As a newly qualified accountant coming out of your training contract in Q3 2024, there are lots of things you’ll be thinking and wondering about. For many people, just like you, money is usually high on the agenda. You have, after all, worked hard and sacrificed a lot, so it’s only fair to be compensated correctly for the value of your time.

What’s the going salary for a newly qualified accountant? What information is accurate and what can I rely on? I heard Mary got 61K and Laura got 65K – what does that mean? How do I benchmark my salary against the going ‘rate’ out there?

…nobody wants to be short-changed.

Well, look no further…

Most salary surveys give you an average or range. But depending on the sample size, the average figure can be skewed and often doesn’t give a true reflection of the actual base salary. And sometimes (more than you might imagine) the numbers are not based on surveys but on sentiment. I don’t know about you but I prefer to use hard data when making big decisions that affect my life…

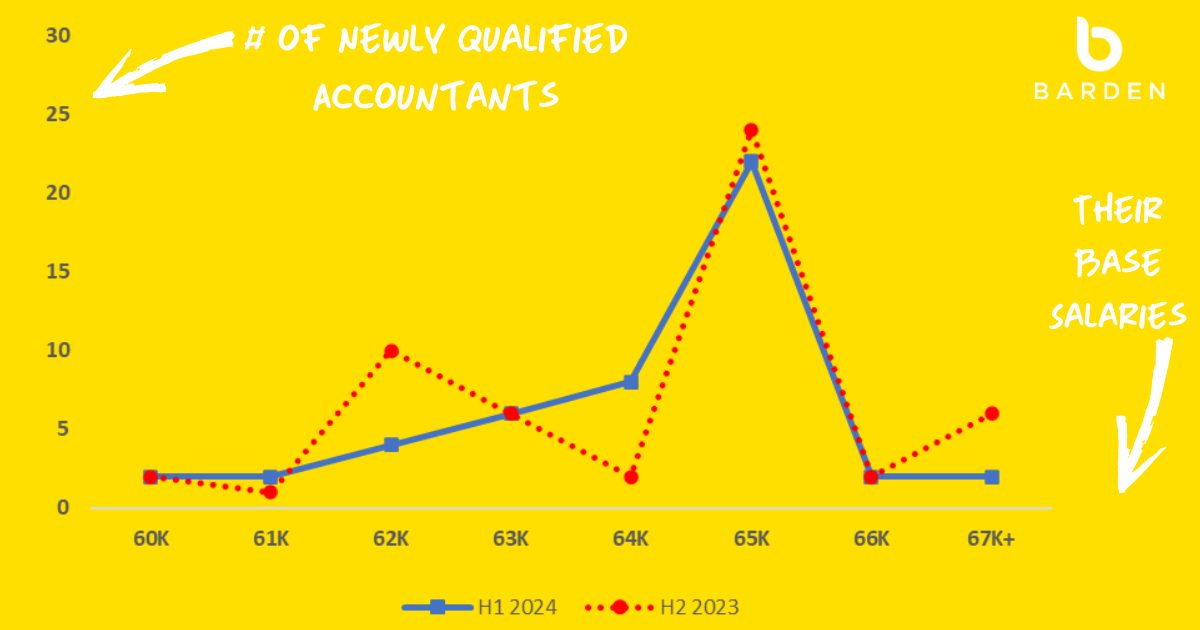

Over the last 12 months, across Dublin*, we’ve helped lots of newly qualified accountants make their first move after their training contract. For fun, we tracked their base salaries (yes that’s what we regard as fun here in Barden!) and created some real-time data points, just for you. We do this every year and this time around it appears that base salaries for Newly qualified accountants are leveling off after a period of significant acceleration.

#1 Base salary is only a part of Total Compensation (Base + Package) – want to know about total comp for newly qualified accountants? We asked one of our experts in Barden Dublin, Niall O’Keeffe, and he shared the following:

- The median salary for H1 2024 is €65,000.

- The average Salary for H1 2024 is €63,889 (The average Salary for H2 2023 was €64,482 and for H1 2023 was €62,964).

- The average Bonus for H1 2024 is 8% (The average Bonus for H2 2023 was 8% and for H1 2023 was 6%).

- % of NQs who received HC for H1 2024: 57% (% who received HC for H2 2023 was 57% and for H1 2023 was 64%).

- The average Pension for H1 2024: 5% (The average Pension for H2 2023 was 6% and for H1 2023 was 5%).

- The average Annual Leave Days for H1 2024: 24 Days (Average Annual Leave Days for H2 2023 was 24 Days and for H1 2023 was 24 Days)

(*these are Dublin-only numbers. For outside Dublin, you would typically apply a 10% reduction on base +/- 2.5 % depending on location. For bespoke salary advice in your area contact one of our team below.)

#2 Sometimes…people get paid a higher base for the same job in a different company. Why? It could be that one company offers additional benefits and the other doesn’t, it could be because one role has a lot of travel and the other doesn’t, it could be that one company finds it harder to attract accountants than the other, or it could be due to a whole host of other variables. When it comes to base salary, make sure you’re not comparing apples with oranges; ask one of our expert team in Barden first.

It should not be all about the base in your first few moves PQE. You may not have prepared a set of accounts yet, you may not have done a month-end management pack, in fact, there are probably a lot of things that you’ve yet to get practical experience in. Your first few years PQE should really be about getting good experience working with great people…and of course, getting fairly paid while you do.

It’s not really about your base salary now; it’s about what your base salary will be in ten years’ time and for the twenty or thirty years after that. Earning follows learning, not the other way around.

If you’re curious, want to learn more, and want to base your life decisions on actual data make sure you contact Niall O’Keeffe (niall.okeeffe@barden.ie) for Leinster or Siobhán Sexton (siobhan.sexton@barden.ie) for Munster and they will take it from there. Simple.

Jump Back

Jump Back