As organisations embark on finance transformation, it’s essential to understand the unique variables that can impact the success of the initiative. Whether you’re revamping legacy systems, adopting new technologies, implementing Gen AI or streamlining processes, these variables will influence not only the scope and direction of your transformation but also its ultimate success. In this article, I explore key factors that should be considered when assessing and navigating the journey towards a more agile and scalable finance function. Let’s explore these in more detail below!

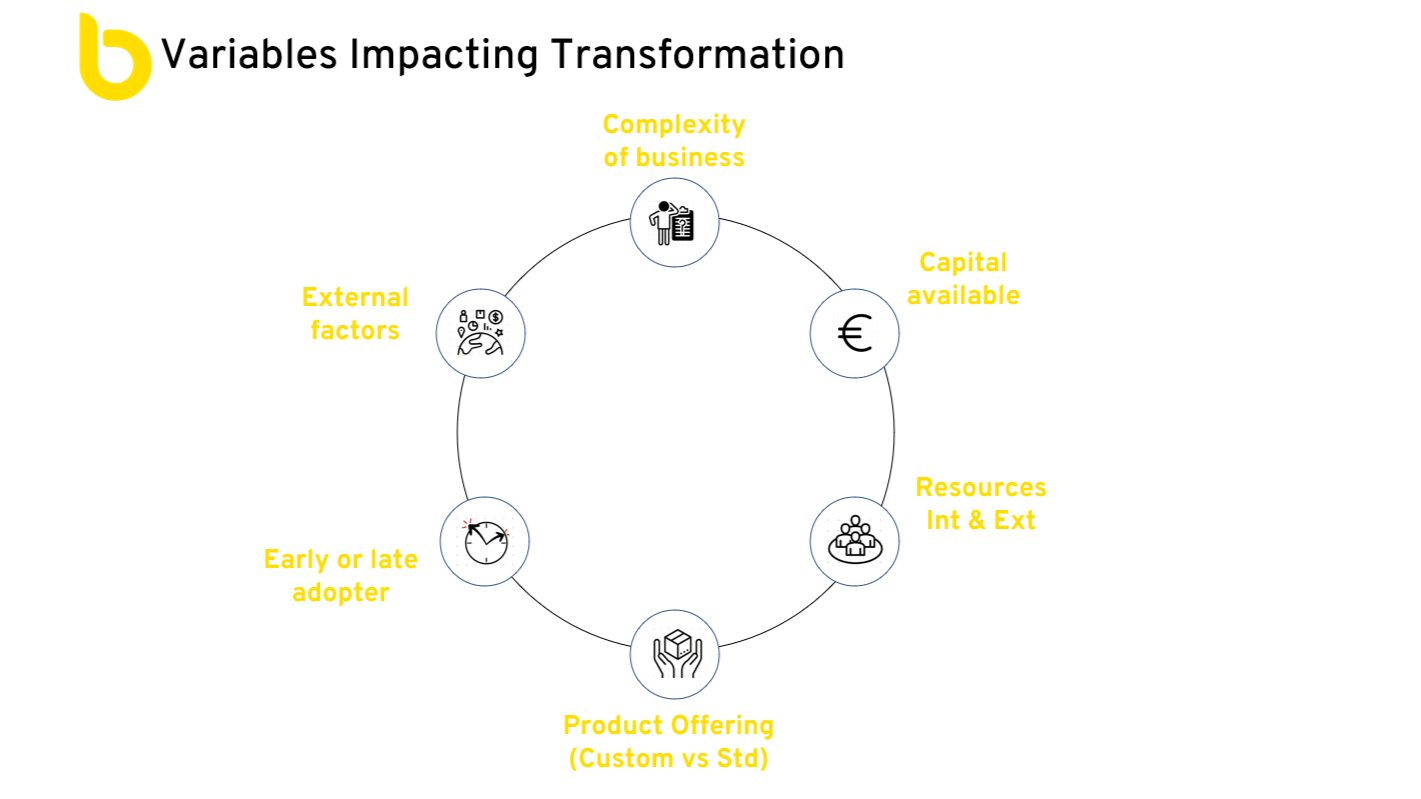

Variables Impacting Transformation

A crucial element of any transformation program involves assessing the variables inherent to your business and understanding how they might influence the transformation objectives. These include:

Complexity of the business / product offerings – Does your business provide standardised or tailored solutions for your customers? Customisation can sometimes necessitate more intricate financial systems and processes, potentially increasing solution costs. How can future business seamlessly integrate with the existing solution if customisation is necessary?

Complexity of the business / product offerings – Does your business provide standardised or tailored solutions for your customers? Customisation can sometimes necessitate more intricate financial systems and processes, potentially increasing solution costs. How can future business seamlessly integrate with the existing solution if customisation is necessary?

Early or late adopter – Prioritising the implementation of streamlined and integrated finance processes alongside robust data early in a business’s lifecycle will enable the finance function to sustain the business’s continued growth effectively. Neglecting this may lead to the necessity of a more intricate and expensive solution as the business matures, potentially impeding the function’s capacity to meet the demands of scaling operations.

Capital available – The availability of capital significantly influences finance transformation projects, as it determines the scope, scale, and pace of implementation. Organisations with greater financial resources may be able to pursue more ambitious projects, such as comprehensive ERP system upgrades or large-scale process reengineering efforts.

Resourcing – Getting the balance right between utilisation of internal and external resources is crucial. Internal resources are pivotal for executing the transformation strategy. In contrast, external resources such as implementation partners, outsourced technology providers and industry partners can contribute specialised knowledge and tools to accelerate the process. Striking a balance between both types of resources can significantly improve the efficiency and effectiveness of finance transformation initiatives.

External Factors – including markets, competitors and global events impacting your industry / business and the wider economy.

The key takeaway:

The success of finance transformation relies not only on implementing new technologies but also on understanding the unique set of internal and external variables that influence the process. By carefully assessing these factors, from business complexity to available resources and external conditions finance leaders can make informed decisions that drive transformation, enabling a more agile, scalable, and value-driven finance function. The key is to navigate these variables with foresight, flexibility, and strategic intent, ensuring that the transformation objectives align with both short-term goals and long-term business growth.

Link to part 1 of the blog series… Look out for part 3 of the series coming next week.

Catherine Drysdale, FCA & member of Technology Committee Chartered Accountants Ireland

Jump Back

Jump Back