Barden’s Financial Accounting Talent Strategies & Insights is a quarterly report focused exclusively on the Accountancy profession within Ireland’s private sector. It examines the trends shaping talent dynamics, with data covering the entire qualified accounting market in Ireland. The data is sourced from LinkedIn, proprietary Barden data, and other third-party sources.

This report aims to offer actionable insights to help Finance leaders make informed decisions about attracting, retaining, and developing this cohort of talent in a rapidly evolving market.

1.1 Demographics

There are approximately 55,000 qualified accountants (ACA, ACCA, CIMA, CPA etc.) in Ireland (source here and here) – this is an ever-evolving figure given the annual churn caused by retirements, new accountants qualifying and the effects of immigration/emigration.

Chartered Accountants Ireland’s membership (Ireland’s largest professional accountancy membership body) had a net increase of 6,132 in 2024 (source here) and this growth is expected to continue in 2025, showing the profession in Ireland is still expanding despite changes in Technology.

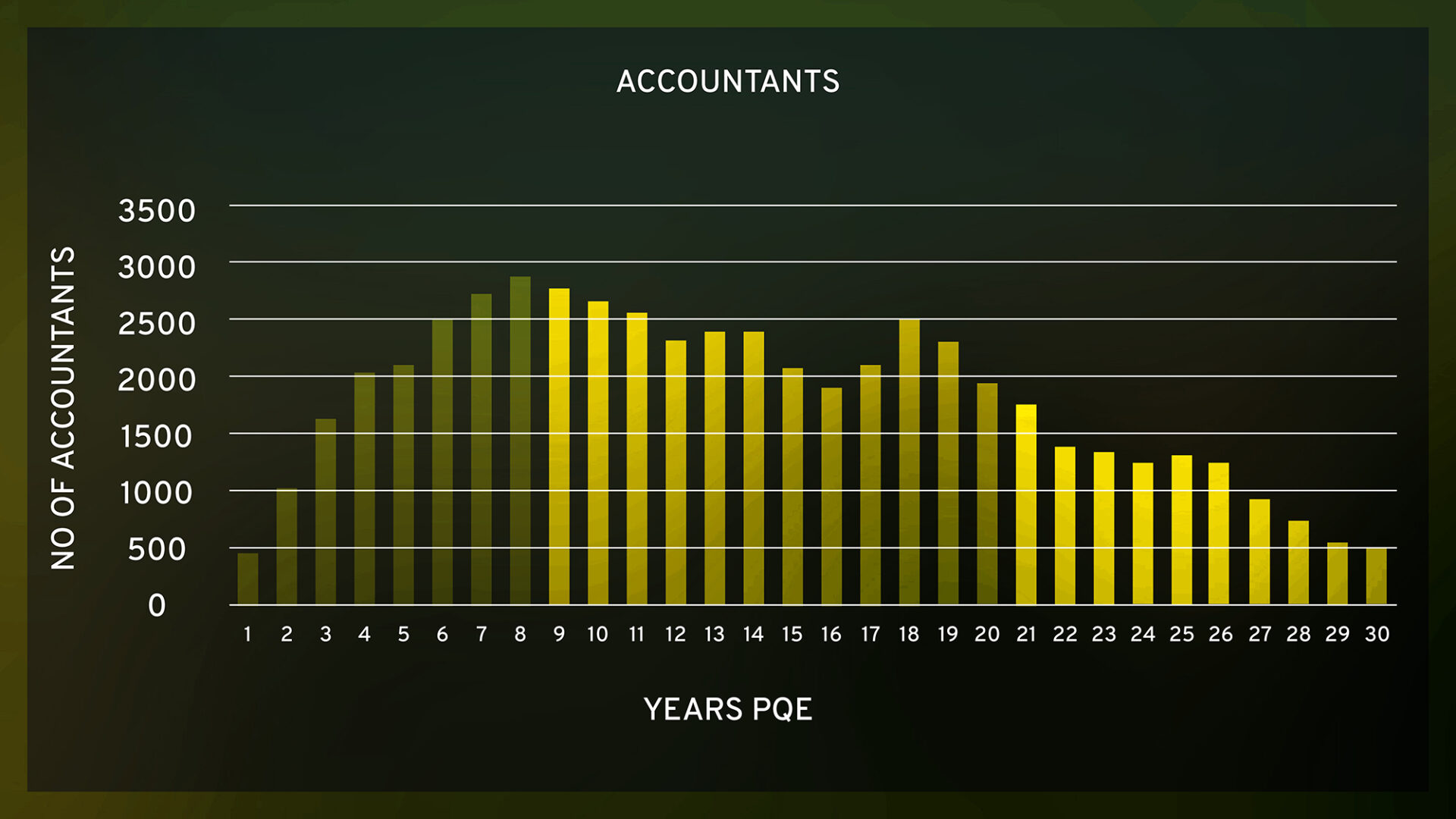

The graph above shows the distribution of qualified accountants in Ireland by years’ qualified.

Depending on the level of experience you are looking to hire for, there are certain things to consider when looking for talent:

- 0 to 5 years (28% of the qualified population) – This cohort will be less experienced, so it is important to be flexible on the exact experience you are looking for and to consider other factors like potential, academics, openness to travel etc. This is also the most transient cohort of accountants and will be more open minded to exploring new opportunities.

- 8 to 20 years (51% of the qualified population) – This will be more experienced but less likely to consider moving.

- 20 years+ (20% of the qualified population) – Most experienced but least likely to consider moving.

It is important to note that the more post-qualified experience (PQE) accountants have, the less relevant the “PQE years” becomes, and the focus increasingly shifts towards the specific nature of their experience. From 5 years PQE, this becomes very noticeable, and by 10 years PQE, employers generally stop considering it altogether.

For the purposes of this report, we will be focusing on the 0 to 5 years’ PQE (Recently Qualified) and the 6 to 10 years’ PQE (Senior Qualified) cohorts of the population as these are the levels that are targeted most by employers. 90% of roles fall at these levels, with Finance Director and CFO roles being in the minority. For more information on statistics at that level, feel free to reach out to Elaine Brady – Managing Partner for Barden Leinster (elaine.brady@barden.ie)

1.2 Job-Seeking & Medium Tenure

The median tenure for accounting professionals currently stands at 1.8 years, which is slightly higher than the national average of 1.6 years, as reported in Barden’s National Talent Monitor, showing it is a relatively stable profession.

“Job seeking behaviour” is derived from LinkedIn and represents people who actively applying for roles/have shared a profile update/recently uploaded a CV or work at company that may be experiencing layoffs. For accountants in Ireland, this is currently at 28% which is slightly higher than the national average of 26.1%. This shows there is an appetite in the market for exploring new roles and is likely related to the decline in job postings, which is covered below.

1.3 Observations

- It’s important to note that the median tenure is not limited to a change of employer but also incorporates changes of role within the same business i.e. promotions, change in job titles etc.

- The median tenure for recently qualified (0 to 5 years PQE), will be shorter in comparison to more experienced accountants due to higher rates of emigration/travel, faster promotion cycles and a desire to try different specialisms and industries at that level.

- It will be higher at the more experienced level, as people stay longer in their roles for a multitude of reasons (family, less inclined to emigrate).

- A large number of Accountants will also move roles shortly after qualifying i.e. leaving practice to explore industry, which again impacts the overall median tenure.

2.1 Job Posting Trends

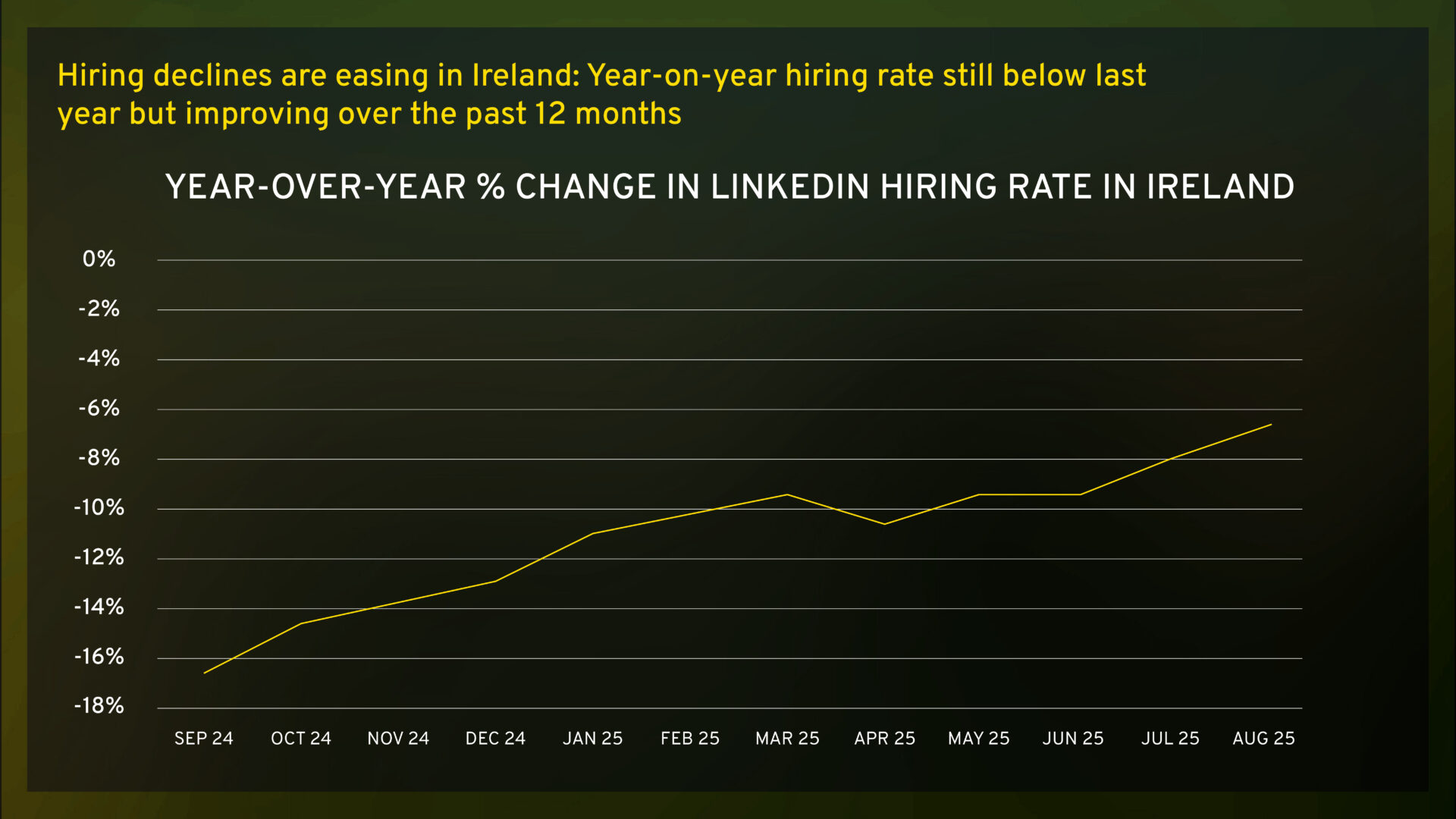

Online job posts for Q3 2025 are 16% lower than Q3 2024, however, LinkedIn data shows that the despite the decline in job postings, the rate of decline in Ireland is easing as outlined in the graph below.

Decreasing jobs posts isn’t a surprise given the increased uncertainty in the economy, arising from the on-going US tariff affair as well as the market normalising after the increased demand for talent experienced in the 24 months post-covid.

As there has been an overall drop in both unemployment and job vacancy rates, reflecting historically low unemployment levels and ongoing significant demand for talent. This positioning suggests that despite the decrease in job postings, the overall job market remains competitive and is expected to remain so for the remainder of the year and into 2026.

3.1 Gender Balance

Workforce participation in the accounting profession is 56% female and 44% male. This shows that the profession boasts a 13% higher female participation than the national figure of 43%.

However, disparities do still exist across specialisms and seniority levels.

3.2 Hybrid policies

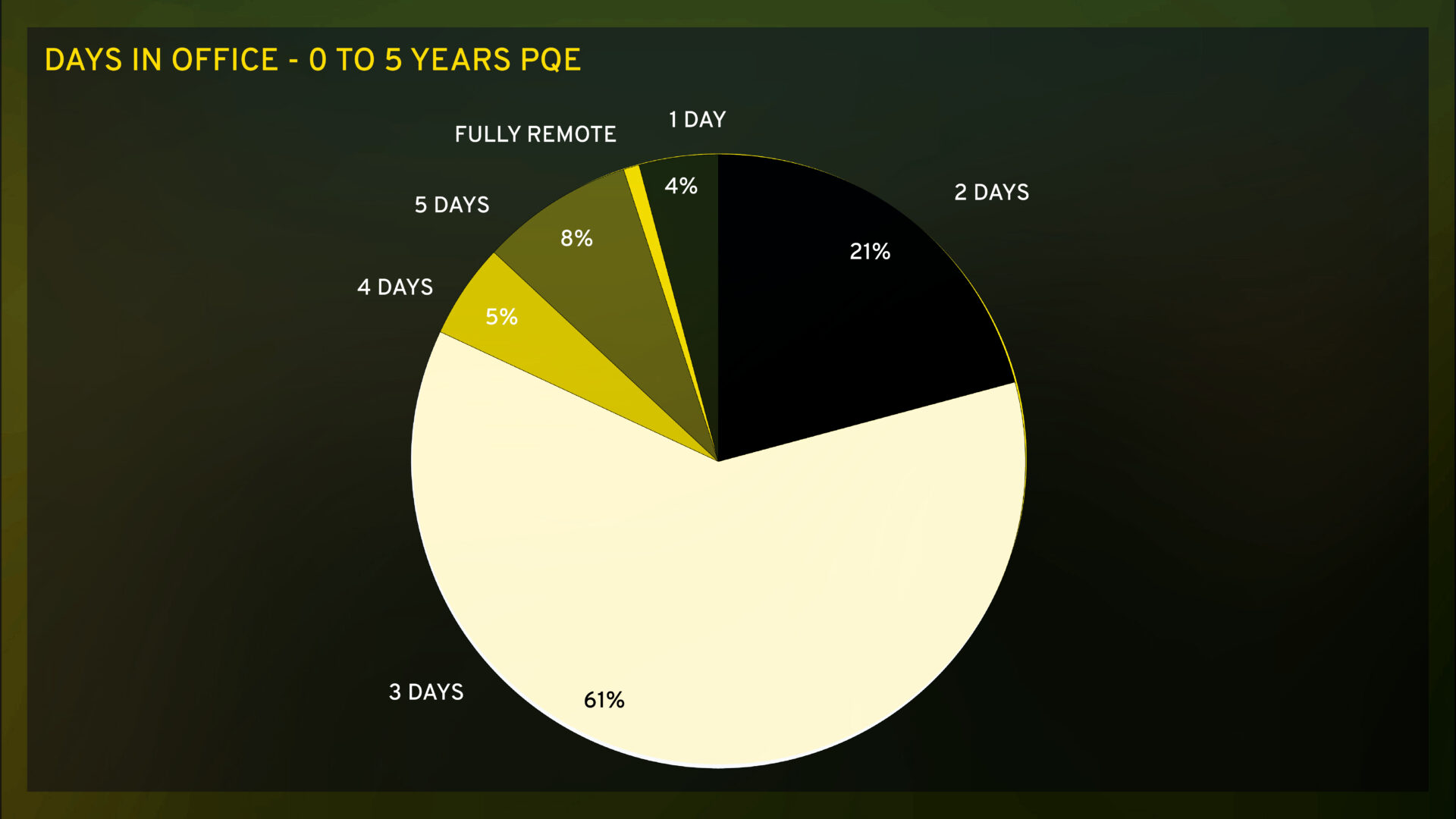

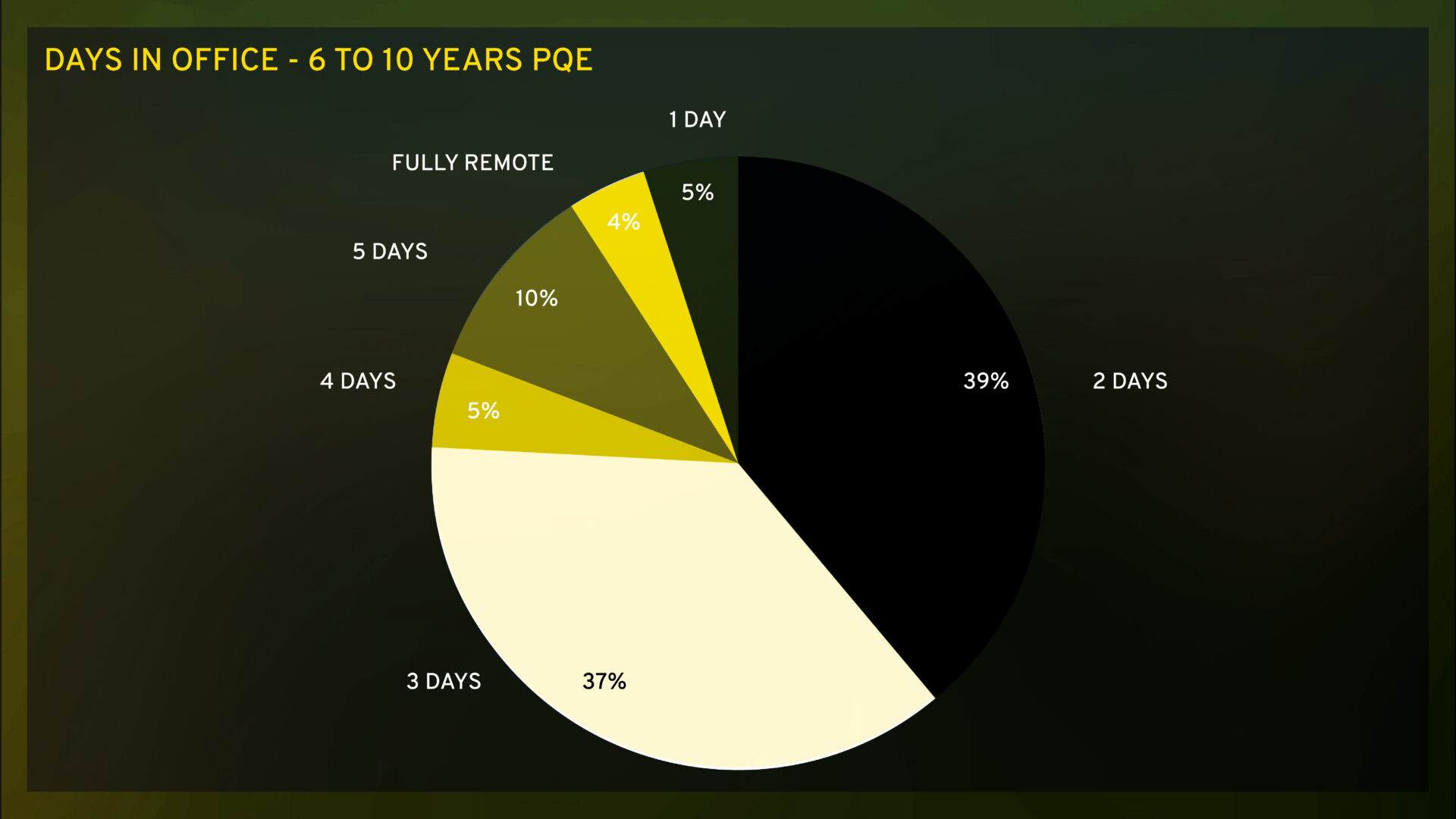

The graphs below are based on a material sample of the Financial Accounting population in Ireland and as you can see, the most common WFH policies vary depending on the level.

It is no surprise that early career accountants (0–5 years PQE) are required to be in office more often than their more experienced peers. They require On-the-job training, closer supervision and live feedback. Being physically present allows for faster learning through osmosis, shadowing senior colleagues, and immediate support during complex tasks.

The increased flexibility in hybrid policies for the 6–10 years PQE cohort is also unsurprising, given the roles are more autonomous and less reliant on daily oversight, making remote or hybrid work more feasible.

It is important to note that the working arrangements change depending on seniority, the sector and the specialism in finance. Certain specialisms like Corporate Finance, Corporate Development, Finance Business Partnering and senior management positions are more likely to be office based regardless of wider company policies as they can require more face-to-face engagement. Sectors like Construction, Commercial Property, Family Offices also tend to be more office based.

The overall of 52% having 3 days a week in office policy, is consistent with the national average (circa 46.1% of all private workplaces adhering to a 3-day model).

Where there has been a notable shift to more officed based working over the last 18 months and although this is expected to continue, there is no expectation for fundamental changes to what we see in the graphs above.

IrishJobs research shows that nearly half of all job seekers would be happy to turn down a role that does not offer hybrid working arrangements (here). This is consistent with what we have seen in the market – where hybrid working arrangements are as important for some people as salary, location and the role itself. Where possible, offering a flexible WFH policy gives access to a much larger pool when looking to attract new talent.

3.3 Benefits

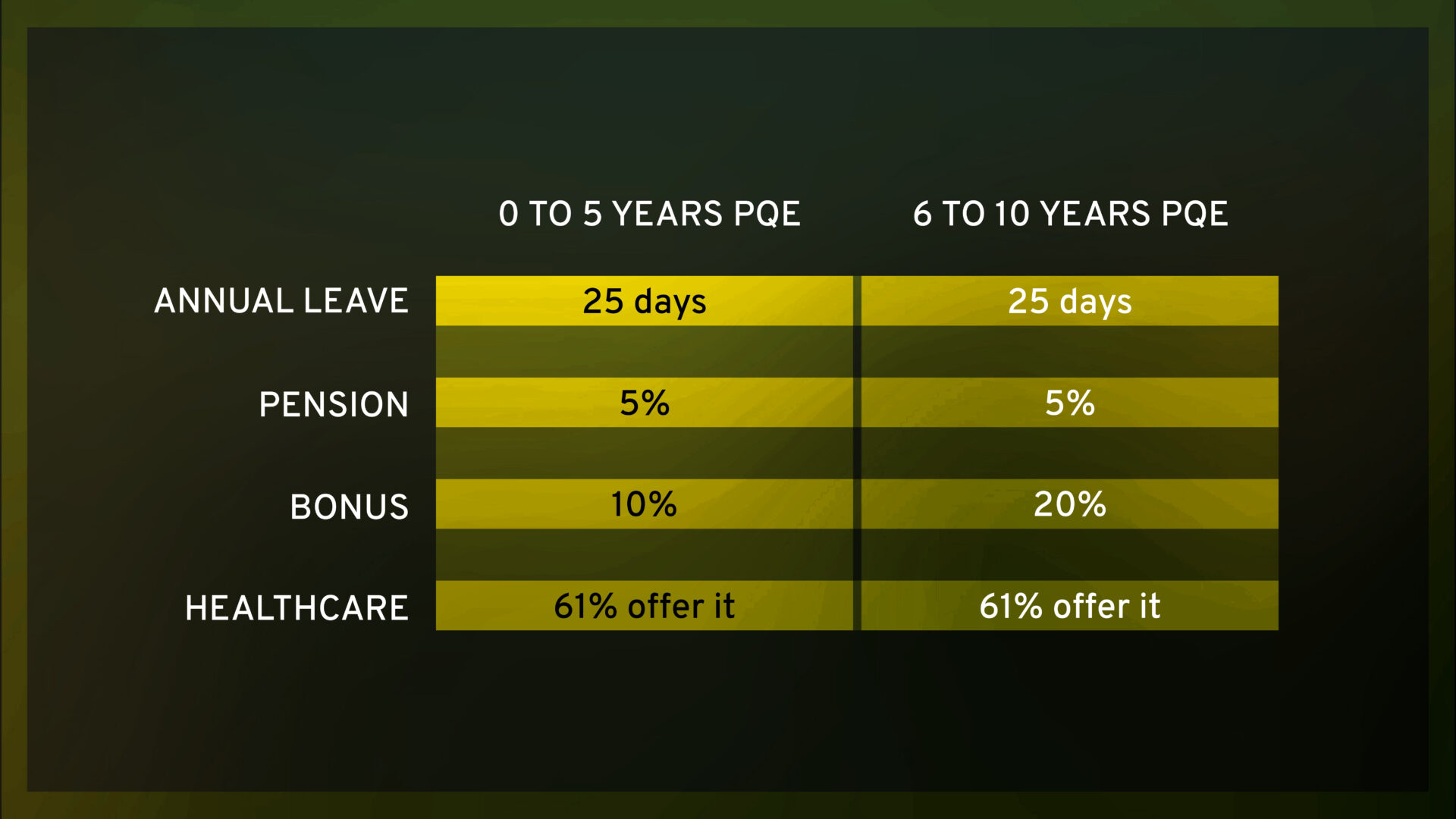

Using the same population sample as for the WFH data above, below is an outline of the common benefits seen at both the recently qualified level and senior qualified levels.

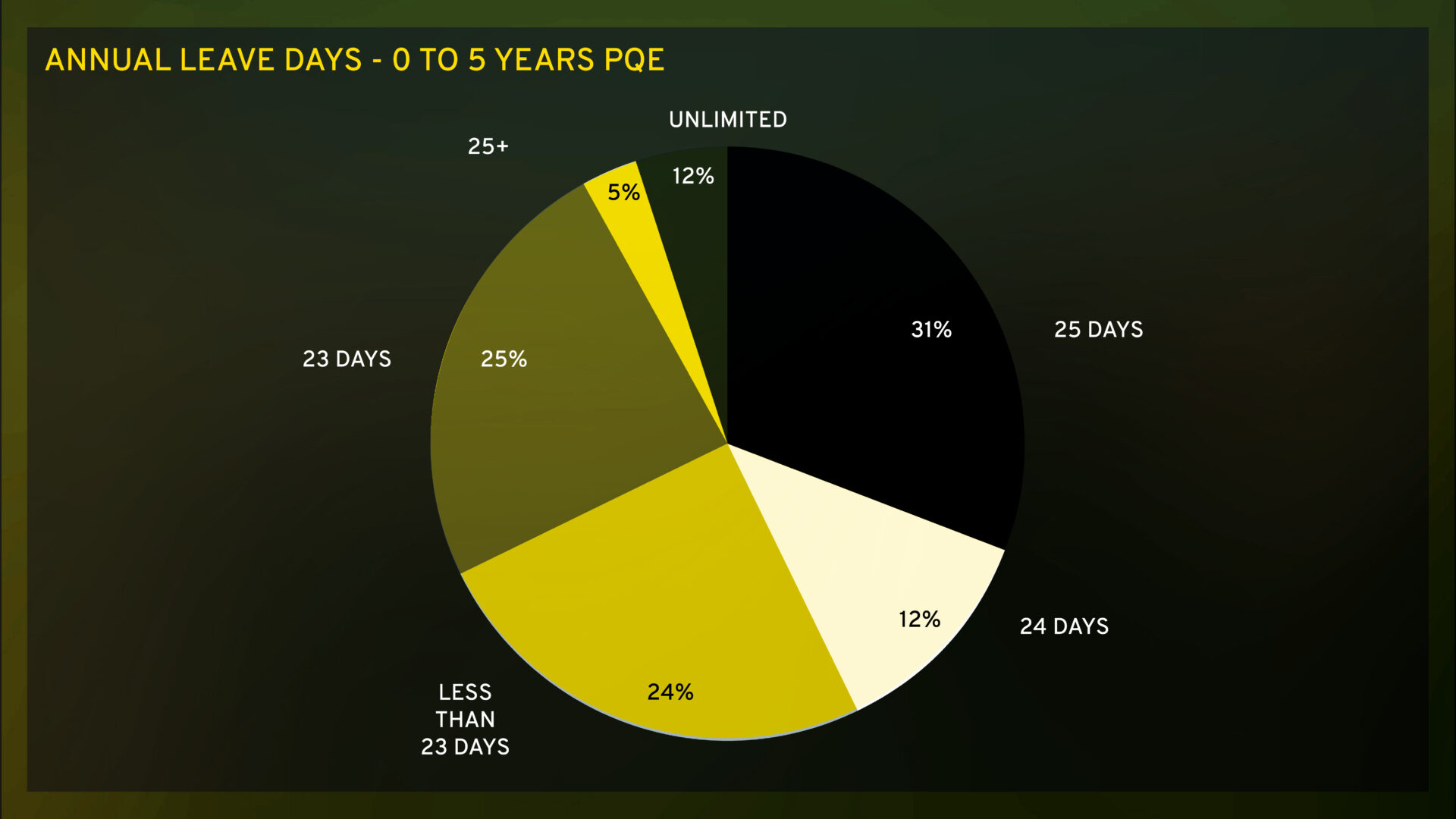

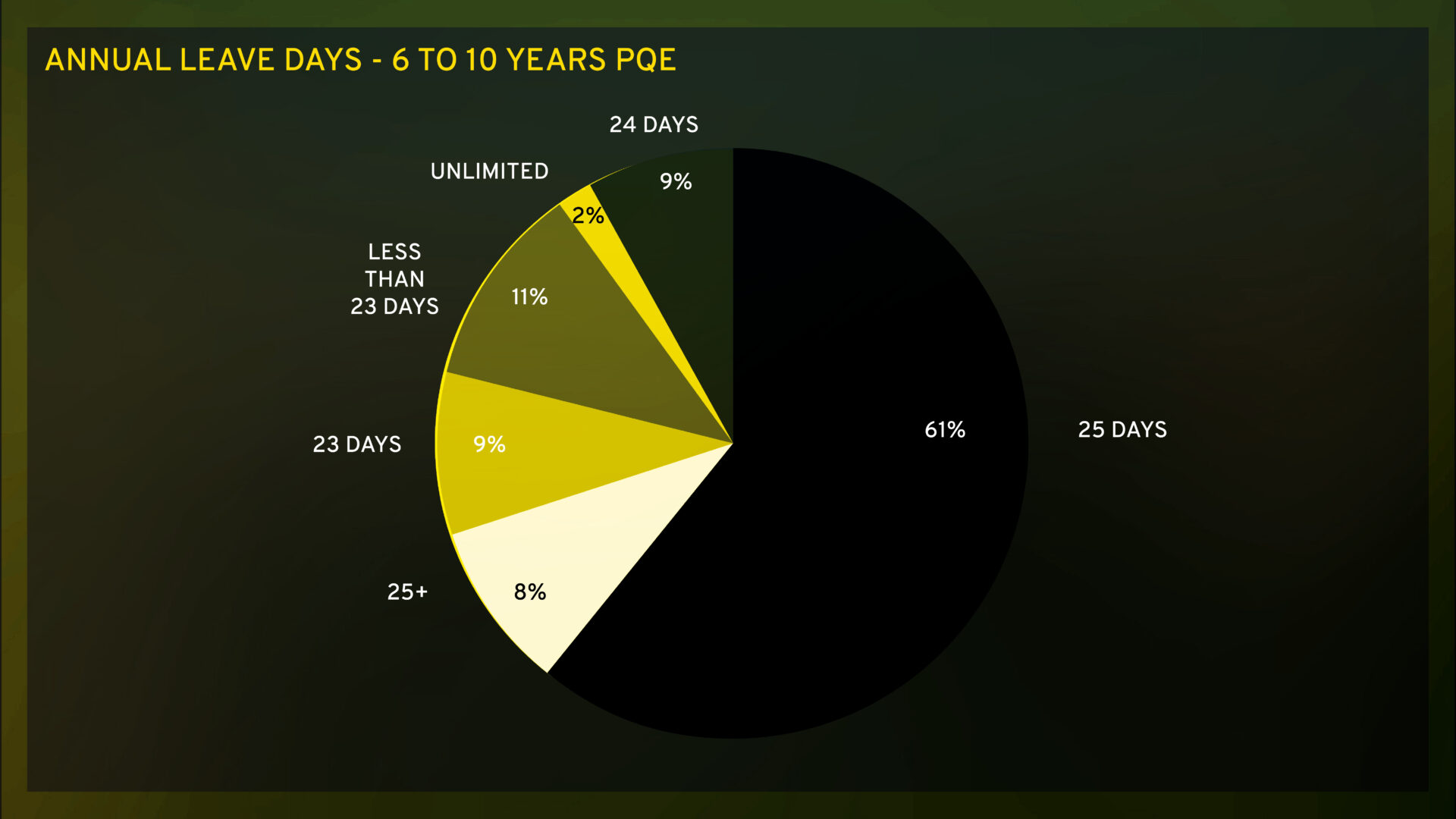

Annual Leave:

Other benefits are not always guaranteed but the legal minimum annual leave allowance an employer can offer in Ireland is 20 days per annum.

An annual leave policy of 25 days per annum appears to be the most common policy within the accounting profession as per the above (61% of instances). Offering competitive leave policies acts as a strong incentive for attracting new talent and helps retain existing talent.

Some employers offer an increase in annual leave based on years of service i.e. starting with 20/21 days and increasing by a day per year of service to a limit of 25/26.

“Unlimited” annual leave policies are popular within the tech sector but are spreading to other sectors. There is no cap on the annual leave an employee can take but it must be approved by management. This can be an effective arrangement within finance where busy times are cyclical. Management knows in advance when full team engagement is required and can be flexible in quieter times.

Other Benefits:

The graph above outlines the mode for other benefits across both levels. As you can see, other than bonus, the offerings remain consistent. Employer pension contributions are usually based on off the voluntary contribution, therefore will vary person to person.

4.1 What companies can do to attract and retain talent?

To attract and retain top talent, companies need to offer more than just competitive salaries. Good office culture, benefits, and workplace flexibility are crucial considerations as well as offering structured career growth pathways so talent can see long-term opportunities within the organisation.

- Invest in internal skill development to upskill talent and enhance career progression, rather than relying solely on external hiring.

- Facilitate internal moves where possible for people who are looking to explore different areas of finance. E.g. Moves from Group Finance to FP&A and vice versa to avoid team members looking externally.

- Provide examples of staff who’ve progressed internally, have had the opportunity to explore different sub teams within finance and facilitate this as much as possible to avoid losing existing talent.

- As some companies shift back to on-site work, maintaining hybrid or remote options (where possible) can provide a competitive edge in attracting and retaining talent.

- Some businesses won’t consider talent who require sponsorship or don’t have local experience – there is a significant pool of qualified accountants, with strong overseas experience. Keeping an open mind to this experience and exploring the requirements to provide sponsorship will give access to a largely untapped talent pool.

This is where Barden can help you. We offer over 20 profession-specific talent monitors, such as for early-career accountants or data analysts, that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

*For more detailed insights, peer comparisons, company-specific turnover data, performance benchmarks, or gender diversity trends by profession and level, contact Elaine Brady at elaine.brady@barden.ie for bespoke insights to help shape your talent strategy.

Jump Back

Jump Back