Your FAE exams will soon be a thing of the past, and Barden is here to guide you with real-time insights and a network of top employers. Ed Heffernan takes you through the finance and accounting market and helps you plan your future path.

In Barden, we’re obsessed with sharing real-time insights to help Chartered Accountants make more informed decisions about their future. That’s why we spend so much time working with CASSI, the Young Professionals and Chartered Accountants Ireland on this FAE Guide. It’s important to you, so it’s important to us. The earlier in your career you understand the market fundamentals, the more strategic you can be with your career decisions once you qualify. That’s why we do what we do – Barden is here to guide you through those fundamentals so you can put yourself on the correct career path. It also helps that all of the top employers in Ireland work with us here in Barden to help build their accounting, finance and tax teams – when you know what you want to do, we’ll have the network to help you do it. In this article, we wanted to share a couple of the basic insights to get you started and perhaps give you a feel for what might be there for you when you finish your training contract.

1. Choose your course

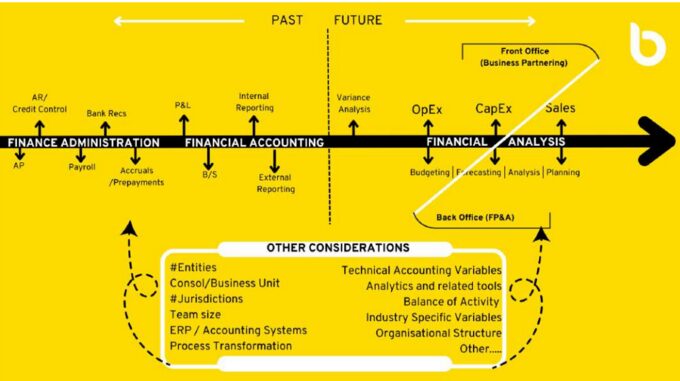

This is what we call the continuum of activity in Barden; it’s a simple visual to help you map out the activity in a basic finance team and understand the context of the roles you will look at after you qualify. There are a few things you should keep in mind.

Organisation size

Think of the continuum like a coiled spring – collapse it down for a smaller business/entity, and one person does everything. Expand it for a larger business, and you get specialisation emerging in various areas such as tax, stat reporting, and technical accounting. Overlap finance process transformation on any element. Why does this change? With size comes complexity.

Path of least resistance

Most newly qualified accountants (roughly 80 percent) make their first move into financial accounting. With experience and understanding of how to produce a profit and loss statement comes the right to have an opinion on it. By contrast, only about 10 percent move straight into financial analysis, and those who do often come from non-audit departments. Why is financial accounting so common? It’s where hiring managers see the easiest transition from an audit or related background.

Organisational structure

The nature of the financial accounting activity and how much of the continuum it covers will often be a manifestation of the organisational structure (group function v shared services sector v small and medium enterprise, for example). Job titles mean nothing without context, and every financial accountant role will be subtly different depending on the structure in which it sits and the division of labour on the team.

The balance of activity in a job

The balance of activity in a job specification can be very telling. People list tasks in job postings but rarely do they give those tasks a weighting of time. Why? Because very few people think about jobs like we do in Barden. This continuum can be very useful when reviewing job specs and understanding what the role you are going for actually involves. When the time is right for you, talk to the team in Barden to understand this continuum and a number of other lenses we use to help accountants navigate the jobs market.

2. It’s all about the base

Frankly speaking, qualifying as a Chartered Accountant is worth it. In Barden, we chart actual market data on a quarterly basis to make sure we know exactly what you should be paid in the external market. We also advise all of Ireland’s top finance teams on how to structure rewards for their people. If you want data, we got data. Check in with us closer to the end of your contract to get real-time salary and package insights – supply and demand pressures do have an impact. Right now, though, we can tell you that our clients are paying between €62,000 and €65,000 base salaries and circa 10 to 15 percent bonus as standard for financial accounting and related roles. There are outliers for sure, but that range is where the majority land. Curious about what package comes with the above? Want to know what the average annual leave is, how companies are dealing with hybrid and if healthcare coverage is the norm? When you’re about three months out from finishing your training contract, drop us a line, and we’ll get you that data in real-time.

3. We have more to share. Just ask.

Once you are on the other side of your FAEs and have the headspace to start seriously thinking about your future, then you should check out the Barden career guide for newly qualified accountants. This guide is packed full of insights and has been used as a career compass by thousands of newly qualified accountants over the past decade. If you want one-on-one advice on everything from CV formats to interview preparation, or if you want exclusive access to Ireland’s top finance teams, make sure to drop us a line when the time is right for you, and we can take it from there. Simple.

Source: FAE Exam Guide 2023

Jump Back

Jump Back