Ireland is a thriving hub for corporate treasury, with a strong demand for corporate treasury professionals. Offering a favourable business environment, low corporate tax rate, and a well-educated workforce, Ireland has attracted a growing number of multinational corporations, many of which have established their treasury operations here.

The strategic importance of corporate treasury functions has grown as businesses face an increasingly complex and volatile business environment. While there is no formal entry route to the world of corporate treasury, we’ve noticed that the talent pool has transformed over the last few years. Treasury professionals’ roles have taken centre stage – the flow of and the value of funds having a material impact on company performance now, more than ever. This has naturally driven a demand for treasury professionals to really get involved in business and financial strategy for companies, large and small.

One thing is for sure, a career in treasury, whilst it may not be a traditional role in business finance, is an exciting, rewarding and varied career and a profession in demand in Ireland and internationally.

We have spent a lot of our time getting to know a large cohort of this pool, and here’s what we’ve noticed…

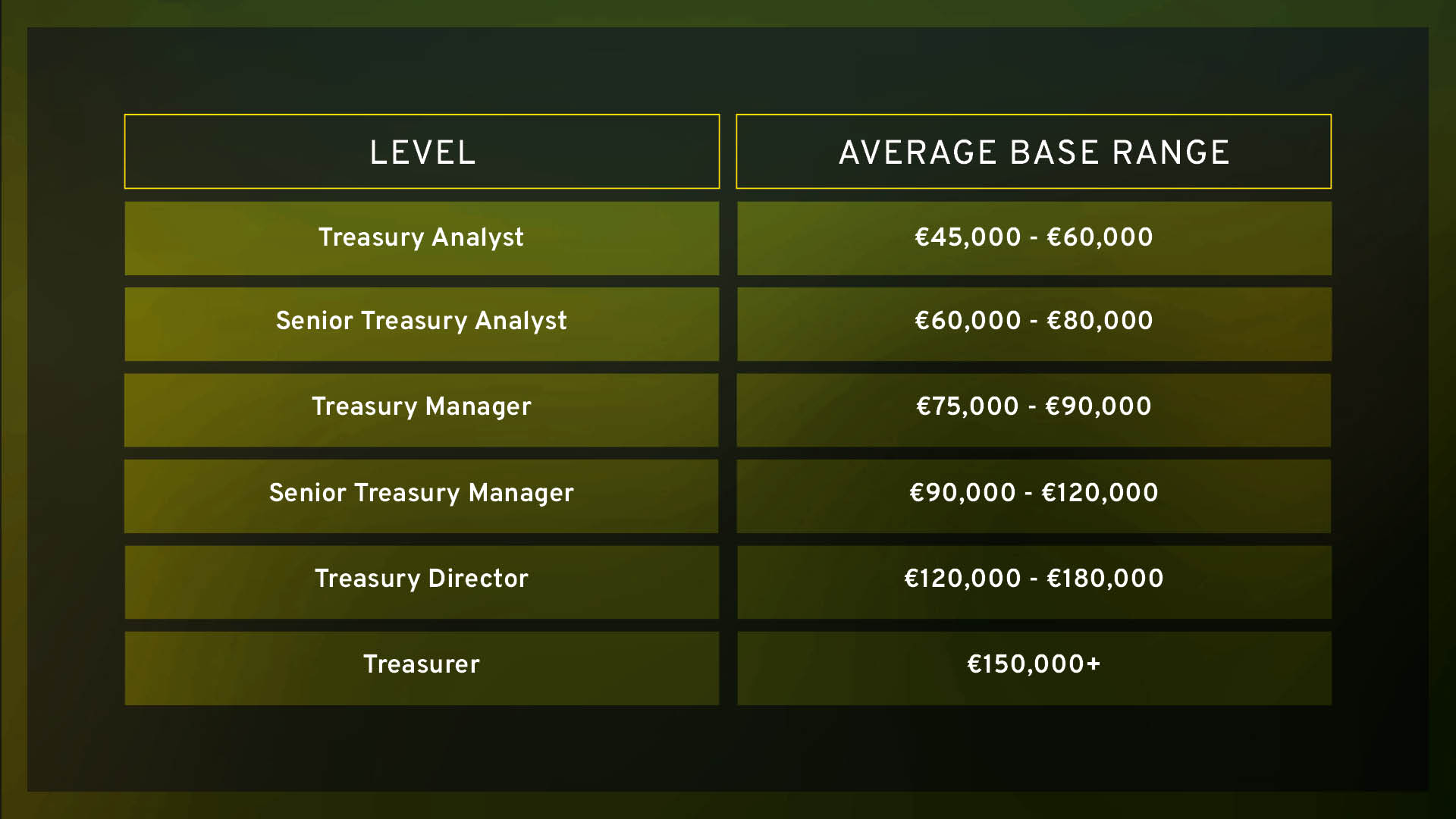

#1 Base Salary

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice please contact our team; aoibhin.byrne@barden.ie (Leinster), kate.flanagan@barden.ie (Ireland) or aideen.murphy@barden.ie (Munster).

For the purposes of transparency, this is a very broad guideline, and it’s important to understand the specifics of each individual role, i.e., reporting manager, size of team, scope of responsibilities (context is very important when considering salary guides as we further delve into #2 below!).

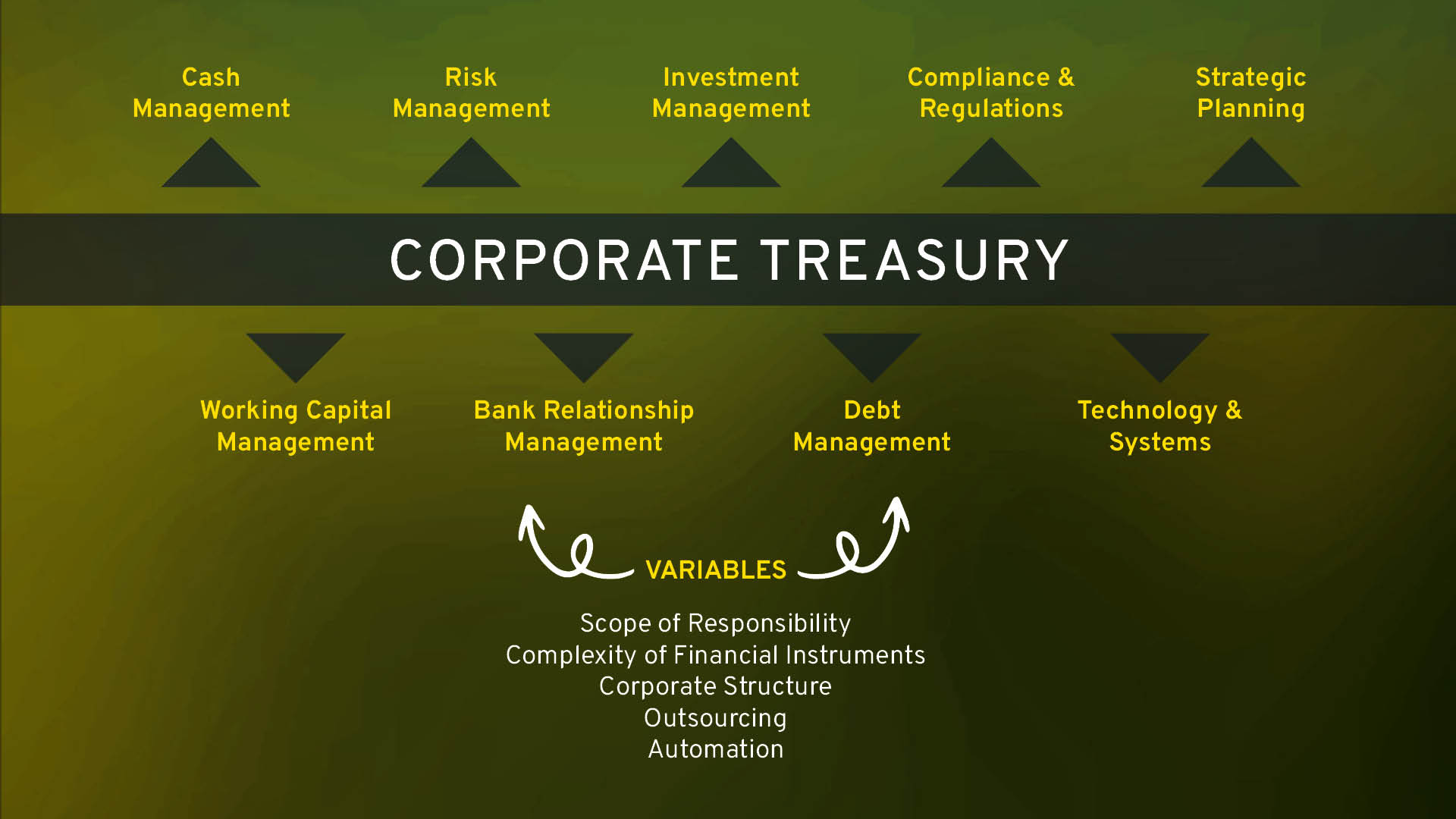

#2 Corporate Treasury Landscape

A job title in Corporate Treasury doesn’t define your role in the external market. This is largely dictated by the structure or landscape of a business. The core responsibilities of the Corporate Treasury Professional will greatly vary from business to business (which we have highlighted at #3). But in general scope of responsibilities will fall under some (or all) of these verticals.

Corporate Treasury functions manage a company’s financial assets, liabilities, and liquidity to ensure financial stability, which in turn helps to support the strategic goals of the business. The landscape of corporate treasury is broad, and job responsibilities may vary based on the size and complexity of the organisation. These responsibilities collectively contribute to the effective management of a company’s financial resources and play a crucial role in supporting its overall financial health and strategic objectives.

#3 Variables

The difference in size and scale of treasury functions will depend on the scope and complexity of their respective operations. Typically, you may notice the following between smaller and larger functions:

- Scope of Responsibilities: Larger treasury functions tend to handle a broad spectrum of activities (cash management, risk management, investment management, debt management, and strategic financial planning). Smaller teams tend to focus on a more limited set of activities.

- Complexity of Financial Instruments: Larger treasury teams tend to manage a complex portfolio of financial instruments. Smaller teams deal with a simpler financial structure with fewer instruments.

- Corporate Structure: The larger the corporate treasury function, the more specialised your day-to-day tends to be. The smaller the function, the broader your day-to-day will be. Larger companies with global operations require larger treasury teams to manage international complexities. Smaller teams may focus on domestic operations or have a simpler international presence.

- Outsourcing: It can be more cost-effective for a business to outsource treasury functions or certain treasury duties to external service providers.

- Automation: Smaller businesses may leverage technology platforms and software to manage cash flow, payments, and other financial functions without the need for a dedicated treasury team.

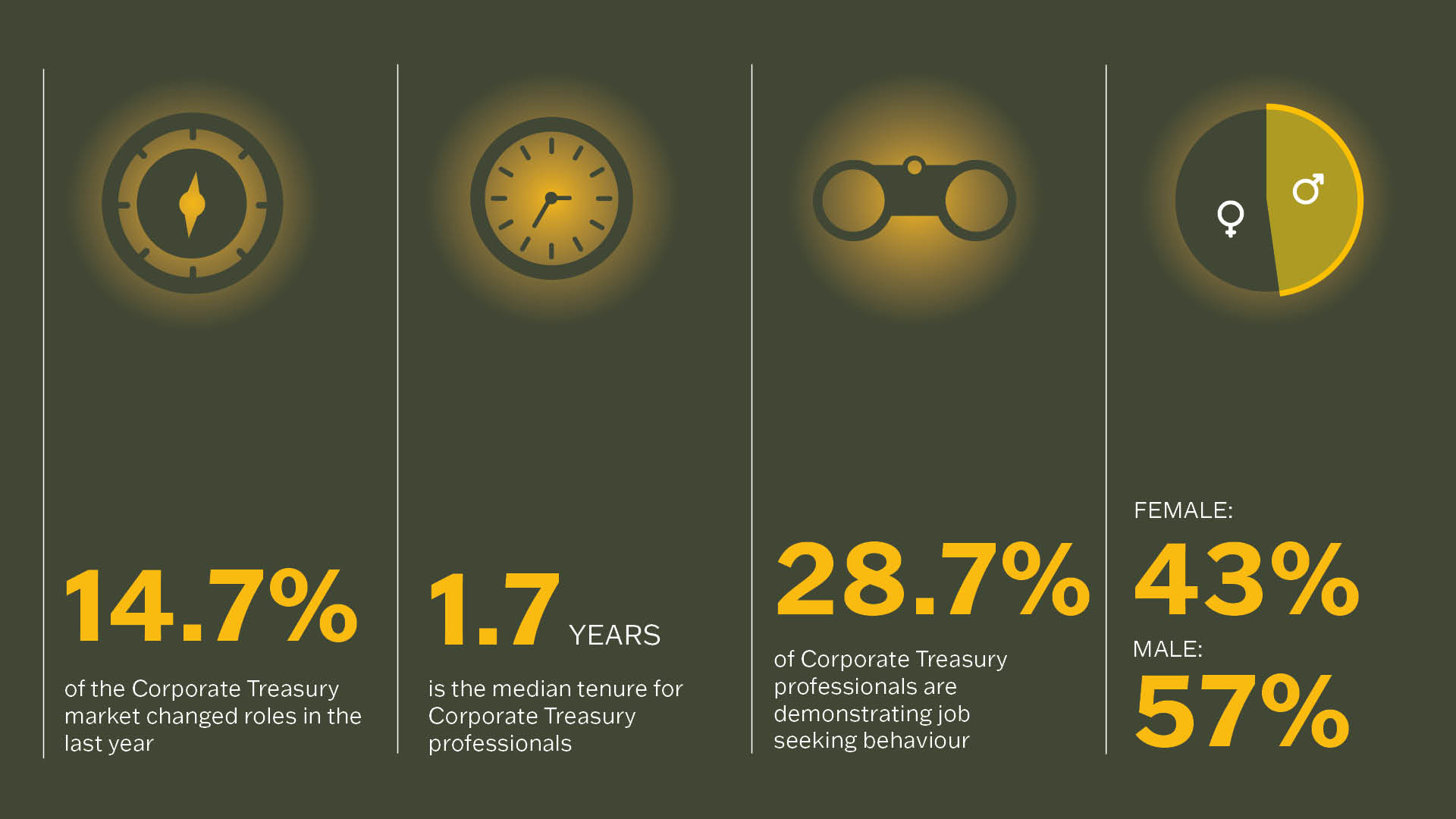

#4 Current Snapshot of the Treasury Talent Pool

Here’s what we’ve noticed this quarter in the Corporate Treasury talent pool in Ireland:

* The specific skillset required by a business or treasury function will dictate the pool of talent available. Depending on the role, you may only be able to consider a small fraction of the total estimated talent available due to a potential shortage of certain skills.

#5 What are the recruitment considerations for companies in 2025?

- Limited Pool of Experienced Professionals: The demand for experienced corporate treasury professionals is expected to outweigh supply in 2025, as the Irish economy continues to grow, and businesses expand their operations.

- Rising Compensation Expectations: With an increased demand for experienced corporate treasury professionals, compensation expectations are also on the rise to combat the lack of supply of talent.

- Skills Gaps in New Talent Pool: While there is a growing number of professionals eager to join the corporate treasury community, many of these individuals may not have the specific skills and experience that companies are looking for. Businesses should embrace this skills gap if possible and look beyond the technical treasury experience requirements if professionals can demonstrate other transferable skills.

- Digital Transformation in Treasury Operations: The treasury function is undergoing a digital transformation, with the implementation of new technologies to automate tasks, improve efficiency, and gain greater visibility into financial data. Corporate treasury professionals will need to embrace these new technologies, which may result in an initial knowledge gap for businesses. Enhanced L&D opportunities would be encouraged for new joiners.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Aoibhín Byrne (Leinster), Kate Flanagan (Ireland) or Aideen Murphy (Munster) our Corporate Treasury Talent Advisory & Recruitment team here in Barden (aoibhin.byrne@barden.ie; kate.flanagan@barden.ie; aideen.murphy@barden.ie); we’re where leaders go before they start looking for Corporate Treasury talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Aoibhín Byrne (Leinster) at aoibhin.byrne@barden.ie, Kate Flanagan (Ireland) at kate.flanagan@barden.ie or Aideen Murphy (Munster) at aideen.murphy@barden.ie.

Jump Back

Jump Back