In Focus: Technology Talent Strategies & Insights is a quarterly deep dive focused exclusively on the technology profession within Ireland’s private sector. Using data from LinkedIn, proprietary Barden data, and other trusted sources, the report is designed for technology leaders and delivers practical insights on market trends, challenges, and strategies to stay ahead in a rapidly evolving market.

#1 Navigating Ireland’s Tech Landscape in Q4 2025

After a year of volatility, Ireland’s tech sector enters Q4 2025 with renewed optimism. Manpower’s Net Employment Outlook (NEO) shows confidence in the IT sector rebounding to +43%, up from +28% in Q2 and +29% in Q3. This signals that more employers plan to expand their teams rather than cut back, reflecting sustained demand for digital talent and growing multinational investment. Nearly half (49%) of Irish employers say hiring is being driven by business growth rather than backfilling roles. As a result, Ireland now leads Europe in hiring sentiment heading into the quarter.

While Q1 2025 saw record optimism (+49% NEO), global uncertainty and cost pressures triggered a temporary slowdown in Q2 and Q3. The strong Q4 rebound underscores the resilience of Ireland’s tech talent market and shows employers’ ongoing commitment to growth despite macroeconomic headwinds.

#2 The Latest in Tech Job Postings

Job postings for tech roles provide further insight into sector performance and largely mirror the trends highlighted by Manpower’s NEO. In Q1, postings were particularly strong: Indeed’s 2025 Ireland Jobs & Hiring Trends Report shows that by mid-January 2025, overall job postings were 19% higher than pre-pandemic levels (across all categories, not just tech).

By mid-year, however, the picture was more mixed. Indeed, reported that certain tech roles slipped below pre-pandemic levels, while Dublin – home to much of Ireland’s tech workforce – was 13% under baseline, reflecting the sector’s exposure to global uncertainties. Seasonal patterns also played a role: the summer months typically see fewer vacancies as hiring slows, before picking up again in September when schools return and businesses refocus. Broader job market data pointed to a similarly mixed picture.

Although postings softened through Q2 and Q3, rising employer confidence and continued multinational investment suggest tech hiring will strengthen in Q4, pointing to a solid finish to the year. Accenture (2025) reports that 66% of technology job postings are now outside Dublin, with regional hubs in Cork, Galway, Limerick, and Waterford expanding.

Notably, tech roles still account for the highest share of remote or hybrid postings (47% according to Indeed), reinforcing Ireland’s competitiveness in attracting both domestic and international talent.

#3 Advancing Gender Representation in Tech

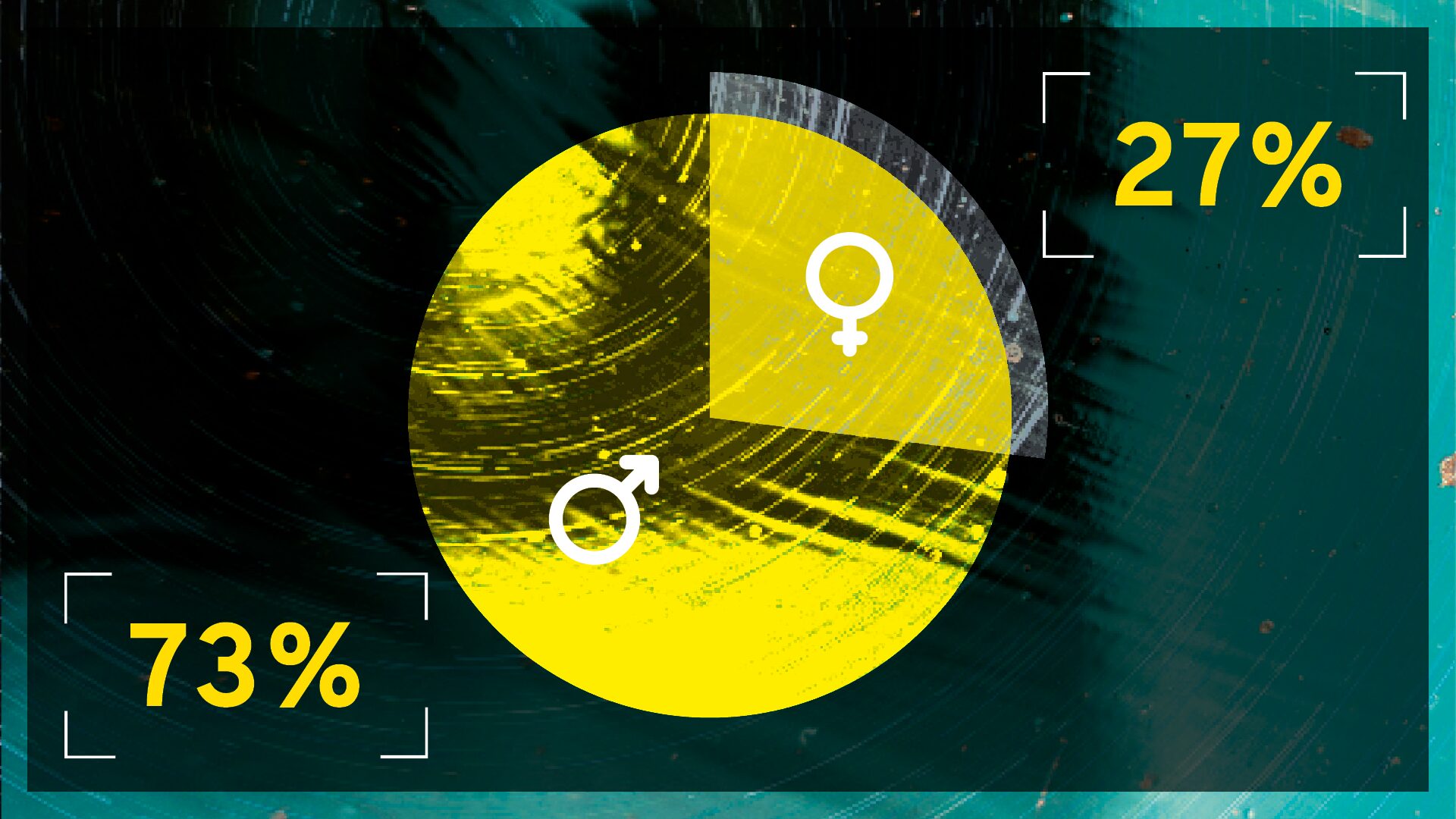

Gender participation in the Irish technology sector remains male-dominated, with 73% of workers being male and 27% female.

If your organisation has 27% or more female participation – whether in leadership roles or IT functions – you’re doing well. If the percentage is lower, you may be missing an opportunity.

Striving for a 50/50 gender split is ambitious given the current demographics, but improving diversity is still valuable. Organisations looking to enhance gender balance might benefit from addressing the issue earlier in the supply chain by encouraging initiatives that allow for higher participation, which will overtime address this imbalance.

#4 How Tech Talent Moves: Job-Seeking & Tenure Trends

Around 30.8% of tech professionals are actively seeking new roles, while 14% have changed jobs within the past year. The median tenure in technology is now just two years, reflecting the sector’s fast pace and high mobility. Frequent movement is driven by skill development, career growth, better compensation, and the prevalence of contract work, which naturally shortens tenure.

Key Observations:

- The rapidly evolving technology landscape encourages professionals to adopt new tech stacks and explore emerging innovations, leading to more frequent job changes.

- A large share of tech talent works on a contract basis, reducing average tenure and fuelling demand for skilled IT contractors as companies tackle complex projects.

- Many tech teams operate in project-driven environments, prompting even permanent staff to seek new opportunities once major projects conclude.

#5 How to Win and Retain the Best in Tech

In Ireland’s tight labour market, securing talent with the right skills is one of the greatest challenges organisations face – making effective retention and engagement strategies more critical than ever. Here are the benefits that matter most:

Flexible and Hybrid Work:

Flexibility is a top priority. While some prefer fully remote roles, most are happy with 1-3 office days per week, and very few want a five-day schedule. Some employers adopt a “hyper-hybrid” model, with only occasional office visits (monthly or quarterly), which works well when local talent is scarce. Offering the option to work remotely outside Ireland for a set period is also attractive. Prioritising work-life balance through flexibility is key to retention.

Competitive Compensation and Benefits:

A competitive salary remains essential, alongside healthcare, pensions, bonuses, and generous annual leave (Barden data shows a median of 25 days). Many employees will also accept slightly lower pay if opportunities for upskilling and career growth are provided.

Employee Wellbeing:

Wellbeing-related benefits strongly influence employment decisions. Mercer’s 2024 Global Talent Trends report highlights that mental health support and wellbeing initiatives are increasingly valued. Companies that invest in wellbeing and foster positive team-manager relationships boost both retention and morale.

Internal Skill Development and Career Growth:

Reskilling and upskilling are top priorities for businesses. Providing training, support, and clear career pathways helps employees adapt and progress. Offering opportunities to work on emerging technologies internally reduces turnover, as talent are less likely to leave for better learning opportunities elsewhere. Section 5.2 explores strategies for navigating this evolving landscape in more detail.

#5 Future-Proofing Talent

Mercer reports that managing the risks of digital acceleration and cyber security ranks just behind inflation as a top near-term priority for organisations. At the same time, the integration of AI, automation, and advanced data analytics presents major opportunities to boost efficiency and innovation.

AI adoption in Irish organisations has surged to 91%, nearly doubling from 49% in 2024 (Trinity Business School & Microsoft Ireland, 2025). This rapid integration is reshaping job roles, requiring employers to rethink long-term hiring and workforce strategies. PwC (2025) projects that by 2030, 67% of the workforce will require upskilling, with 39% facing significant skill instability.

5.1 Skills Gap: The New Hiring Reality

Despite rising demand, roles such as software engineering, cloud computing, cybersecurity, and AI remain among the hardest to fill. According to Indeed (2025), 35% of software engineering positions stay open for over 60 days, underscoring a persistent skills mismatch.

Meanwhile, Manpower’s 2025 Talent Shortage Survey reveals that more than 4 in 5 employers in Ireland struggle to find the skilled talent they need – more than double the figure reported in 2019 (34%) and marking an all-time high.

LinkedIn research (Think Business Ireland, 2025) reinforces these challenges:

- 52% of HR professionals cite finding talent with the right technical skills as their biggest obstacle.

- 75% struggled to find qualified talent in the past year, with only 40% of pre-qualified applications meeting preferred requirements.

- 73% believe graduates often lack essential soft skills.

Bridging Ireland’s skills gap requires accessible training and reskilling pathways. McKinsey & Company (2025) highlight the role of adult education in unlocking latent talent and improving social mobility.

5.2 Recommendations for Employers

According to Business Ireland, 76% of Irish HR professionals say upskilling employees will be a top organisational priority in 2025. The most in-demand capabilities include analytical thinking, technology literacy, AI expertise, and problem-solving.

To navigate this evolving landscape, employers should:

- Reshape roles to integrate AI and emerging technologies.

- Prioritise upskilling and reskilling, focusing on AI, cloud, cybersecurity, analytical thinking, and adaptability.

- Adopt flexible working models to attract diverse and regional talent.

- Align hiring strategies with business goals, proactively identifying and addressing skills gaps.

By embedding these strategies, organisations can retain top talent, stay competitive, and build a resilient team.

#6 Resilient Growth, Evolving Demands

Ireland’s tech sector enters Q4 2025 with strong momentum and leading hiring optimism in Europe. However, persistent talent shortages mean employers must focus on flexible working, upskilling, and strong employer branding to secure the talent and skills they need. With AI and digital transformation reshaping roles, organisations that adapt quickly will maintain a competitive edge. Overall, Ireland’s tech market remains vibrant and resilient, despite ongoing challenges.

This is where Barden can help you. If you are interested in a future built on tech talent, we offer tech-specific quarterly talent monitors that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

References:

- Manpower report: Ireland Leads Europe in Hiring Optimism for Q4 2025 · Manpower Ireland

- Indeed reports:

- PwC report: The Future of Work — Insight | PwC Ireland

- Mercer report: Five for 2025: Mercer’s top priorities for Irish employers this year

- Manpower Talent Shortage report: ManpowerGroup Ireland Recruitment & HR Blog · ManpowerGroup IE

- McKinsey Report: Mckinsey & Company Report: Bridging Ireland’s Tech Skills Gap Through Social Mobility – Irish Tech News

Other sources:

Jump Back

Jump Back