Barden’s National Talent Monitor is a quarterly snapshot of Ireland’s private enterprise professional workforce, covering all major professions including accounting, engineering, analytics, administration, legal, engineering and beyond. Collated through multiple data sources (LinkedIn data mining, CSO data, Barden data, third-party proprietary source), using our unique research methodologies, we are able to identify patterns and insights that help business leaders make more informed decisions about their talent attraction and retention strategies.

#1 Key Talent Market Trends

1.1 Barden Beveridge Curve

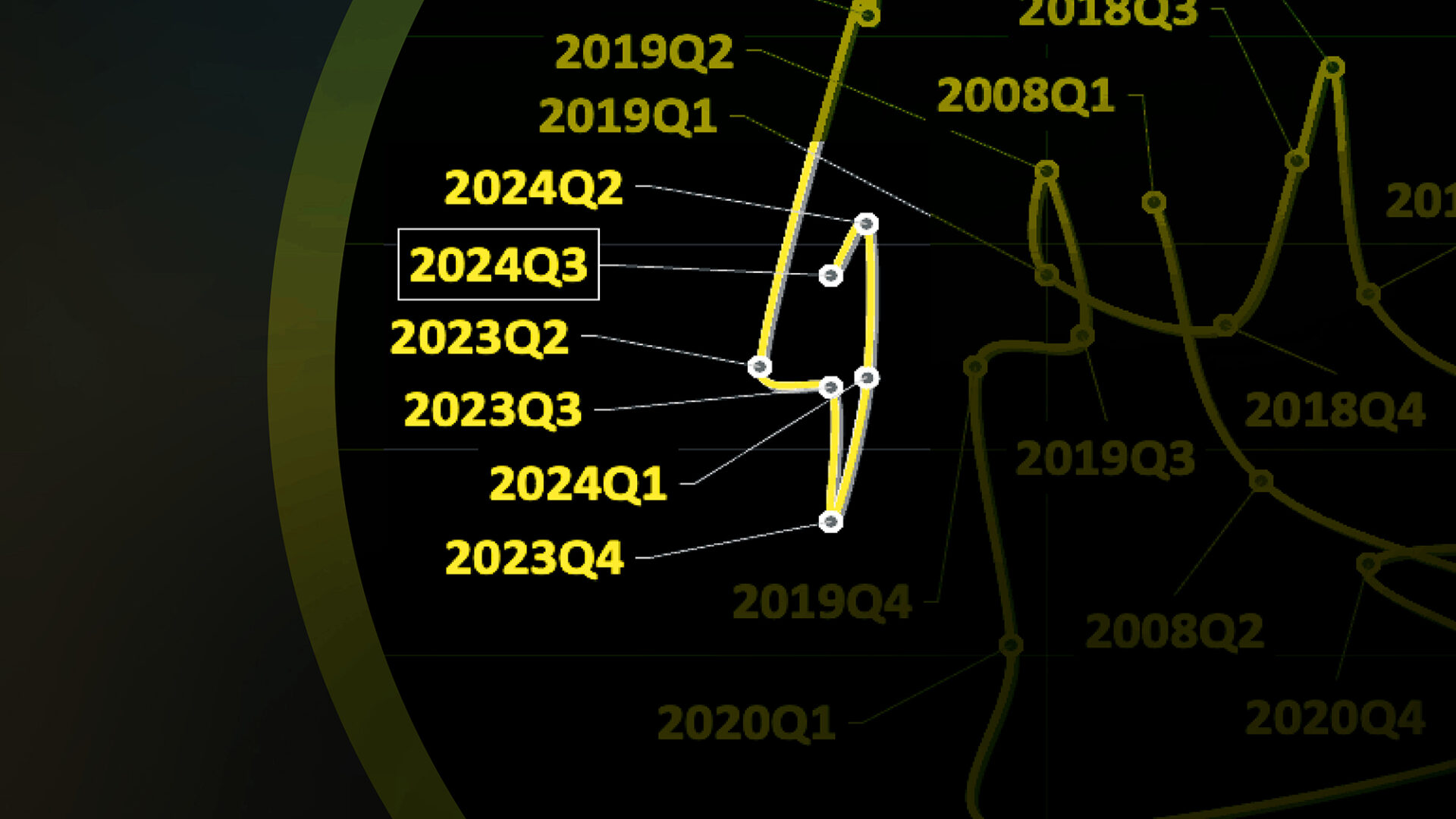

The Barden Beveridge Curve is an indicator of employment activity and talent demand in the market. It plots job vacancy rates against unemployment levels, with movements to the top left indicating higher demand for talent and movements to the bottom right indicating lower demand.

Specifically curated by Barden to represent private enterprise professionals, the curve helps track trends using CSO data, which lags quarter-on-quarter. Recent data for Q3 2024 shows a slight drop in both unemployment and job vacancy rates, reflecting historically low unemployment levels and ongoing significant demand for talent. This positioning suggests that the job market remains competitive and will do so in 2025.

1.2 Job-Seeking Behaviour:

20.2% of professionals in Ireland are demonstrating job-seeking behaviour. Companies with less than 20.2% of their workforce showing this behaviour are performing well, while those above this benchmark may need to address potential challenges.

Of those exhibiting job-seeking activity, less than 10% (7.6%) actually changed roles last year. For a company with 100 employees, a normalised turnover rate suggests a loss of 7–10 people annually.* As above, this number can be used to benchmark a companies current turnover rate against the norm.

1.3 Tenure and Role Changes:

The median tenure for professionals is 1.6 years, meaning that while people are not necessarily changing companies every 1.6 years, they are likely changing roles within that timeframe (promotion, moving teams, etc.). Leaders should consider this when planning promotions, development, and succession strategies.*

1.4 Gender Balance:

Workforce participation in this cohort is 43% female and 57% male, though disparities exist across professions and seniority levels.*

1.5 Talent Movement Trends:

In 2024, Ireland’s professional workforce grew by nearly 11,000 people compared to the previous year. However, Ireland continues to face a net loss of talent to some jurisdictions, specifically English-speaking markets and, in particular, Australia, where two Irish professionals leave for every one returning.

On the other hand, Ireland is seeing a net gain of talent from countries like India and Brazil, contributing to workforce diversification and signalling a continuing trend toward more international hiring strategies.

#2 Trends in Work Arrangements and Benefits

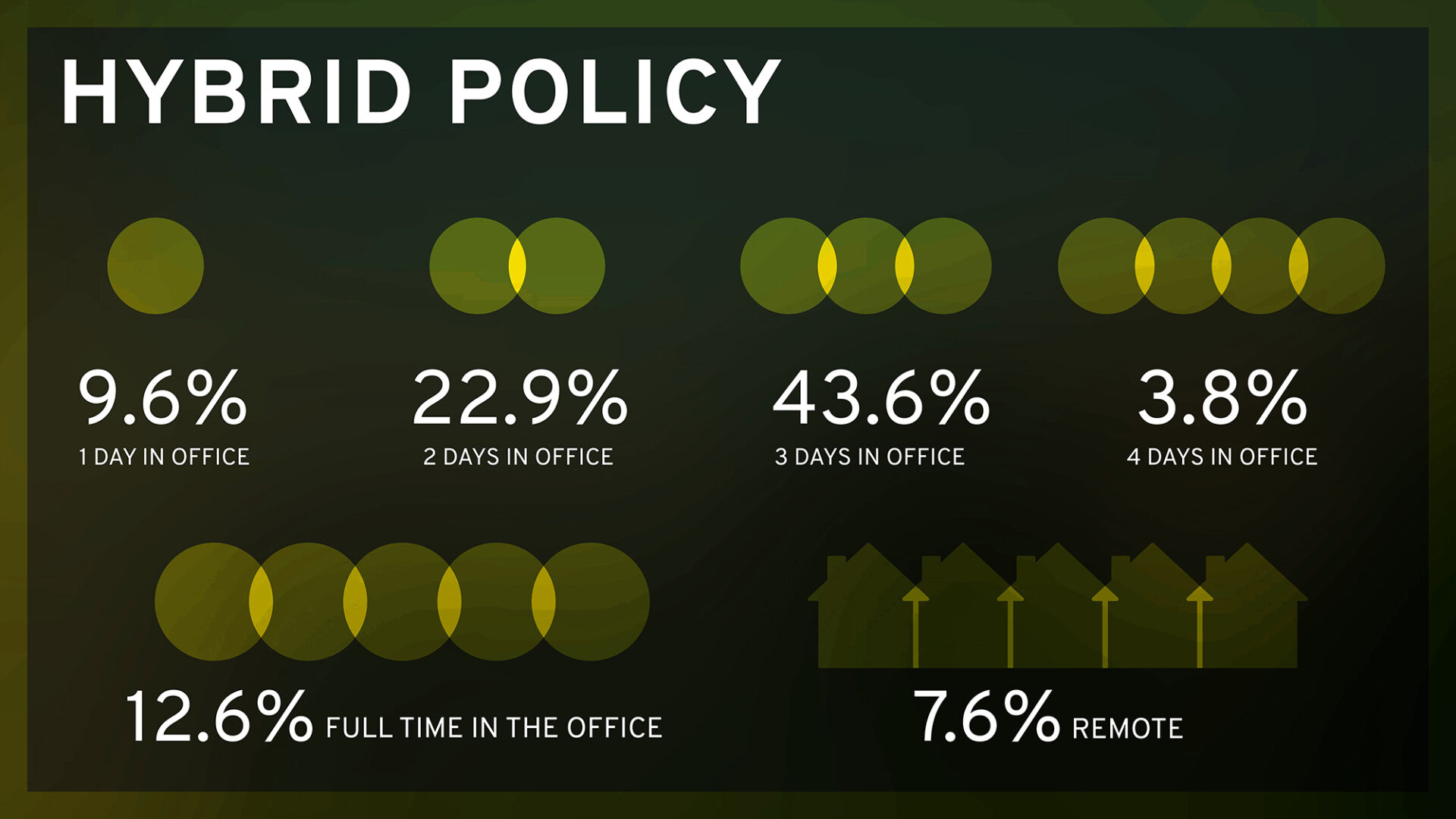

2.1 Hybrid Work as the Norm: 66.5% of roles now follow a 2–3 day hybrid model, making it the clear standard for most organisations. While there has been a slight increase in full-time office roles, they remain a minority. Companies mandating full-time office attendance risk significant challenges, as this does not reflect what talent seeks or needs.

Fully remote roles are also decreasing, highlighting that expectations of 100% remote work may no longer align with market realities. Surprisingly, tech roles comprised only 30% of all remote work positions.

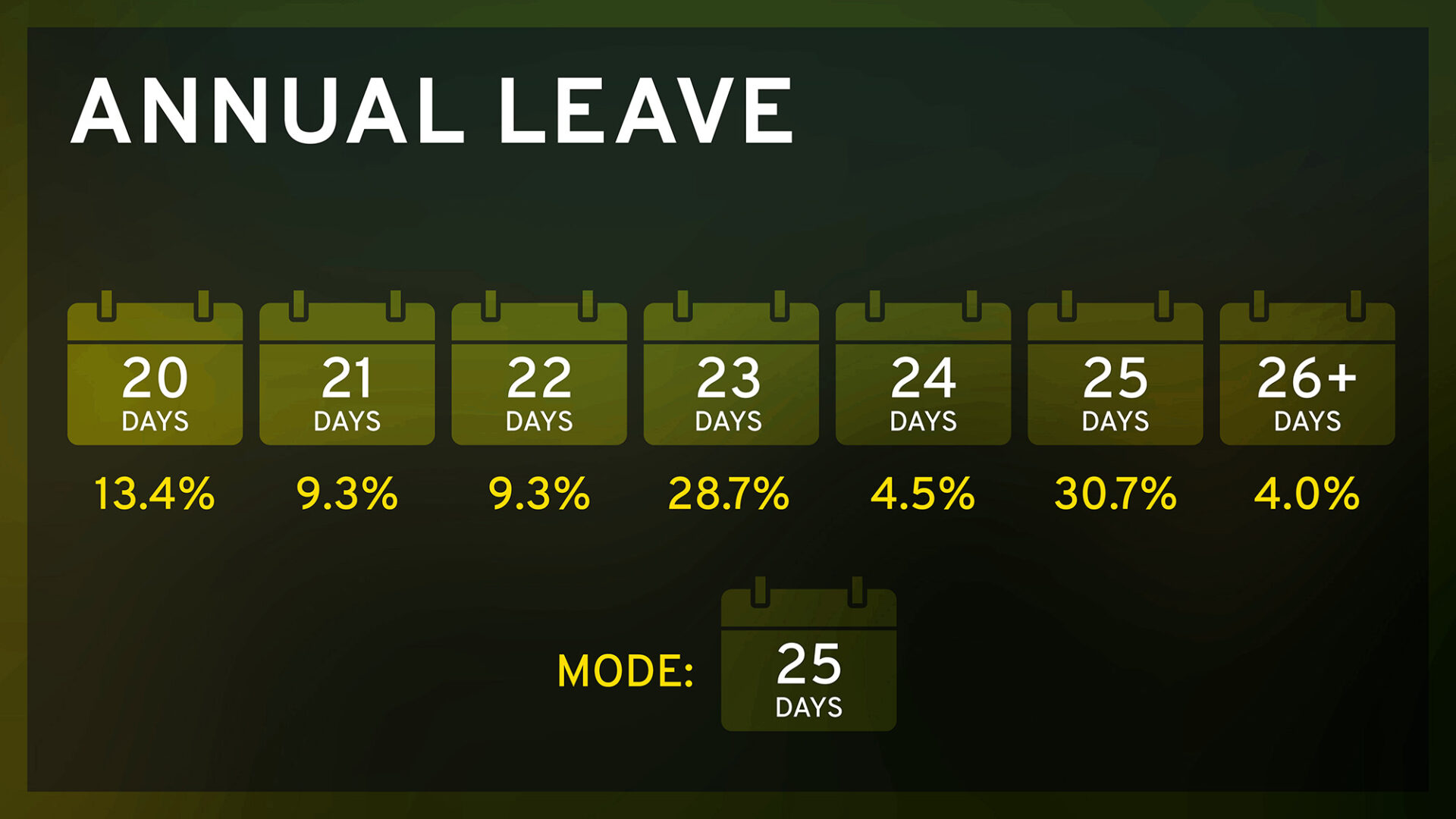

2.2 Reward Packages: Offering 23–25 days of annual leave or more is critical. Anything less puts companies at a notable disadvantage in attracting and retaining talent.

The mode represents the number that occurs the most in a given list.

The mode represents the number that occurs the most in a given list.

The most frequent (mode) employer pension contribution offered is 5% and for bonuses, it is 10%. However, it is important to highlight that standard benefits vary significantly between SMEs and multinational companies.*

#3 Are you shaping your 2025 Talent Strategy?

The above data provides valuable national-level insights but competition for talent is typically local rather than national. While understanding the macro perspective is essential, it should be complemented with real-time, localised, peer-to-peer comparisons to assess your organisation’s true competitiveness for talent and inform strategic decision-making. For example, a large multinational group function will typically not be competing for the same talent as a local SME in a given location.

This is where Barden can help you. We offer over 20 profession-specific talent monitors, such as for early-career accountants or data analysts, that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

*For more detailed insights, peer comparisons, company-specific turnover data, performance benchmarks, or gender diversity trends by profession and level, contact Ed Heffernan at ed.heffernan@barden.ie for bespoke insights to help shape your talent strategy.

Jump Back

Jump Back