The pool of talent within the mid-senior accounting & finance market (Finance Manager through to Finance Director) in Leinster is always in high demand. Today, finance professionals do far more than keep a close eye on the company’s balance sheet and profit and loss account. Increasingly they are partnering closely with the CEO in developing business strategies for future growth, and ensuring the company has firm financial foundations to support the longer-term view.

With the ever-evolving role of finance, the talent pool of accounting and finance professionals has transformed within the last five years alone and will continue to do so. Demand for top accounting & finance talent is always high, with Ireland’s top finance teams competing intensely for the best of the best. Before you think about trying to attract accounting & finance talent to your team, it’s important to get a real-time snapshot of the driving forces in the market and how you could position yourself as an employer of choice. That’s where Barden comes in.

We spend the majority of our time getting to know mid-senior accounting & finance talent in Ireland and here’s what we’ve learned along the way:

#1 Accounting & Finance Landscape

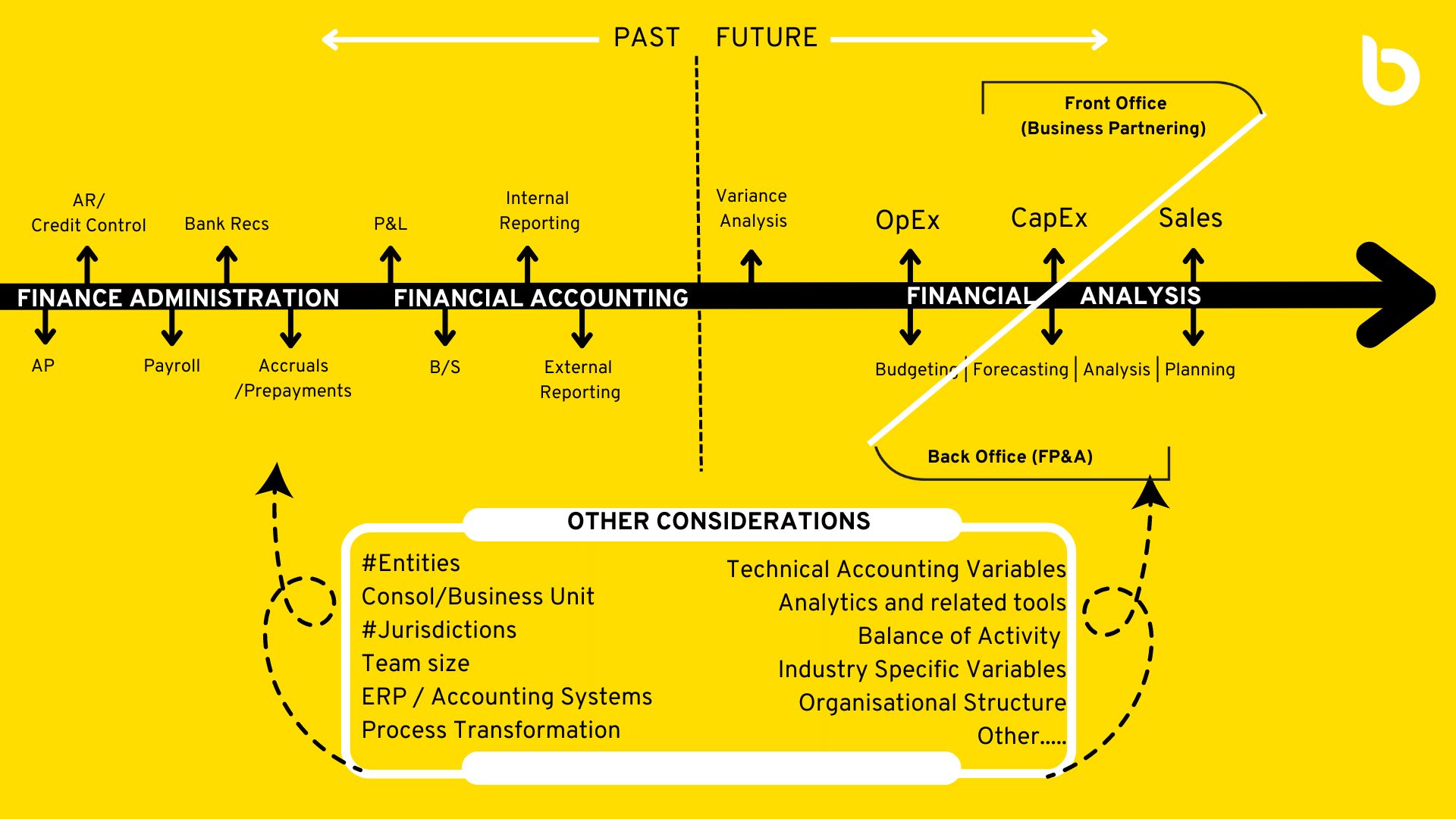

This is important. But a little tricky. Below is a simple continuum of the activity you will expect to see in any finance team/role split into reporting-focused and future-focused. It ignores things like finance transformation, stat reporting, and tax… let’s keep it simple for now. This illustrates the typical activity in a basic finance team along with some of the variables that come with the context of the role. The % of time your hire will spend either side of the line below, along with the variables in their client/company experience compared to your company/needs, are critical considerations for you and your HR team.

Two companies can be looking to hire a Financial Controller, but the nature of their roles can be very, very different. What percentage of the person’s time is spent on what activity, will matter to talent.

Want to learn more about applying these concepts to make sure your role is fit for the market, and you attract the right talent for the right role at the right time? Simple. Drop our Talent Advisors a line and they will help you bespoke these concepts to your unique needs.

#2 Base Salary

For the purposes of transparency, for the mid-senior accounting & finance talent in Leinster, we’re going to focus on job titles (as opposed to PQE given this disconnects from salary and job title as early as 3 years after completing your training) and business structure for the accounting & finance industry.

This is also a very broad guideline and it’s important to understand the specifics of each individual role i.e., reporting manager, size of the team, scope of responsibilities. What one company calls a ‘finance manager’, another might call a ‘FP&A manager’, and another might call a ‘financial controller’.

*We are deliberately not covering the salaries of CFOs in this Talent Monitor but will address this in a separate publication.

You can expect a 10-15% reduction on the above numbers when considering appointments outside of Leinster. For appointments outside of Leinster, please contact denis.galvin@barden.ie.

You can expect a 10-15% reduction on the above numbers when considering appointments outside of Leinster. For appointments outside of Leinster, please contact denis.galvin@barden.ie.

Titles mean nothing without context, and every organisation is different and there are lots of factors and variables that impact this.

Examples of recent appointments in Leinster and how context can impact salary include:

- Finance Manager Irish SME Hospitality – €75k – managing the month end & reporting and all statutory compliance for one of the business units. No direct reports.

- Finance Manager US MNC Real Estate – €80k – managing the month end & reporting and all statutory compliance for the Irish entity. No direct reports.

- Group Finance Manager Irish MNC – €85k – managing the consolidations, month end & reporting and all statutory compliance for the group. No direct reports.

- Financial Controller Irish SME Energy Renewables Start-up – €85k – managing a small finance team of 2 responsible for a broad range of controllership & commercial finance activities.

- FP&A Controller – MNC Pharma – €90k – business partnering with commercial finance and managing a small team.

- Financial Controller Irish HQ PLC Tech – €95k – managing a small finance team of 2 responsible for managing the month end & reporting and all statutory compliance.

- Finance Director Irish SME Retail – €120k – managing a small finance team responsible for the finance function.

- FP&A Director – Irish HQ – €130k – managing a small finance team responsible for all FP&A activities globally.

For illustrative purposes above, we have only focused on base salary. Of course, it’s important to highlight here all components of total compensation (Base + Package) should be considered, including pension contribution, bonus, LTIP, healthcare, and annual leave entitlement. Again, this can vary from company to company, role to role.

Sometimes… people get paid more for the same job in a different company. Why? Higher profitability businesses often pay a premium for attracting the top talent of circa 15%/20%. Industries known to pay this premium include Tech, Aircraft leasing, Pharma, and some Financial Services Companies.

The difference in size and scale of accounting & finance functions will depend on the scope and complexity of their respective operations and can often impact salaries based on responsibilities, complexity of business operating model and corporate structure.

#3 What are companies doing to attract Mid to Senior Accounting & Finance talent these days?

In our experience and what we see hiring managers with the most success doing to best attract and retain talent:

Talent-driven job market – Individuals are now firmly in the driving seat due to a shortage of talent to meet the demand for suitably qualified accountants, particularly at the junior and mid-career levels. Be market-led, or risk not attracting top talent!

- Culture and values – One of the key differentiators for individuals when seeking their next opportunity is understanding the culture of a prospective employer. Massive focus and priority when we speak to individuals every day. For long-term fit, individuals want to align with the company’s values and culture. After Covid, people want to be passionate about what they do, and culture is a huge focus along with working for a Company they believe in and the wider mission of the Company. There is a sense of a movement from work being something you do to pay your bills to being something that you want to do where you feel valued and making a positive impact.

- Employer Brand – To attract top talent, hiring managers must therefore have a stellar brand in the marketplace As we all know, the finance community in Ireland specifically in Dublin is very close-knit and your brand in the market therefore matters.

- Clear articulation of the people, role, and purpose – if you want to compete for the best you need to compete like the best.

- WLB and flexibility – The demand for flexible working arrangements continues to be of growing importance and a continued focus on work-life balance. The impact of Covid has made people reassess priorities around family, mental health and wellness. People are willing to take less money for a role that will offer more WLB. We hear it all the time from talent and striking the right balance is key.

- Hybrid working – What hybrid working arrangements are being offered to individuals? The ongoing discussion. To stay competitive, a hybrid work model that offers both flexibility and the benefits of workplace collaboration. No flexibility to work from home is a significant detractor and will limit greatly your access to talent.

- Reward and benefits – competitive base salaries that are talent/market-led rather than budget-led and definitive salary review. Strengthening additional benefits i.e., sign-on bonus, bonus multipliers to recognise professionals exceeding expectations, stronger employer % pension contribution, wellness subsidies, enhanced annual leave offering and other enhanced statutory leave entitlements.

- This talent-driven market will also lead to salary inflation in the months and years ahead while intrinsic reward – how people feel about the work they do – will become an increasingly important differentiator.

- Career progression – defining clear paths for progression in the current role and secondment opportunities to other business functions.

- Learning & development – offering exposure to commercial projects/decisions and supporting educational opportunities to upskill in line with career progression.

- Technology and automation – focusing on automation and technology enhancements where possible and outsourcing administrative duties.

Finally, and most importantly, how you make someone feel in a process is vital. Don’t leave ‘em hanging. Hiring managers must be willing to act quickly when the right individual comes along. If engaging in a recruitment process, expectation management and a fast-hiring process are absolutely key. As the hiring manager, it is your responsibility to set expectations with both internal and external stakeholders. If expectations are managed correctly, you’ll dramatically increase the likelihood of a positive outcome for both you and your prospective hire. Remember, silence and time kill all deals.

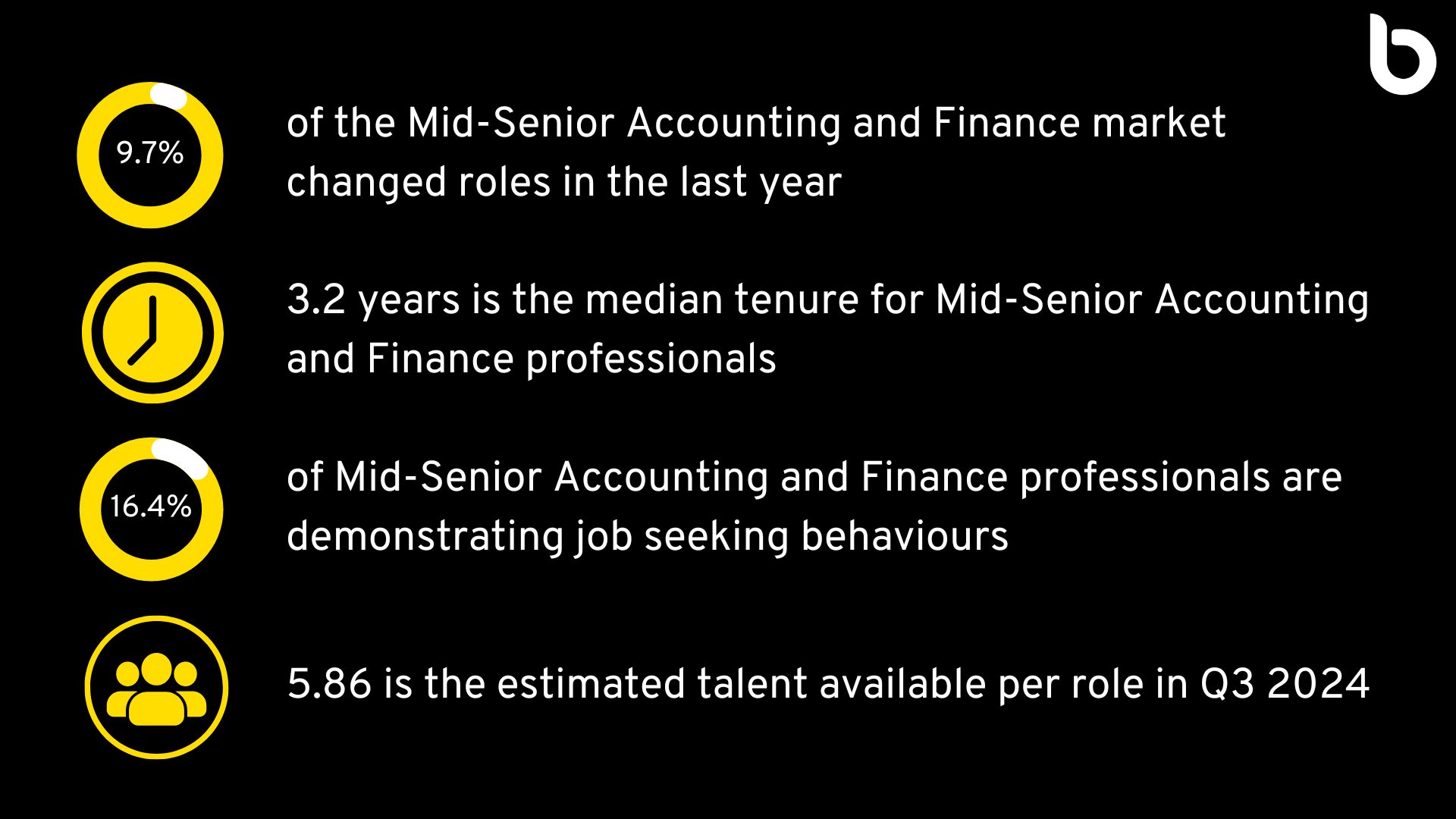

#4 Current Snapshot of the Mid-Senior Accounting & Finance Pool in Leinster

Here’s what we’ve noticed this quarter….

In Barden, we understand that each team, role, and requirement is unique. We’re where leaders go before, they start hiring Mid-Senior Accounting & Finance talent.

If you would like to discuss any of the above in more detail or you would like our expert advice, please contact our Mid-Senior Accounting & Finance Team in Barden, Leinster – Tony Kerslake (tony.kerslake@barden.ie), Sarah Murphy and Ornaith Giblin, Munster – Denis Galvin (denis.galvin@barden.ie), Caroline Frawley and Simon Cogan. All qualified accountants who have walked similar paths to both hiring managers and talent alike.

This information is accurate as per July 2024 and will be updated periodically. Data sources include Barden Proprietary Data, LinkedIn Analytics, and other proprietary 3rd party data sources.

Jump Back

Jump Back