Audit as a profession is often in the spotlight.

For quite some time, the supply of external audit talent in Ireland has been significantly below demand. This has been evident from the reliance we’ve had on other talent markets, including the Philippines, India and Pakistan.

The audit talent supply has faced many challenges over the last number of years. From the outflow of talent to international markets and other verticals, to the slight “audit aversion” – there is a lot to digest.

Here are some things that may be worth thinking about as an audit professional or audit hiring manager…

#1 Perception of Audit Careers in Practice

Before we dive into real-time data, it’s vital we take a step back and assess the perception of external audit as a profession.

For the purposes of this Talent Monitor, we are not focusing on client bases below the audit threshold.

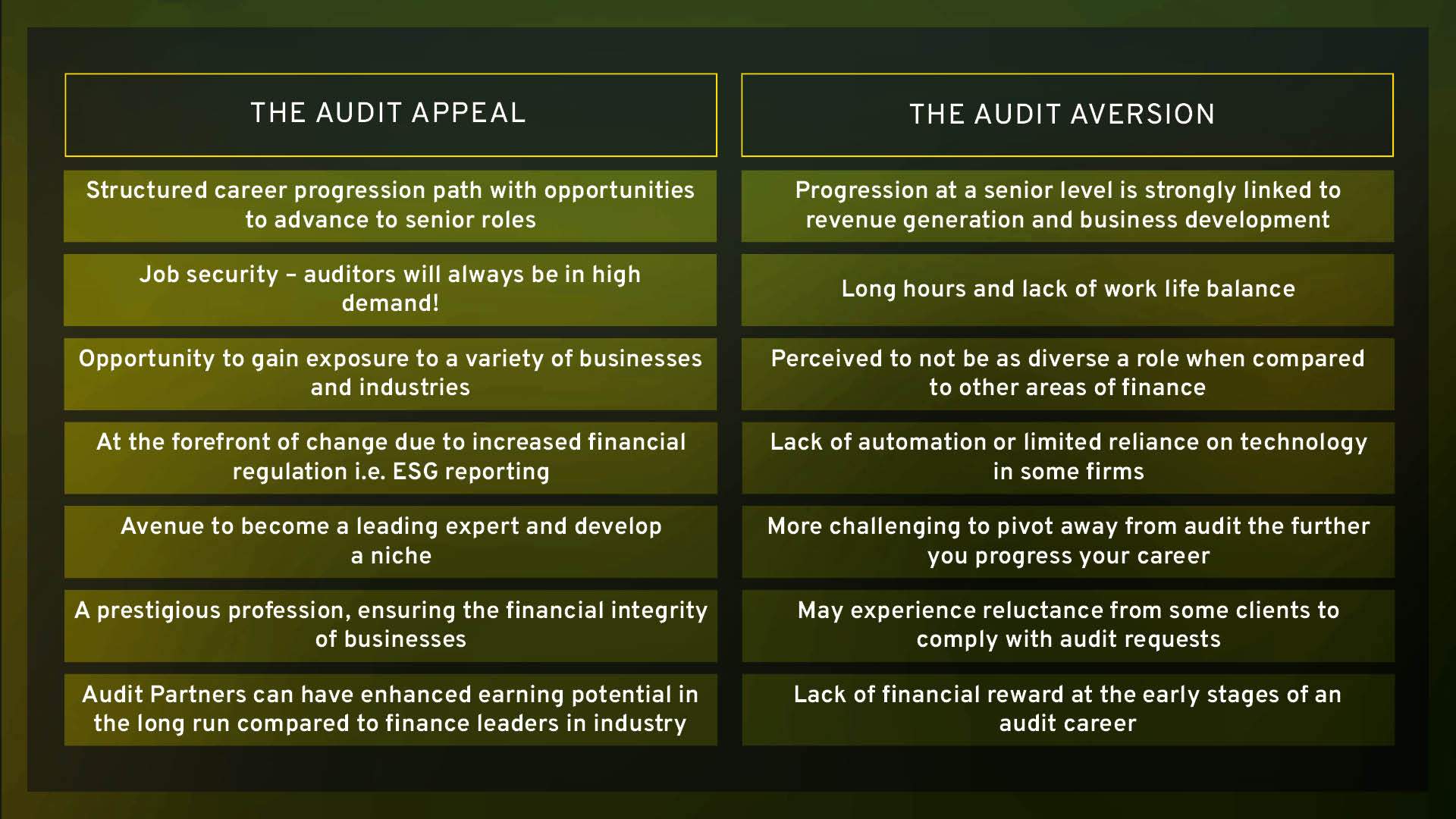

We’ve spent a lot of time getting to know the audit community, and here are some shared views of a long-term career in audit…

There are thousands of people happily employed in the external audit world worldwide; however by the nature of the general audit training route in Ireland, many leave the audit profession on completion of their training. It’s important to note that this is to do with the structure of a typical audit training path and not the audit profession itself – many professionals are burnt out and feel a career change (or career break) is necessary.

Although this profession evokes mixed feelings, the role of the external auditor is crucial in maintaining the financial health and integrity of businesses.

#2 The Audit Landscape

When assessing your audit experience and how this may be perceived on the external audit market, it’s important to consider…

- Your client base

- Which tends to be dictated by the size of the firm you are working in

- And in turn will shape your scope of experience

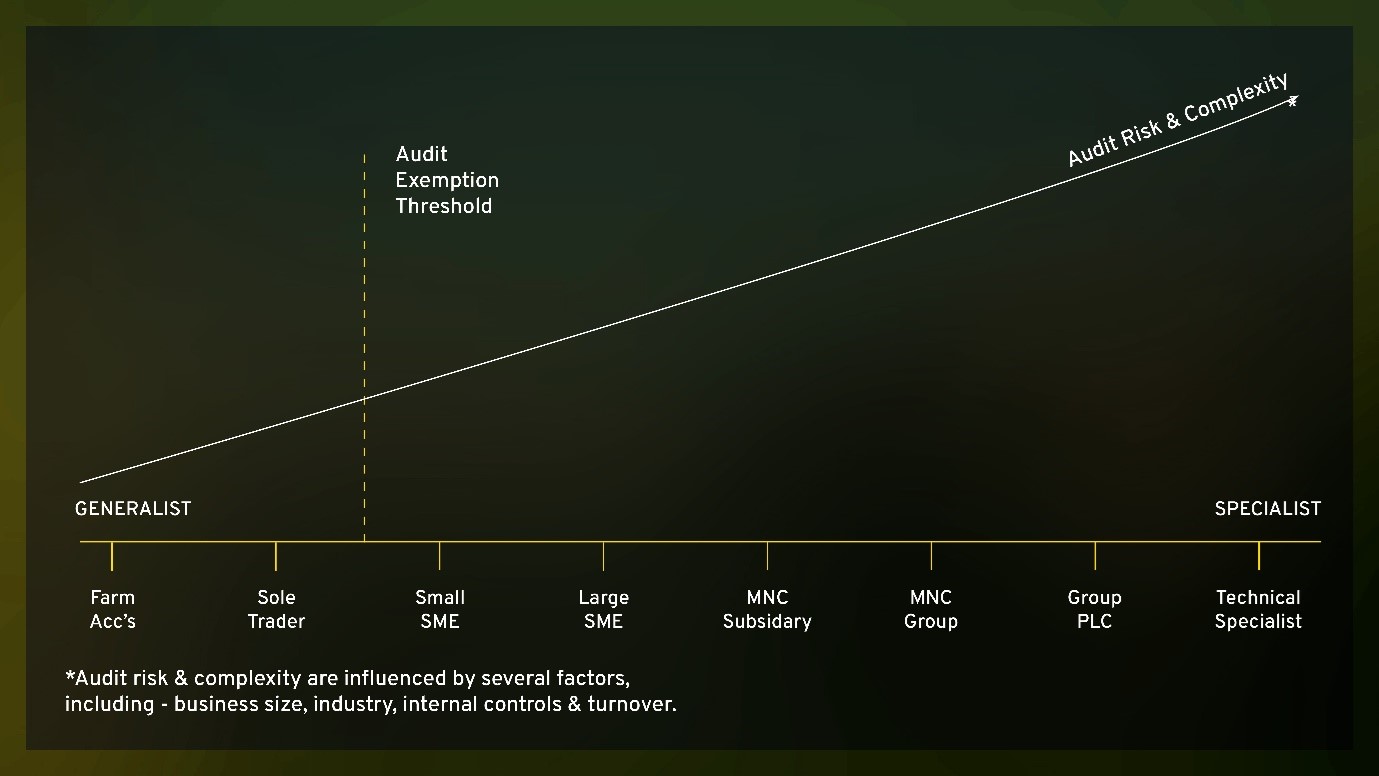

For the purposes of transparency, let’s categorise the audit landscape into two categories based on client base – Generalist and Specialist.

As a Generalist…

Client Base – usually serves local businesses and SME’s. More diverse in terms of industry. More likely to have direct and frequent interactions with clients, providing personalised services while building strong relationships.

Scope of Work – a broad range of audit responsibilities and tends to be involved at all stages of the audit – planning, execution and reporting. Need to adapt to a variety of client needs and industries, offering a broader skillset. The audit team can also wear multiple hats and support other areas of the firm, i.e. payroll, accounts preparation, tax compliance.

Team Structure – Smaller teams, often with more responsibility and autonomy. Less hierarchical in terms of structure.

As a Specialist…

Client Base – support larger businesses, including multinational corporations, public companies and government entities. Relationships tend to be managed by senior members of the team, so less direct client interaction at a junior level. Larger audit firms can have dedicated industry teams, allowing you to develop a niche, so you may only gain exposure to certain industries, i.e. financial services, pharmaceuticals, technology.

Scope of Work – the audits tend to be larger and more complex, with enhanced reporting requirements leading to a higher degree of risk. They can also involve multiple accounting standards, various jurisdictions and extensive documentation. Roles will be more specialised, and you may only focus on a specific area of the audit. More likely to use advanced audit software and data analytics tools.

Team Structure – Larger teams, often with less responsibility and autonomy. More hierarchical in terms of structure, with defined roles. More likely you will collaborate with other specialists, i.e. tax, advisory.

#3 Base

As we have explored above, the role of an auditor can differ depending on the client portfolio, which tends to be influenced by the size of the firm you’re working in.

For the purposes of transparency, we’re going to focus on years of experience and audit category (Specialist or Generalist).

This is also a very broad guideline, and it’s important to understand the specifics of each individual role, i.e., people management, scope of responsibilities, business development initiatives and technical knowledge.

As you will notice, deemed specialists are paid a premium for their technical knowledge as their clients are under more scrutiny in terms of financial regulation.

#3 Demand v Supply

The demand for audit professionals in practice continues to outweigh the supply of experienced audit professionals, which can largely be explained by:

- Near-full employment.

- Increased global financial regulation, resulting in further demand for audit services (and talent).

- Significant outflows of talent to other verticals (mainly industry accounting and financial services).

The audit professional is in “very high demand”. Here are some data points about the audit talent pool in Ireland this quarter. It’s important to note that while a portion of the talent pool is demonstrating job-seeking behaviours, the majority are likely to be seeking a move away from the external audit profession.

#4 What are employers doing to attract Audit talent?

- Flexibility – while client demands and statutory deadlines will dictate working arrangements, flexible working hours and an opportunity to work from home are essential. Part-time arrangements may be worth considering in certain circumstances.

- Monetary – competitive base salaries that are talent-led rather than budget-led, and definitive salary review periods. Strengthening additional benefits, i.e. sign-on bonus and bonus multipliers, to recognise professionals exceeding expectations.

- Career Progression – defining clear paths for progression in the current role and offering promotions based on performance rather than tenure.

- Learning & Development – rotations through different departments, exposure to various types of audits, and opportunities to work on diverse projects. Offering a sense of purpose is essential for auditors and has recently been connected to sustainability assurance and reporting.

- Boomerangs – Employers are placing greater emphasis on “boomerang” employees—those who leave and later return. By fostering positive relationships with former staff and creating a welcoming environment, companies can benefit from their experience while signalling a commitment to long-term career growth

- Embrace technology to remain relevant – those considering a career in the profession wish to embrace advanced technologies. While certain firms can fulfil that wish, others are lagging. Bridging the technology gap is a strategic imperative for the profession.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Aoibhín Byrne, our Audit Talent Advisor & Recruiter here in Barden (aoibhin.byrne@barden.ie); we’re where leaders go before they start looking for Audit talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Aoibhín Byrne at aoibhin.byrne@barden.ie.

Jump Back

Jump Back