Firstly, it’s important to clarify what we mean by the mid-senior segment of the accounting & finance market. At Barden, this typically refers to professionals with 5+ years of post-qualified experience, encompassing roles such as Finance Director, Head of Finance, Financial Controller, and Finance Manager level roles, across Controllership, FP&A, Finance Business Partnering, Compliance, and Corporate Finance.

*Tax & Treasury insights are covered in a separate publication.

#1 Framing the mid-senior market

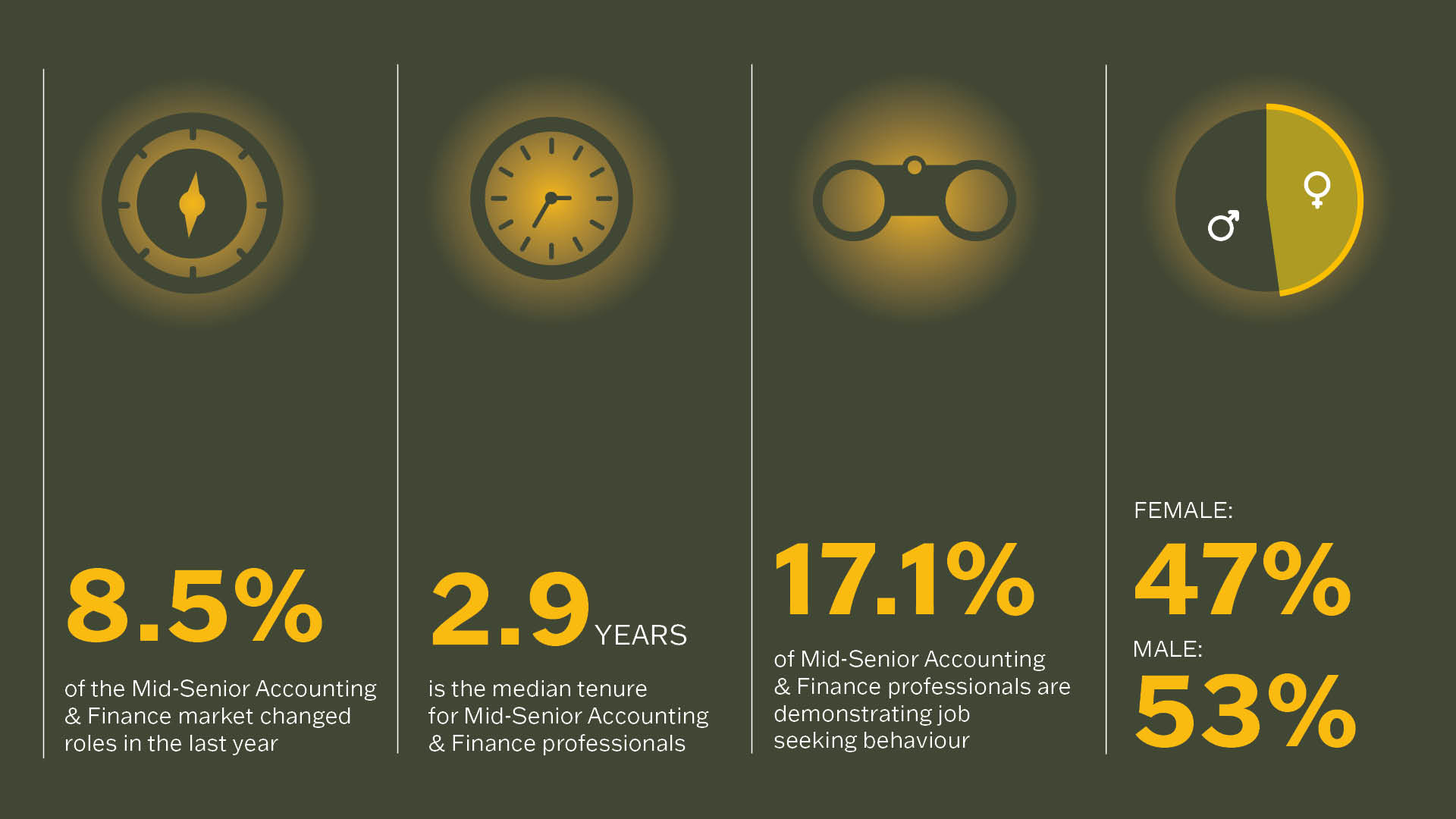

17.1% of professionals in this segment of the market are demonstrating job-seeking behaviour, an increase of 1.1% from this time last year. Of those exhibiting job-seeking activity, 8.5% actually changed roles last year. For a company with 100 employees, a normalised turnover rate suggests a loss of 9–10 people annually.

Talent behaviour remains measured in this segment. The median tenure has edged up to approximately 2.9 years, reflecting a continued trend towards longer tenure and greater role commitment, influenced in part by ongoing macroeconomic uncertainty.

Workforce participation in this cohort is 47% female and 53% male, though disparities exist across professions and seniority levels.

Quality over volume is the dominant theme. Employers seek finance leaders who can operate effectively in ambiguity, control costs, influence decision making, and communicate confidently with senior stakeholders – particularly in roles close to the executive leadership. Many senior finance positions now also encompass responsibility for finance transformation, systems upgrades & implementation, process improvement, or automation initiatives.

#2 Outlook for 2026

Global economic uncertainty has driven a more cautious approach to hiring, with many organisations moderating recruitment activity throughout 2025, and this is likely to continue into 2026. Career focused professionals are likely to stay largely passive, engaging selectively for roles that offer clear scope, career progression, and organisational credibility & culture.

We believe demand will continue to centre on finance professionals who combine strong financial control, governance, transformation capability, and commercial partnering. Salary growth is expected to remain contained, with successful hiring outcomes driven more by role clarity, leadership quality, and culture than by remuneration alone.

Talent movement is expected to rise modestly as more professionals reach the 2.5-3 year tenure mark, particularly where progression has stalled or responsibilities have expanded without commensurate recognition. Organisations that offer clear career pathways, flexible working, and ongoing investment in finance systems will be best positioned to attract and retain top mid-senior accounting & finance talent.

We spend the majority of our time getting to know mid-senior accounting & finance talent in Ireland, and here’s what we’ve learned along the way:

#3 Base Salary

Salaries in Ireland at the mid-senior accounting & finance end have remained strong, with clear premiums for roles that carry leadership responsibility, strategic impact, or manage the full finance function. Overall, salaries have been broadly rising in line with inflation, reflecting both market competition for talent and the increasing complexity of finance roles, with compensation now driven as much by scope and impact as by title.

For the purposes of transparency, for the mid-senior accounting & finance talent in Leinster, we’re going to focus on job titles (as opposed to PQE given this disconnects from salary and job title as early as 3 years after completing your training) and business structure for the accounting & finance industry.

This is also a very broad guideline, and it’s important to understand the specifics of each individual role, i.e., reporting manager, size of the team, and scope of responsibilities. What one company calls a ‘finance manager’, another might call a ‘FP&A manager’, and another might call a ‘financial controller’.

*We are deliberately not covering the salaries of CFOs in this Talent Monitor but will address this in a separate publication.

You can expect a 10-15% reduction on the above numbers when considering appointments outside of Leinster.

Titles mean nothing without context, and every organisation is different and there are lots of factors and variables that impact this.

Examples of recent appointments in Leinster and how context can impact salary include:

- Head of Finance Irish MNC – €170k – managing small team responsible for all finance & compliance related activities.

- M&A Manager Irish HQ – €130k – leading all mergers & acquisition activities for the group.

- Interim FD MNC – €145k – commercially focused across FP&A and Controllership, managing small high performing team.

- Head of Commercial Finance Irish HQ – €105k – managing commercial finance activities for a specific business unit. Managing small team.

- Senior Manager FP&A – Irish HQ PLC – €145k – managing FP&A and business partnering for a large division.

- FP&A Manager – Irish international – €80k – managing FP&A and business partnering for a business unit. No direct reports.

- Finance Manager – Irish SME – €85k – managing small team responsible for a broad range of finance activities.

- Financial Controller – Irish international – €115k – managing small team responsible for month end, external reporting & compliance.

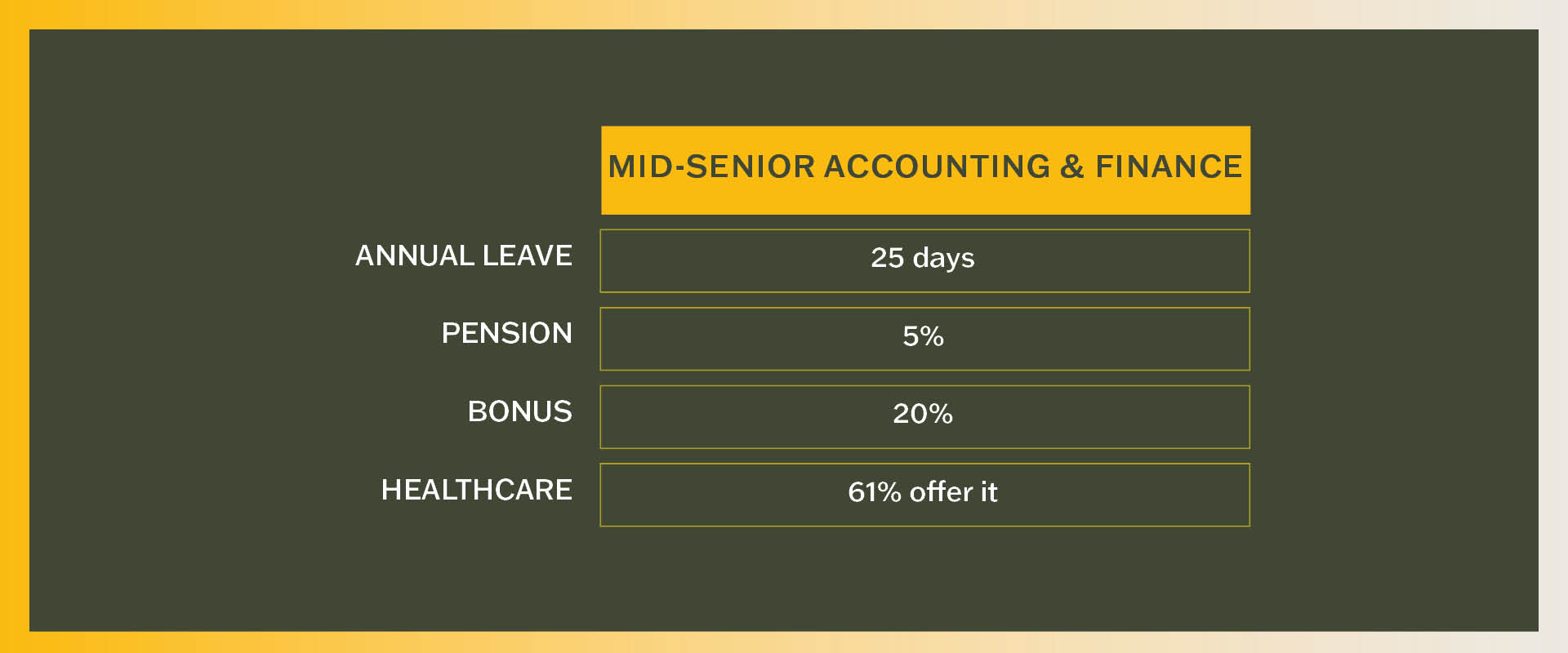

For illustrative purposes above, we have only focused on base salary. Of course, it’s important to highlight here all components of total compensation (Base + Package) should be considered, including pension contribution, bonus, LTIP, healthcare, and annual leave entitlement. Again, this can vary from company to company, role to role.

#4 Other benefits

The graph below outlines the mode for benefits offered based on a sample of roles the mid-senior accounting & finance team in Barden supported in 2025.

#5 Key Market Trends

Here’s what we’ve observed this quarter in the mid-senior accounting & finance talent pool in Ireland:

Hybrid working trends:

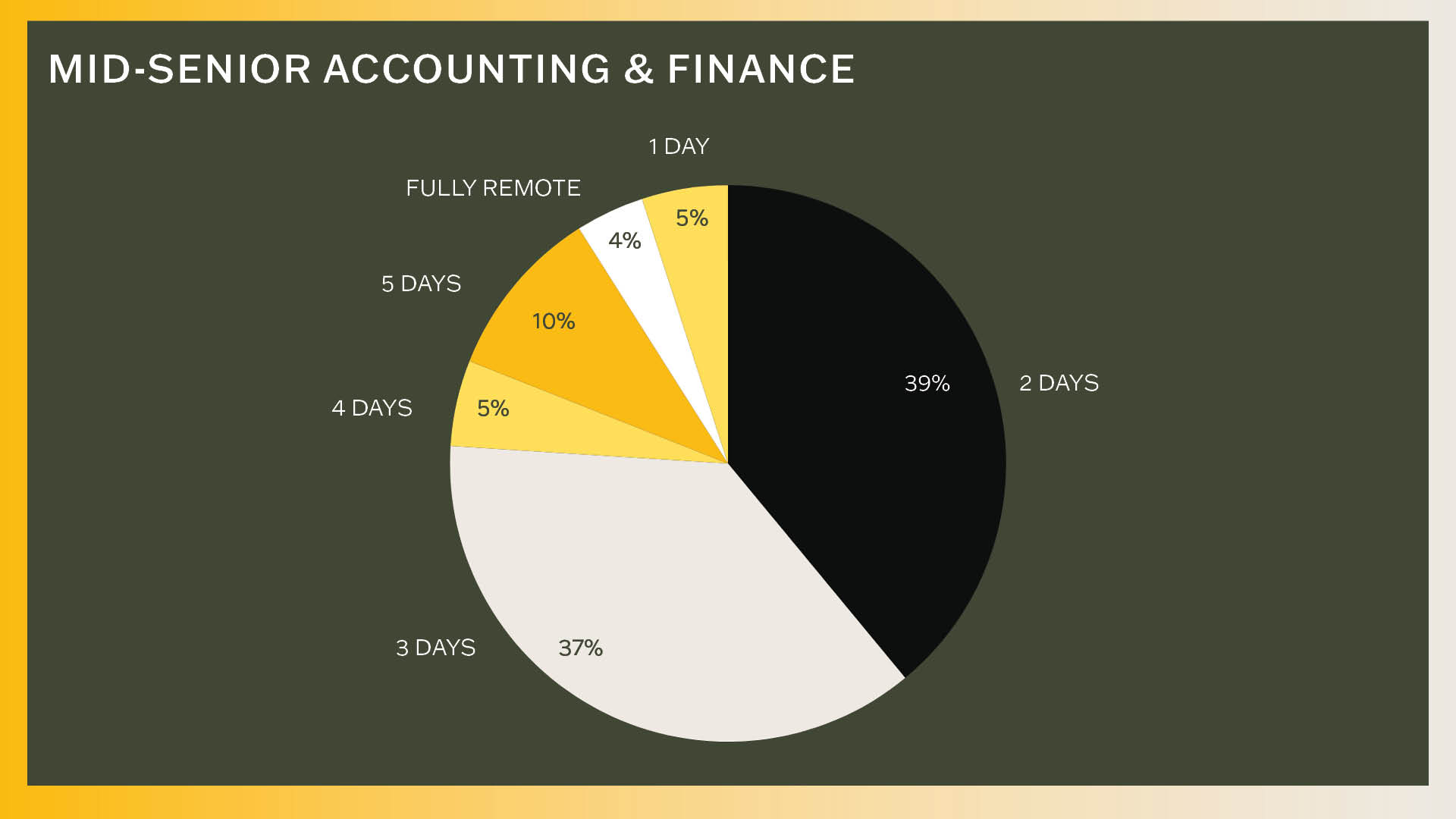

Hybrid working has firmly established itself as the default expectation at the mid-senior accounting & finance level in Leinster. While hybrid models remain prevalent, many Irish organisations are beginning to reduce flexibility and encourage a greater on-site presence as we move into 2026. Especially at the more senior end of the market, we see some companies pushing for nearly a fully onsite presence. Although fully remote leadership roles remain rare, employers mandating a full-time office presence are finding it more difficult to attract top-tier talent unless the role offers exceptional scope or remuneration. This dynamic has become a subtle but increasingly important differentiator in hiring outcomes.

The graph below is based on a sample of roles the mid-senior accounting & finance team in Barden supported in 2025 and as you can see, the most common hybrid arrangements vary depending on the organisation.

It is important to note that the working arrangements change depending on seniority, the sector and the specialism in finance. Certain specialisms like Corporate Finance, Corporate Development, Finance Business Partnering and senior management positions are more likely to be office based regardless of wider company policies as they can require more face-to-face engagement. Sectors like Construction, Commercial Property, Family Offices also tend to be more office based.

Where there has been a notable shift to more officed based working over the last 18 months and although this is expected to continue, there is no expectation for fundamental changes to what we see in the graphs above.

We hear on a daily basis, that most professionals would be happy to turn down a role that does not offer hybrid working arrangements – where hybrid working arrangements are as important for some people as salary, location and the role itself. Where possible, offering a flexible hybrid policy gives access to a much larger pool when looking to attract new talent.

#6 What are companies doing to attract mid-senior accounting & finance talent these days?

In our experience and what we see, hiring managers with the most success, tend to follow some of these key aspects below:

Talent-driven job market – Individuals are now firmly in the driving seat due to a shortage of talent to meet the demand for suitably qualified accountants, particularly at the junior and mid-career levels. Be market-led, or risk not attracting top talent!

- Culture and values – Culture is a key differentiator for professionals considering their next move. Individuals increasingly want to align with a company’s values, feel passionate about their work, and believe in the wider mission, with a clear shift towards roles where they feel valued and can make a positive impact.

- Employer Brand – To attract top talent, hiring managers must therefore have a stellar brand in the marketplace. As we all know, the finance community in Ireland, specifically in Dublin, is very close-knit, and your brand in the market therefore matters.

- Clear articulation of the people, role, and purpose – High-calibre professionals expect clarity on leadership, role scope, and organisational direction from the outset. To compete for the best, organisations must communicate opportunities with conviction and purpose.

- WLB and flexibility – The demand for flexible working arrangements continues to be of growing importance and a continued focus on work-life balance (“WLB”). Day in day out, we hear from talent that they are willing to take less money for a role that will offer more WLB. Striking the right balance is key.

- Hybrid working – What hybrid working arrangements are being offered to individuals? The ongoing discussion. To stay competitive, a hybrid work model that offers both flexibility and the benefits of workplace collaboration. No flexibility to work from home is a significant detractor and will greatly limit your access to talent.

- Reward and benefits – Competitive base salaries that are talent/market-led rather than budget-led, and definitive salary review. Strengthening additional benefits i.e., sign-on bonus, bonus multipliers to recognise professionals exceeding expectations, stronger employer % pension contribution, wellness subsidies, enhanced annual leave offering and other enhanced statutory leave entitlements.

- This talent-driven market will also lead to salary inflation in the months and years ahead, while intrinsic reward – how people feel about the work they do – will become an increasingly important differentiator.

- Career progression – Defining clear paths for progression in the current role and secondment opportunities to other business functions.

- Learning & development – Offering exposure to commercial projects/decisions and supporting educational opportunities to upskill in line with career progression.

- Technology and automation – Focusing on automation and technology enhancements where possible and outsourcing administrative duties.

Finally, and most importantly, how you make someone feel in a process is vital. Don’t leave ‘em hanging. Hiring managers must be willing to act quickly when the right individual comes along. If engaging in a recruitment process, expectation management and a fast-hiring process are absolutely key. As the hiring manager, it is your responsibility to set expectations with both internal and external stakeholders. If expectations are managed correctly, you’ll dramatically increase the likelihood of a positive outcome for both you and your prospective hire. Remember, silence and time kill all deals.

This is where Barden can help you. We offer over 20 profession-specific talent monitors, such as for early-career accountants or data analysts, that provide real-time, quarter-by-quarter insights. While some of this data is publicly available here>>>, bespoke analysis remains key to effectively shaping your talent strategy.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact contact Tony Kerslake (Leinster) at tony.kerslake@barden.ie, or Denis Galvin (Munster) at denis.galvin@barden.ie; we’re where leaders go before they start looking for Mid-Senior Accounting & Finance talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Tony Kerslake (Leinster) at tony.kerslake@barden.ie, or Denis Galvin (Munster) at denis.galvin@barden.ie.

Jump Back

Jump Back