Tax professionals remain in demand. Our latest talent monitor highlights specific trends and data around the movement, availability and salary trends for tax professionals in Ireland:

#1 The Big Picture:

The demand for tax professionals has arisen due to the rapid change in the tax landscape. “There are decades where nothing happens, and then there are weeks where decades happen.” This observation is particularly relevant to the tax profession today. The tax world is undergoing one of the most profound transformations in its history – global, complex, and unlike anything we have seen before.

A central driver of change has been the OECD’s global tax reform, especially its Pillar Two initiative. Tax reform is not limited to Pillar Two. There are ongoing changes in BEPS (Base Erosion and Profit Shifting), especially around transfer pricing. This has increased demand for specialists who understand cross-border risks and who can advise on tax structuring across jurisdictions.

Ongoing VAT complexity across the EU, including cross-border trade, e-commerce, and supply chain restructuring has increased the need for specialist VAT/indirect tax professionals.

Tax transparency has also become a critical issue. Organisations must now actively demonstrate and communicate their tax transparency. This trend has deepened the relationship between tax and financial reporting, and tax professionals now need to be fluent in both.

Alongside regulatory upheaval, we are witnessing a revolution in how tax work is done. Generative AI and automation are beginning to streamline traditionally manual processes like reporting and compliance.

Whilst the most talked about changes in the tax landscape feature predominantly around the international tax landscape, domestic issues remain a focal point. Ireland has seen an unprecedented level of wealth circulating in the Irish economy right now leading to a demand in private client tax advisors particularly in the advisory/consulting space.

#2 Framing the tax market – movement trends of tax professionals this quarter

12.8% of professionals in this segment of the market are demonstrating job-seeking behaviour, a decrease from this time last year (13.2% ) which reflects the macroeconomic uncertainty felt throughout 2025. Of those exhibiting job-seeking activity, 15.4% actually changed roles last year (a slight decrease 15.6% changed roles in 2024) again reflecting a cautious market.

Talent behaviour remains measured in this segment. The median tenure has gone down from 2.7 to approximately 2.3 years, which is unusual given tax professionals tend to work towards longer tenure and greater role commitment. This is likely driven in part by higher-than-usual movement of talent between firms throughout 2025. It is also almost certainly influenced by redundancies in the tech sector, which have forced many professionals to seek new opportunities earlier than anticipated.

Workforce participation in this cohort is 53% female and 47% male, though disparities exist across professions and seniority levels.

#3 Outlook for 2026

The cautious sentiment that characterised much of 2025 began to ease as the year drew to a close. A more optimistic outlook emerged, leading to a noticeable increase in recruitment activity across many firms, particularly at senior level.

Global economic uncertainty will continue to drive a more cautious approach to hiring in 2026 however the supply of tax professionals will not outweigh the demand for tax professionals. Career focused professionals are likely to stay largely passive, engaging selectively for roles that offer clear scope, career progression, and organisational credibility & culture.

Talent movement is expected to rise modestly as more professionals reach the 2.5-3 year tenure mark, particularly where progression has stalled or responsibilities have expanded without commensurate recognition. Organisations that offer clear career pathways, flexible working, and ongoing investment in finance systems will be best positioned to attract and retain top tax talent.

#4 Salary trends of tax professionals

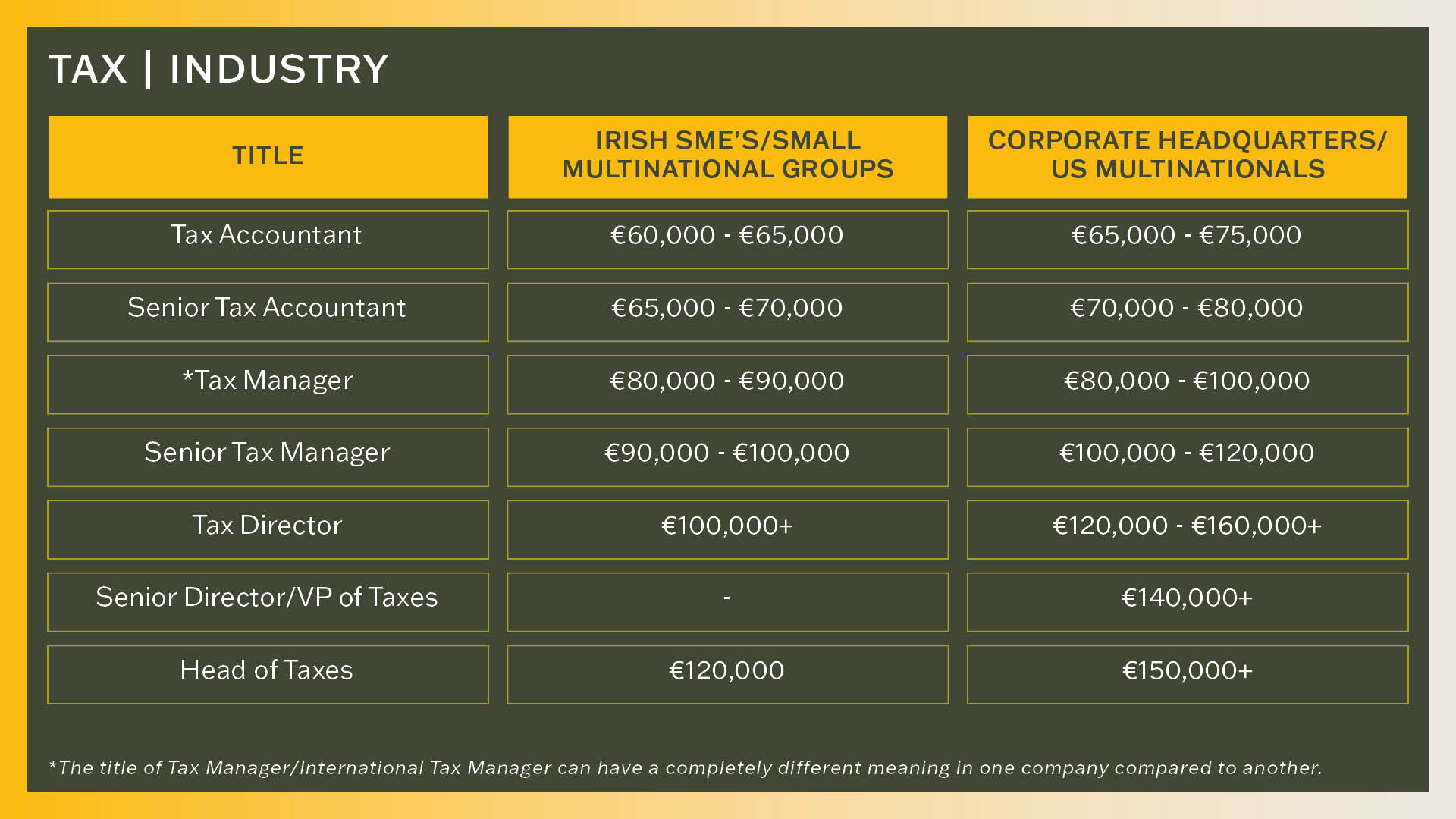

Salaries have remained steady over recent quarters and are in line with average salaries monitored throughout 2025. Below are some guidelines for salaries within the industry and practice.

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster.

You can expect a 10-15% reduction on the above numbers, when considering appointments outside of Leinster.

Some important points to note:

- Figures relate to base salary only.

- Context is key. There can be variances in these figures(and significant ones) dependent on the industry sector, scope of responsibility, geographical reach, reporting line and years of experience.

- Job titles themselves can vary between one company to another, so it’s important to figure out what they mean, particularly the title of Tax Manager/International Tax Manager.

- Bonuses and other benefits impact the total comp value of a tax professional’s salary and need to be considered.

- Finally to note the importance of benchmarking each role using real-time market info from a trusted source, as our salary guideline (as many others on the markets) is a broad guide…

#5 Key market trends

Hybrid working trends:

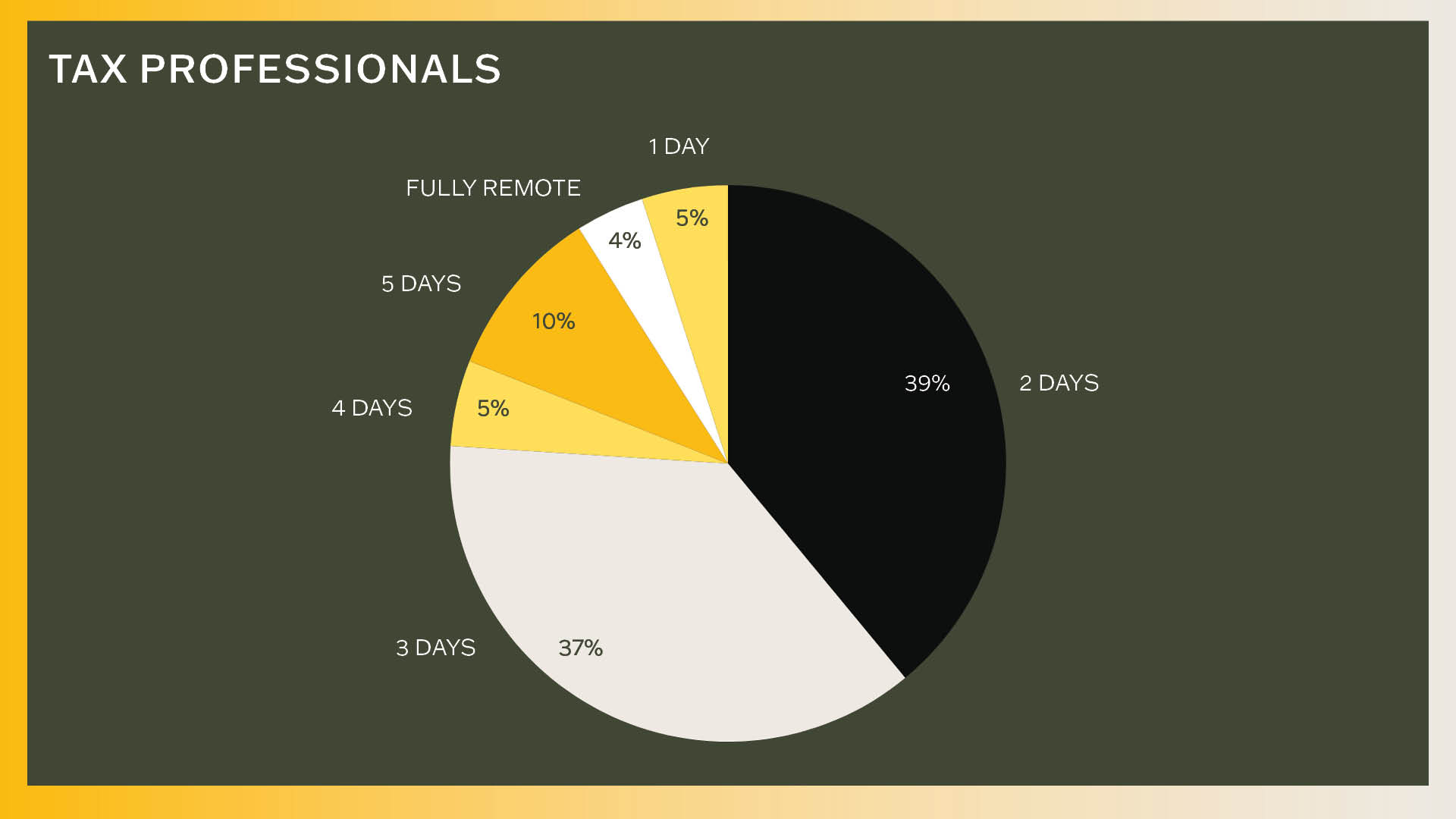

Hybrid working has firmly established itself as the default expectation for tax professionals in Ireland. While hybrid models remain prevalent, many Irish organisations are beginning to reduce flexibility and encourage a greater on-site presence as we move into 2026. We see some companies pushing for nearly a fully onsite presence. Although fully remote leadership roles remain rare, employers mandating a full-time office presence are finding it more difficult to attract top-tier talent unless the role offers exceptional scope or remuneration. This dynamic has become a subtle but increasingly important differentiator in hiring outcomes.

The graph below is based on a sample of roles the tax team in Barden supported in 2025 and as you can see, the most common working arrangements are 2/3 days in the office.

It is important to note that the working arrangements change depending on seniority, the sector and the often tenure of the individual. Professional services firms are training grounds and all levels are being encouraged to be based on site to ensure proper learning and development can occur and of course client facing obligations.

It is important to note that the working arrangements change depending on seniority, the sector and the often tenure of the individual. Professional services firms are training grounds and all levels are being encouraged to be based on site to ensure proper learning and development can occur and of course client facing obligations.

Where there has been a notable shift to more office based working over the last 18 months and although this is expected to continue, there is no expectation for fundamental changes to what we see in the graphs above.

We hear on a daily basis, that most professionals would be happy to turn down a role that does not offer hybrid working arrangements – where hybrid working arrangements are as important for some people as salary, location and the role itself. Where possible, offering a flexible hybrid policy gives access to a much larger pool when looking to attract new talent.

#6 What can companies do to attract and retain talent?

- Align salary expectations to current market trends. Unfortunately, current team members may be below the salary averages, so when looking to recruit an additional person onto the team, it can be challenging for many hiring managers to meet an increased base salary.

- If base salaries can’t be moved, strengthen additional benefits – sign-on bonus, bonus multipliers, stronger employer % pension contribution, wellness subsidies, enhanced annual leave offering.

- Emphasise the culture of the firm or company.

- Provide a clear pathway for career development, and if possible, promotional opportunities.

- Communicate the hybrid working policy or any flexible work practices.

In Barden, we understand that each team, role, and requirement is unique. If you would like to discuss what tactics and approaches would suit you, please feel free to contact Aoibhín Byrne (Leinster), Kate Flanagan (Ireland), Aideen Murphy (Munster) our Tax Talent Advisory & Recruitment team here in Barden (aoibhin.byrne@barden.ie; kate.flanagan@barden.ie; aideen.murphy@barden.ie); we’re where leaders go before they start looking for Tax talent.

This information is accurate as per January 2026 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics and other 3rd party data sources. If you have a request and would like real-time information to inform your hiring decisions, contact Aoibhín Byrne (Leinster) at aoibhin.byrne@barden.ie, Kate Flanagan (Ireland) at kate.flanagan@barden.ie, or Aideen Murphy (Munster) at aideen.murphy@barden.ie.

Jump Back

Jump Back