Barden’s Financial Accounting Talent Strategies & Insights is a bi-annual report focused exclusively on the Accountancy profession within Ireland’s private sector. It examines the trends shaping talent dynamics, with data covering Ireland’s entire qualified accounting market. The data is sourced from LinkedIn, proprietary Barden data, and other third-party sources.

1.1 Overview

There are approximately 55,000 qualified accountants (ACA, ACCA, CIMA, CPA etc.) in Ireland – this is an ever-evolving figure given the annual churn caused by retirements, new accountants qualifying and immigration/emigration. This report offers actionable insights to help finance leaders make informed decisions about attracting, retaining, and developing this cohort of talent in a rapidly evolving market.

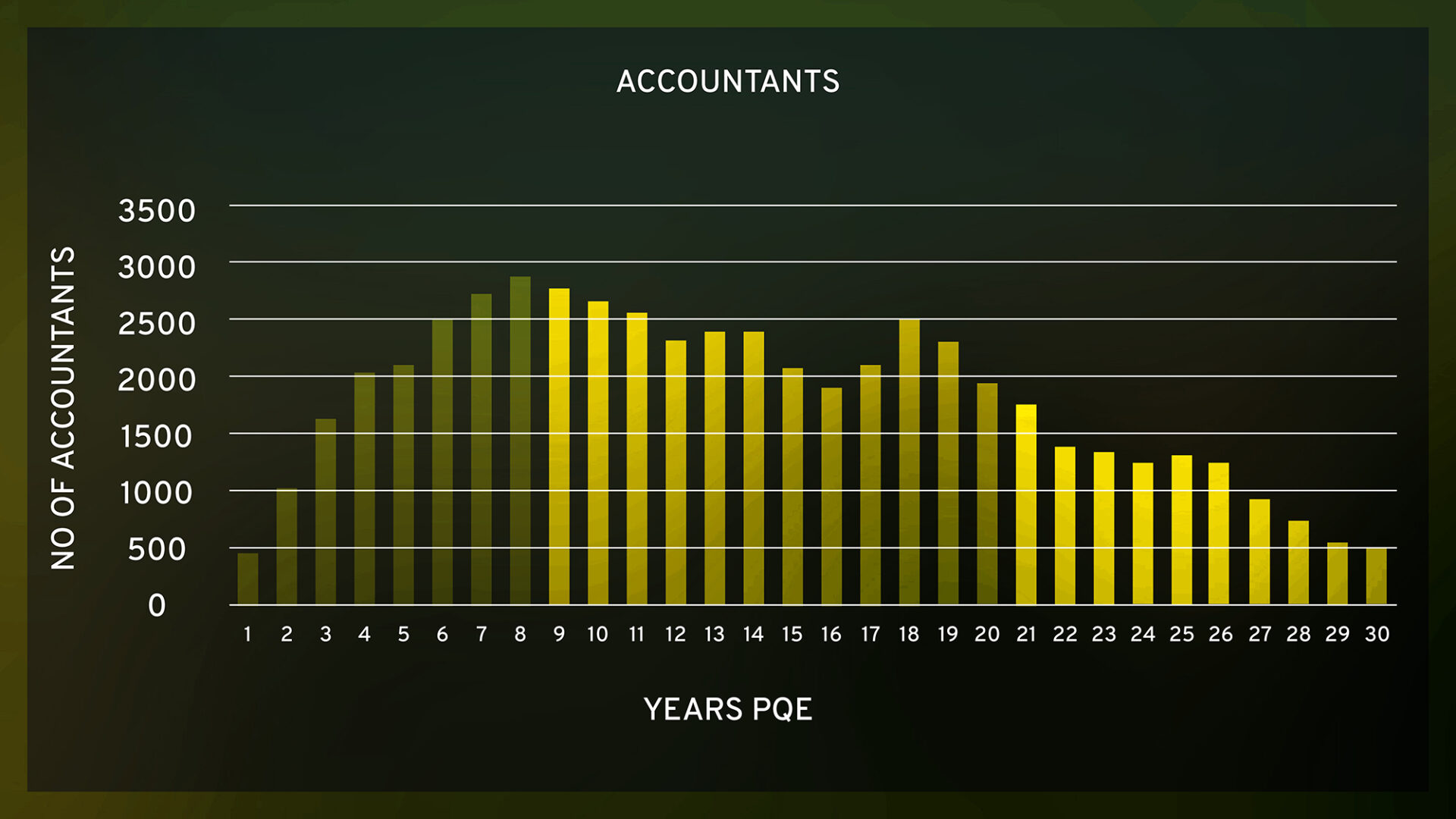

The graph above shows the distribution of qualified accountants in Ireland by years of qualification. Depending on the level of experience you are looking to hire for, there are certain things to consider when looking for talent;

- 0 to 8 years (28% of the qualified population) – This cohort will be less experienced, so it is important to be flexible on the exact experience you are looking for and to consider other factors like potential, academics, openness to travel etc. This is also the most transient cohort of accountants and will be more open-minded to exploring new opportunities.

- 8 to 20 years (51% of the qualified population) – This group will be more experienced but more expensive and less likely to change roles. These professionals will become more specialised and/or industry-specific, which makes this a prime group for finding people with relevant and specific experience. However, as expected, people at this level may put a higher importance on work-life balance, flexibility, hybrid working, and part-time working due to family commitments.

- 20 years+ (20% of the qualified population) – Most experienced but least likely to consider moving roles/organisation. For professionals in this cohort, it is essential to focus on developing new skills and embracing new technologies.

1.2 Job-Seeking & Medium Tenure

The median tenure for accounting professionals currently stands at 1.7 years, on par with the national average of 1.6 years, as reported in Barden’s National Talent Monitor. This trend highlights the dynamic nature of the accounting profession, where employees regularly move between roles in search of new opportunities, skills development, promotions, and better compensation.

“Job-seeking behaviour” is derived from LinkedIn and represents people who actively apply for roles, have shared a profile update, recently uploaded a CV, or work at companies that may be experiencing layoffs. For accountants in Ireland, this was 27%, which again is higher than the national average of 20.2%. Given the lower-than-average median tenure, this doesn’t come as a surprise and shows that the talent pool is more dynamic than other professions.

1.3 Observations

- It’s important to note that the median tenure is not limited to a change of employer but also incorporates changes of role within the same business, i.e., promotions, changes in job titles, etc.

- These trends are likely amplified by the 0-8 years PQE, recently qualified end of the profession, where median tenures are short due to emigration/travel, faster promotion cycles and a desire to try different specialisms and industries.

- Many accountants will also move roles shortly after qualifying i.e. leaving practice to explore industry, which again impacts the median tenure.

2.1 Job Posting Trends

Online job posts decreased by approximately 16% from Q1 2024 to Q1 2025 (based on data taken from LinkedIn, Indeed, and IrishJobs). This could be a sign of increased uncertainty in the market due to the evolving US tariff affair.

From a macro perspective, there has been an overall drop in both unemployment and job vacancy rates, reflecting historically low unemployment levels and ongoing significant demand for talent. This positioning suggests that despite the decrease in Q1 job postings, the overall job market remains competitive and is expected to remain so in 2025.

3.1 Gender Balance

The accounting profession has 56% female and 44% male workforce participation. This shows that the profession boasts a 13% higher female participation rate than the national figure of 43%.

However, disparities do still exist across specialisms and seniority levels.

3.2 Hybrid policies

The above is based on a material sample of the Financial Accounting population in Ireland. As you can see, the most common WFH policy across the accounting profession is 3 days per week in office at 53%, slightly higher than the national average (circa 43% of all private workplaces adhering to a 3-day model). There has been a notable shift to more office-based working over the last 12 months, and although this is expected to continue, there is no expectation for major changes to what we see in the graph above.

Certain industries are more inclined to be office-based. The Construction, Real Estate, and Property development sectors tend to have higher in-office requirements, as do some SMEs. The technology sector has higher levels of remote working, but this has declined over recent years as more US multinationals have called people back into the office (Salesforce, Amazon, etc.).

IrishJobs research shows that nearly half of all job seekers would be happy to turn down a role that does not offer hybrid working arrangements. This statistic is consistent with what we have seen in the market – where hybrid working arrangements are as important for some people as salary, location and the role itself. Where possible, offering a flexible WFH policy gives access to a much larger pool when looking to attract new talent.

It is important to note that working arrangements change depending on seniority and specialism in finance. Certain specialisms, like Corporate Finance, Corporate Development, Finance Business Partnership, and senior management positions, are more likely to be office-based regardless of wider company policies. Therefore, the number of people attending the office may be higher than the percentages outlined above, as this is based on company policy rather than how often people attend.

4.1 What companies can do to attract and retain talent?

To attract and retain top talent, companies need to offer more than just competitive salaries. Office culture, benefits, and workplace flexibility are crucial considerations, as are structured career growth pathways so talent can see long-term opportunities within the organisation.

- Invest in internal skill development to upskill talent and enhance career progression, rather than relying solely on external hiring.

- Facilitate internal moves where possible for people looking to explore different areas of finance. For example, transitions from Group Finance to FP&A and vice versa should be made to avoid team members looking externally.

- Provide examples of staff who have progressed internally and have had the opportunity to explore different sub-teams within finance. Facilitate this as much as possible to avoid losing existing talent.

- As some companies return to on-site work, maintaining hybrid or remote options (where possible) can provide a competitive edge in attracting and retaining talent.

- Some businesses won’t consider talent who require sponsorship or don’t have local experience. However, there is a significant pool of qualified accountants with strong overseas experience. Keeping an open mind to this experience and exploring the requirements to provide sponsorship will give access to a largely untapped talent pool.

Sources

The above data provides valuable national-level insights but competition for talent is typically local rather than national. While understanding the macro perspective is essential, it should be complemented with real-time, localised, peer-to-peer comparisons to assess your organisation’s true competitiveness for talent and inform strategic decision-making. For example, a large multinational group function will typically not be competing for the same talent as a local SME in a given location.

This is where Barden can help you. We offer over 20 profession-specific talent monitors, such as for early-career accountants or data analysts, that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

*For more detailed insights, peer comparisons, company-specific turnover data, performance benchmarks, or gender diversity trends by profession and level, contact Ed Heffernan at ed.heffernan@barden.ie for bespoke insights to help shape your talent strategy.

Jump Back

Jump Back