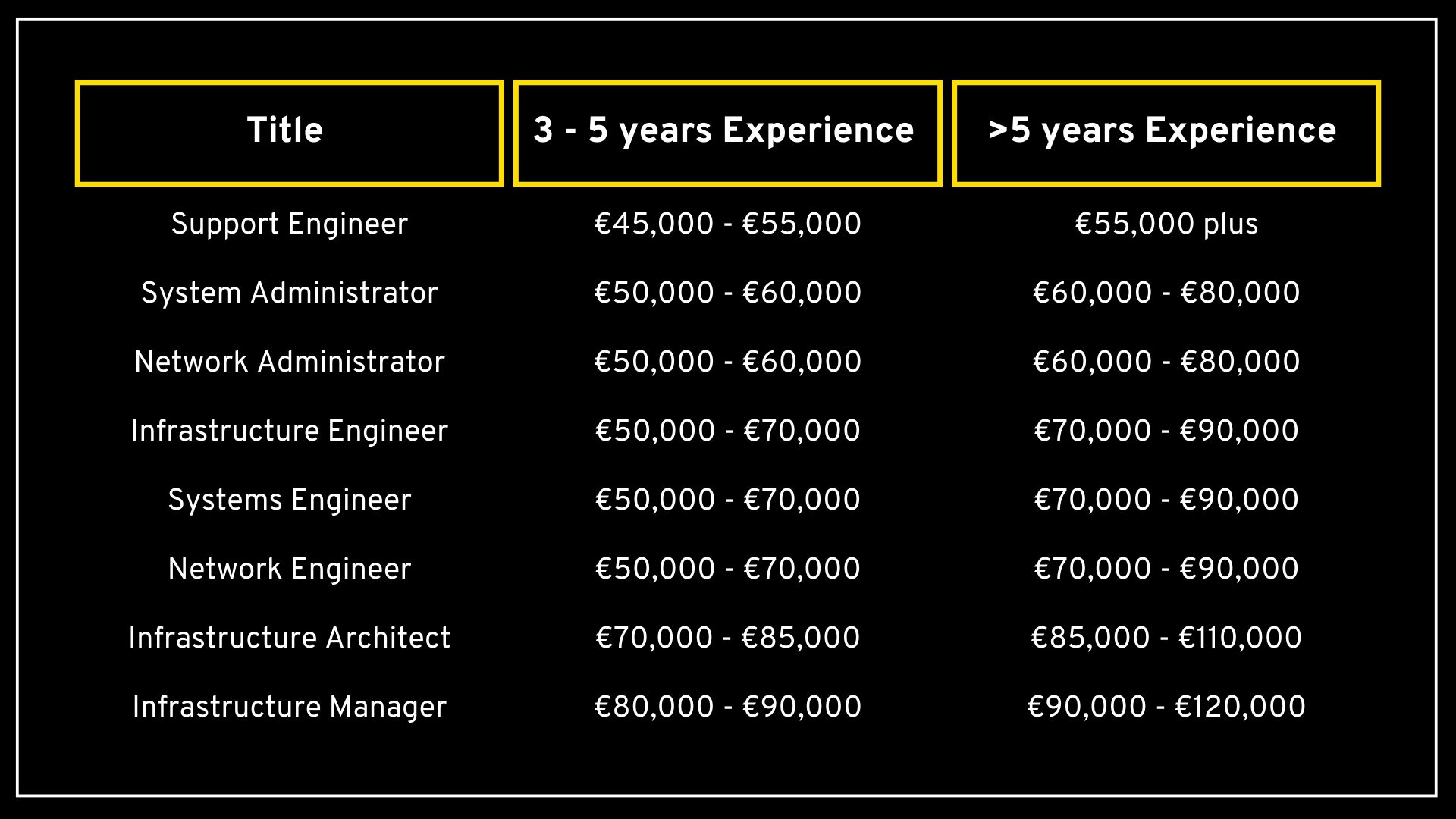

#1 Base Salary

Salaries for IT infrastructure roles in Ireland vary widely, and for good reason. Here are the key factors that influence base salary:

- Certifications: Industry-recognised certifications such as AWS, Azure, or ITIL can substantially enhance earning potential.

- Organisation Size: Larger organisations, tend to offer more competitive salaries due to the complexity and scale of their IT infrastructure requirements.

- Supply & Demand: Skills in high demand but short supply, such as cloud computing, cybersecurity, and automation can directly influence salary.

- Location: Dublin typically leads in salary offerings, reflecting the concentration of tech hubs and multinational companies in the capital.

This is a very broad guideline and it’s important to take into account the specifics of each individual role. For bespoke advice please contact Lorraine at lorraine.oleary@barden.ie

This is a very broad guideline and it’s important to take into account the specifics of each individual role. For bespoke advice please contact Lorraine at lorraine.oleary@barden.ie

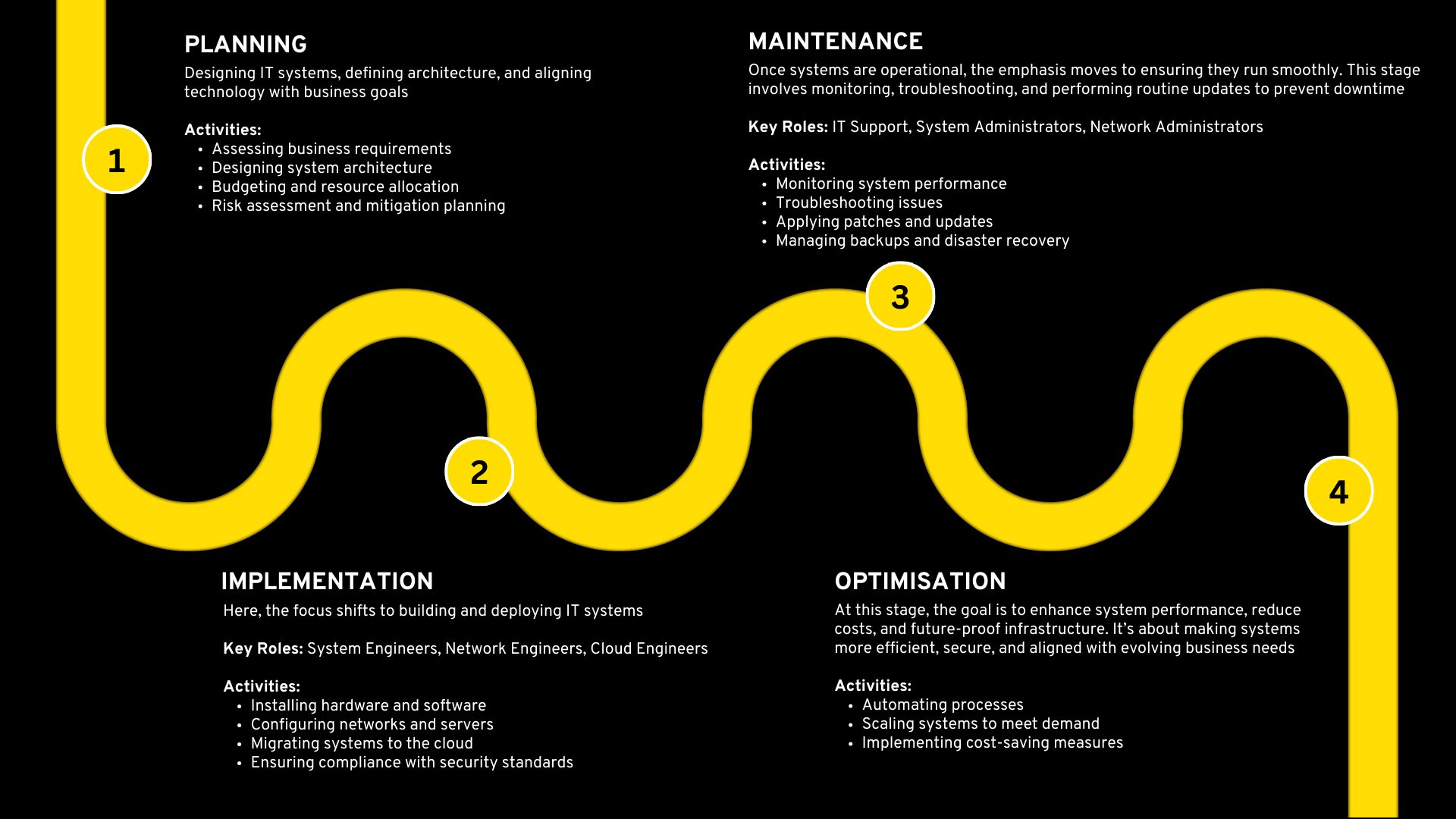

#2 IT Infrastructure Lifecycle

IT infrastructure roles typically follow a continuum of activities, spanning planning, implementation, maintenance, and optimisation. Understanding this lifecycle is essential, as it underscores the complexity of the field and highlights the importance of context when evaluating roles and responsibilities.

While some roles encompass the entire lifecycle, others are more specialised, focusing on specific stages. Here’s a structured view of the continuum and the roles that align with each stage:

#3 Variables that matter

Job title alone often doesn’t capture the full scope of an IT infrastructure role. Here are the key variables that help define what a position truly entails:

Role Focus: Is the role operational and hands-on, or more strategic, focusing on planning and architecture?

Technical Focus: Does the role emphasise hardware, software, networking, or a combination of these?

Project-Based vs. Ongoing Support: Is the position centred on implementing new systems (project-based) or maintaining and optimising existing ones (ongoing support)?

Industry Requirements: Different sectors, such as finance, healthcare, and technology, come with unique challenges and regulatory demands that shape the role.

By considering these variables, employers and talent can gain a clearer understanding of what a specific IT infrastructure role entails, beyond the job title alone. This helps in matching the right skills and experience with the appropriate job functions.

#4 IT Infrastructure Talent Availability

Here’s what we’ve observed this quarter in the IT infrastructure talent pool in Ireland:

#5 Projected challenges for the next 12 months

For Employers:

- Cloud Migration: The transition to cloud-based systems presents both technical and organisational challenges, requiring the expertise to navigate this effectively.

- Cybersecurity: As cyber threats evolve, ensuring IT infrastructure remains secure will be a top priority.

- Sustainability: Organisations will face increasing demands to adopt greener IT practices, such as energy-efficient data centres and sustainable hardware solutions.

For Talent:

- Continuous Learning: Staying relevant in the field will require ongoing learning to keep pace with emerging technologies like AI, edge computing, and automation.

- Competition: High demand for specialised skills will lead to more competition for roles, making it essential for talent to differentiate themselves.

- Specialisation: Professionals may face the challenge of choosing between specialising in a niche area (e.g., cloud architecture) or developing a broader skill set to remain versatile.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches that would suit you, please feel free to contact Lorraine O’Leary our IT Infrastructure Talent Advisory & Recruitment expert here in Barden (lorraine.oleary@barden.ie); we’re where leaders go before they start looking for IT Infrastructure talent.

This information is accurate as per July 2025 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions contact Lorraine O’Leary at lorraine.oleary@barden.ie