Finance transformation isn’t just about new systems or processes; it’s about delivering meaningful & lasting change. The best transformations don’t just improve finance functions; they enable smarter decision-making, drive efficiency, and future-proof businesses, enabling the finance function to scale. When done right, finance transformation feels seamless, but behind the scenes, skilled professionals are making it all happen.

At Barden, we understand the Finance Transformation space and the talent that drives it. Our latest talent monitor highlights specific trends and data around the movement, availability and salary trends for Finance transformation professionals in Ireland. If you’re thinking about strengthening your team in the coming months, here are a few key things to consider.

#1 Finance Transformation Professionals – Verticals

Finance transformation specialists are the architects of change, translating vision into action. Their work may not always be front and centre, but the impact of what they deliver is significant. Finding the right talent to shape and execute transformation initiatives is critical to ensuring meaningful, sustainable results.

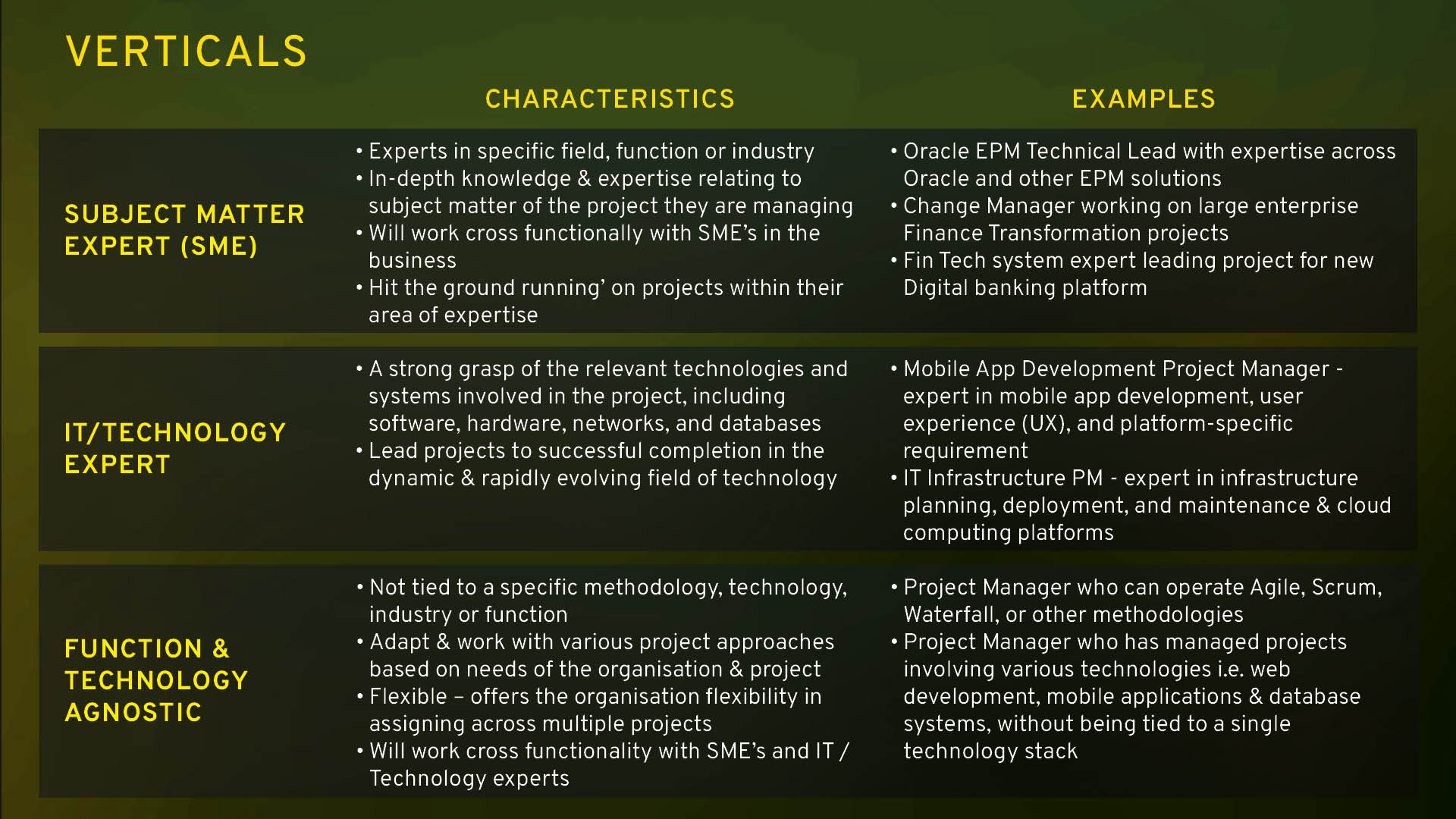

In Barden, we categorise Finance Transformation professionals across 3 core verticals as follows:

- Subject Matter Expert

- IT / Technology Expert

- Agnostic – SME & Technology

Let’s explore the verticals in more detail including typical characteristics and examples, delving into the SME category in more granular detail.

When defining your talent needs for a finance transformation program you should focus on the key verticals and essential attributes required for successful delivery. It will of course be dependent on the Finance project or programme of work you are looking to deliver. It is worth noting that most projects will have a number of these verticals involved; for example, when delivering an ERP project, a technology professional with expertise in delivering ERP projects will work alongside SME’s in areas such as Record to Report, Order to Cash, Finance & Controlling.

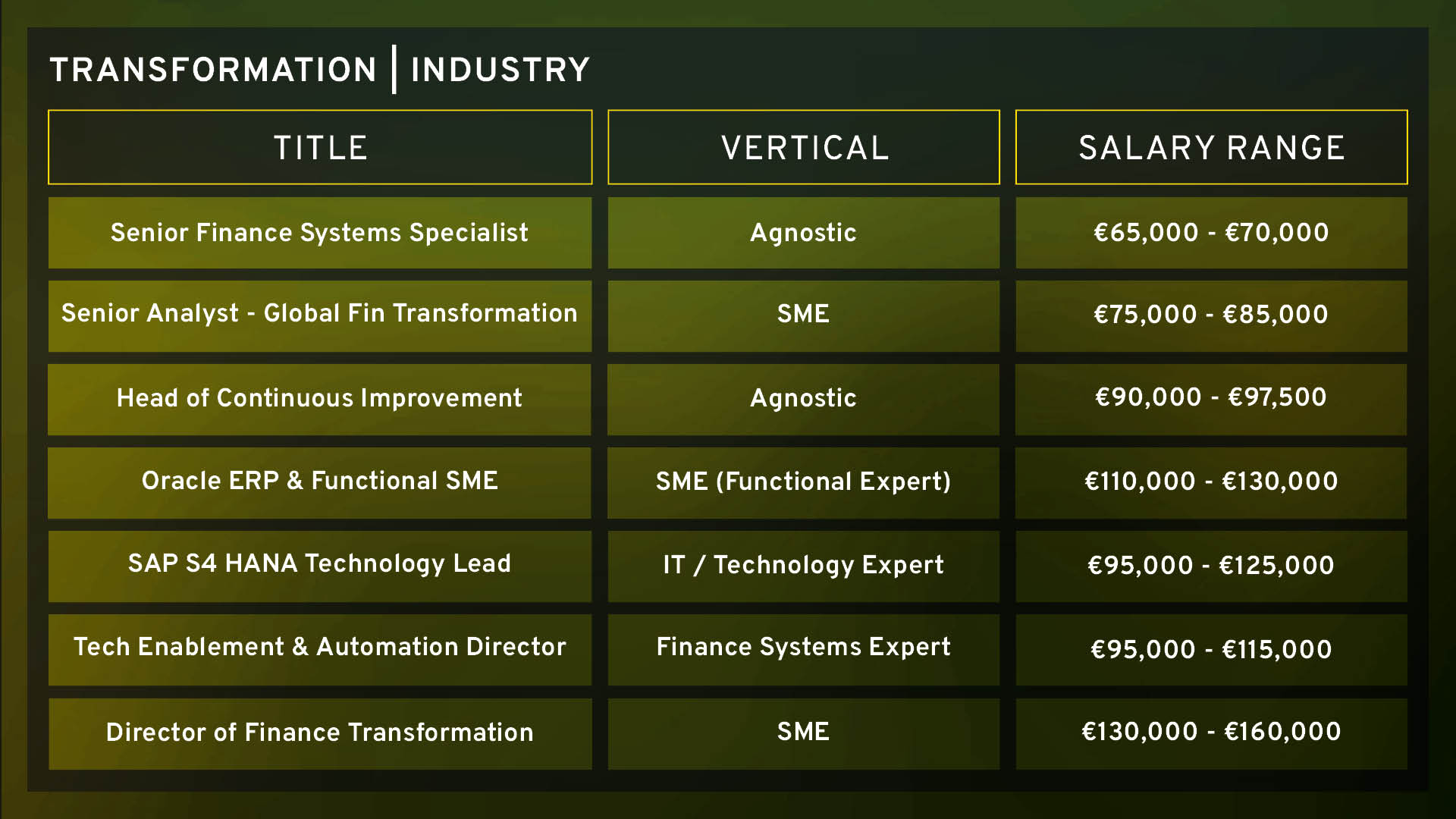

#2 Base/Salary Considerations

Salaries have remained steady over recent quarters and are in line with average salaries monitored throughout 2025. Below are some guidelines for salaries, for Finance Transformation roles both within industry and practice.

Some important points to note:

- Figures above relate to base salary only.

- Context is key – this includes both context on breath and scope of the role and sector in which the role resides. There can be considerable variances in these figures dependent on those variables including industry, scope of responsibility, geographical reach, reporting line and years of experience.

- Important consideration is being attributed to benefits outside of base salary. These include bonus, health (individual & family), pension, LTIP’s (level dependent), hybrid working arrangements etc. These are as important to people as the base salary alone and often form key aspect of attracting talent to an organisation.

- Offering 23–25 days of annual leave or more is critical. Anything less puts companies at a notable disadvantage in attracting and retaining talent.

Bespoke salary advice based on your unique set of requirements is always the best approach to benchmark salaries for the talent required in the project and transformation space.

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster. For bespoke advice please contact our team; catherine.drysdale@barden.ie (Leinster) or christine.mccarthy@barden.ie (Munster).

#3 Continuum of Activity | Finance Transformation

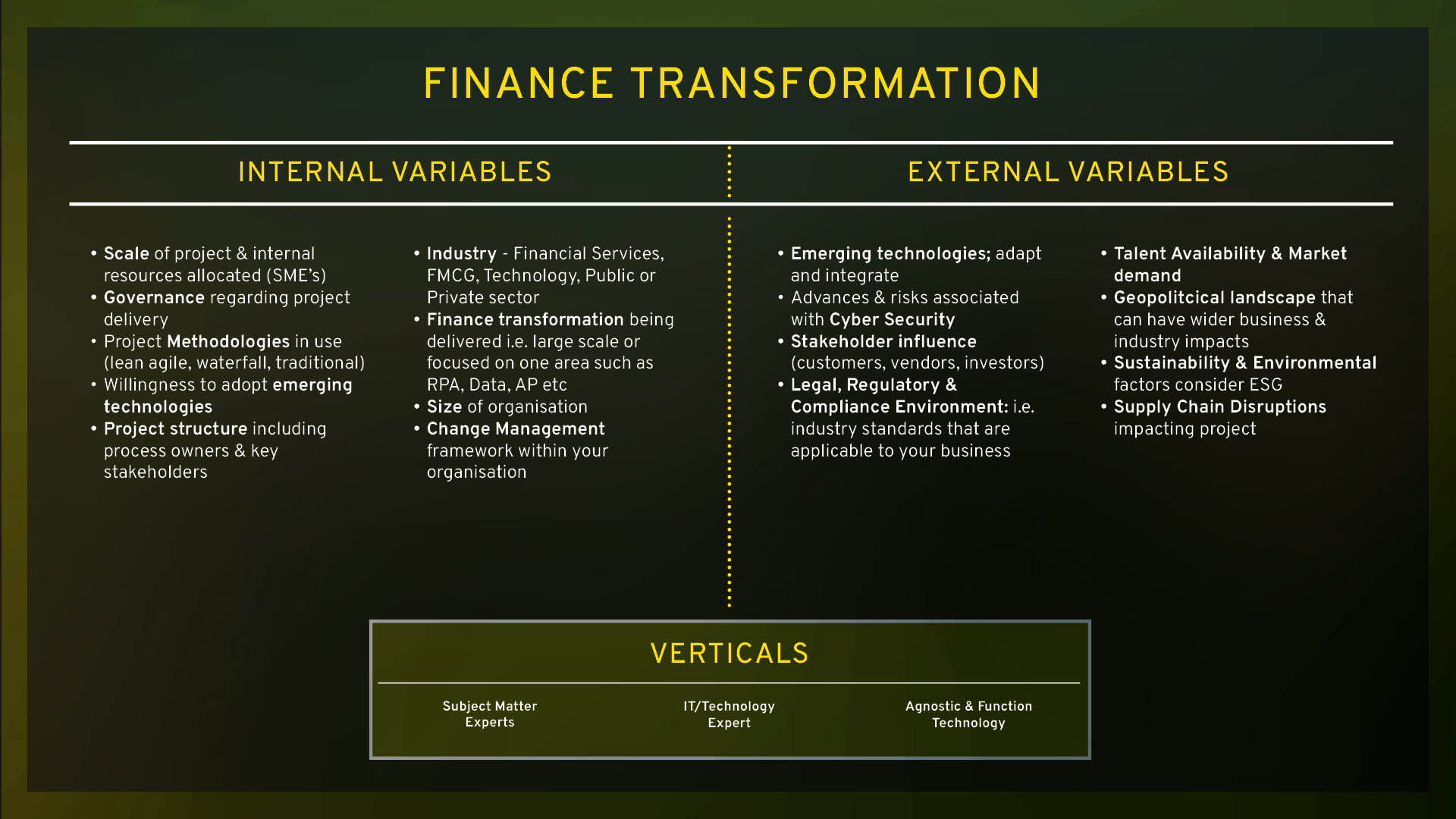

The variables that are relevant to the role you are hiring for matter a lot in Finance Transformation and will play an important factor in defining the base salary and overall remuneration package. We have provided below some general guides along with an overview of both the internal & external variables, some include:

- Technology or SME expertise – a project requiring specialised skills in areas such as ERP, emerging technologies, Change and programme management and IT or specific industry expertise can contribute to higher salaries.

- Project Complexity – The complexity and scale of the finance project or programme often comes with higher compensation & specialised niche talent requirements.

- Industry and Sector – Project and transformation talent working in specific sectors such as Technology or financial services may receive higher compensation due to the specialised knowledge and complexities associated with programmes of work being delivered.

- Responsibilities and Scope – Transformation experts overseeing a portfolio of projects or managing cross-functional teams are likely to receive higher salaries compared to those handling smaller, less complex projects.

- Market Demand & talent availability – The demand for finance transformation professionals in a particular region or industry can influence salaries and may lead to increased compensation. For example, talent specialising in ERP implementations such as Oracle Fusion & SAP S4 HANA are seeing increased demand for their expertise as organisations move from on-prem to Cloud solutions across those ERP platforms.

#3 Talent Availability & Working Arrangements

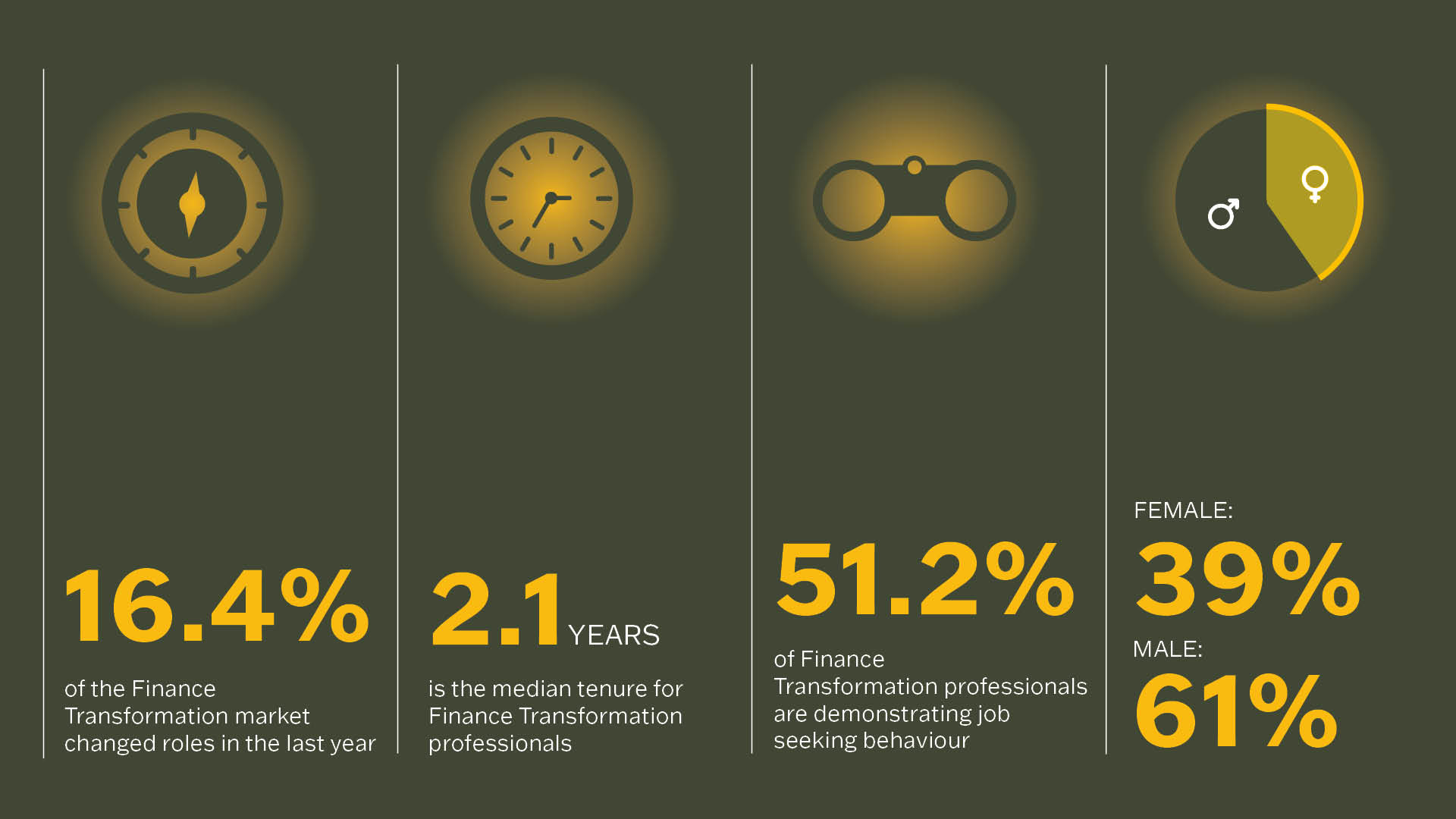

Demand remains “very high” for finance transformation professionals across both industry and practice. Here are some key data points about the Finance Transformation talent pool in Ireland this quarter:

- The first quarter of the year is traditionally when bonuses are paid and promotions are granted, which tends to reduce employee movement and leads to a tighter talent market across the board.

- There has been a surge in demand for talent across projects, transformation and change functions, particularly in roles at the intersection of compliance, risk, operations, finance and technology. At Barden, we see this play out across sectors, including financial services, pharma, technology, fintech, and beyond, as companies respond to increased scrutiny, new standards, and heightened expectations from regulators, investors, and the public alike.

- Given the current geopolitical landscape and uncertainty surrounding the Trump administration, there’s a sense of caution among transformation professionals especially those at senior level, many of whom are choosing to stay put and wait for more stability.

- A marked shift in hybrid models has been experienced since the start of 2025 with 71.6% of roles now aligning to a 2–3-day hybrid model, making it the clear standard for most organisations. Notably, full-time office work has increased from 7.6% to 13.3%, which is undeniably reflective of the move by some US multinationals and others to a five-day working week in the office in H1 of this year.

- Fully remote roles continue to decrease, now accounting for just 4.4% of jobs. This highlights that expectations of 100% remote work no longer align with market realities.

#4 Key Considerations for the Next 12 Months

The Finance Transformation Office within any organisation continues to play a vital role, especially in the context of the continued heightened focus on finance transformation. Staying agile and forward-thinking will be critical for professionals in this space.

Some key considerations for the year ahead:

- Compliance at the Core of Transformation & Change: Project and change professionals are no longer operating on the periphery of compliance; they are being pulled into the centre of it. Whether it’s leading SOX readiness programmes, DORA implementation, ESG reporting readiness, or integrating cybersecurity and privacy solutions, transformation teams are increasingly at the forefront of regulatory and compliance initiatives. This shift requires new capabilities, including understanding the language of controls, compliance, and regulation and designing change initiatives that meet both business and regulatory objectives. For employers, this means the talent profile is evolving.

- Project Governance: As transformation agendas grow in scope and complexity, strong project governance remains a key consideration. Placing continued emphasis on clear prioritisation, structured oversight, and tangible value tracking across finance transformation programmes is a key aspect to ensure successful delivery. This drives demand for talent with deep programme governance expertise, not just delivery capability.

- AI Governance & Ethics: With AI adoption, Finance leaders must manage risks such as bias and transparency while ensuring compliance and accountability to maintain trust and drive responsible AI use across their finance functions.

- Cybersecurity considerations: As organisations accelerate digital transformation, cybersecurity risk continues to remain a top priority. Finance transformation initiatives must embed security from the outset, requiring leaders to be well-versed in risk management & data privacy regulations. Close collaboration with key business stakeholders is essential to proactively identify and mitigate vulnerabilities, ensuring transformation outcomes are secure and compliant. This is especially important in highly regulated environments such as financial services.

- Value creation through data: Companies with large, fragmented data systems will need Transformation talent who can integrate these systems, unlocking the value of data across the organisation for smarter decision-making and competitive advantage.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Catherine Drysdale (Leinster) or Christine McCarthy (Munster) our Finance Transformation Talent Advisory & Recruitment team here in Barden (catherine.drysdale@barden.ie; christine.mccarthy@barden.ie); we’re where leaders go before they start looking for Finance Transformation talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Catherine Drysdale at catherine.drysdale@barden.ie or Christine McCarthy at christine.mccarthy@barden.ie.

Jump Back

Jump Back